JHVEPhoto

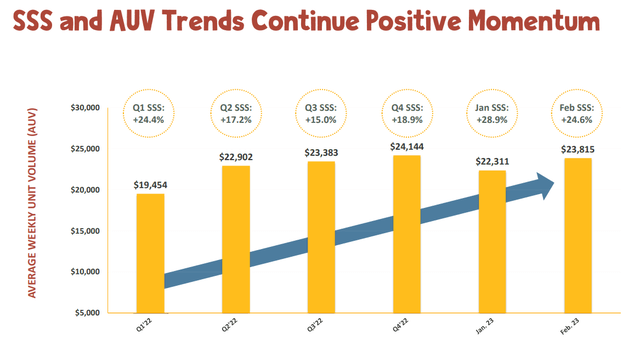

Potbelly (NASDAQ:PBPB) has continued its string of excellent results with Q4 2022 same store sales growth of +18.9%. It also believes that it can generate high-single digits same store sales growth in 2023 along with low-teens shop-level margins (an improvement of several percent compared to 2022). This puts Potbelly in good shape to reach its 2024 targets.

Potbelly also announced a New York City development and refranchise agreement that saw eight shops refranchised and involved a commitment for 13 additional new shops over the next eight years.

Potbelly’s excellent performance in 2022 and its strong guidance for 2023 boosts its estimated value to $8 to $9 per share. This estimated value was boosted by around $0.50 from when I last looked at Potbelly since it is slightly outperforming my expectations and looks increasingly likely to hit its 2024 targets. At its current price, I am neutral on PBPB stock.

Potbelly’s same store sales growth is likely to slow considerably (to mid-single digits) later in 2023, but that is due to tougher year-over-year comps.

Excellent 2022 Results

Potbelly had announced preliminary Q4 2022 results before with +18.9% same store sales growth along with revenues of $119 million to $120 million. Potbelly’s actual results for Q4 2022 had an identical (+18.9%) same store sales growth, but also revenues of $120.2 million, marginally above its preliminary expectations.

In addition, Potbelly noted that its shop-level margins reached 14.2% in Q4 2022, above its preliminary estimate for 13.4% to 13.9% shop-level margins. That preliminary estimate was already above Potbelly’s initial guidance for 10% to 13% shop-level margins.

All in all, Potbelly’s Q4 2022 results were very strong, as were its full-year 2022 results. Potbelly achieved its full-year 2022 guidance for low double-digit shop level margins and double-digit same store sales growth. It reported 10.5% shop-level margins for 2022 along with +18.5% same-store sales growth.

Positive Guidance For 2023

Potbelly’s guidance for 2023 also looks to be pretty good. It expects high single-digit same store sales growth for 2023 along with a low teens shop-level margin. This would probably put Potbelly at around $30 million to $35 million in adjusted EBITDA for the year.

Potbelly expects close to 20% same store sales growth for Q1 2023 and this should be a pretty accurate forecast since it already had two months of data for Q1 2023 when it provided guidance.

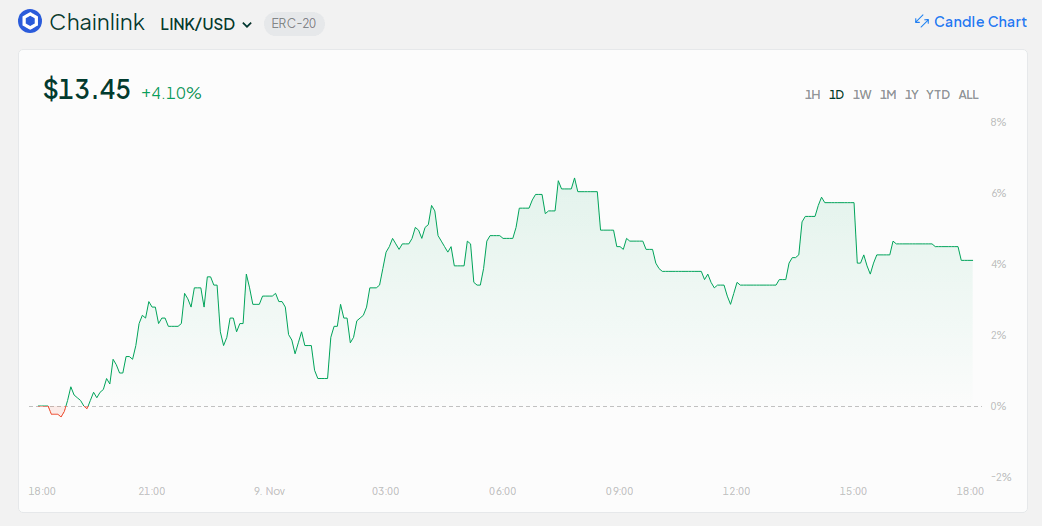

Potbelly reported +28.9% same store sales growth in January 2023 and +24.6% same store sales growth in February 2023. Those were against easy comps though with Potbelly’s sales affected in early 2022 by Omicron and severe winter weather.

Potbelly’s Sale Trends (potbelly.com)

Against tougher comps from March onward, it appears that Potbelly is expecting roughly mid-single digits same store sales growth.

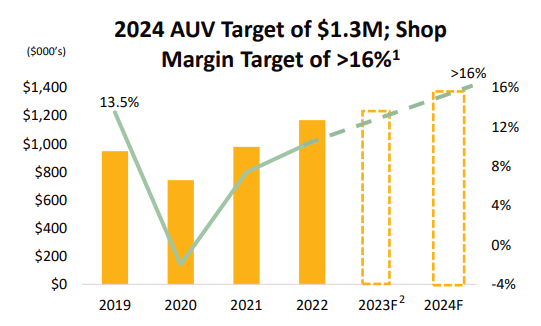

2024 Targets Are Within Reach

Assuming that Potbelly can meet its guidance for 2023, it would be within striking distance of hitting its 2024 targets. Another 2% to 3% same store sales growth in 2024 should result in it getting to its sales level target for that year. Potbelly is also aiming to reach 16% shop-level margins by 2024, with would probably require a 2% to 3% increase in shop-level margins from Potbelly’s 2023 expectations for low-teens shop-level margins.

Potbelly’s Targets (potbelly.com)

Potbelly seems more likely to overperform with its sales targets than with its margin targets. Given its 14.2% shop-level margins in Q4 2022 though, getting to 16% in 2024 appears to be an achievable target.

Notes On Valuation

I now believe Potbelly is worth around $8.00 to $9.00 per share. This is up around $0.50 per share from my previous estimates due to its strong start to 2023 along with its full-year guidance for high-single digits same store sales growth.

While Potbelly’s sales growth is expected to slow as comps get tougher, it looks to be in good shape to reach its 2024 targets with respect to both sales levels and shop-level margins.

Conclusion

Potbelly has continued to perform well in early 2023, with same store sales up over +25% during the first couple months of the year. Sales growth is likely to slow considerably later in the year due to tougher comps though.

This sales growth plus its improvement in shop-level margins puts it on track to generate around $30 million to $35 million in adjusted EBITDA in 2023. It looks capable of reaching its 2024 targets as well, as that would only require another 2% to 3% improvement in same store sales in 2024. Potbelly’s shop-level margin target for 2024 may be a bit tougher to reach, although it still looks achievable with a 2% to 3% improvement in margins from its expected low-teens level in 2023.

Potbelly’s strong performance has boosted its estimated value to $8 to $9 per share. Its current share price reflects its strong operational performance though, so I am neutral on it for now.