hirun

In April 2024, I wrote a bit on Plains All American Pipeline (NASDAQ:PAA) arguing that regardless that the inventory worth had registered vital alpha over the index, there may be nonetheless room for additional worth creation. All in all, the case boiled down extra to receiving engaging dividends at very restricted danger. Plus, the truth that the Administration had communicated that it’s going to develop the dividend by $0.15 per share a 12 months till the 1.6x distribution protection is obtained already implies a ahead yield between 8 – 9% (it clearly will depend on the incremental EBITDA development). That is very engaging, particularly contemplating the goal dividend protection is ready at a stage from which it will likely be attainable to accommodate development through inside money flows and / or keep a enough margin of security within the Firm.

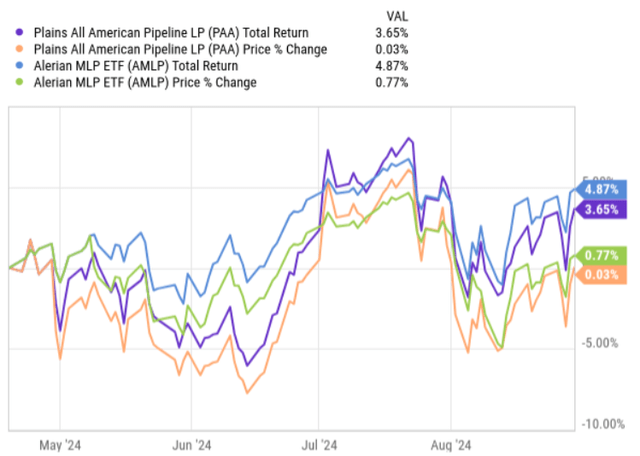

In my newest article on PAA, I assessed the Q1, 2024 earnings efficiency and concluded that the case stays engaging as there have been no modified to the draw back. Since then, PAA has delivered complete returns which might be considerably in step with the market. But, price-wise the Inventory is flat, which implies that until one thing sever has occurred to the underlying enterprise, my funding case for PAA ought to stay intact.

YCharts

Let’s now assessment the comparatively not too long ago revealed Q2, 2024 earnings deck to see whether or not the premise continues to be there to justify a bullish view.

Thesis assessment

In a nutshell, Q2, 2024 earnings as soon as once more embody information factors that present a strong efficiency and powerful fundamentals. Throughout this quarter, PAA reported adjusted EBITDA of $674 million, which is meaningfully above the extent achieved in the identical interval final 12 months. The enhancements have been registered at each ends of the core companies – i.e., the treatment oil phase’s EBITDA grew by 8.8% and for the NGL phase, the EBITDA rose by 51%. In complete adjusted EBITDA foundation, the year-over-year development landed at ~ 13%, which is huge within the context of PAA’s EV / EBITDA a number of of 9.3x.

On a quarter-to-quarter foundation, the speed of change within the complete adjusted EBITDA was barely detrimental, however that was totally associated to the seasonality within the NGL phase (as pre-communicated by the Administration and totally anticipated by the market). If we regulate for the seasonality issue within the NGL phase, the whole EBITDA technology can be up by ~4.4% relative to the prior quarter.

So, already from these statistics, we might indicate that PAA’s enterprise has strengthened and delivered rock-solid outcomes from which PAA might fund additional development alternatives or distribute even greater streams to the unitholders. This dynamic doesn’t coincide with the flat share worth of PAA and the truth that the rates of interest are set to go down, which ought to in concept present an upwards stress for the a number of.

Even other than the strong EBITDA technology ranges, PAA delivered some extra parts that, for my part, improve the bull case much more.

For example, throughout the quarter PAA signed a bolt-on M&A deal by buying an extra 0.7% curiosity within the Wink to Webster Pipeline Firm paying a ticket dimension of $20 million. It’s clearly a small deal, which is not going to transfer the needle, however I feel it sends a robust message that PAA is keen to think about M&A in an effort to develop the enterprise.

Furthermore, whereas the Administration has saved the manufacturing outlook unchanged at a rise of 200,000 to 300,000 barrels a day, as a result of M&A synergies and operational efficiencies stemming from the beforehand dedicated upkeep CapEx, it determined to boost the midpoint for full 12 months 2024 adjusted EBITDA steerage by $75 million into a variety of $2.725 billion – $2.775 billion.

Because of this, the anticipated adjusted free money move stage for 2024 now lands at $1.55 billion, which incorporates $130 million of M&A and $1.15 billion of distributions to frequent and most well-liked unit holders. Plus, as per Q2, 2024 earnings report, the maintained and development CapEx applications have remained largely unchanged at $250 million and $375 million, respectively.

What this implies is that PAA continues to have a robust money technology profile, which is enough to go away ample room for accretive capital allocation maneuvers past the distribution and status-quo CapEx wants.

As acknowledged above, a part of this surplus liquidity shall be regularly directed in the direction of additional will increase within the dividend till dividend protection stage drops from the present 1.9x stage to 1.6x. This course of and dividend protection of 1.6x per definition nonetheless permits PAA to retain respectable quantities of money. Provided that PAA’s leverage is already beneath its goal vary of three.25x to three.75x (presently at 3.1x), my base case is that we should always see an elevated exercise from PAA on the M&A finish. This, in flip, will present a lift for future EBITDA from which a sustained dividend development momentum may very well be maintained even after the 1.6x dividend protection goal is met.

Lastly, there may be another essential information level to keep in mind, which is PAA’s long-term settlement within the NGL phase that won’t solely warrant higher money move stability, but additionally cut back the general enterprise danger. The remark within the latest earnings name by Jeremy Goebel – Government Vice President and CCO – explains this dynamics properly:

Sure Tristan, that is Jeremy once more. What I might say is, we’re not going to present ahead steerage on the NGL phase, however we have entered into 15-plus 12 months contract, which has changed roughly a 3rd of our frac unfold publicity. We’re investing $150 million to $200 million to interchange that enterprise with gathering, fractionation, storage, transportation. So it should look identical to an built-in NGL worth chain, which we have already got. That is bolting on and bolstering that piece. So we’ll transfer from roughly 60/40 frac unfold publicity to lower than 50/50. So I might say long run, that is undoubtedly a extra predictable chain, however we do just like the straddle enterprise, and we’ll proceed to lean into that enterprise as nicely.

The underside line

All in all, PAA has managed to flow into one more robust quarter wherein it has not solely achieved the required stability, but additionally strengthened the general return prospects of the enterprise. Within the meantime, the share worth because the publication of my earlier article has remained flat, which results in a simple conclusion that the bull case stays intact. Particularly, throughout Q2, 2024 interval the PAA’s enterprise has strengthened on prime of a extra favorable rate of interest outlook, however the share worth has stayed unchanged.

Because of this, I stay bullish on Plains All American.