staticnak1983

Pioneer Floating Rate Fund, Inc. (NYSE:PHD) is one closed-end fund aka CEF that could be used by investors who are seeking a very high level of current income from their portfolios. This need for income has become ever more important lately, as the rising costs of everything that we buy have had a devastating effect on the lifestyles of many retirees and others who live off of the assets that they have accumulated over their lives. As of the time of writing, the Pioneer Floating Rate Fund pays a whopping 12.43% yield, so it certainly makes an attractive offer for anyone who is seeking a high level of income.

However, as I have pointed out numerous times before, any time a fund achieves double-digit yields, it is a sign that the market expects that the fund will have to cut its distribution in the near future. With that said, this rule does not appear to apply as much today as it did a few years ago, due partly to the fact that everything has a higher yield than it did prior to 2022. We should still analyze the fund’s finances though, in order to determine exactly how sustainable the current distribution is.

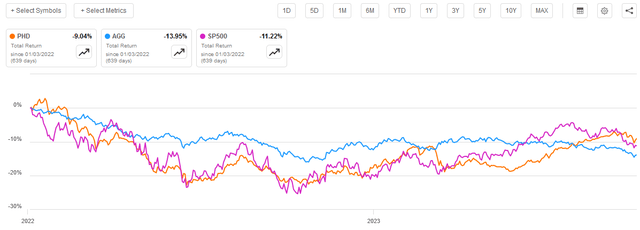

In previous articles, such as this one, I pointed out that funds that invest in floating-rate securities have delivered superior performance to most other debt funds over the past year or two. The Pioneer Floating Rate Fund is no exception to this, as the fund has managed to outperform both the Bloomberg U.S. Aggregate Bond Index (AGG) and the S&P 500 Index (SP500) on a total return basis since the start of 2022:

Seeking Alpha

Unfortunately, we can still see that the investors in this fund lost money even after the effects of the distribution are considered, so that is likely to reduce its appeal somewhat. With that said, though, investors in other floating-rate debt funds also lost money over the same period. In fact, just about anything except for cash or energy stocks declined over the period, so the fact that the fund delivered a negative total return over the past 21 months is not really the end of the world since it still compares favorably to most other things.

About The Fund

As is the case with other Pioneer funds, the Pioneer Floating Rate Fund does not have a dedicated webpage. All it has is this site, which lists all of the funds currently in existence using the Pioneer brand and provides some downloadable information about them. As such, the fact sheet basically serves the role of a website as it contains the latest information about the fund’s holdings and performance that can be directly obtained from the fund sponsor. This is certainly not ideal, in particular, because the link provided will probably stop working once the fund sponsor updates the fact sheet but it is all that we have for this fund.

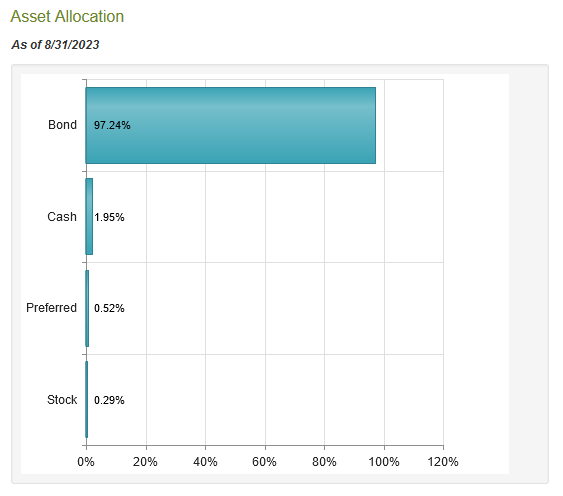

According to the fact sheet, the primary objective of the Pioneer Floating Rate Fund is to provide its investors with a high level of current income. This makes sense considering that it specifically states that it seeks to achieve this objective by investing in floating-rate loans. Indeed, it does appear that this fund is invested primarily in debt securities as CEF Connect puts its bond allocation at 97.24% of total assets:

CEF Connect

These are not the bonds that most of us picture when we think about a bond, but they are similar. These securities are issued with a face value that the investor pays to purchase the newly issued security. The security pays this same amount back at maturity. The twist comes with the coupon, as the amount paid to the investor by the issuer changes based on the market interest rate. This is an advantage during periods in which interest rates are rising like they are now. This is because the security will be paying out ever greater amounts of money. Thus, the fund should have been seeing its income go up substantially over the past eighteen months or so.

