Yauhen Akulich

Introduction

What is the Fed as much as?

If you happen to can reply this query, you’ll make a ton of cash on Wall Road.

Sadly, none of us know what the Fed will do, which suggests we’ll must discover the perfect threat/reward with the information at hand.

Fortunately, Fed Chair Jerome Powell’s most up-to-date speech on the Kansas Metropolis Fed’s financial symposium in Jackson Gap revealed loads. For instance, he promised a charge reduce in September.

Though the Fed will monitor incoming information (this virtually goes with out saying), we’re doubtless taking a look at quite a few charge cuts until inflation makes a sudden comeback. I added emphasis to Powell’s quotes under.

The time has come for coverage to regulate.

[…] The route of journey is evident, and the timing and tempo of charge cuts will rely upon incoming information, the evolving outlook, and the stability of dangers. – Jerome Powell (by way of Bloomberg).

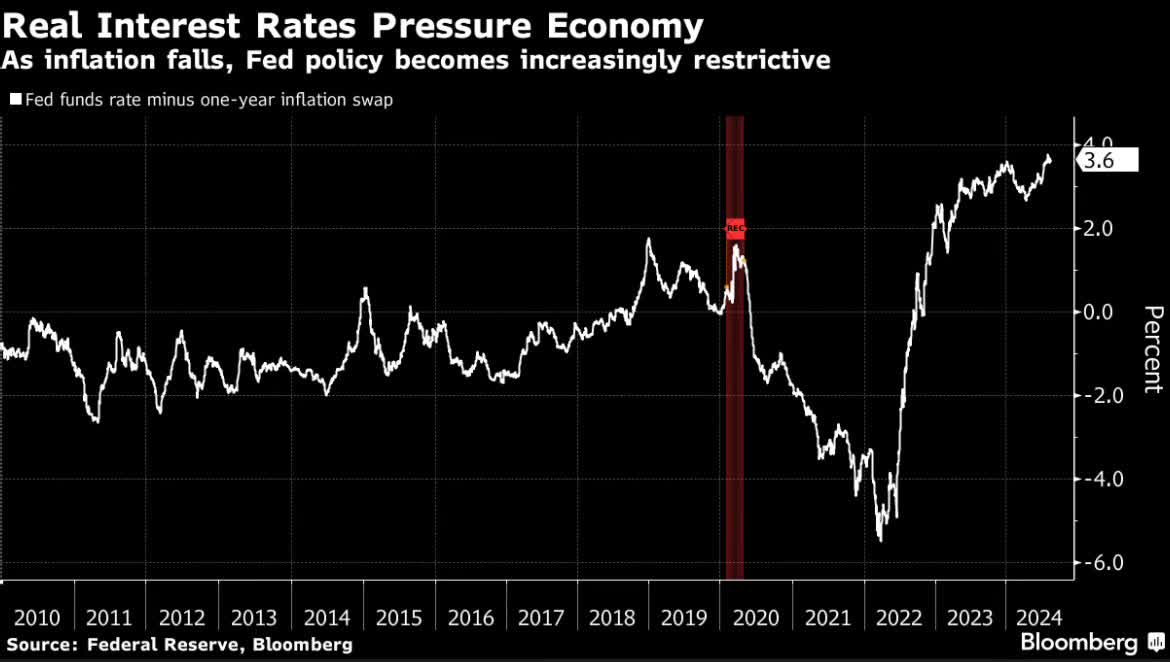

These feedback make sense, as inflation has come down. This has elevated the Fed’s impression on the economic system, as actual rates of interest (rates of interest adjusted for inflation) lately made one other excessive.

Bloomberg

Hypothetically, a 5% rate of interest has a extra important impression on the economic system when inflation is at 4% than when it is at 6%

