SimonSkafar

Dear readers/subscribers,

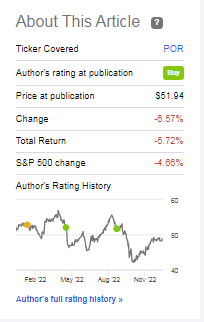

In my last article on Portland General Electric (NYSE:POR), I maintained my “BUY” rating on the company. This was before a significant decline in the company’s share price, which by the way saw me adding to my position.

Seeking Alpha POR article (Seeking Alpha)

You might think that that sort of trend worries me – but this would be entirely wrong. I will explain why that is, and how you go about investing in the company this time around – because you have two choices if you’re interested.

Revisiting Portland General Electric

This company’s fundamentals are no joke. Oh, investing in the west-coast area utilities given the mixture of population trends, and climate changes (including forest fires) might not be on the top of your list of things to do as an investor. However, at a certain valuation, any company can become valuable enough to buy (unless we’re talking negative assets on the books).

Portland General Electric is a Fortune 1000 company with assets around the state of Oregon. It’s a mixed utility, both generating, transmitting, and distributing electricity. It covers over 40% of the inhabitants of the state with its services, and it’s over 130 years old with a history that involves brief ownership by the Enron company – though it divested itself of POR during its bankruptcy.

The focus for POR is the western area across the Willamette river, whereas the company Pacific Power, which isn’t publicly listed, works the eastern bank and beyond.

As a utility, POR is regulated with large parts of its business. It both produces and purchases energy from legacy assets such as coal and natgas, but also from hydro power. It once operated a nuclear plant, but the company decided to close that one early – a decision it might regret in this environment, though it was long ago this was done.

The company has BBB+ fundamentals with a current yield of 3.73%. It’s not a top-yielder in the utility sector, but it’s nonetheless quite stable in terms of income, averaging growth of about 5.7% CAGR for the past 15 years, which is about on par with most utilities.

The company wants to continue to present itself as investing in a clean and reliable energy future, through its adopted framework and strategy which calls for 100% greenhouse gas emissions by no later than 2040, with an 80% reduction in 2030.

In my past articles, particularly the early ones, I highlighted the company risk in terms of generation shortfalls because it’s leaving legacy assets for greenwashing. POR is removing its own capacity before its ready to replace it with renewables, which has caused the company to look for solutions in some unorthodox manners, such as encouraging more customer generation of electricity through renewables.

However, these risks are minor when we look at what POR is and what it offers. Even the CapEx risks where the company needs to invest to both harden existing infrastructure and prepare for the coming decades, there’s plenty of upside to like for POR here.

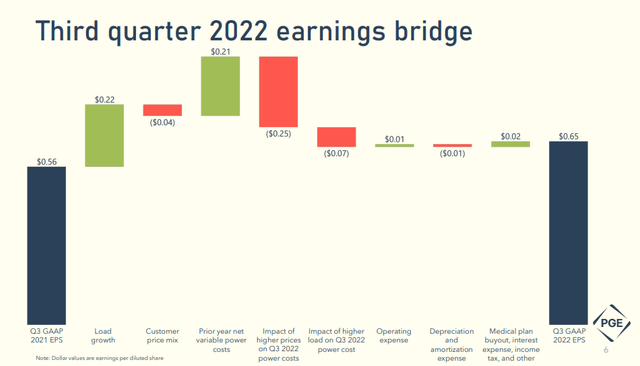

We have 3Q22 results to consider – and those results were good. The company increased GAAP income on an EPS basis by almost 10 cents, and are ahead of 2021 on a YTD basis.

As I mentioned about the company’s strategy in terms of generation – higher prices are punishing to POR when you don’t have the flexibility in terms of generation.

POR IR (POR IR)

And you can see that here. Take a look at how those impacts from prices and load costs are pushing earnings down, despite the company’s positive results. if POR still owned its legacy assets, they could have taken far more advantage of this situation.

