Dallas, Texas, is one of the fastest-growing metropolitan areas in the country, with a large, diversified, and growing economy. With home prices below the national average and solid cash flow potential, Dallas has many traits that support favorable long-term conditions for real estate investors.

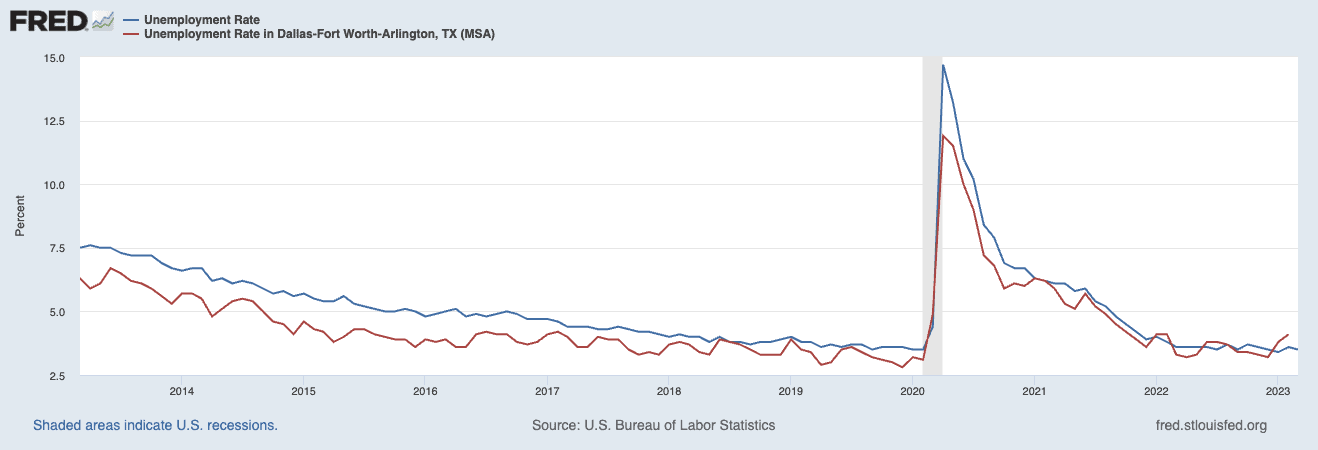

Population and Labor Market

Located in Northeast Texas, the Dallas metropolitan area is actually composed of two large cities and one small city: Dallas and Fort Worth, and then the smaller city of Arlington that lies between them. Combined, the Dallas metropolitan area has a population that is growing well above the national average. The median age of residents in Dallas is just under 33 years old, which is right around the peak homebuying and household formation age—which indicates strong and sustainable demand for housing in the region.

Dallas’ large and diverse economy helps insulate it from economic downturns. The area has large medical and educational institutions and a significant airline presence anchored by American Airlines and Southwest Airlines. The unemployment rate is low but slightly above the national average and has ticked up slightly of late.

