Caiaimage/Trevor Adeline/iStock via Getty Images

Investment Thesis

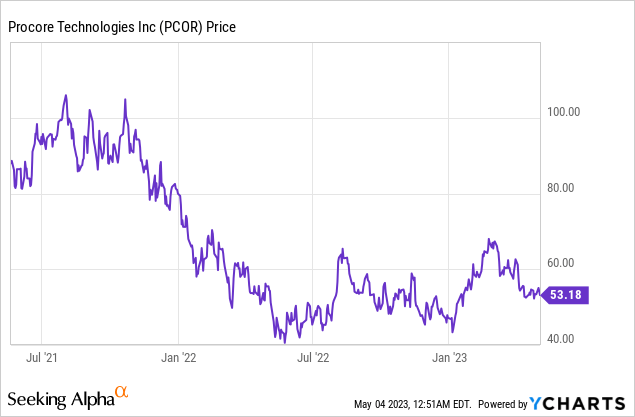

Procore (NYSE:PCOR) has performed poorly since going public in 2021, with the share price down nearly 50% from its all-time high, as rising rates and elevated inflation continue to put pressure on growth companies.

However, the company’s fundamentals remain very strong. It is seeing huge growth opportunities in the construction industry, which is massive and poised for ongoing digital transformation. Despite facing a tough macro backdrop, the latest earnings still demonstrated excellent revenue growth and improved profitability. After the recent pullback, the current valuation is also discounted compared to SaaS peers with similar growth rates. I believe the massive drop is unjustified and I rate the company as a buy.

Huge Market Opportunity

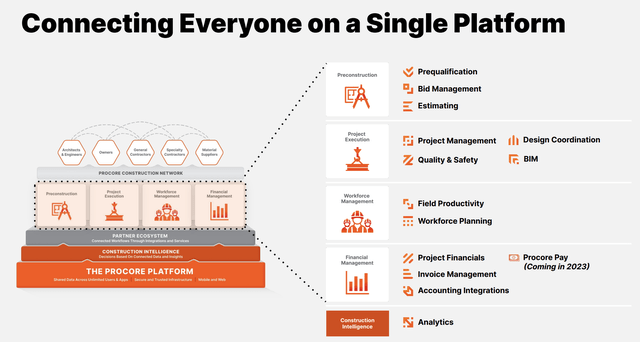

Procore is a vertical SaaS company that specializes in the construction industry. It provides construction management software to property owners, contractors, and home builders. The company’s integrated platform offers solutions for project execution, workforce management, financial management, and more. It currently has over 14,000 customers across the globe, including notable blue-chip companies such as Walmart (WMT), Shell (SHEL), and Brookfield Corporation (BN).

I believe Procore has huge growth opportunities in the massive construction industry. According to the company, global construction spending is expected to hit $15 trillion in 2030. However, less than 2% of the revenue is being spent on technologies for construction and infrastructure, which resulted in operators having outdated technology stacks. This alongside the complex nature of the industry makes operations extremely inefficient. In order to improve the overall operational efficiency, the industry is now starting to spend more on better technologies. According to Allied Market Research, the market size of construction management software is forecasted to grow from $9.3 billion in 2021 to $23.9 billion in 2030, representing a solid CAGR (compounded annual growth rate) of 10.2%.

Procore should be well-positioned to capture market growth thanks to its comprehensive offerings. Unlike other traditional technologies that are fragmented, Procore’s all-in-one platform is able to consolidate all workflows and data into one place, which keeps every party on the same page and vastly improves operational efficiency. The company has also been expanding its offerings in order to capture more opportunities. For instance, it launched a solution for workforce management last year and is expected to expand into payments later this year. I believe the ongoing digitization of the industry and the expansion of its platform should continue to drive growth moving forward.

Procore

Upbeat Q1 Earnings

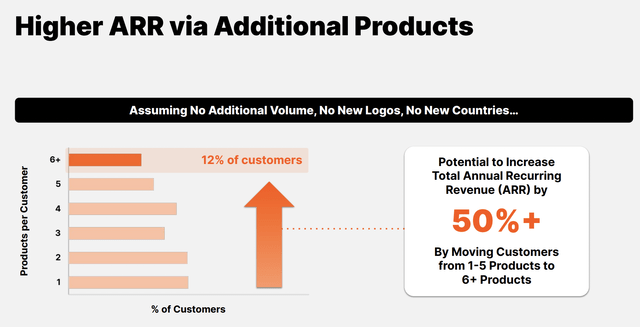

Procore just announced its first-quarter earnings and the results are very solid, as growth remains upbeat despite facing a slowdown in the economy. The company reported revenue of $213.5 million, up 34% YoY (year over year) compared to $159.5 million. The growth is driven by both an increase in customer count and higher spending from existing customers. The number of customers increased 22% YoY from 12,809 to 15,089. Spending also increased as existing customers continue to adopt more products, demonstrating its land-and-expand model’s strength.

