PM Images

Without a doubt, one of the biggest problems faced by Americans today is the pervasive inflation that has afflicted every facet of our society. This inflation is at the highest levels that we have seen in more than forty years and has caused real incomes to decline for 41 straight months. As might be expected, this has forced many people to take on second jobs or enter the gig economy in order to obtain the money that is needed to pay their bills or cover other expenses. This is particularly true among people of limited means that may not have the flexibility in their budget to handle the rising expenses for everything.

Fortunately, as investors, we have other methods that we can utilize in order to obtain the additional money that we need to support ourselves. One of the most effective of these methods is to purchase shares of a closed-end fund (“CEF”) that specializes in the generation of income. This is because these funds provide easy access to a professionally-managed and diversified portfolio of assets that can usually deliver a higher yield than any individual asset possesses.

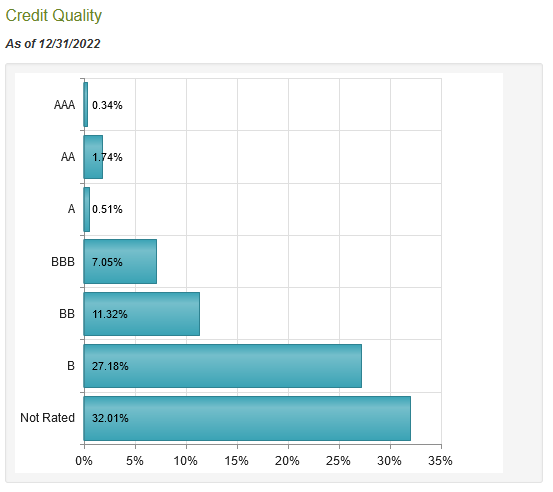

In this article, we will discuss the PIMCO High Income Fund (NYSE:PHK), which is one CEF that falls into this category. As of the time of writing, this fund boasts an 11.64% yield, so it certainly can provide its investors with sufficient income to turn anyone’s head. Unfortunately, any asset with a yield that high is usually surrounded by concerns that it will soon be forced to reduce the distribution. Thus, we should investigate the fund’s financial situation before investing in it. As long-time readers may recall, I have discussed this fund before, but more than a year has passed since that time so obviously, a great many things have changed. This article will therefore focus specifically on those changes as well as provide an updated analysis of the fund’s finances in order to determine if it could be a suitable target for investment today.

About The Fund

According to the fund’s webpage, the PIMCO High Income Fund has the stated objective of providing its investors with a high current income. This is hardly surprising for a PIMCO fund. PIMCO is generally considered to be a fixed-income fund house and indeed this is a fixed-income fund. As I have noted in various previous articles, fixed-income securities tend to be somewhat lacking when it comes to their potential to generate capital gains. This is because these securities have no direct link to the growth and prosperity of the issuing companies. After all, a company will not increase the interest rate that it pays on its loans just because its profitability increases. As such, the value of a bond or other fixed-income security will not increase as the company grows and prospers. Rather, these securities trade based on interest rates.

