TERADAT SANTIVIVUT

Again at first of the quarter, we supplied a decile evaluation in a Chart of the Day taking a look at Q2 efficiency of Russell 1,000 members. In that report, we highlighted a theme that has been no secret this 12 months: shares with bigger market caps have outperformed.

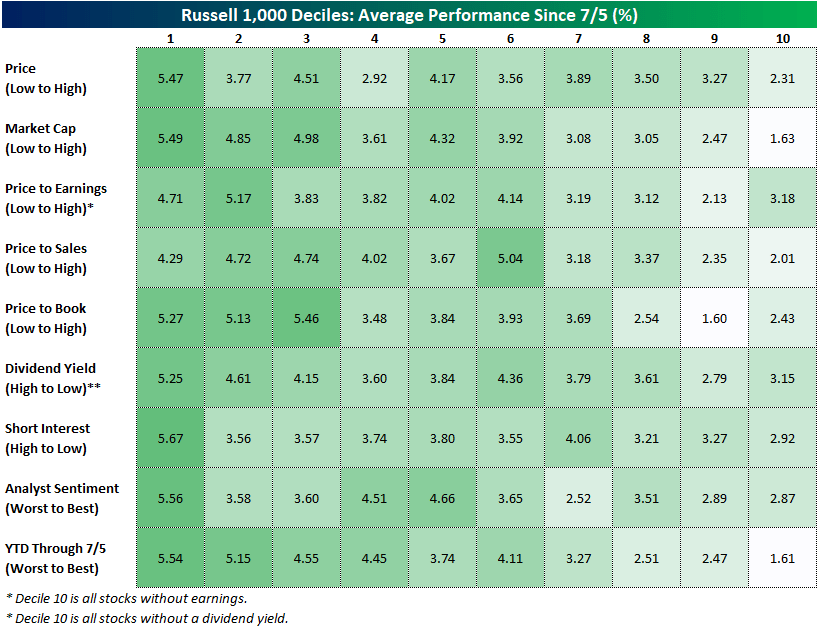

Quick ahead to this week and a cooler-than-expected CPI report, the themes of efficiency have flip-flopped. Since final Friday’s shut, the common Russell 1,000 member has risen by 3.73%.

Nevertheless, the shares with the biggest market caps solely rose 1.6%. In the meantime, the deciles of the smallest shares (by worth and market cap) have outperformed, rallying nearer to five.5%.

Equally, the deciles of shares with the most cost effective valuations, highest dividend yields, highest brief curiosity, most optimistic analyst sentiment, and worst performers YTD have seen positive aspects within the 5% vary.

Unique Put up

Editor’s Observe: The abstract bullets for this text have been chosen by In search of Alpha editors.