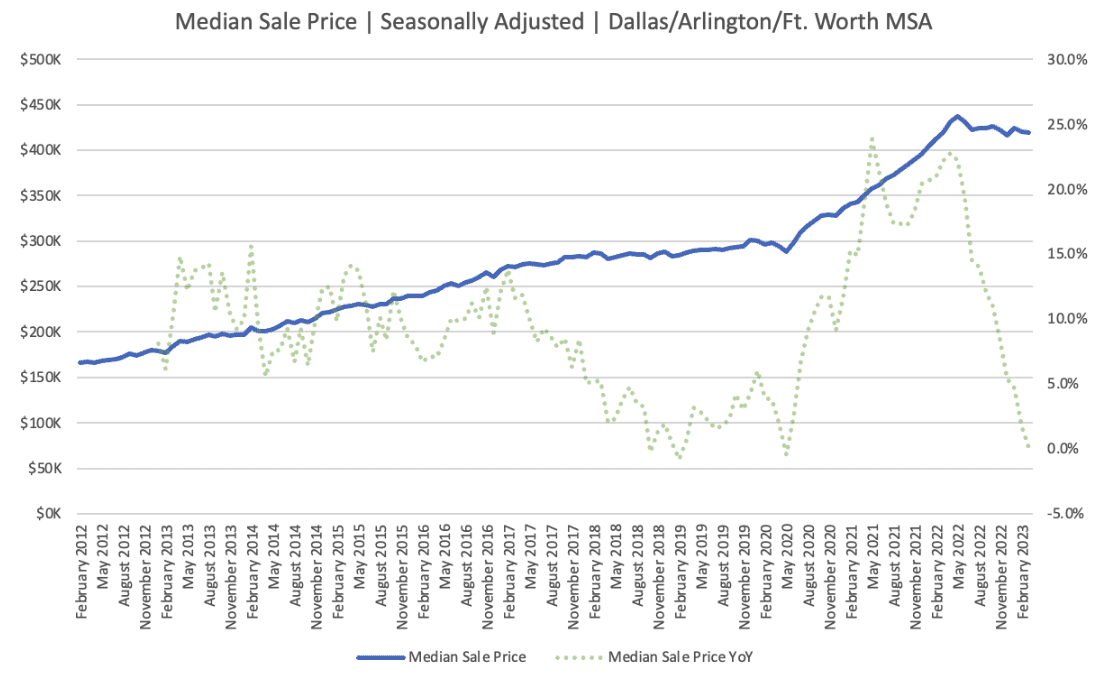

Home Prices

Despite strong demand and a strong economy, investing conditions in Dallas remain attractive. As of this writing, the median sales price in the Dallas area is just above $400,000—which is relatively close to the national average but below that of cities with similarly sized economies.

It’s important to note that while prices in Dallas have been relatively flat over the last several months, the pace of growth has come down considerably. This is to be expected, given the macroeconomic climate, but it’s worth noting that appreciation in Dallas, as a whole, is likely to be modest or even slightly negative in the coming months.

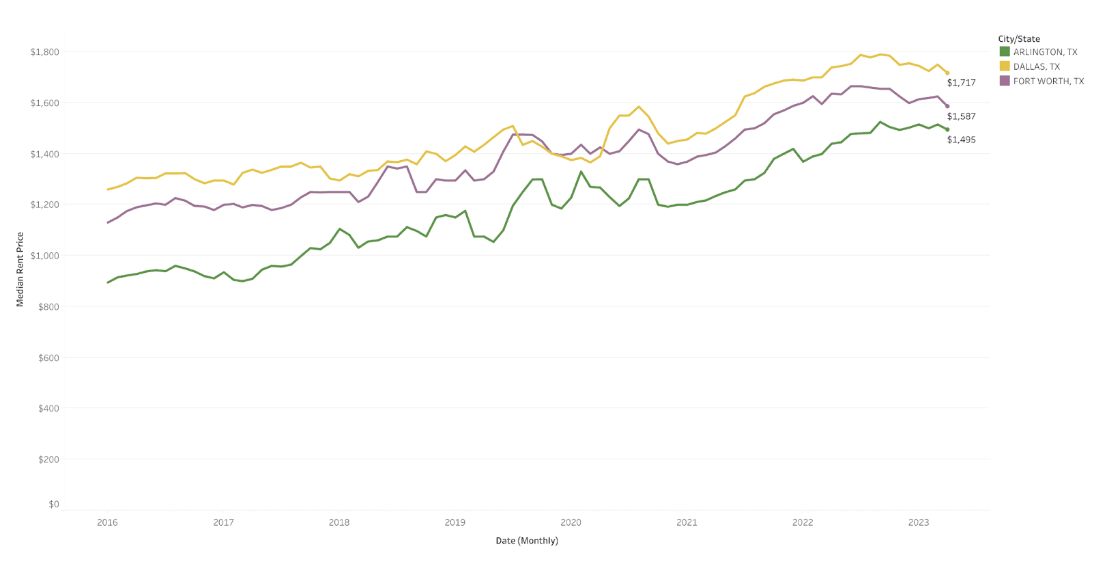

Rent Growth and Cash Flow

Rent growth has followed similar patterns to housing but varies slightly by city within the metropolitan area. Rents in Arlington, for example, have remained flat over the last six months, while rents in Dallas and Fort Worth have come down modestly. Some decline in rent is not concerning, given the rapid pace of rent growth in recent years, and most data supports that rent declines will be minimal.

