Darren415

This article was first released to Systematic Income subscribers and free trials on Oct. 9.

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferreds and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the first week of October.

Be sure to check out our other weekly updates covering the BDC as well as the CEF markets for perspectives across the broader income space.

Market Action

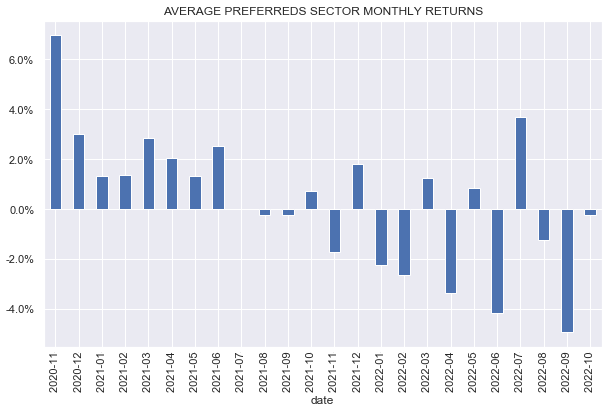

The preferreds sector was down marginally in the first week of October as longer-term Treasury yields rose somewhat. September was the worst month for the space since March of 2020 and October has not yet brought much relief.

Systematic Income

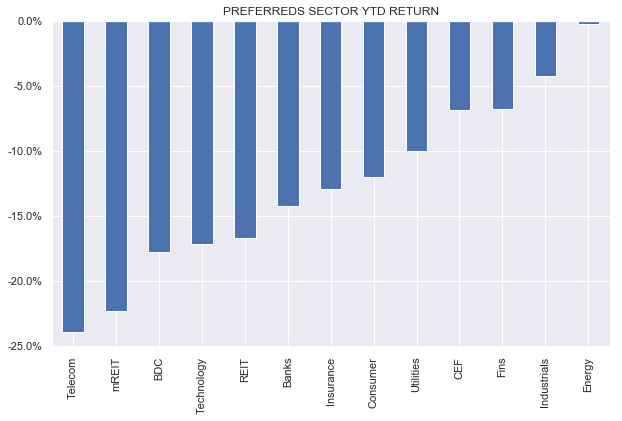

All preferreds sectors are now in the red year-to-date even the Energy sector.

Systematic Income

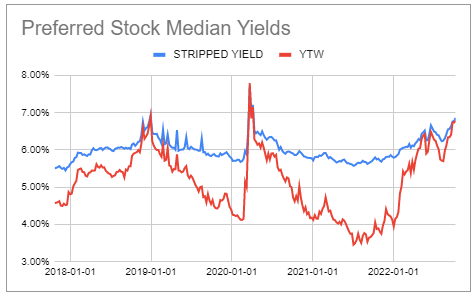

Preferreds yields have moved out to new highs as the following chart shows.

Systematic Income Preferreds Tool

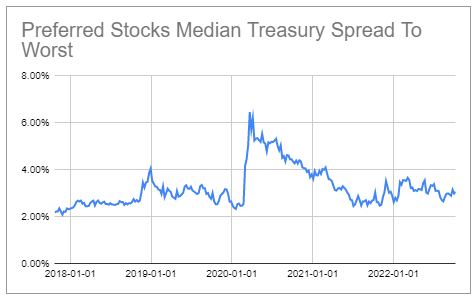

However, credit spreads have not reached new highs and remain at middling levels.

Systematic Income Preferreds Tool

Although yields have risen substantially, the preferreds sector is far from a distressed level which suggests that higher-quality preferreds make more sense for new capital allocation.

Market Themes

The preferreds market is going through one of the most volatile periods in recent history. However, even by this metric, end-of-month September price action was unusual with many preferreds moving by high single digit levels.

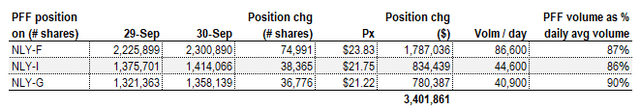

We specifically registered big moves in NLY preferreds. As is often the case, when we see end-of-month volatility, ETF rebalancing is the likely culprit. The following table shows the holdings of NLY preferreds by the largest preferred fund iShares Preferred and Income Securities ETF (PFF).