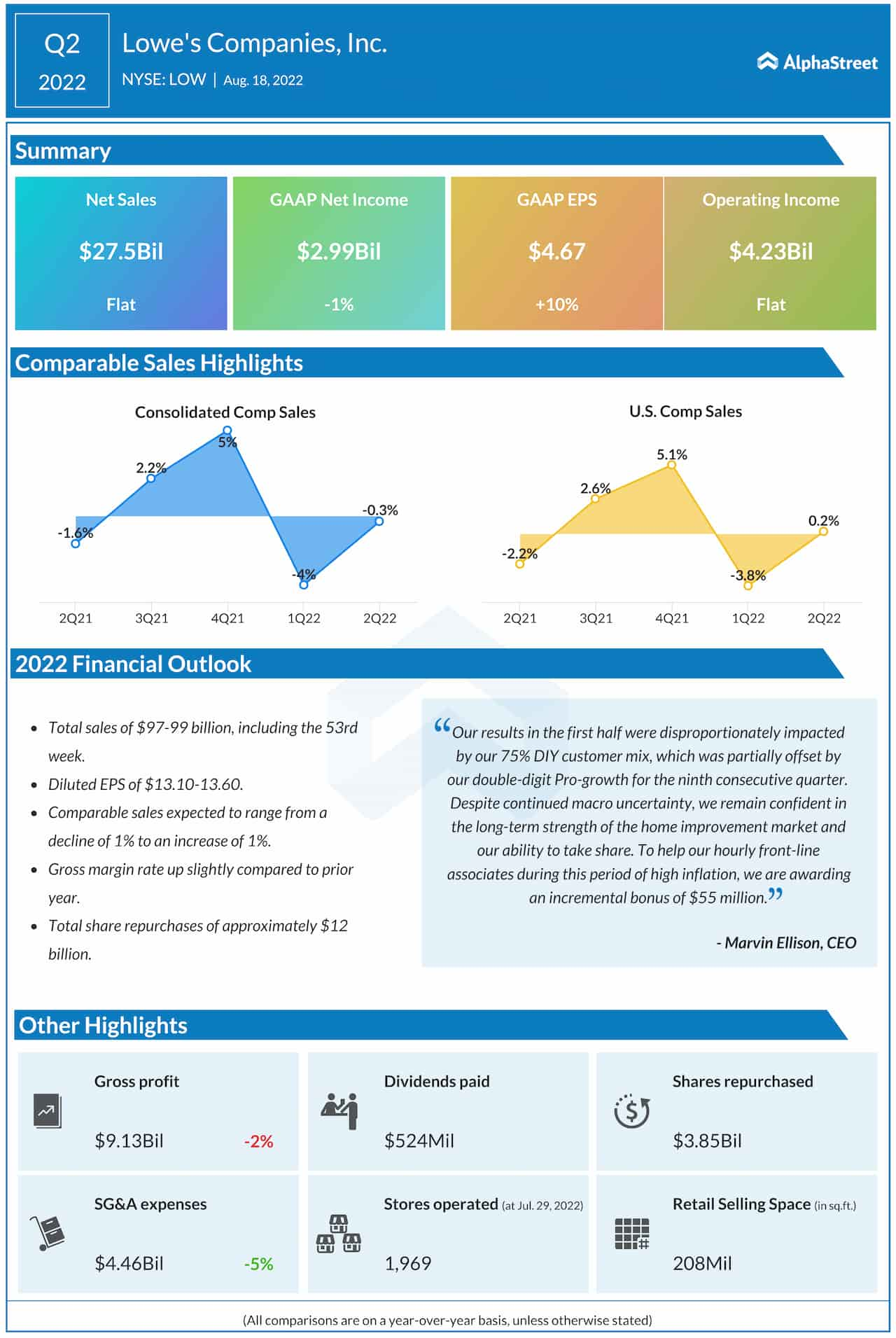

In short, when interest rates increase, bond prices decrease, and vice versa. This is because the yield-to-maturity of existing bonds needs to adjust to match that of newly-issued bonds in order to entice investors to purchase securities in the secondary market. As everyone reading this is certainly well aware, the Federal Reserve has been aggressively raising interest rates since March of 2022 in an effort to combat inflation. We can see this quite clearly by looking at the benchmark federal funds rate, which is the rate at which commercial banks lend to each other in the overnight market:

Federal Reserve Bank of St. Louis

As we can see here, the effective federal funds rate was 0.08% back in February 2022. It sits at 4.10% today. This has certainly had an impact on bond prices, with the Bloomberg U.S. Aggregate Bond Index declining by 10.92% over the past year.

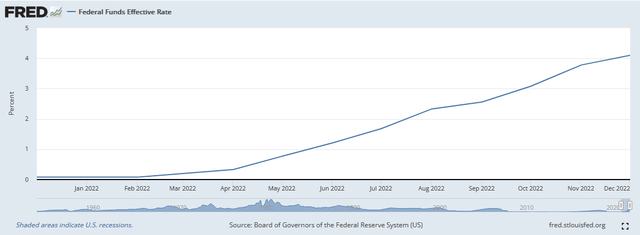

The PIMCO High Income Fund has certainly not been spared from the weakness in the bond market. After all, the fund is very highly invested in bonds:

CEF Connect

The fund is down 20.93% over the past twelve months so it has underperformed the index. This is not exactly surprising since most bond funds have underperformed the index. One reason for this is that the PIMCO High Income Fund uses leverage, which we will discuss later in this article. Another reason for this is that the fund has a 37.00% annual turnover, which is much higher than a comparable index fund. The reason that this has an impact on the performance of the fund is that it costs money to trade bonds or other assets. These expenses are billed to the holders of the fund and thus create something of a drag on the portfolio’s performance. After all, management needs to generate sufficient excess returns to both cover these trading costs and match the index.

