ronniechua

Whenever I dive into an ETF to see what the true drivers of its return are, a few aspects like a particular sector overweight or a high percentage of the allocation coming from one region jump out. That is the case with the Invesco International Dividend Achievers ETF (NASDAQ:PID).

On the surface, it sounds like it’s a run-of-the-mill global high-yield fund, but its diversification is not all that strong. The bulk of its equity holdings are domiciled in Canada.

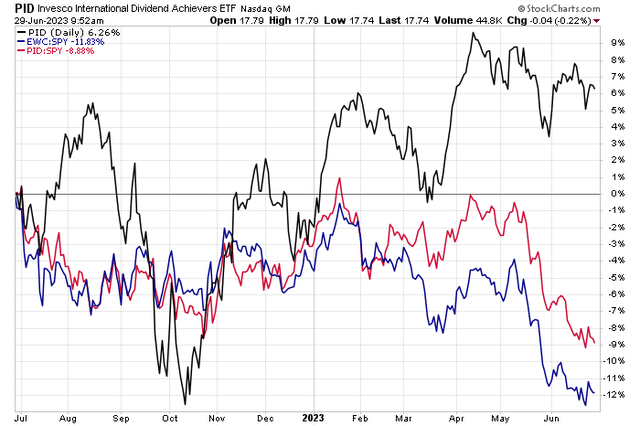

I have a hold on the fund due to that country risk, though the valuation is attractive. Notice in the total return chart below that PID is higher from a year ago, but relative performance is closely correlated with how the major Canada ETF (EWC) performs compared to the S&P 500.

PID Performance: Fate Is Tied To EWC (Canada)

Stockcharts.com

According to the issuer, PID is based on the Nasdaq International Dividend Achievers index. The fund will normally invest at least 90% of its total assets in dividend-paying common stocks and other securities that comprise the index. It is designed to identify an international group of equities that have qualified as International Dividend Achievers. It’s said that these companies have increased their aggregate annual regular cash dividend payments consistently for at least each of the last five consecutive years.

With a 3.3% dividend yield and an annual expense ratio of 0.53%, income investors may be drawn to PID, but the rate is not that high and its annual cost is not cheap either. Still, with $1.1 billion in assets under management and a somewhat tight 6 basis point 30-day median bid/ask spread, tradeability is generally strong, though its 30-day average trading volume is only 167,000 shares. Invesco lists the forward price-to-earnings ratio at 14.9, making it about 20% less expensive than the S&P 500.

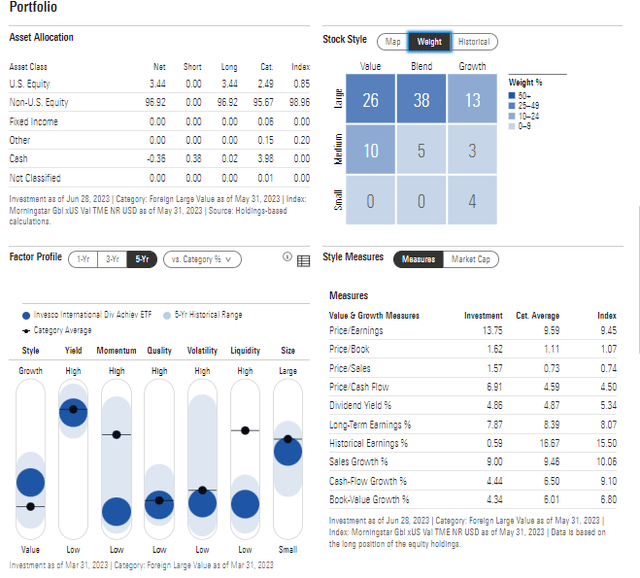

Digging into the portfolio, PID holds 49 individual equities, and the average market cap is $53 billion. Illustrated in the Morningstar Style Box below, the silver-rated 4-star fund has just a modest allocation in small caps while mid-caps represent about 18% of the fund. There is certainly a value bent to PID while the yield factor is high. Earnings quality is weak while volatility has been low, per Morningstar.

