imaginima

Dear readers,

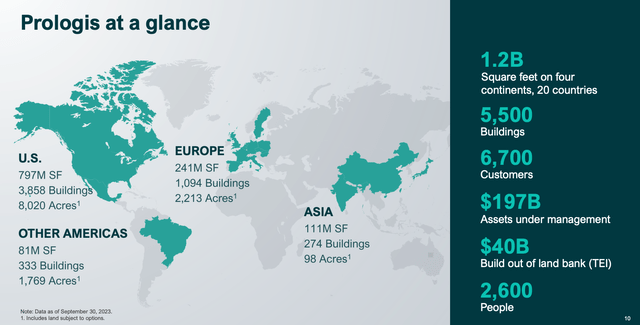

Prologis (NYSE:PLD) is a global industrial REIT which needs little introduction. If you live in a major city in the Western world, chances are that you’ve driven past Prologis’ warehouses countless times. The company owns 1.2 Billion sft of space on four continents and in 20 countries and completely dominates the sector with a market capitalization of $123 Billion, triple that of its closest 10 competitors combined. Moreover, it has a fortress balance sheet and is one of only two A rated REITs. And since I know you’re gonna ask, the other one is Public Storage (PSA).

PLD IR

I’ve covered Prologis before, most recently here. My HOLD rating, which I’ve maintained since last February, was mainly based on a premium valuation of 23-24x FFO which, despite promising FFO growth, allowed for unexciting upside potential. Moreover, with a low dividend of 2.5%, I didn’t see much room for market outperformance. Since my last article, PLD’s performance has been subpar as it has returned an RoR of 12% vs the RoR of the S&P 500 (SPX) of 16%.

Seeking Alpha

In mid January, Prologis reported their full year 2023 results, which were in line with analysts’ FFO per share estimates of $1.26, but importantly revealed strong future growth potential which may help justify the premium valuation. Today I publish an update to my thesis, based on the most recent results and based on the recently increased dividend.

Prologis is a growth story …

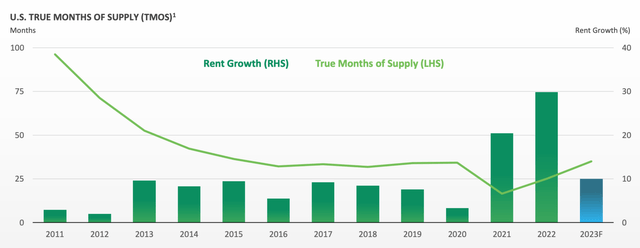

Prologis has a number of tailwinds going for it which combined have the potential to drive FFO per share growth of 10%+ in the coming years. First and foremost, the REIT operates in a growing sector. This one is obvious. We all know that e-commerce has become a significant part of our everyday lives and this trend isn’t about to stop anytime soon. As a result of the growing penetration of e-commerce, demand for logistics space is expected to grow by double digits for (at least) the rest of the decade. Second, while demand is likely to remain strong, supply of new logistics space remains relatively low due to recent increases in construction and financing costs with about 30 months worth of inventory in the U.S, in line with historical averages. Historically speaking, inventory below 50 months tends to drive rents higher.

PLD IR

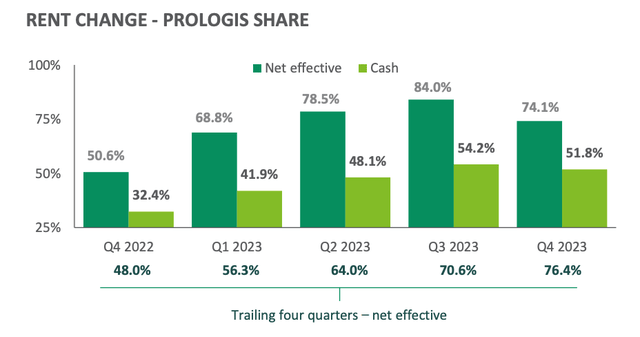

As demand and supply dynamics drive market rent prices higher, Prologis is able to re-lease space at substantially higher rents. Over the most recent quarter, the REIT has been able to increase rents on re-leases by an impressive 74.1% (51.8% on a cash basis) and over the trailing 12 months by as much as 76.4%. This show that space is currently severely under rented (rents are below market rents) and if all leases were to reset at market rents today, NOI would nearly double. Of course this growth will only be realized gradually as 12-15% of lease expire each year, but it will translate into very predictable same store NOI growth of 8-10% per year on top of any further market rent growth which management estimates will be around 4-6% per year for the next three years.

PLD IR

… and it has a one of a kind balance sheet

There is a reason why Prologis is A rated by S&P Global.

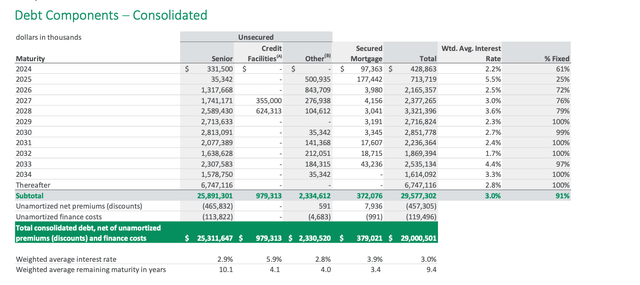

The REIT has a fortress balance sheet with:

- net debt / EBITDA of 4.9x,

- a large portion of fixed rate debt (91%),

- a long weighted average remaining maturity of 9.4 years,

- low near-term maturities of only $400 Million and $700 Million in 2024 and 2025, respectively, compared to annual NOI of $5.7 Billion,

- and a low weighted average interest rate of 3%, thanks to 33% exposure to EUR-denominated debt.

PLD IR

But is the premium valuation justified?

Prologis recently increased the dividend by 10.3% to $0.96 per share which translates into a forward yield of 2.9% and a payout ratio of 69%. But while I expect the dividend to grow going forward, a sub-3% dividend yield is not very enticing for a REIT. Consequently, anyone investing in Prologis is likely doing so in anticipation of capital gains.

At $133 per share the stock trades at 24x FFO which is right in line with the historical average. But one must realize that the historical P/FFO average is likely skewed to the upside because of a different interest rate environment. Moreover, a comparison to peers is not meaningful here, because PLD size and balance sheet really put it in a category of its own.

FAST Graphs

What is meaningful, however, is looking at the REIT’s implied cap rate in comparison to long-term yields, which is my favorite valuation measure for REITs. PLD reported an annual NOI of $5.7 Billion in 2023 which corresponds to an implied cap rate of under 4%. That’s slightly below the 10-year yield which currently stands at 4.3%.

For comparison, looking back at 2021 which was the peak of the Covid bull market, PLD ended the year at an implied rate of 2.2% which was above 10-year yields which stood at 1.5-1.6% at the time. A negative spread to long-term yields puts the stock in dangerous territory, unless yields decline quickly.

Bottom line

Prologis is no doubt a blue chip REIT.

But the market has priced the stock at a high premium which is, in my opinion, not justified. The REIT dominates in a growing sector and has significant rent growth potential which will get unlocked over time as existing leases expire, but an implied cap rate below 10-year yields is too aggressive to allow any sort of meaningful upside.

Limited upside combined with a sub-3% dividend yield is a recipe for underperformance which is why I downgrade PLD to a SELL here at $130 per share.