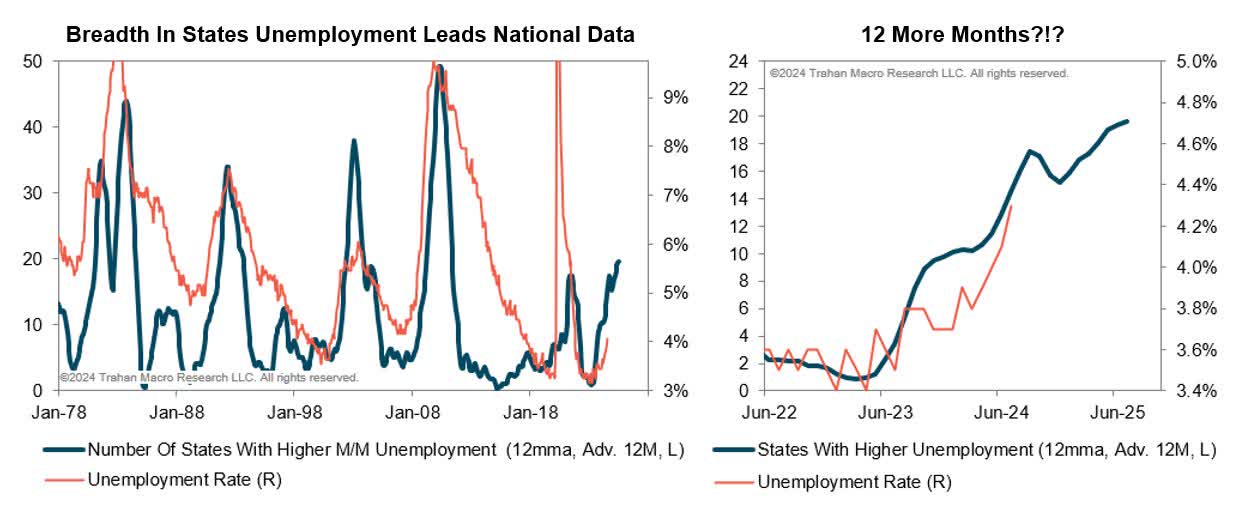

For the Federal Reserve, unemployment is a vital issue. They goal to keep away from a “exhausting financial touchdown,” as they know that defeating inflation by crushing the economic system would finally damage everybody. Discovering a stability between defending progress and combating inflation is the difficult half.

Primarily based on that context, current information means that unemployment breadth is pointing in the direction of a possible improve within the nationwide unemployment charge, probably reaching 5% within the subsequent 6–12 months.

Trahan Macro Analysis

With that in thoughts, yesterday, I had a name with a few of my investor mates. We mentioned the place to place our cash. One of many key conclusions was our need so as to add “some yield” to our portfolios, regardless of the larger focus being on dividend progress.

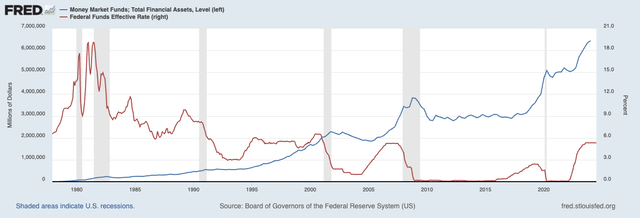

That is primarily based on a thesis I’ve been overlaying for a couple of months, which is a possible trillion-dollar rotation when risk-free authorities bonds begin to provide much less compelling charges. So long as short-term bonds yield shut to five%, many traders will doubtless decide that possibility over extra dangerous dividend shares.

The seek for yield pushed cash market property to $6.4 trillion within the first quarter of this 12 months, up from $3 trillion in 2017.

Federal Reserve Financial institution of St. Louis

I consider as soon as charges come down, a LOT of cash must discover a new dwelling. This can be a gradual improvement and profit shares that supply an elevated revenue with threat/reward.