Systematic Income

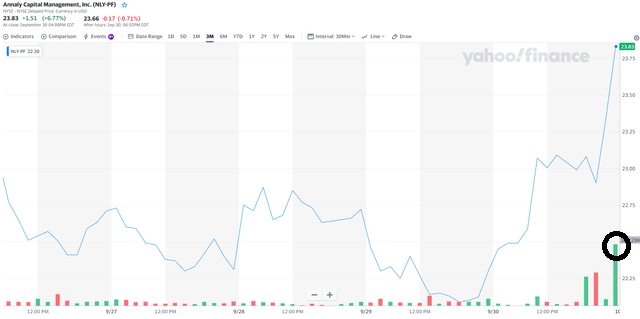

The table shows that the fund bought 150k shares of NLY preferreds on 30-Sept which equated to around 90% of each stock’s daily volume. This all happened in the last half hour of trading as the following 30-minute volume bar chart shows.

Yahoo

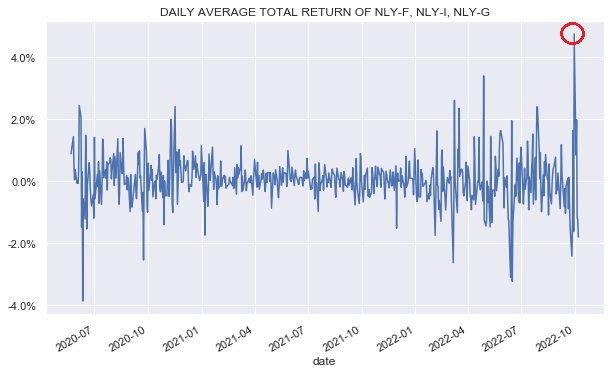

This kind of volume at the end of the day on Friday is going to leave a mark. The following chart shows the average daily total return of the 3 NLY preferreds which was unusual in the post-COVID period.

Systematic Income

The obvious question is whether investors can take advantage of this kind of dynamic. In theory the answer is clearly yes, however, in practice this is unlikely for the vast majority of investors. To take advantage of this pattern, investors would have to know the change in the underlying index as well as how the fund manages the sampling of the index. The sharp rally in the 3 stocks as well as no significant gains prior to the jump also suggest that the pattern is probably hard to monetize. Investors, however, can take advantage of this pattern by providing liquidity to the funds i.e. selling during sharp gains and picking up cheap securities during sharp drops with the view that the yields will renormalize eventually.

Market Commentary

This week we added a number of securities to our Tools. Specifically, we added the split investment-grade Bank preferreds KeyCorp Series H (KEY.PL) which trades at a 6.36% stripped yield as well as the sub-investment grade Merchants Bancorp Series D (MBINM) which trades at a 7.96% stripped yield. Both stocks are the best picks in their suites.

Household name BB+ rated Ford 6.5% 2062 bond (F.PD) was added to the Baby Bond Tool. It looks more attractive than F.PC and trades at a 7.01% yield. It’s a good choice for investors who want to pick up a decent quality longer-duration bond.

Stance And Takeaways

This week we rotated from the redeemed bank floating-rate preferred (PNC.PP) to another bank soon-to-float preferred ZIONO (from Zions Bank (ZION)) in our Defensive Income Portfolio. ZIONO will float in Mar-2023 unless redeemed. ZIONO reset yield is 8.9% i.e. this is the yield it will have at the current price on the first call date (Mar-2023) at the current Libor forward which is pretty good. It could also be redeemed but if that happens the YTC is decent at 6.3% for 5 months.

Hawkish Fed talk is putting some pressure on markets. Mary Daly (SF Fed Chief) said she does not expect any cuts next year in the policy rate. Raphael Bostic (Atlanta Fed Chief) said he wants to see the rate rise to 4-4.5% and stay there for a while. OPEC’s decision to cut output by 2m barrels – the most ever (to keep Brent above $90 it seems) – should keep pressure on inflation and keep the Fed from swift reversals of the hikes. This should, in turn, continue to support preferreds that will reset over the next year like ZIONO, NLY.PG and others which are all worth a look.