Nandani Bridglal

Investment thesis

PriceSmart (NASDAQ:PSMT) introduced a successful U.S. membership-only warehouse club business model to the emerging markets of neighboring countries. When companies from developed economies enter emerging markets, they should target to generate premium profitability metrics considering all the risks inherent to investing in the emerging world. However, PSMT’s profitability metrics do not impress me, and it is crucial to mention that they stagnated over the past decade despite decent revenue growth. PSMT’s bulls might argue that the stock offers dividends to shareholders, and the dividend has grown by 9.5% over the last three years. However, the company’s low profitability metrics and vast uncertainties related to operating in emerging markets mean that the dividend growth is unsafe. Lastly, my valuation analysis suggests the stock is slightly overvalued. All in all, I assign the stock a “Hold” rating.

Company information

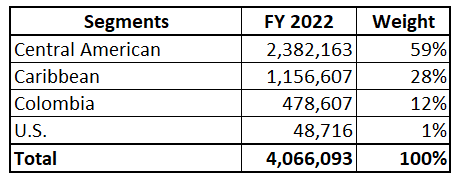

PriceSmart operates as a membership-only warehouse club, offering customers a diverse selection of high-quality products at competitive prices. According to the latest 10-K report, the company operates 50 warehouse clubs in Central America, the Caribbean, and Colombia. PSMT is incorporated in California.

The company’s fiscal year ends on August 31. The Central American segment generates more than half of the company’s revenue.

Compiled by the author based on the latest 10-K

Financials

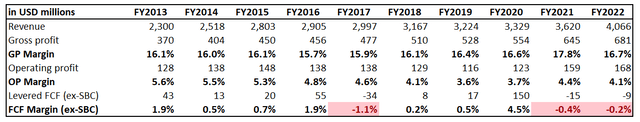

PSMT mainly targets emerging markets near the U.S.. Therefore, I was not surprised much when I figured out a solid 6.5% revenue CAGR for the past decade. That said, revenue almost doubled over the last ten years, from $2.3 billion to $4.1 billion. However, profitability metrics did not expand, which is a red flag for investors. Efficient businesses are supposed to widen their profitability ratios as operations scale up. And PSMT failed to do so. While the gross margin demonstrated slight expansion over the decade, the items below in the P&L shrank. The operating margin decreased from 5.6% in FY2013 to 4.1% in FY2022. As a result, PSMT’s levered free cash flow [FCF] margin ex-stock-based compensation [ex-SBC] was slightly below zero in the last two fiscal years.

Author’s calculations

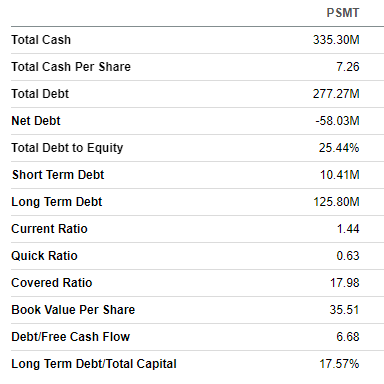

I prefer not to invest in businesses with stagnating margins over the long term because it indicates that the business model cannot generate much value for shareholders. Despite having a razor-thin FCF margin that peaks below 5%, the company has consistently paid dividends and conducted stock buybacks over the past decade. On the other hand, the forward dividend yield is low at 1.2%, and the dividend compounded at below 5% CAGR over the past decade, which does not impress me. But I have to give credit to the management’s capital allocation skills since the balance sheet is solid considering low FCF and consistent returns to shareholders.

Seeking Alpha

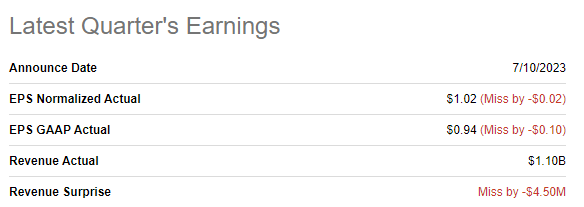

The latest quarterly earnings were released on July 10, when the company missed consensus estimates. Revenue demonstrated a solid 6.4% YoY growth. The topline strength allowed PSMT to expand its operating margin by more than 60 basis points. As a result, the adjusted EPS expanded from $0.62 to $0.94.

Seeking Alpha

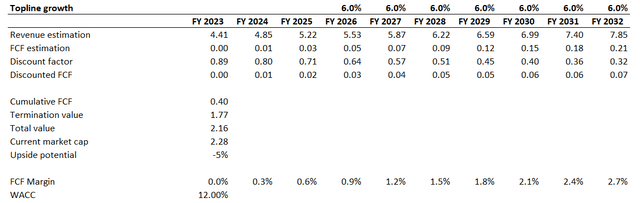

The upcoming quarter’s earnings are scheduled for release on October 30. Quarterly revenue is expected by consensus to be flat sequentially and demonstrate about 8% YoY growth, which is solid. The adjusted EPS is expected to expand from $0.75 to $0.81.