The gross profit margin expanded 210 basis points from 79.1% to 81.2%, as the company continues to benefit from improved economies of scale. This resulted in the gross profit up 37.3% YoY from $126.2 million to $173.3 million.

Procore

The bottom line also saw some improvements, as spending slightly moderated. Operating expenses were only up 23% YoY from $197.3 million to $242.6 million. S&M (sales and marketing) expenses as a percentage of revenue dipped 390 basis points from 58.9% to 55%. G&A (general and administrative) expenses as a percentage of revenue also dipped 590 basis points from 27.1% to 21.2%. The lower spending resulted in the net loss improving by 11.2% YoY from $(71.4) million to $(63.4) million. The net loss margin was (29.7)% compared to (44.8)%. The EPS was $(0.45) compared to $(0.53), up 15.1%.

The company also raised its full-year guidance amid the upbeat traction. It now expects revenue growth to be 26% to 27%, up from 24% to 25% previously announced. The non-GAAP operating margin is now expected to be (5.5)% to (6.5)%, up from (6.5)% to (7.5)% previously announced.

Valuation

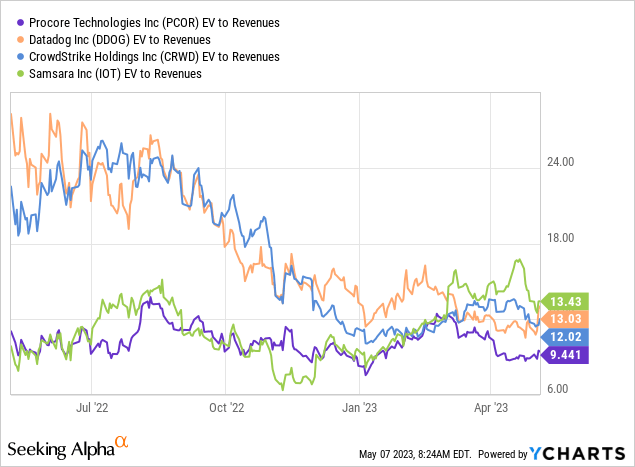

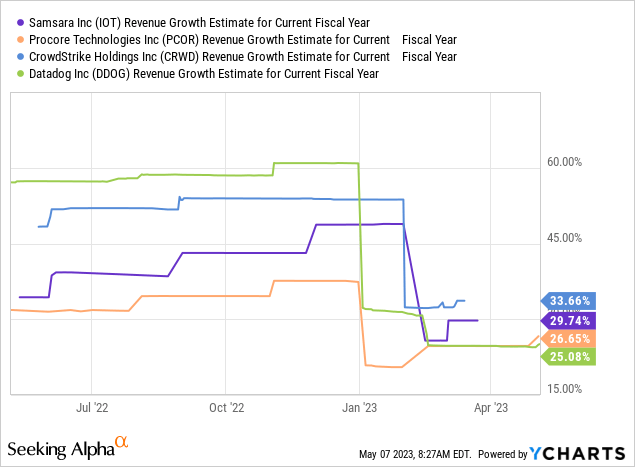

After the decent pullback, Procore’s valuation is now looking a lot more reasonable in my opinion. The company is currently trading at an EV/sales ratio of 9.4x, which is discounted compared to other SaaS companies such as CrowdStrike (CRWD), Datadog (DDOG), and Samsara (IOT). From the first chart below, you can see that the peer group has an average EV/sales ratio of 12.8x, which translates to a meaningful premium of 36.2%. The huge valuation gap seems unjustified as the company’s forward growth rate of 27% is basically in-line with peers, as shown in the second chart below. Profitability continues to be Procore’s major weakness compared to peers. However, it is finally starting to show some improvements in the latest earnings and should continue to do so moving forward.

Risks

One notable risk is the ongoing slowdown in commercial real estate, as vacancy rates continue to be high. This will likely impact office construction in the near term as the supply is currently very elevated. According to the company, office buildings account for roughly 5% of the total construction value in the US. While the low percentage will likely limit the impact, it could still be a meaningful concern if the industry continues to deteriorate. As the economy continues to weaken, we may also see the slowdown spread to other real estate categories, which could post an unprecedented impact on the company. The slowing economy may also result in construction companies being more cautious about spending, which could further impact demand.

Investors Takeaway

Overall, I believe the huge pullback presents a decent buying opportunity for Procore. The company is seeing massive growth opportunities and the ongoing digitization of the construction industry should generate meaningful tailwinds. The strong momentum is shown in the latest earnings, as revenue growth and guidance continue to be upbeat despite facing a tough macro backdrop, which is very impressive. The market also seems to be discounting the company as its valuation remains well below peers with similar growth rates. The weak profitability may be an explanation but it is now starting to show some improvements as operating leverage improves. I believe the valuation gap should contract over time as Procore continues to execute, therefore I rate PCOR stock as a buy.