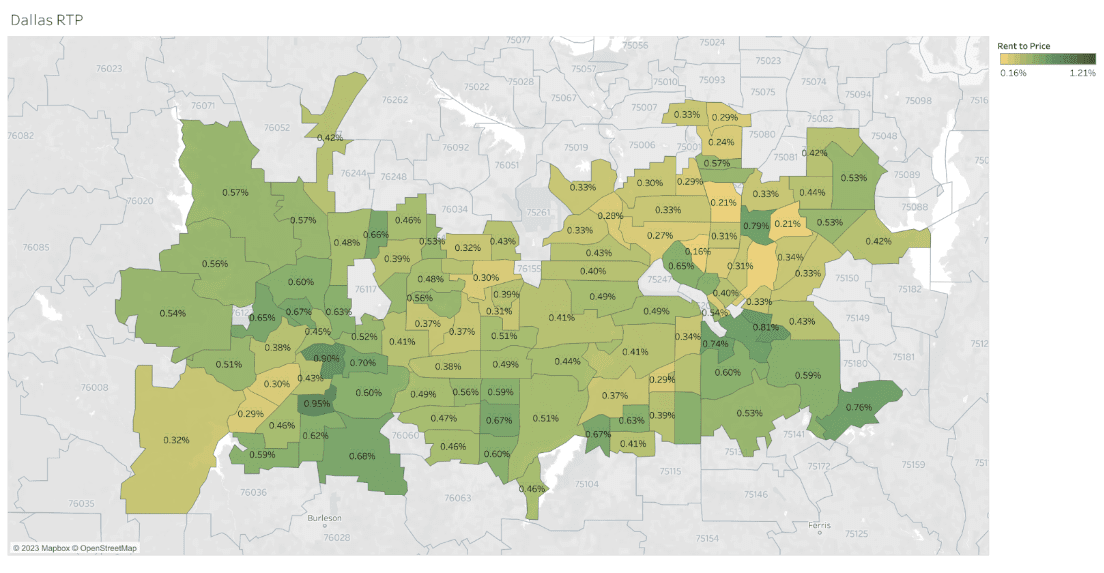

When looking at cash flow prospects for Dallas, it varies considerably by location within the metropolitan area. Areas near Fort Worth and south of Dallas have rent-to-price ratios (a good proxy for cash flow) near 1%—which is a good sign for cash flow potential. However, North Dallas and most of the area between Dallas and Fort Worth have rent-to-price ratios that suggest cash flow will be difficult to find. Overall, there’s solid cash flow prospects for a metro area of this size!

Inventory and Market Health

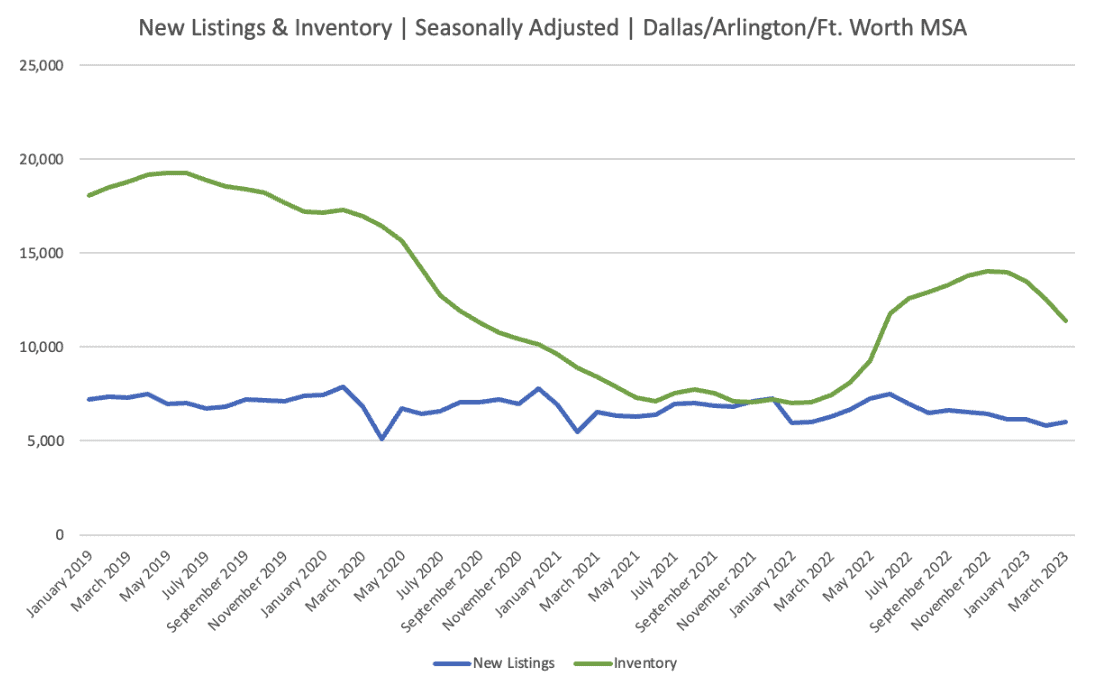

Looking ahead, there are signals that although the housing market in Dallas has loosened up—it’s still on fairly strong ground. New listings are declining, and although inventory is up from its pandemic lows, its actually fallen over the last several months. This points to a market with fairly strong competition for properties and perhaps even a seller’s market.