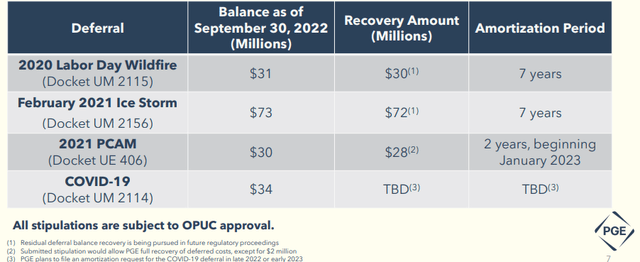

The company still has some wildfire issues. The list highlights the climate issues the company has to deal with as well as other issues.

POR IR (POR IR)

That’s also why reliability and hardening/resilience investments are on the top of the list, with an average of $750-$800M per year all the way until 2028.

However, the company is liquid enough to handle most of it – the company has a BBB+, liquidity of almost $800M, and the forecast is that, while earnings instability might be in the near term, will still come around to growth in the next few years.

The recent quarter means that the company is actually rising beyond its 2022E guidance base – which is likely part of the reason the company has bounced back quickly to relatively high levels, but 2023 will be different. According to the company’s own plans, 2023 is a heavy investment year, and a CapEx outlier with over $1.1B in planned investments or more, and the company still isn’t done with its deferrals, which means that guidance for 2023E is hard to give at this point.

The company is planning to bring Clearwater online in 2023, which will generate a nameplate capacity for POR of 208 MW, which should go some way to offset the lack of flexibility that the company has been working under. The company is expecting a rate case inclusion for clearwater right away due to adjustment clauses, which is a net positive for the company here.

It doesn’t change the next 5-7 years for POR. I believe that POR will be one of the utilities that might have a harder time reaching its 5-7% EPS growth on an annual basis. Rates in Oregon are already high, and the company’s massive CapEx plans as well as combining with it leaving legacy assets leave little legroom for error here.

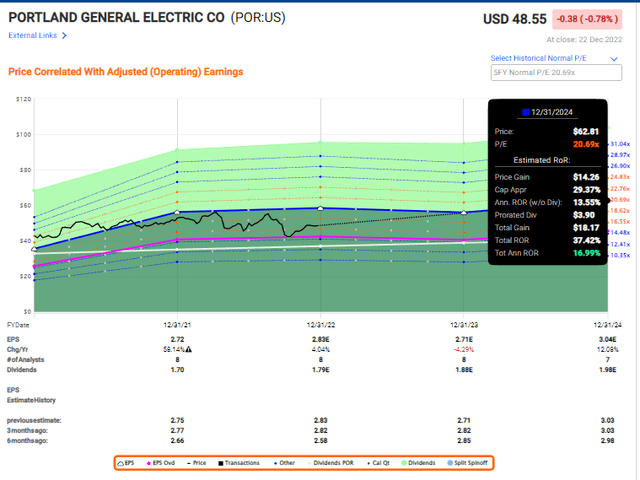

Current forecasts more or less confirm this, with the analyst forecasts for POR offering an upside in terms of adjusted EPS growth of less than 4% until 2024E on an annual basis.

This also includes a negative 4% drop in 2023.

Headwinds aren’t a problem though – as long as the utility is cheap enough to make up for it.

Is this the case here?

Portland General Electric Valuation

The trouble with the company remains the premium to the name – usually above 20x, in large part due to operating area and trends. Unfortunately, it doesn’t really warrant such a premium anymore – not 20x.

Though I’m happy to buy it cheaper than that. The upside to POR is, as I said in my last piece, no longer negligible.

While having recovered somewhat from its valuation troughs a few months back, POR is still trading below 19x P/E – quite far below it at the moment. Remember, the most premium utility trade is about the 20x P/E mark, with Fortis (FTS) a good example of one that I have recently written on. It doesn’t go much higher than that.

