Edwin Tan/E+ through Getty Photographs

Some firms find yourself being presents that carry on giving. One good instance of this that I may level to entails a slightly small regional financial institution by the title of Most well-liked Financial institution (NASDAQ:PFBC). Up to now, I’ve written in regards to the establishment, which emphasizes serving the Chinese language American market, on two separate events. In my final article, which was revealed in March of this 12 months, I said that the corporate nonetheless represented a strong prospect for traders. This led me to reaffirm the ‘purchase’ score I had on the inventory beforehand. Since then, shares have outperformed the market barely, being up 10.1% at a time when the S&P 500 is up 9.2%. And since I first rated it a ‘purchase’ in July of final 12 months, shares have generated upside of 24.7% whereas the S&P 500 has risen by 22.2%.

Though that is technically outperforming the market, I would not say that the outperformance has been important. However sturdy efficiency is powerful efficiency nonetheless. After seeing the strikes greater that shares have seen, it stands to motive that traders may marvel how a lot extra upside, if any, can nonetheless be had. Wanting on the firm’s most up-to-date monetary outcomes, we do see a little bit of weak point on its prime and backside traces. However relative to earnings, even projected earnings, shares stay attractively priced. The corporate could be a bit expensive relative to its e-book worth. That is very true when you think about how little income comes from non-interest earnings. However while you come to grasp simply how top quality its belongings are, and also you pair that up with the affordability of shares relative to earnings, it is troublesome to charge the corporate something aside from a ‘purchase’.

The image stays sound

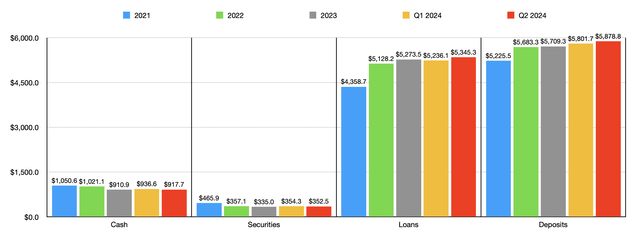

In my final article about Most well-liked Financial institution, we solely had knowledge overlaying by the ultimate quarter of the 2023 fiscal 12 months. At the moment, outcomes now prolong by the second quarter of 2024. The beauty of Most well-liked Financial institution is that the corporate continues to realize development, even throughout these unsure occasions. Take deposits for example. On the finish of 2023, the enterprise had deposits of $5.71 billion. These elevated to $5.81 billion within the first quarter of this 12 months, earlier than climbing additional to $5.88 billion within the second quarter. On the finish of the day, deposit development is integral to any financial institution that wishes to develop. And it is because the deposits are what banks use with the intention to give out loans, put money into securities, and finally generate a revenue.

Writer – SEC EDGAR Knowledge

This residue development has, certain sufficient, powered the corporate to even better heights in relation to sure components of its stability sheet. In the latest quarter, loans totaled $5.35 billion. That is up from the $5.24 billion reported only one quarter earlier, and it stacks up properly in opposition to the $5.27 billion the financial institution ended final 12 months at. Over the identical window of time, the worth of securities on its books went from $335 million to $352.5 million. It’s price mentioning that the second quarter determine was a tad decrease than the $354.3 million reported for the primary quarter of the 2024 fiscal 12 months. However you will notice fluctuations infrequently.

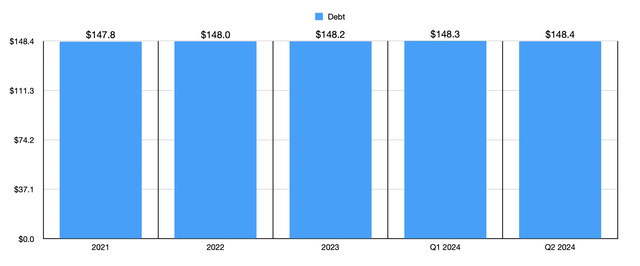

Money and money equivalents have been a bit extra risky. After climbing from $910.9 million on the finish of final 12 months to $936.6 million within the first quarter, they did dip right down to $917.7 million within the second quarter of this 12 months. Though I do not wish to see declines in any main asset, these fluctuations are inevitable. One factor that has barely budged, nevertheless, has been debt. On the finish of the 2023 fiscal 12 months, the corporate had $148.2 million in debt on its books. This quantity inched up solely barely to $148.4 million in the latest quarter. This can be a pretty small quantity of debt that ought to end in pretty low threat to traders.

Writer – SEC EDGAR Knowledge

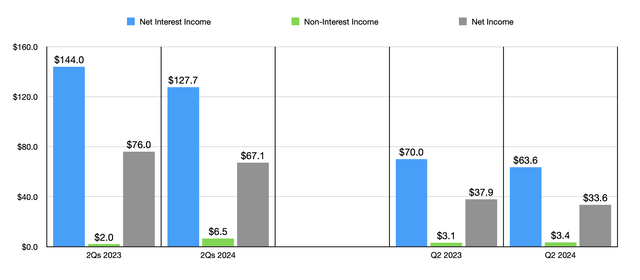

Shifting on to the earnings assertion, we’ve seen some weaknesses. Though loans and securities have elevated and debt has remained nearly unchanged, internet curiosity earnings dropped from $70.8 million within the second quarter of final 12 months to $63.6 million the identical time this 12 months. For the primary half of this 12 months as a complete, the quantity was $127.7 million, in comparison with the $144 million reported one 12 months earlier. This drop was pushed by a plunge within the firm’s internet curiosity margin from 4.58% within the second quarter of final 12 months to three.96% the identical time this 12 months, and from 4.67% within the first half of final 12 months to 4.07% the identical time this 12 months.