There are very few management teams that are able to successfully do this over an extended period, which is why actively-managed funds tend to underperform their comparable indices. The PIMCO fund clearly fails to match the performance of the aggregate bond index, although it does have a much higher yield that reduces the performance disparity somewhat.

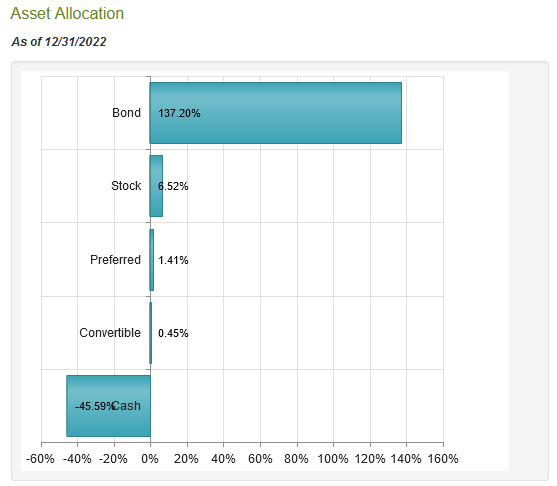

With that said, the PIMCO High Income Fund does not invest in the exact same bonds as the Bloomberg U.S. Aggregate Bond Index so that is not a perfect benchmark for this fund. The PIMCO fund differs as it invests heavily in high-yield bonds, which are what many investors call “junk bonds.” We can see this by looking at the credit ratings of the bonds in the fund’s portfolio. Here they are:

CEF Connect

An investment-grade bond is anything rated BBB or higher. As we can clearly see, that is only 9.64% of the portfolio. The overwhelming majority then consists of junk bonds. This is something that may concern risk-averse investors considering that we have all heard about the high risk of losses due to defaults that accompany these bonds. These are valid concerns, although admittedly the risk of default-related losses is not as high as many in the media have led you to believe. During the aftermath of the 2007-2008 financial crisis, default rates hit 12% but they were only 3% in 2019. Thus, the stronger the economy, the lower the risk of default. Even that 12% number is lower than what some people might think and thus generally the higher yield offered by these bonds is actually more than what is truly needed to compensate for the higher default risk. In the case of this fund, we can see that 38.5% of the bonds have either BB or B ratings. These are the two highest ratings for speculative-grade bonds and are generally issued only to those companies that have strong enough balance sheets to weather short-term economic shocks without defaulting (see here). Although there might be some risk of losses across the fund’s portfolio during a prolonged economic downturn, we have not had one of those since the Great Depression so that is very much an unlikely event. Overall, the general risks here are not as great as they may at first appear.

One common method for a fund to reduce its risk of losses due to defaults is to hold a substantial number of positions. This is because that scenario ensures that any individual company only accounts for a very small proportion of the portfolio. Thus, if any given company were to default, it would only have a negligible impact on the portfolio that would quickly be offset by the interest payments received from the other assets. The PIMCO High Income Fund currently has 373 positions so it is certainly doing this.

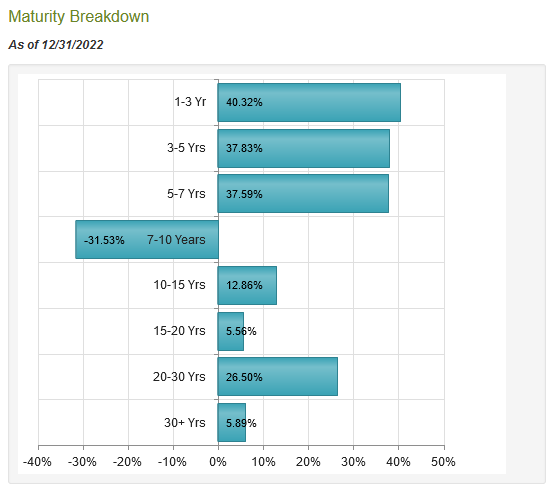

One major change from the last time that we looked at the fund is that the fund has substantially changed its portfolio composition in terms of duration. We can see this here:

CEF Connect

The biggest thing that we notice is that the fund has gone short seven to ten-year bonds. This is probably in response to the yield curve inversion that occurred in October of 2022. A yield curve inversion means that the ten-year Treasury is selling with a lesser yield-to-maturity than the three-month Treasury, which is a sign that the market expects the Federal Reserve to reduce interest rates in the near future. It is considered a warning sign of a recession since every single time that this has happened in the past, the United States entered a recession within two years.