Seeking Alpha

Despite demonstrating solid near-term revenue growth momentum and profitability metrics expansion, especially in the current unfavorable global economic environment, I am not bullish on PSMT. Despite decent revenue growth over the last ten years, the company’s stagnating profitability is a red flag, meaning that the management might not be efficient enough to absorb the economies of scale effect. A razor-thin FCF margin also means that the company will start burning cash even if a slight disruption occurs to the business. PSMT’s dividend growth is not safe over the long term, while the current forward yield does not look worth a risk. Therefore, I cannot call PSMT a value company. But the company’s revenue growth also looks useless, considering stagnating profitability. That said, PSMT is neither a growth stock nor a value one.

The only potential positive catalyst for the stock price, which I see, is news about the company’s acquisition from any of the largest global retail chains willing to expand to a new niche or geographic presence. However, this catalyst is unlikely because many hyper-scale chains already have loyalty programs. Neither PSMT’s business looks like an attractive target for acquisition, given its weak fundamentals.

Valuation

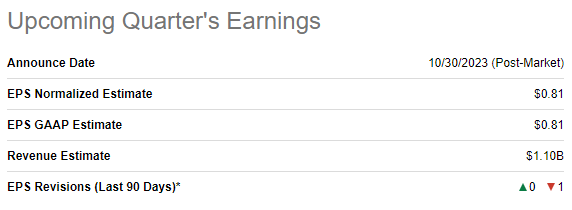

The stock rallied 21% year-to-date, significantly outperforming the broader U.S. market. Seeking Alpha Quant assigns the stock a decent “B-” valuation grade because PSMT’s multiples are substantially lower than the sector median and five-year averages across the board. Valuation multiples analysis indicates substantial undervaluation.

Seeking Alpha

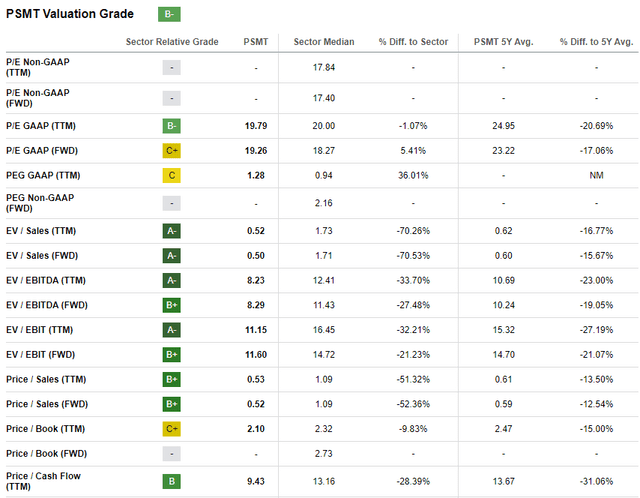

Now, I want to proceed with the discounted cash flow [DCF] simulation. I use an elevated 12% WACC for discounting since the company’s FCF margin has been unstable recently. Consensus revenue estimates forecast high-single-digit revenue growth in the next three years. For the years beyond, I have implemented a 6% revenue CAGR to be conservative. I expect the base year FCF margin to be zero with a 30 basis points yearly expansion.

Author’s calculations

According to my valuation analysis, the current market cap is very close to the business’s fair value. The stock is approximately fairly valued with a slight 5% downside potential. Therefore, the valuation of PSMT does not look attractive at current levels.

Risks to consider

Operating in emerging markets is risky. Emerging markets usually have higher economic and political instability levels than more developed economies. PriceSmart’s operations and financial performance can be disrupted by local currencies devaluation and sudden changes in governmental policies. Rapid shifts in economic conditions can weigh on consumer spending and soften the company’s sales.

Emerging markets also tend to have less developed infrastructure, including transportation and distribution networks. These challenges can limit the company’s ability to improve operating efficiency because disruptions in the supply chain are likely to occur more frequently in the emerging environment. Disruptions can lead to delays, increased costs, and inventory management issues.

Bottom line

To conclude, PSMT is a “Hold”. I do not like long-term trends in the company’s profitability metrics. Revenue growth over the past ten years looks decent, but I am not impressed when there is no profitability expansion. The FCF margin is razor-thin, meaning that any insignificant disruption to the company’s operations might lead PSMT to start burning cash. Apart from not strong fundamentals, the valuation also suggests that the stock is not attractively priced. Operating only in emerging markets around the U.S. is also substantially risky, and the dividend yield offered by the stock does not outweigh these risks.