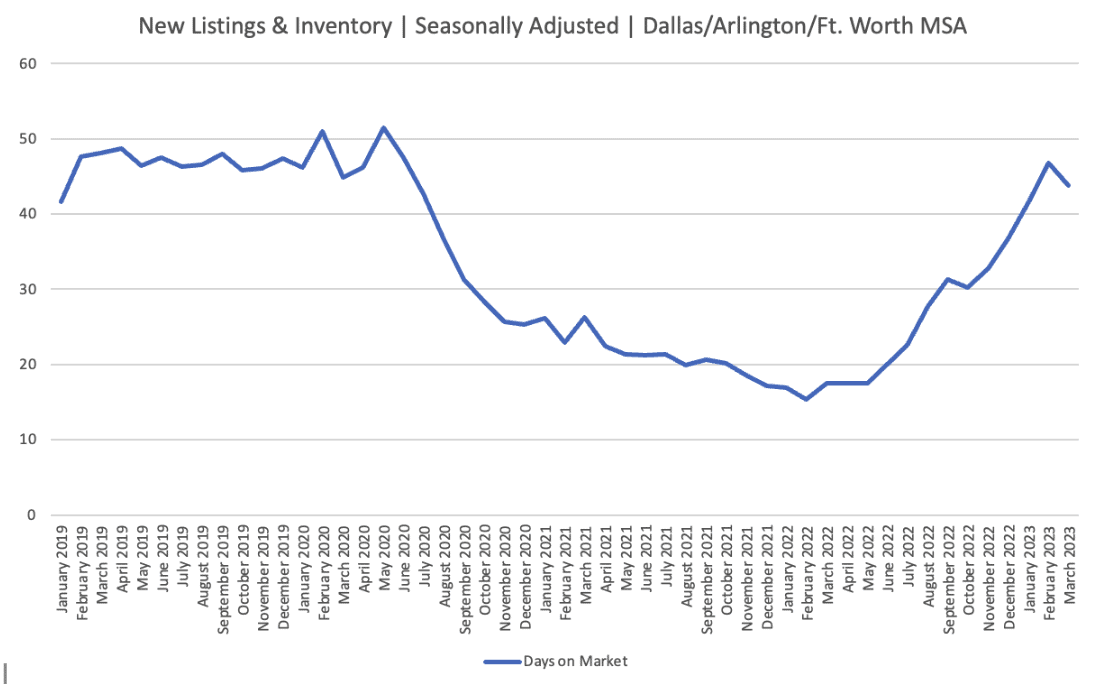

Additionally, although days on market (DOM) has almost returned to pre-pandemic levels, they dropped in the most recent reading. One new data point does not make a trend, so this will be an important metric to watch in the coming months.

Winning Strategies

Overall, Dallas is a robust all-around market for real estate investors. It has a reasonable price point, solid cash flow potential, and a strong economy to support future growth. While the national housing market experiences a correction, Dallas is holding up relatively well. Prices have been relatively flat, and key lead indicators suggest that the market will be one of the more stable housing markets in the country over the coming months.

Victor Steffen, an investor-friendly real estate agent in the Dallas area, says, “The investors we see winning right now are leaning into B.E.A.F properties. BEAF stands for break-even appreciation-focused. Our most successful investors target areas with increasing populations, increasing numbers of jobs, and increasing median incomes. We aim for an entry price 10-20% below the previous market high, and we want to see today’s lease rate cover the PITI. At this point in the market cycle, when most retail buyers are sitting on the sidelines our investors have more opportunity than ever to pick up high-quality B+ or even A-grade, turnkey inventory. It’s one of those rare market cycles where investors are some of the last players in the market. We can pick up ‘blue chip’ assets at discounts without competing against a dozen retail buyers.”

If you’re interested in learning more about investing in Dallas, partner with a local investor-friendly real estate agent like Victor Steffen, who can guide you through which strategies, tactics, and neighborhoods to focus on.

Here’s how to contact Steffen on Agent Finder:

- Search “Dallas, Texas”

- Enter your investment criteria

- Select Victor Steffen or other agents you want to contact

Steffen ranked #22 of 86,000 agents at EXP Realty by sale volume and #5 in the state of Texas. He and his wife are active real estate investors, owning a variety of cash-producing assets including rent-by-room housing, long, mid, and short term rentals. They plan to continue building their portfolio with an emphasis on new construction assets and 20-50 unit complexes in 2023.

Find an Elite Agent in Minutes

Use Agent Finder to connect with local market experts like Victor Steffen, Kim Meredith-Hampton, and Matthew Nicklin.

- Search target markets like Dallas, Tampa, or Atlanta

- Enter investment criteria

- Select investor-friendly agents that fit your needs

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.