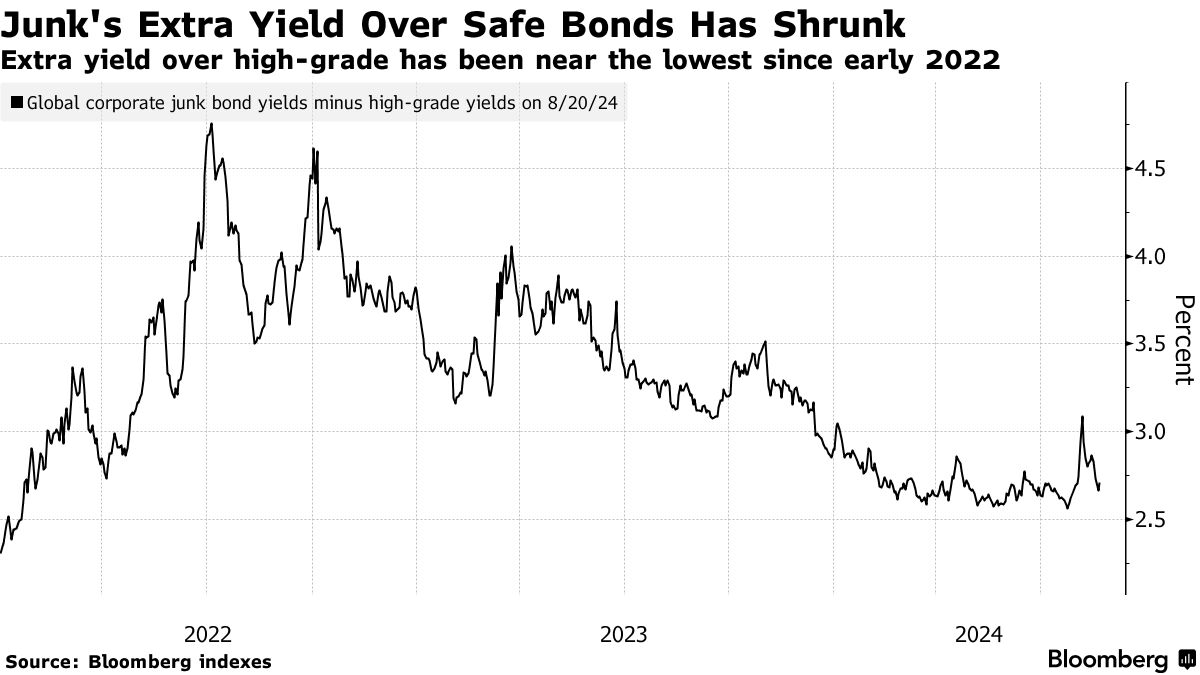

Because it seems, the rotation has already began, as traders are shopping for junk bonds for revenue functions. Utilizing the information under, we see this retains the premium of junk bond charges over protected bonds very low — even on this setting.

Bloomberg

To me, it appears the market is clearly telling us we’re taking a look at a longer-term rotation to high quality revenue.

That is the place ONEOK, Inc. (OKE) is available in, an organization I’ve been bullish on since 2020.

My most up-to-date article on this midstream operator (which does NOT difficulty a Okay-1 type) was written on July 16, after I stated it’s “Gushing With Potential.” Since then, shares have added one other 5%, beating the market by 6%.

Though its yield has come down considerably on account of its robust inventory value efficiency, I consider OKE stays an important funding for revenue and progress. Therefore, as a part of our dialog, we got here to the conclusion that OKE is among the shares price shopping for at an all-time excessive.

Now, let me present you the up to date bull case, utilizing its newest earnings and new main developments.

So, let’s get to it!

Midstream Is The place It is At

I consider the worth the midstream sector brings to the desk on this financial setting could be very troublesome to beat.

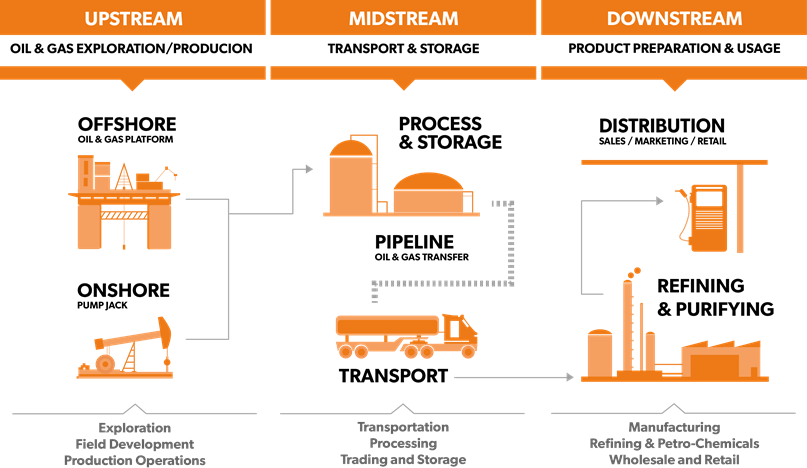

As most readers will know, midstream corporations are a part of the vitality sector. These corporations personal the infrastructure wanted to course of and ship commodities like crude oil, pure gasoline, pure gasoline liquids (“NGL”), and others.

