Andrzej Rostek

Thesis

PGT Innovations (NYSE:PGTI) is a leading manufacturer of impact-resistant windows and doors in the West and Southeast of the United States. Their products are in high demand in areas prone to extreme weather conditions that occur in rising frequency across the states. PGTI has been slowly bleeding market share against Tecnoglass (TGLS), which has a cost advantage over PGTI due to its production being based in Colombia. Even though I believe PGTI will continue losing market share, the structural growth trend is strong enough to fuel growth for both players over time. I am cautiously optimistic.

Overview of the business

PGT Innovations manufactures and sells vinyl and aluminum impact-resistant windows and doors with a focus on protection against extreme weather conditions. It was founded in 1980 and is headquartered in North Venice, Florida. It has roughly ~5500 employees and a distribution network of ~4000 dealers. 100% of revenue is generated in the US, and that is split between Western (75%) and Southeast (25%). Furthermore, 60% of sales depend on the Repair and Remodel end markets and 40% on new residential.

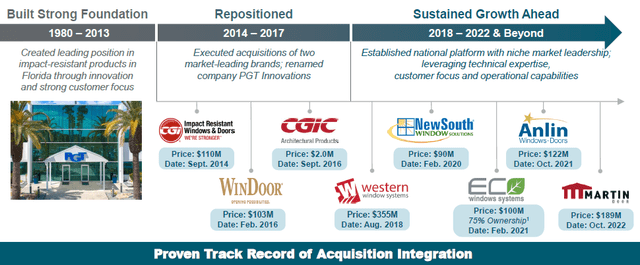

The company grew through a series of acquisitions that contributed to a strong foothold in the windows business. Today PGTI has ~60% market share in Florida and continues to expand across the US.

Company history (Investor Relations)

Recent Performance

In the most recent quarter, Q2 2023, results were in line with expectations. Organic sales were down 8%, but total revenue declined 5% Year over Year, including the M&A activity. EBITDA margins beat the street’s expectations and contracted ten basis points to 19.1%. On the call, management called out a challenging operating environment while noting strength in the Repair and Remodel market. Management expects the new construction market to pick up in the second half of 2023. Although 2023 full-year guidance was not given, Q3 2023 sales are expected to be between $385 million and $405 million and adjusted EBITDA is $71 million to $77 million. That represents a 0-5% Year over Year sales growth and an EBITDA margin expansion to about 18.7%.

Hurricanes are a long-term driver of demand

Florida is the mecha of hurricanes in the US. In fact, more than 41% of hurricanes that hit the US since 1851 have also hit Florida. Given that PGTI specializes in selling impact-resistant windows and doors, Florida is a core market with a large penetration opportunity. This has trickled down into building codes for new construction in Florida’s coastal areas where “Window and Door replacements also require upgrading to products that provide opening protection (i.e. impact resistant Windows and Doors)”. PGTI’s comprehensive sales channel and established brand names in Florida position them to continue growing and expanding their presence in new locations. The unfortunate rise in the frequency of extreme weather events will continue to be a long-term tailwind for PGTI’s demand.

Financial profile and outlook

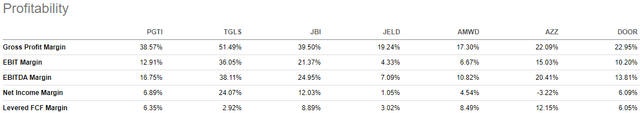

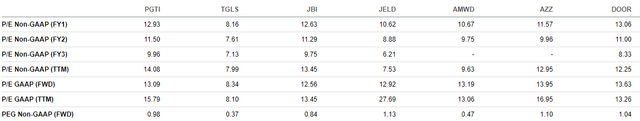

Profitability vs peers (Seeking Alpha)

PGTI has strong profitability compared to peers and is continuously investing in manufacturing efficiencies that will contribute to improving profitability going forward. Its biggest competitor in Florida, Tecnoglass, has been gaining traction in the Repair and Remodel segment, but PGTI is taking steps to minimize the long-term effects of intensifying competition. The main reason behind the large gap in profitability between PGTI and Tecnoglass is that TGLS has its manufacturing facilities in Colombia, where labour, land and transportation costs are in order of magnitude lower than in the US. Even though Tecnoglass currently has only a 10% market share in Florida, its margins allow for price undercutting to continue penetrating and gaining market share. This is very bad for the incumbents for two reasons. First, TGLS has the highest gross margins and can afford to cut prices lower than any other competitor. Second, TGLS has the lowest net debt position of all peers and can subsequently react to competitive pressures with greater flexibility.

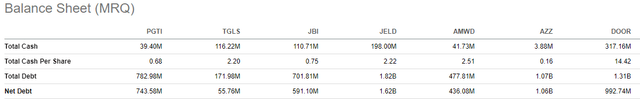

Balance Sheet comparison (Seeking Alpha)

Considering the competitive backdrop, I am wary of PGTI’s ability to outcompete its main competitor, TGLS, at a time when net debt to EBITDA is at its highest (~3x) in the past seven years. Tecnoglass has a structural cost advantage over PGTI, and this will likely lead to market share losses over time.

Valuation

Based on forward-looking estimates, the current valuation appears to be at the top range among peers, whereas the emerging player, Tecnoglass, is trading at a much cheaper multiple across all metrics. Even compared to historical multiples, PGTI trades in line with its ~11x EV/EBIT average, despite being in a cyclically challenging period.

Valuation versus peers (Seeking Alpha)

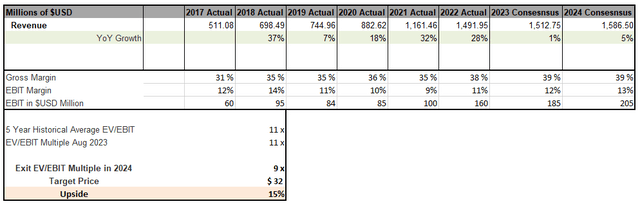

For my model, I assumed a modest expansion in operating margins to reflect the investments in efficiencies that management has in place. My growth assumptions that are in line with consensus reflect the long-term drivers that will likely help defy a large cyclical downswing. Additionally, my exit multiple by the end of 2024 is based on my view that the market will recognize the relatively weakening competitive position and will be willing to pay two points less for earnings.

Valuation model (Refinitiv and Author)

Conclusion

All in all, PGTI is a leading player in extreme weather-resistant windows and doors that is struggling with market share losses against a competitor that has a structural cost advantage. I believe that these competitive forces will continue to erode PGTI’s dominant market share, but the company will continue to grow due to its strong brand positioning and expansive network of dealers.