Writer – SEC EDGAR Knowledge

The very fact of the matter is that top rates of interest have confirmed to be problematic for a lot of establishments. They’ve needed to, sadly, enhance the quantity that they pay depositors with the intention to develop deposits or, in some instances, to even hold them unchanged. For instance, within the second quarter of final 12 months, the corporate had solely pay 3.69% every year on all interest-bearing deposits. That quantity in the latest quarter of this 12 months was 4.63%. And for all curiosity incomes liabilities, the rise was from 3.73% to 4.60%. By comparability, for all curiosity incomes belongings, we noticed solely a modest uptick from 7.39% to 7.61%.

Though internet curiosity earnings took successful 12 months over 12 months, the identical can’t be stated of non-interest earnings. The rise for the latest quarter was from $3.1 million final 12 months to $3.4 million this 12 months. And for the primary half of this 12 months, it was $6.5 million in comparison with the $2 million reported final 12 months. That is largely as a result of, final 12 months, Most well-liked Financial institution incurred $4.1 million in internet losses on the sale of funding securities. This greater than offset development elsewhere, such because the rise in letters of credit score payment earnings from $2.9 million to $3.3 million. Sadly, these enhancements weren’t sufficient to stop internet earnings from dropping. In the latest quarter, the corporate generated income of $33.6 million. That is a decline from the $37.9 million reported one 12 months earlier. For the primary half of this 12 months, the $67.1 million that the corporate generated was down from the $76 million reported for the primary half of 2023.

Writer – SEC EDGAR Knowledge

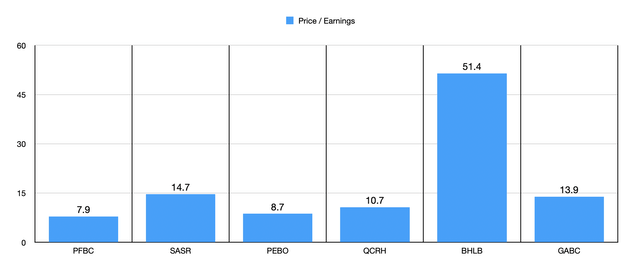

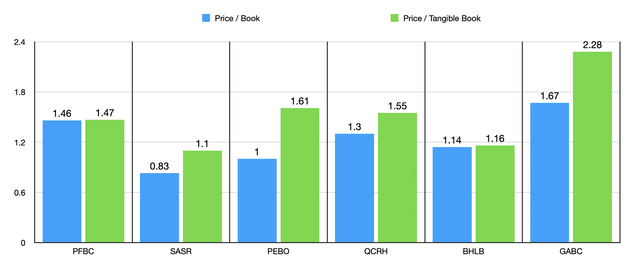

On the subject of valuing the corporate, the very first thing I did was have a look at its value relative to earnings. I really annualized the outcomes that we’ve seen to date for 2024 to get a extra conservative studying than if we have been to make use of outcomes from 2023 as a complete. Throughout this, we get a value to earnings a number of of seven.9. Within the chart above, I in contrast Most well-liked Financial institution to 5 comparable corporations. And of the 5, it ended up being the most cost effective. Sadly, that was not the case on a value to e-book or value to tangible e-book foundation. Within the chart under, you possibly can see precisely what I imply. On a value to e-book foundation, 4 of the 5 establishments ended up being cheaper than our goal. Luckily, this drops to solely two of the 5 when utilizing the worth to tangible e-book method.

Writer – SEC EDGAR Knowledge

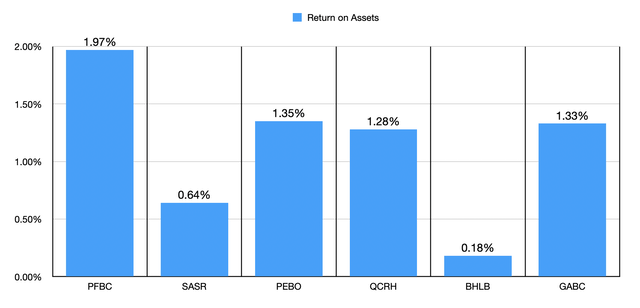

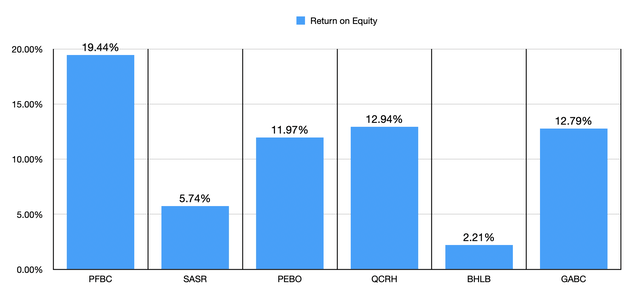

One other factor that we ought to be listening to is asset high quality. Usually, asset high quality is greater if you end up speaking about an establishment that has a big portion of its income coming from non-interest earnings. However that is not what we see right here. With a return on belongings of 1.97%, as proven within the first chart under, Most well-liked Financial institution is superior to the opposite 5 firms I’m taking a look at on this article. The identical may be stated, wanting on the subsequent chart, in relation to return on fairness. As soon as once more, our candidate is the crème de la crème.

Writer – SEC EDGAR Knowledge Writer – SEC EDGAR Knowledge

Takeaway

Basically talking, the image for Most well-liked Financial institution has been fairly strong. It’s disappointing to see the drop in income this 12 months. However not all the things may be excellent. Debt stays low, whereas securities and loans observe deposits greater. Shares are low cost on a value to earnings foundation and, relative to comparable corporations, they don’t seem to be precisely costly in relation to e-book worth. Asset high quality is excessive on each fronts. Add all of this collectively, and I do suppose that preserving the corporate rated a ‘purchase’ is smart.