Eland Cables

These corporations profit from rising volumes and have favorable contracts, most of that are primarily based on the full volumes flowing via their property or on take-or-pay agreements. Though this makes midstream corporations the improper selection for traders trying to capitalize on potential will increase within the value of oil and gasoline, they provide stability that’s troublesome to match.

Furthermore, over the previous few years, most midstream corporations have began to really feel the tailwinds from accomplished mega-projects, constant progress in oil and gasoline output, and more and more wholesome stability sheets. This was not the case earlier than the pandemic.

Particularly in mild of stress on oil and gasoline costs, midstream corporations stay in a great place, as main output progress areas just like the Permian Basin are in determined want of latest infrastructure. This advantages future progress and present utilization charges.

S&P International

For instance, in response to S&P International information, dry pure gasoline manufacturing within the Permian Basin has risen by virtually 40% since mid-2021!

S&P International

This brings me to OKE.

Why ONEOK Stays In A Improbable Place

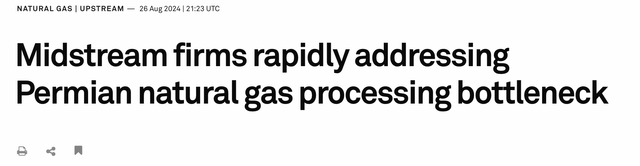

With a market cap of $52 billion, the Oklahoma-based firm is considered one of America’s most essential midstream corporations, because it owns a community of roughly 50 thousand miles of pipelines for NGL, refined merchandise, pure gasoline, and crude oil. This makes it one of many largest suppliers of NGL for the petrochemical trade, serving practically 50% of U.S. refining capability, in response to the corporate.

This additionally contains operations in three main basins, together with Bakken, Anadarko, and the Permian — amongst others.

ONEOK Inc.

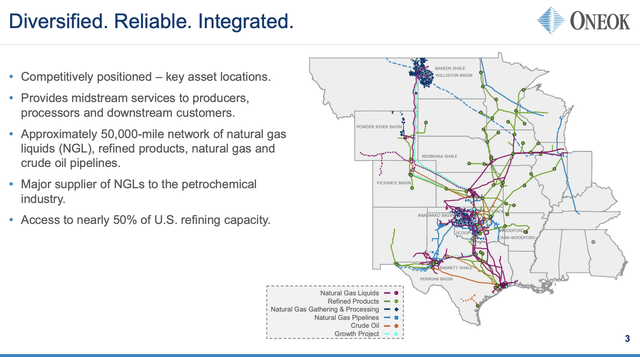

Though I consider most readers understand how important these operations are, I just like the slide under, which clearly reveals how important a constant provide of NGLs, pure gasoline, and refined merchandise is. With out it, our fashionable economies would flip into full-blown anarchy inside days.

ONEOK Inc.

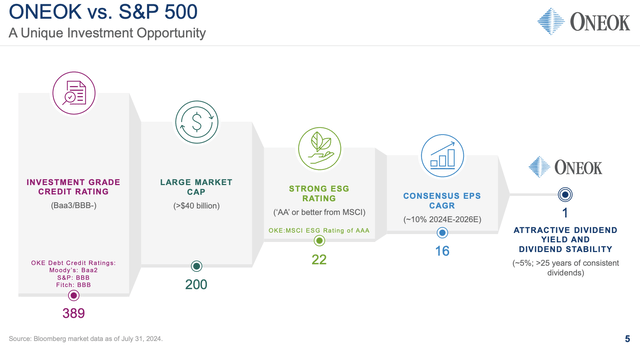

What’s attention-grabbing is that the corporate constructed a funnel, exhibiting it is the one selection for traders searching for enticing and steady revenue.

The factors have been:

- An investment-grade credit standing (that means a minimum of BBB- or comparable). I believe specializing in investment-grade scores is vital. OKE has a BBB score (one step above BBB-).

- A market cap of a minimum of $40 billion. That is the place it will get difficult. A variety of “good” corporations are smaller than $40 billion.