The fact that the coupons on these securities change with the market interest rate allows them to avoid the major pitfall possessed by other bonds in a rising rate environment. In short, these securities will always deliver a competitive interest rate, so their price does not decline when rates go up. In fact, the Bloomberg Floating Rate Note < 5 Yrs Index (FLOT) has been almost perfectly flat over the past ten years:

Seeking Alpha

This does, unfortunately, make it difficult to understand why the Pioneer Floating Rate Fund declined as much as it did when interest rates started to rise in the first quarter of last year. The fund’s price actually went down by 24.85% over the course of 2022 despite the fact that the market price of its assets should not have moved very much at all. It was hardly alone though, as the Apollo Senior Floating Rate Fund (AFT) and the Eaton Vance Floating-Rate Income Trust (EFT) also fell by similar amounts:

Seeking Alpha

My first thought is that the fund was slow to raise its distribution as rates started rising, but that was not the case. In fact, this fund raised its distribution five times in 2022 and four times so far in 2023. One possible answer is that it was the victim of a widespread market sell-off that did not discriminate between income funds that use different strategies. For example, it did make a lot of sense that the market would sell off traditional bond funds since fixed-rate bonds do fall in price when market interest rates go up. Thus, the fund could have gotten caught up in a market panic as investors started selling everything to go to cash out of fear of the changing monetary conditions.

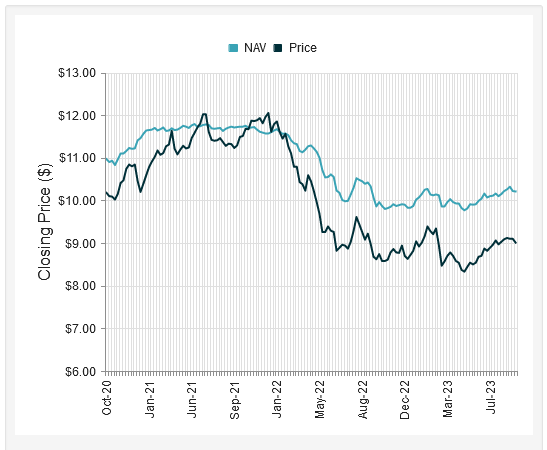

This theory does appear to have some merit. As I have pointed out numerous times in the past, one of the defining characteristics of closed-end funds is that their market price performance does not always match the performance of the portfolio itself. In the case of this fund, we do indeed see that in a fairly big way since the COVID-19 pandemic. This chart shows the fund’s market price performance against the value of the assets in its portfolio:

CEF Connect

As we can see, the portfolio itself held up much better than the shares did throughout most of 2022. This year, it appears as if the market price has been somewhat more volatile than the portfolio, but for the most part, the shares are trading for less than the actual value of the fund’s assets. While this was certainly not a good thing for anyone who owned the fund during 2022, it does create a pretty good opportunity for us to get in today.

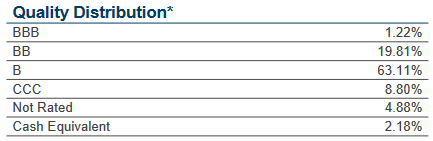

One of the defining characteristics of floating-rate debt securities is that they tend to be issued by entities with less-than-stellar balance sheets. This is due to the risks that are put on the borrower. After all, a rise in interest rates forces the borrower to pay more instead of the investor taking a loss. As most borrowers want to reduce their own risks, any company or government that is capable of issuing fixed-rate securities at a reasonable price will almost certainly take that option. As such, we can expect that the securities held by the Pioneer Floating Rate Fund will have somewhat poor credit ratings. This is exactly the case, as shown here:

Fund Fact Sheet

An investment-grade security is anything rated BBB or above, so we can clearly see that this only describes 1.22% of the portfolio. Cash equivalent securities tend to be very low-risk and are only issued by stable entities so these would fall into that category as well. Thus, we have 3.40% of the fund invested in investment-grade securities or better. However, that still means that the overwhelming majority of the fund’s total assets are invested in speculative-grade securities. These are colloquially known as “junk bonds,” and they tend to carry much higher default risks than ordinary investment-grade bonds. That is something that could be very concerning to those investors who are highly risk-averse and are concerned about the preservation of the principal. However, one thing that we see here is that 82.92% of the fund’s assets are invested in securities that carry either a BB or a B credit rating. According to the official bond ratings scale, securities with these weightings are issued by companies that have sufficient financial strength to carry their existing debt obligations even through a short-term economic shock. Thus, the risk of default losses here probably is not much worse than that of investment-grade bonds. When we combine this with the fact that the largest issuer whose securities are represented in the fund only accounts for 1.62% of total assets, we can see that any default will have a negligible effect on the fund as a whole.

Thus, there is probably not too much for us to worry about with respect to the fund’s junk debt portfolio as we should not be at huge risk of default losses. The biggest risk with this fund is interest rates, and even then, the fact that these are all floating-rate securities reduces that risk considerably as already mentioned.

Leverage

As is the case with most closed-end funds, the Pioneer Floating Rate Fund employs leverage as a method of boosting the effective yield of its portfolio. I explained how this works in a previous article:

In short, the fund borrows money and then uses that borrowed money to purchase floating-rate debt and similar income-producing securities with variable yields. As long as the purchased securities have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, this will normally be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much debt because that would expose us to an excessive amount of risk. I do not typically like a fund’s leverage to exceed a third as a percentage of its assets for that reason.

