Tommaso Boddi/Getty Images Entertainment

Polestar Automotive Holding UK PLC (NASDAQ:PSNY) reported delivery numbers for the second-quarter recently and the electric vehicle company is seeing continually strong demand for its key EV product, the Polestar 2. Polestar said that it delivered approximately 15,800 electric vehicles in the second-quarter, showing 36% year over year growth. The EV company also confirmed its delivery goal of 60-70 thousand electric vehicles in 2023 which Polestar lowered in May 2023 due to a delayed launch of the Polestar 3 electric sport utility vehicle. While the valuation is high, I believe Polestar executes much better than some U.S.-based EV companies regarding ramping up deliveries and continues to have an attractive risk profile for investors!

Strong delivery achievements in the second-quarter, lower delivery guidance confirmed

Electric vehicle companies have recently submitted their delivery cards for the second-quarter to show how the ramp of their product portfolio is going. While some companies did not do so great, like Lucid Group (LCID), there were other companies that saw strong growth in deliveries, like Rivian Automotive (RIVN) or Polestar.

Polestar, according to the company’s quarterly update, delivered 15,800 electric vehicles in Q2’23, showing an increase of 36% year over year. Polestar also said in its disclosure that June deliveries soared at more than twice the rate, 73%, due to a strong product line-up and continual popularity of the company’s Polestar 2 model.

The second-quarter marked a new delivery record for the Swedish EV company as well. Polestar delivered 12,000 electric vehicles in the first-quarter, so the EV start-up increased its total deliveries an impressive 32% quarter over quarter.

Earlier this year, Polestar expected to deliver 80 thousand electric vehicles in FY 2023, but due to software issues delaying the launch of the Polestar 3 electric sport utility vehicle — the firm’s next major EV product after the Polestar 2 — the EV company lowered its delivery target to 60-70 thousand in May. Volvo is Polestar’s major production partner and Volvo also recently delayed the launch of its own electric SUV, the EX90, for the same reason: software issues.

Polestar confirmed that it plans to deliver 60-70 thousand electric vehicles in its press release, but the guidance still represents a rather large cut of 12.5-25.0% compared to the earlier outlook.

Year-to-date, Polestar has delivered 27,800 electric vehicles so far, or roughly 46% of the company’s low-case delivery goal this year. Polestar will have to smoothly ramp up its production in the second half of the year in order to meet this delivery goal, but given the recent increase in volume, I believe Polestar is on a good path. In FY 2022, Polestar delivered 51,500 electric vehicles, which was a larger delivery volume than companies like Lucid or Rivian achieved. Polestar’s delivery guidance for FY 2023 implies year over year delivery growth of between 17% and 36%, and 26% at a mid-point basis.

Good balance sheet supports delivery ambitions

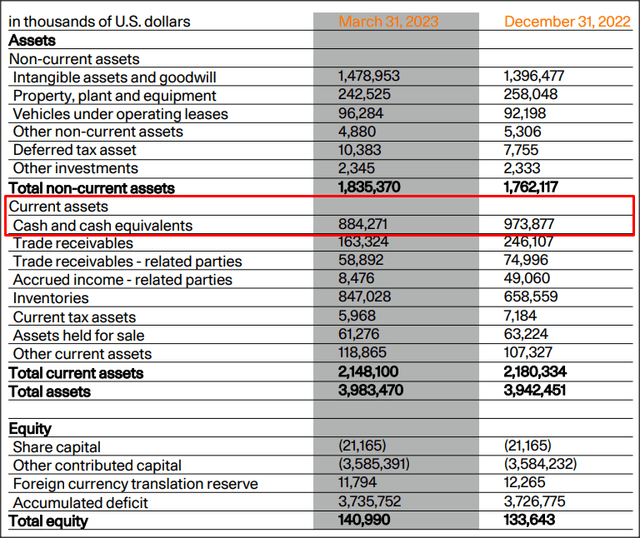

Polestar doesn’t have the best balance sheet in the EV industry — Rivian does — but the EV company is nonetheless on a promising path. The firm’s net losses are narrowing and Polestar has sufficient liquidity to finance the ramp of its production. At the end of the first-quarter, Polestar had cash of $884.3M, which is enough cash to last until next year (assuming $200M/quarter operating losses and not accounting for major increases in revenues).