- Robust ESG scores. Regardless of being a participant within the “soiled” vitality sector, OKE has a triple-A ESG score from MSCI, because it successfully manages emissions, relationships with stakeholders, and clear governance and oversight. Though I respect the corporate’s elevated ESG rating, I’d not embody this in any funding screener — until we’re coping with corporations recognized for air pollution and mismanagement.

- Elevated EPS progress of roughly 10% per 12 months via 2026. As we are going to discover out on this article, OKE has elevated progress.

Whereas I’d not make the case that OKE is the one S&P 500 decide worthy of our cash (on account of some disagreement with its standards), I actually consider it is among the finest.

ONEOK Inc.

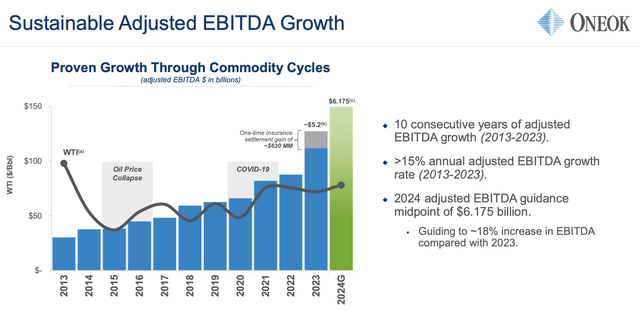

With all of this in thoughts, the corporate’s progress is spectacular. Regardless of two main oil value collapses since 2013 (and plenty of extra pure gasoline bear markets), it has grown its adjusted EBITDA for ten consecutive years. Between 2013 and 2023, it has grown its adjusted EBITDA by greater than 15% per 12 months.

For 2024, it’s guiding for $6.2 billion in EBITDA, 18% larger in comparison with 2023.

ONEOK Inc.

At the moment, OKE continues to show it’s in a implausible spot to seize secular progress in its trade, turning this into elevated progress.

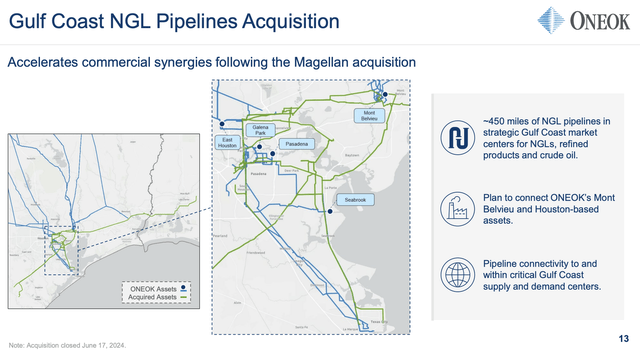

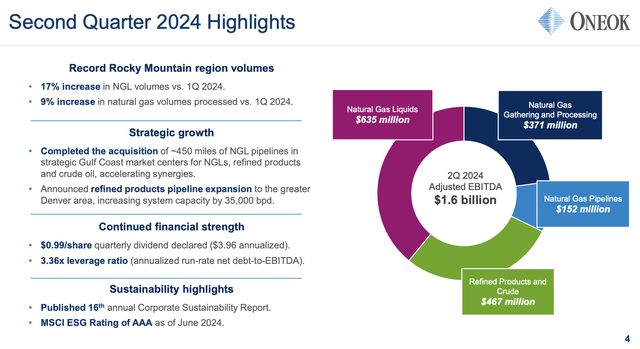

For instance, the acquisition of NGL pipelines from Easton Vitality, which was accomplished in June, provides important worth to its Mont Belvieu fractionation property. When mixed with the legacy Magellan property (this M&A deal was closed final 12 months), this acquisition enhances the corporate’s means to seize worth downstream and unlock extra synergies.

ONEOK Inc.

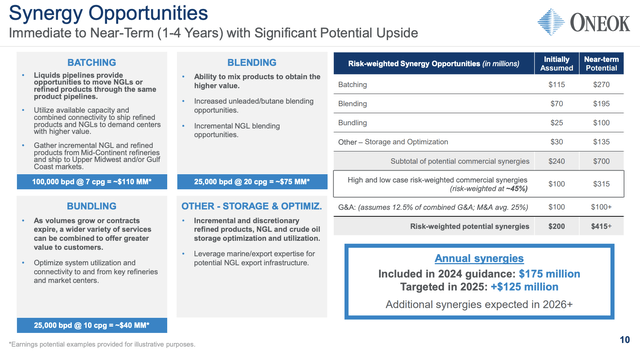

Even higher, the corporate’s synergies are anticipated to be larger than initially forecasted.