Admittedly, the prediction of a recession is unlikely to be a surprise to anyone reading this, since every analyst and economist is predicting a recession in 2023. That makes this short position very curious since a short position indicates that the fund’s management expects the price of the bonds to decline. That would push up their yields and thus fix the yield curve inversion. That scenario is somewhat unlikely if the Federal Reserve were to cut its rates in response to a recession. The fund appears to be betting here that there will either be no recession or that the Federal Reserve will continue to hike rates in a recession, which is in stark contrast to the predictions of pretty much everybody else in the market. It will be curious to see how exactly this position plays out. The size of it though could result in some fairly large losses if the fund’s management team is wrong on this.

Leverage

In the introduction to this article, I stated that closed-end funds like the PIMCO High Income Fund have the ability to generate yields far in excess of those possessed by any of the underlying assets in the portfolio. We also saw in our description of the fund’s portfolio that it has a negative cash position. This is because the fund is employing leverage, which is a common strategy meant to increase the yield of a portfolio. Basically, the fund borrows money and then uses those borrowed funds to purchase high-yield bonds. As long as the purchased assets pay a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the overall portfolio yield. As a fund like this one is able to borrow at institutional rates, which are substantially below retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword because debt boosts both gains and losses. This is likely one reason why the fund has underperformed the aggregate bond index to the degree that it has. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I do not generally like to see a fund’s leverage exceed a third as a percentage of its assets for this reason. As of January 13, 2023, the PIMCO High Income Fund had levered assets comprising 31.59% of its portfolio. This is a bit below the one-third level that I like to see so this fund does appear to be running a pretty good balance between risk and reward. Overall, there is little to complain about here.

Distribution Analysis

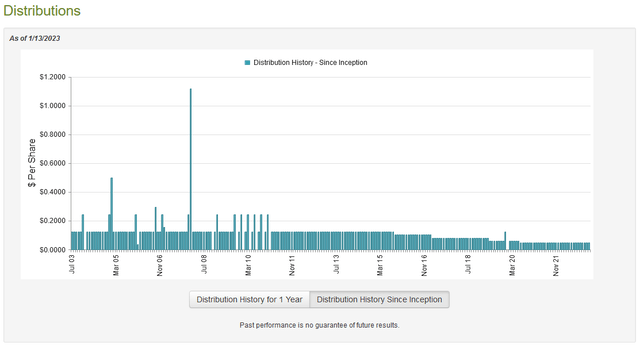

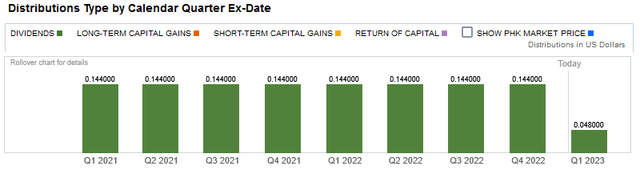

As stated earlier in this article, the primary objective of the PIMCO High Income Fund is to provide its investors with a high level of current income. In order to accomplish this, it invests in a portfolio that primarily consists of junk bonds and then leverages them up in order to boost the yield of the portfolio. When we consider that junk bonds themselves tend to have fairly high yields, we can likely assume that the fund itself will also have one. This is certainly the case, as the fund pays out a monthly distribution of $0.048 per share ($0.576 per share annually), which gives it an 11.64% yield at the current price. Unfortunately, the fund has not been particularly consistent about this payment and has, in fact, decreased it several times over its history:

CEF Connect

The fact that the fund’s history shows generally consistent declines over the past half-decade or so is likely to be a bit of a turn-off for any investor that is looking for a safe and secure source of income with which to use to pay their bills or cover other expenses. This is particularly concerning for a bond fund considering that most of those years were characterized by a fairly strong bull market in bonds. However, there may be some comfort in the fact that the fund’s distributions are entirely classified as dividend income:

Fidelity Investments

The reason that this may be comforting is that dividend income is generally the most sustainable form of distribution for a closed-end fund. This is because a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. A capital gains distribution, meanwhile, requires that the fund actually have capital gains to distribute. That is very difficult to accomplish for a bond fund during periods of rising interest rates. A dividend distribution, meanwhile, is funded solely out of dividends and interest payments that the fund receives from its assets so it is theoretically much more sustainable. However, I have pointed out before that it is possible for these distributions to be misclassified. As such, we should investigate the fund’s finances in order to determine how they are actually being funded and sustainable they are likely to be.