Source: Polestar

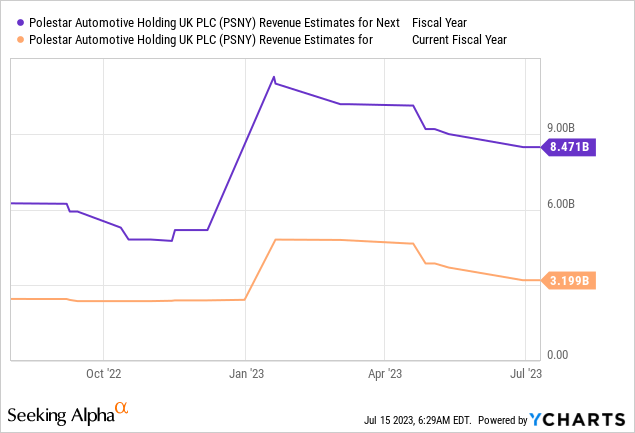

Massive revenue ramp ahead, valuation

Polestar is expected to generate 165% year over year revenue growth next year and achieve a revenue volume of $8.5B which would exceed Rivian’s estimated top line of $7.74B. Rivian is expected to see 89% top line growth next year.

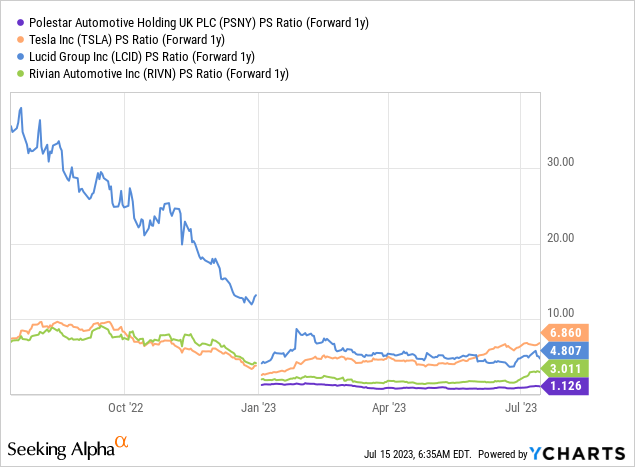

Polestar has a low price-to-revenue ratio when compared to the international EV competition. Lucid and Rivian obviously are the two EV companies with the largest price-to-revenue ratios in the U.S., with the exception of Tesla (TSLA).

However, Tesla delivers millions of cars annually and is already widely profitable while the other two start-ups are delivering materially less volume and are not anywhere near profitability. For those reasons, Tesla still has the largest price-to-revenue ratio in the industry and the company’s shares trade at 6.9X FY 2024 revenues.

From a valuation point of view, I like Polestar: the company trades at a reasonable 1.13X price-to-revenue ratio and is way ahead of Lucid regarding deliveries and is on track to achieve higher revenues than Rivian next year. What holds me back from issuing a buy recommendation, however, is the guidance cut from May as well as the delayed launch of the Polestar 3.

Risks with Polestar

Polestar recently had to lower its delivery outlook for FY 2023 and pushed out the launch date of the Polestar 3 sport utility vehicle into FY 2024, which highlights that Polestar still has considerable timeline and production risks as it attempts to broaden its EV portfolio. The launch of the Polestar 3 SUV could accelerate the company’s delivery growth going forward, but further delays also have the potential to delay revenue recognition and hurt the company’s valuation factor.

Final thoughts

Electric vehicle start-up Polestar submitted a strong delivery card for the second-quarter that showed 32% quarter over quarter delivery growth, in large part because the company faces strong customer demand for its key EV model, the Polestar 2. Additionally, Polestar confirmed its delivery target for FY 2023 which is set at 60,000 to 70,000 electric vehicles, implying 26% year over year growth, at mid-point. I like Polestar’s delivery accomplishments in Q2 and its valuation, and I continue to see revaluation potential. However, the previously cut full-year delivery target as well as the delayed launch of the Polestar 3 are what is holding me back from a buy rating!