We proceed to anticipate to fulfill or exceed our midpoint of $175 million in value and business synergies in 2024 and anticipate extra annual synergies to fulfill or exceed $125 million in 2025. – OKE 2Q24 Earnings Name.

ONEOK Inc.

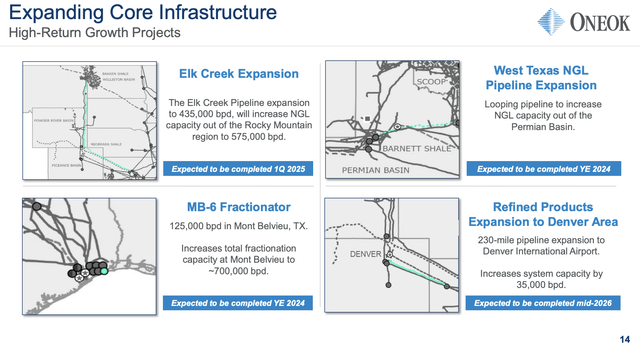

Furthermore, the corporate invests in natural progress, that means non-M&A progress.

In its 2Q24 earnings name, the corporate up to date traders on natural progress in its refined and crude segments. This contains the growth of its refined merchandise pipeline within the Better Denver space, a venture that aligns completely with rising demand within the space, together with transportation fuels.

When including sustainable aviation gas tasks at its Galena Park terminal, OKE has develop into a important participant within the growth of vitality reliability in america.

Furthermore, the corporate is accelerating the timeline for key tasks just like the West Texas NGL pipeline growth and the MB-6 fractionator. Each at the moment are anticipated to be in service by the top of this 12 months (see the overview under).

ONEOK Inc.

The West Texas growth will finally present a capability of roughly 740 thousand barrels per day, making OKE a fair larger heavyweight within the NGL area.

So as to add some numbers, OKE’s second-quarter outcomes spotlight its spectacular progress in its NGL, pushed by important quantity will increase in key areas. In 2Q24 alone, it noticed 17% larger volumes in comparison with the primary quarter. Pure gasoline volumes elevated by 9%.

Based on the corporate, the Rocky Mountain and Mid-Continent areas noticed NGL quantity progress of 17% and 16%, respectively, in comparison with the primary quarter of this 12 months.

This progress was fueled by elevated propane and ethane volumes, with the Rocky Mountain area benefiting from larger incentivized ethane manufacturing.

ONEOK Inc.

So, what does this imply for shareholders?

ONEOK’s Dividend & Valuation

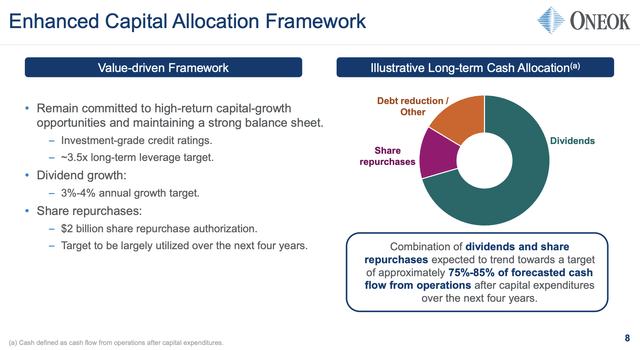

To elucidate the corporate’s objectives, I am utilizing its phrases (emphasis added).

Our first purpose is all the time to search out high-growth tasks which can be extraordinarily accretive to our shareholders. Then we need to preserve that stability sheet. We have clearly demonstrated that we have now a very robust dividend that we have maintained via some very troublesome occasions over time and proceed to develop. After which if we have now extra money, that does present the chance for inventory repurchases. – OKE 2Q24 Earnings Name.

ONEOK Inc.

Over the following 4 years, the corporate expects to allocate near 75% of its money to dividends. The mixture of dividends and buybacks is anticipated to account for 75% to 85% of complete free money circulate. Which means that after it has taken care of capital tasks like upkeep and progress spending.