As of the time of writing, the Pioneer Floating Rate Fund has leveraged assets comprising 5.27% of its total assets. This is one of the lowest leverage ratios that I have ever seen a closed-end fund possess. It is well below our desired one-third level to allow for acceptable risk, and when we consider that the fund’s assets tend to be much less volatile than either stocks or bonds, we can conclude that it should have no difficulty carrying the leverage. In fact, this fund should be able to increase its leverage with no ill effects although it does not need to since its distribution yield is quite acceptable right now.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Pioneer Floating Rate Fund is to provide its investors with a high level of current income. In pursuance of this objective, the fund invests its money in a portfolio of variable-rate securities that are issued by speculative-grade companies, which means that they will always provide a yield that is quite a bit above the risk-free rate. The fund collects all of the payments made by these securities, artificially boosts its income with a layer of leverage, and then pays out the money to its own shareholders net of the fund’s own expenses. As such, we can assume that this fund will have a very high yield itself.

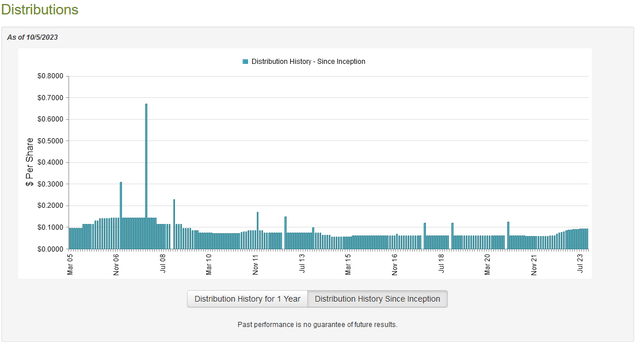

This is certainly the case as the Pioneer Floating Rate Fund pays a monthly distribution of $0.0925 per share ($1.11 per share annually), which gives it a 12.43% yield at the current price. This is certainly a yield that any income-hunting investor will appreciate but unfortunately, the fund has not been particularly consistent with respect to its distribution over the years. As we can see here, the fund has both raised and cut its distribution numerous times since its inception:

CEF Connect

This variable distribution seems likely to be somewhat problematic to those investors who are seeking a steady and secure source of income to use to pay their bills or finance their lifestyles. However, it does make a great deal of sense. As we can clearly see above, the fund’s distribution tends to vary with interest rates. The fund’s distribution rises when interest rates go up and falls when they go down. This is the exact opposite of what we tend to see with funds that invest in traditional fixed-rate bonds so this could allow it to serve as a diversifier in a portfolio consisting of fixed-income funds.

As is always the case though, we want to have a look at the fund’s finances in order to determine how sustainable its distribution is likely to be. After all, we do not want to be the victims of a sudden distribution cut that both reduces our incomes and almost certainly causes the fund’s share price to decline.

Fortunately, we have a relatively recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on May 31, 2023. This report will therefore cover most of the first half of this year, which was a very optimistic period for the market. Traders generally assumed that the Federal Reserve would quickly pivot and cut rates, so they started buying up most assets and driving up the price of just about everything.

However, this fund would not have been able to take advantage of this like many others due to the overall stability of floating-rate security prices. However, this fund did increase its distribution four times during the period of time covered by this report so it should be able to give us a good idea of how exactly it managed to accomplish that given the fact that market optimism was keeping rates lower than the Federal Reserve desired.

During the six-month period, the Pioneer Floating Rate Fund received $9,005,464 in interest and $191,436 in dividends from the assets in its portfolio. This gives the fund a total investment income of $9,196,900 during the period. It paid its expenses out of this amount, which left it with $6,685,608 available for shareholders. This was, fortunately, sufficient to cover the $6,434,965 that the fund paid out in distributions to the shareholders.

The same thing was the case during the full-year period that ended on November 30, 2022. During that period, the fund reported a net investment income of $10,226,471 and paid out $9,250,058 to its investors.

Thus, it appears that this fund is simply paying out its net investment income, which is nice because its assets have actually been declining over the past eighteen months due to a combination of realized and unrealized losses. However, as long as it is simply paying out its net investment income then it should be able to sustain its distribution as long as interest rates remain at their current levels or go higher. Once interest rates start to decline though, we can assume that the fund’s net investment income will also decline and then it may be forced to cut the payout.

Valuation

As of October 5, 2023 (the most recent date for which data is available as of the time of writing), the Pioneer Floating Rate Fund has a net asset value of $10.15 per share but the shares currently trade for $8.87 each. This gives the fund’s shares an enormous 12.61% discount on net asset value at the current price. This is a very large discount that is quite a lot better than the 11.75% discount that the shares have had on average over the past month. Thus, the current price looks like a reasonable entry price for this fund.

Conclusion

In conclusion, the Pioneer Floating Rate Fund is somewhat underfollowed considering that it is from a smaller fund house. However, the fund does have a lot to offer in today’s rising interest rate environment. In particular, the assets held by the fund should prove to be very stable regardless of which direction the Federal Reserve actually takes over the coming months and the fund adjusts its distribution with a direct correlation to interest rates. This makes this one of the few debt funds that actually raised its distribution during today’s market environment.

When we combine this with the fact that this fund only pays out its net investment income and still manages to achieve a very high yield, it could serve an important purpose in the portfolio of someone who has other bond closed-end funds due to the different interest rate exposure. Overall, this fund might be worth considering.