Darren415

Welcome to another installment of our Preferreds Market Weekly Review, where we discuss preferred stock and baby bond market activity from both the bottom-up, highlighting individual news and events, as well as the top-down, providing an overview of the broader market. We also try to add some historical context as well as relevant themes that look to be driving markets or that investors ought to be mindful of. This update covers the period through the third week of December.

Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the closed-end fund (“CEF”) markets for perspectives across the broader income space.

Market Action

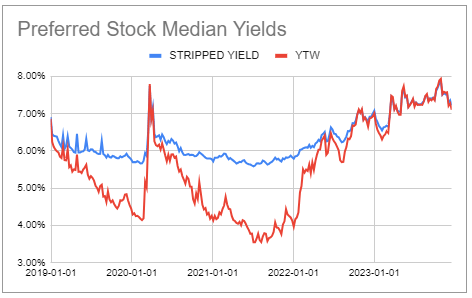

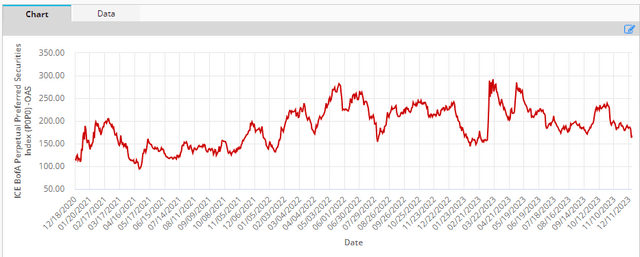

Preferreds continued to rally last week on the back of further falls in Treasury yields, bringing the year-to-date total return of the sector to around 9%. Exchange-traded preferreds yields continued to drift towards 7% from their recent 8% peak.

Systematic Income Preferreds Tool

Credit spreads are trading near the bottom of their post-2022 range.

ICE

Market Themes

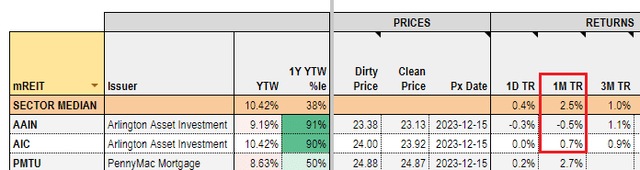

A day after AAIC shareholders voted to approve the proposed merger with Ellington Financial (EFC) on December 12th, AAIC announced its plans to delist and deregister its two baby bonds (AIC) and (AAIN) with the last day of trading on the NYSE being January 5th.

The reason given for the delisting is that “the costs of compliance, the demands on management’s time and the resources required to maintain the listing of the Senior Notes on the NYSE will exceed the benefits”.

There are three odd things here. One is that the AAIC preferreds are converted into EFC preferreds and will continue to trade on the NYSE. In other words, the larger entity is happy to take on additional regulatory requirements of the preferreds but not the debt. Perhaps the compliance and regulatory requirements of exchange-traded debt are more onerous than for exchange-traded preferreds but on the face of it this is a strange outcome.

Two, the costs and benefits in the comment above accrue to different players. EFC don’t accrue many benefits from keeping the bonds listed on the exchange but they do benefit from their existence (due to their relatively low coupons).

The benefits of listed bonds, however, would accrue mostly to bondholders who can take advantage of their daily liquidity. By delisting the bonds, EFC don’t lose many benefits (arguably they lose the ability to buy them back in the secondary but this is a minor benefit) but get rid of burdensome compliance and regulatory costs. Bondholders on the other hand don’t gain anything from the delisting and lose the ability to easily trade the bonds. In short, when AAIC talk about costs of listed bonds exceeding their benefits they are clearly talking only about the company’s cost/benefit calculation which is the polar opposite of the bondholder one.

Third, it’s odd for Arlington to issue a statement saying it’s too burdensome for them to manage the bonds if a day later they don’t have that responsibility anyway as Arlington management is not responsible for the larger merged entity which now backstops the bonds. Perhaps what happened here is that EFC wanted to leave the unpopular dirty work to Arlington as its last public facing task.

In any case, normally, securities going through delisting / deregistration suffer in the market as investors rush to sell their holdings. This is because investors don’t like sitting on illiquid holdings while others sell to get in front of the likely selling wave.

So far the bonds have been fairly resilient though they have underperformed other mortgage REIT bonds by around 2-3% over the last month.

Systematic Income Preferreds Tool

The yields of these bonds are already very attractive even in the higher-risk portfolio of EFC. Any further drops would be attractive entry points in our view for investors who can put up with an illiquid holding.

Stance And Takeaways

Although the delisting of the two AAIC baby bonds is unfortunate, investors who prize liquidity have many other options available to them. In the relatively small mortgage REIT baby bond sector, investors should have a look at the Ready Capital 2026 bond (RCC) as well as the PennyMac 2028 bond (PMTU) which trade at yields of 8.05% and 8.6% respectively.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!