But POR isn’t the sort of company that deserves that sort of Fortis or similar-level premium. However, when I began looking at POR and covering the company, I went in with a very negative and bearish sort of sentiment due to the challenges I saw. These challenges have turned out to be smaller than expected, with next year being a challenge, but beyond that back to at least decently impressive levels of overall growth.

While it’s impossible to completely mitigate overall risk, I believe there are allocations that will work to provide a sense and a structure of stability in a volatile environment. Utilities, Consumer Staples, certain real estate companies, all of these investments are part of this – and POR can be part of such a portfolio for you.

That is also why my portfolio shifts over the past few months have been to increasingly align myself with conservative and well-funded investments and businesses.

Even if I don’t like some of the things about POR, I do believe it to be a solid and well-funded business.

The company trades at an average of 17.17x P/E, which is a discount from the premium and gives us an upside to 18-20x P/E for the next few years. This is a utility with an almost 17% annualized RoR on current premiums – with is the realistic high-end of the stock for the past 12 months.

POR Upside (F.A.S.T graphs)

Analyst accuracy is very decent, hitting targets 83% of the time on a 1-year basis with a 10% margin of error. There’s very little ambiguity to the company’s forecasts and results, despite some of the troughs, and they are relatively stable over time, with a 3-5% EPS CAGR over the past decade and more.

S&P Global analysts have cut their targets to better reflect the increased CapEx and the slightly flatter long-term targets. The range from 7 analysts here is $45 to $58, with an average of $49.1/share, which is an upside of 1% here.

My own PT is slightly higher. I too am adjusting my targets, but I’m not going above $52.5 anymore – my new target is down to $52, reflecting a conservative view for the company’s 2023E and the pressure we might be seeing here.

This brings me to my updated thesis – which I might call a “very slight upside”.

Thesis for Portland General Electric’s common shares

- At a lower price of below $50/share, this becomes an interesting utility play in a potentially strong state. However, the lack of asset flexibility and company-stated plans for its future still does not encourage me to invest further here.

- It’s my view that the company’s plans lack proper context and forecastability, allowing us to easily account for potential provisions for extra costs or income effects, influencing margins and income.

- Because of this and despite good fundamentals, heavy discounting is needed. Energy trading losses during 3Q21 alone accounted for $1.09 per share, as well as $0.39 per share of what the company considers “unfavorable power cost” due to higher temperatures – and this company is seeing recurring problems with that.

- Improved forecasts and more problematic macro do call for a continued premium for utilities though – so I stick to my PT of $52.

- This makes POR a “BUY” here.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized):

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The Options Play for Portland General Electric

However, you can approach Portland General Electric in a different way. By selling cash-secured puts, you can ensure a much better price, while also getting an immediate payday in the form of an option’s premium. The only disadvantage here is that you have to have a few thousand dollars on hand, and be willing to play ball with POR.

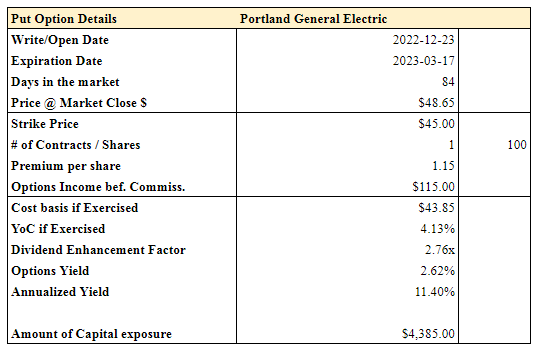

Here is one such possibility I found that I myself am considering as the market moves, with premiums going up and down slightly.

Options Details (Author’s Data)

So, if you’re willing to put about $4,400 on the table, you can get an 11.4% return on that money, annualized, in 84 days, or buy the company at a significantly better valuation than here. Your YoC would be above 4%, or if not, you’d have earned more than 2.6x the annual dividends in less than 3 months.

This is a good option – I’m looking at this one at the moment, and might go in on it.