PID: Portfolio & Factor Profiles

Morningstar

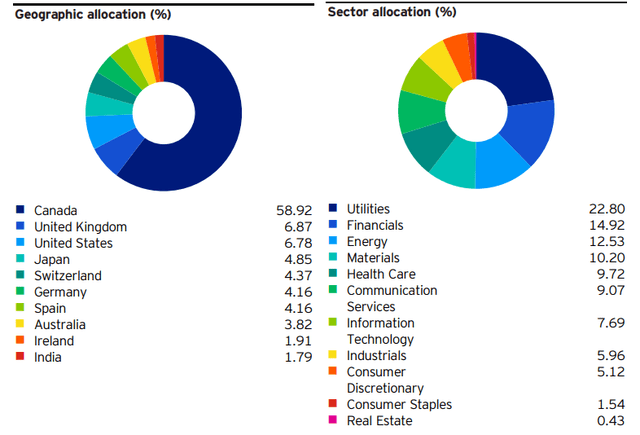

Here is where we see perhaps the biggest risk with PID. Fifty-nine percent of the ETF is from Canadian firms. Investors may not desire to own such a geographically concentrated product. The next-highest country weight is the UK and US, each just shy of 7% of the allocation. Sector-wise, PID is very overweight Utilities compared to the SPX while the cyclical Financials and Energy sectors are significant portions of the ETF. The Information Technology sector and other growth areas are just modest pieces of PID.

PID: Oh Canada! And Did You Say “Utes”?

Invesco Funds

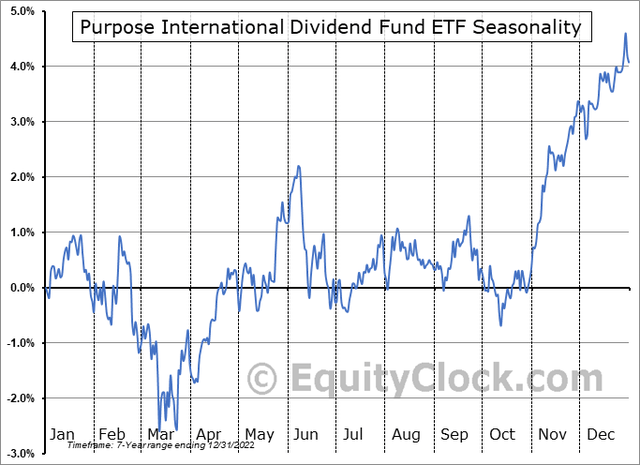

Seasonally, PID tends to waffle from the start of the second half through October, according to data from Equity Clock. A more bullish stretch does not take place until the final two months of the year – that is actually when all annual gains have on average been raked in.

PID Seasonality: Neutral Performance Trends July-October

Equity Clock

The Technical Take

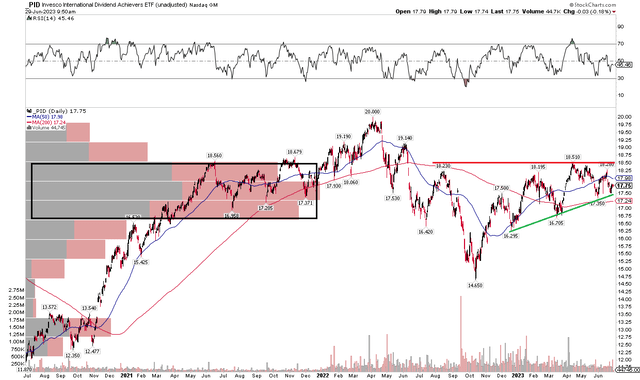

With that concentrated construct, if we see certain market conditions favoring Canadian names and Utilities, then PID is a great play. We are not seeing that, though. Notice in the chart below that the fund has resistance in the $18 to $18.50 range. There is an upwardly sloped support line that comes into play near $17.50 while its long-term 200-day moving average is modestly upwardly sloped.

But what could be tough in the short run is a high amount of volume by price in the $16.50 to $18.50 range. A breakout above $18.50 would be all the more important given this current congestion zone. A bearish breakdown under $16.50 could lead to a retest of the October 2022 low of $14.65. Overall, it’s a neutral chart, and investors should monitor $18.50.

PID: Ascending Triangle With High Volume Congestion, Watch $18.50

Stockcharts.com

The Bottom Line

I have a hold rating on PID. It has a solid valuation, but it is a sneaky concentrated portfolio that might fool folks simply looking at the name of the product.