Unfortunately, we do not have an especially recent document that we can consult for that purpose. The fund’s most recent financial report corresponds to the eleven-month period that ended June 30, 2022 (it stretches from August 1, 2021, to June 30, 2022). As such, it will include no data on how the fund performed during the second half of last year, which was likely a challenging time for it given the rising interest rate environment. However, it is still a much newer document than we had available the last time that we reviewed the fund and will still include the first couple of months of the Federal Reserve’s rising rate regime. During the eleven-month period, the fund received a total of $69.252 million in interest and $2.477 million in dividends from the investments in its portfolio. This gives the fund a total income of $71.729 million during the period. The fund paid its expenses out of this amount, leaving it with $63.684 million available for the shareholders. This was unfortunately not enough to cover the $71.078 million that the fund actually paid out during the period, which is certainly concerning.

The fact that the fund failed to cover its distributions is a sign that the distributions were in fact not entirely dividends, although its annual report is indeed classifying them in that way. This is not a case of dividends earned in previous years being paid out, either, because the fund’s distributions have exceeded its net investment income during each of the past three years:

FY 2022 | FY 2021 | FY 2020 | |

Net Investment Income | $63.684 | $74.602 | $85.274 |

Distributions Paid | $71.078 | $76.790 | $93.463 |

(All figures in millions of U.S. dollars)

Although the fund failed to cover its distributions through net investment income, it still has the potential to cover them through other means. After all, the fund might have capital gains that it can use to finance the distribution. As might be expected from the Federal Reserve’s institution of a monetary tightening policy, the fund failed to accomplish this during the period. It had net realized gains of $104.357 million during the eleven-month period but this was offset by net unrealized losses of $258.669 million. Overall, the fund’s assets declined by $152.352 million during the period after accounting for all inflows and outflows.

With that said, PIMCO High Income Fund did manage to earn enough in net investment income and net realized gains to cover the distribution. Thus, the situation may not be as bad as it seems. However, the fund’s assets are down considerably since August 1, 2019, as well as down since August 1, 2020, so it does appear that it cannot actually maintain the distribution and may need to cut the distribution in the near future. This explains why the current yield of the fund is so high as any yield over 10% is a sign that the market expects a distribution cut in the near future.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund such as the PIMCO High Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the fund’s shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can buy them at a price that is less than the fund’s net asset value. This is because such a scenario implies that we are acquiring the fund’s assets for less than they are actually worth. That is unfortunately not the case with this fund today. As of January 13, 2023 (the most recent date for which data is currently available), the PIMCO High Income Fund had a net asset value of $4.70 per share but the shares actually trade for $4.95 per share. This gives the fund’s shares a 5.32% premium to the net asset value. This is a very expensive price to pay for this fund, especially considering that the shares have traded for a 1.94% premium on average over the past month. It, therefore, would be prudent to wait for a while and see if a more attractive entry price presents itself.

Conclusion

In conclusion, PIMCO is undoubtedly one of the best-known and most-renowned fund houses for bond investors. As such, it may not be surprising to learn that the PIMCO High Income Fund certainly looks like a solid bond fund on the surface. It is incredibly well-diversified and should pose a very minimal risk of losses due to defaults despite investing heavily in junk bonds.

However, PIMCO High Income Fund may be taking on some speculative risk with the short position in seven-to-ten-year bonds that could result in losses. In addition, the fund is failing to cover its distribution and has seen its asset values decline so it may be forced to cut the distribution in the near future in order to maintain the size of its portfolio.

PIMCO High Income Fund also looks fairly expensive right now. Overall, while PIMCO High Income Fund does certainly have some redeeming qualities, it looks like it is probably best to sit on the sidelines for a bit and monitor the fund for a better entry position.