ONEOK Inc.

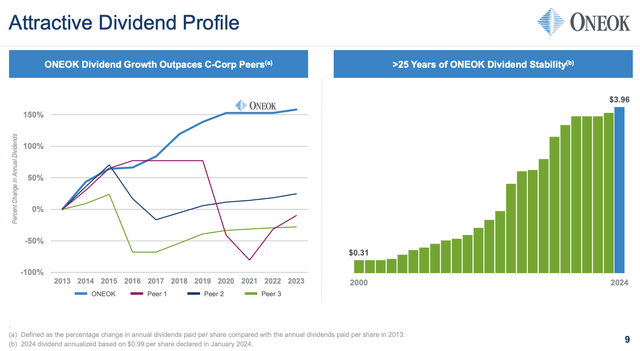

Its steerage additionally contains expectations of 3-4% annual dividend progress. At the moment, OKE shares yield 4.5%.

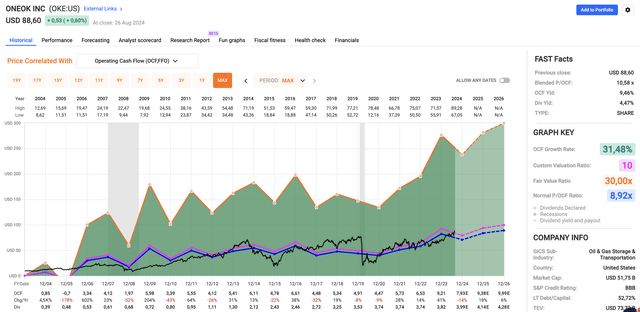

Valuation-wise, I stick with a 10x OCF (working money circulate ratio), which means a good inventory value of roughly $100, 12% above its present value. Utilizing the FactSet information within the chart under, OKE is anticipated to see 25% cumulative per-share OCF progress in 2025 and 2026.

FAST Graphs

When including its dividend, the corporate is in an important spot to return 10% per 12 months, with doubtlessly larger positive factors if the market rotates from risk-free bonds to high quality dividend shares. In that situation, I anticipate OKE will take pleasure in a better a number of.

As such, I stay bullish on OKE, anticipating it to ship a positive mixture of revenue and progress for a few years to return.

On a facet notice, I’m not lengthy OKE. I personal its smaller peer Antero Midstream (AM). Nevertheless, OKE is on my watch record, as it will go nicely with AM in a concentrated dividend (progress) portfolio.

Takeaway

The Federal Reserve’s upcoming selections on rates of interest will doubtless result in important market shifts, with potential charge cuts supporting a rotation of capital to income-generating property (high-quality dividend shares).

As yields on authorities bonds develop into much less enticing, the seek for steady, high-quality revenue will intensify.

ONEOK stands out as a chief decide on this setting, because it provides a mixture of progress and revenue potential.

With its strategic expansions, spectacular EBITDA progress, and a positive dividend outlook, OKE stays a compelling funding, poised to ship satisfying returns for a few years to return.

Professionals & Cons

Unchanged in comparison with my prior article.

Professionals:

- Constant Earnings Development: OKE has a diversified portfolio and a monitor file of steadily rising dividends, making it a dependable revenue generator.

- Resilient Earnings: Regardless of market fluctuations, OKE has proven resilience with its persistently rising adjusted EBITDA over the previous decade.

- Favorable Free Money Circulate Profile: The corporate’s bettering free money circulate place, coupled with diminished capital expenditures, bodes nicely for sustained dividend progress.

- Development Alternatives: The Rocky Mountains and different areas present constant progress alternatives.

- Affordable Valuation: Regardless of current positive factors, OKE’s valuation stays affordable.

Cons:

- Demand Dependency: Though OKE’s dependence on commodity costs is proscribed, commodity demand dangers may rise in a recession.

- Potential Regulatory Dangers: Adjustments in laws or environmental insurance policies may have an effect on the corporate’s operations and profitability.

- Aggressive Panorama: OKE operates in a aggressive trade, going through competitors from different midstream corporations. Nevertheless, usually, the most important midstream corporations have a tendency to return with broad moats.

- Market Volatility: Like every inventory, OKE is topic to market volatility, which may result in short-term fluctuations in its share value.