caio acquesta

Article Thesis

Petróleo Brasileiro S.A. – Petrobras (NYSE:PBR)(NYSE:PBR.A) has reported earnings results that were weaker than expected. On top of that, Petrobras announced a lower dividend compared to what was expected. The market reacted very negatively to this news, sending Petrobras’ shares lower by more than 10%. While the dividend isn’t as excellent as it was in the past, Petrobras remains a high-yielding investment that could be of merit to some investors.

Past Coverage

I covered Petrobras several times in the past, most recently last November in this article titled “Petrobras Stock: The Dividend Machine Keeps Pumping Cash”. Before that, I had given Petrobras a Buy rating in June — shares have returned 29% since then when we account for dividends, which was more than enough to outperform the broad market. With Petrobras’ Q4 results being released and with some changes to the dividend policy, it is time to take another look at the company.

What Happened?

Petrobras announced the results for its fiscal fourth quarter and the entire year of 2023. Profits were down compared to the previous year’s quarter, and Petrobras’ profitability was also weaker than what many investors and analysts had expected. That being said, the company’s results were far from bad in absolute terms:

Petrobras still earned $8.3 billion in Q4 and a little more than $27 billion for the entire year — while those numbers were down versus the comparable periods in 2022, Petrobras remains a very profitable company. $27 billion in annual net profits are still very strong in absolute terms. For comparison, Exxon Mobil Corporation (XOM), the highest-valued US-based energy company, generated $36 billion in net earnings over the last year. Thus, Petrobras is around “75% of an Exxon Mobil” (of course, there are differences when it comes to political risks, production costs, etc.).

Petrobras: Results Are Still Appealing

While profits were somewhat lower compared to the previous year’s quarter, they were still strong in absolute terms. And, importantly, Petrobras’ results were also strong relative to the valuation the company trades at. At current prices, Petrobras is valued at around $95 billion. Exxon Mobil, which generated earnings that were around 30% higher in 2023, as we have seen earlier, is valued at $425 billion right now — which makes for a ~350% higher market capitalization. Considering the comparatively small difference in the profitability of the two companies, a market capitalization difference this big suggests that Petrobras could be undervalued.

But not only that, Petrobras’ profits still looked pretty strong over the last year, and the same can also be said about the company’s cash flows. Petrobras generated operating cash flows of $43 billion over the last year, which made for free cash flows of $31 billion after accounting for capital expenditures. The results during the fourth quarter were actually a little bit stronger compared to the Q1-Q3 average, as Petrobras’ operating cash flows and free cash flows during the fourth quarter totaled $11.7 billion and $8.1 billion, respectively. Annualized, that would make for operating cash flows of $47 billion and for free cash flows of $32 billion. In other words, if Petrobras’ future performance is comparable to the company’s results during the fourth quarter, then 2024’s cash flows could be a little stronger than those from 2023 — the company did not experience ongoing declines in 2023, as results actually improved towards the end of the year.

Petrobras: Dividend Still High, But Lower Than What The Market Hoped For

Over the last two years or so, Petrobras has been pumping out dividends at a hefty pace. With the most recent dividend announcement, the company has declared fewer dividends compared to what the market was expecting. The dividend for the fourth quarter is $2.9 billion, or a little more than 14 billion Reais. The consensus estimate stood at more than $3 billion, which is why we can say that Petrobras wasn’t as generous as expected. That being said, $2.9 billion in quarterly dividends for a company that is currently valued at just $95 billion is still a pretty huge sum — that makes for a quarterly dividend yield of 3.1%.

Unlike many American energy companies, including the supermajors Exxon Mobil and Chevron Corporation (CVX), Petrobras does not make the same dividend payment four times per year, however. Instead, Petrobras’ dividends fluctuate to some degree, which is why we can’t say that shareholders will get a 3.1% quarterly dividend four times over the next year.

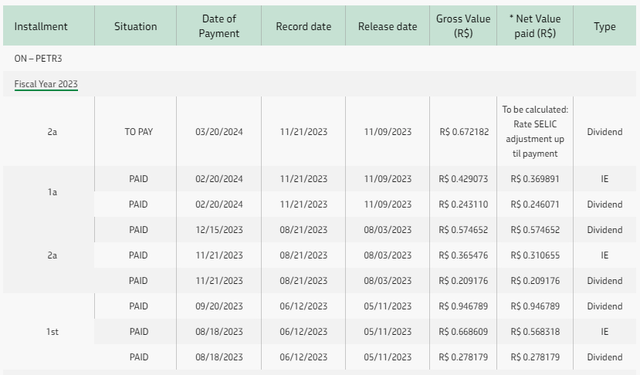

Over the last year, Petrobras declared the following dividends:

PBR dividends (Seeking Alpha)

In total, that’s around 4.4 Brazilian Real per share, or 8.8 Brazilian Real per ADR (one ADR represents two shares). Converted to US Dollars at the current exchange rate, that’s a payment of around $1.75 per ADR. Calculating with a share price of $15.10 for PBR and with $14.70 for PBR.A, that makes for a dividend yield of 11.6% and 11.9%, respectively. At least over the last year, the cash return wasn’t far off from 12% — and if Petrobras were to declare dividends comparable to what the company has declared for the fourth quarter, the yield would be in that range as well.

Even if we assume that future dividends will be somewhat lower compared to today, it’s unlikely, I believe, that Petrobras’ dividend yield will fall below the level we see for US-based supermajors today. If Petrobras’ dividends were to get cut in half, for example, that would still make for a dividend yield of around 6%, while XOM and CVX currently offer dividend yields of 3.5% and 4.4%, respectively.

While the market was hoping for a larger dividend declaration from Petrobras, it’s not like the company is offering a low dividend yield today at all. Instead, PBR’s dividend yield is still pretty high, although there is some risk that dividends will be reduced in the future. Brazil’s leadership, and to some extent Petrobras’ leadership, wants more investments in green technologies and renewable energy. If more cash gets diverted towards building renewable diesel plants, wind parks, and so on, then cash returns to shareholders could decline.

That being said, Petrobras’ free cash flows easily cover the dividend at current levels with considerable excess free cash flow being available. Thus the company could likely increase its green energy investments while continuing to pay dividends at the current level. That is, of course, if oil prices remain around the current level — in a scenario where oil prices crash, the dividend could be in danger, but that also holds true for other energy companies. With OPEC having just prolonged their production cuts, I do not believe that it is likely that oil prices will head dramatically lower in the foreseeable future, thus Petrobras and other energy companies should have a solid macro environment going forward.

Is PBR Stock A Good Investment?

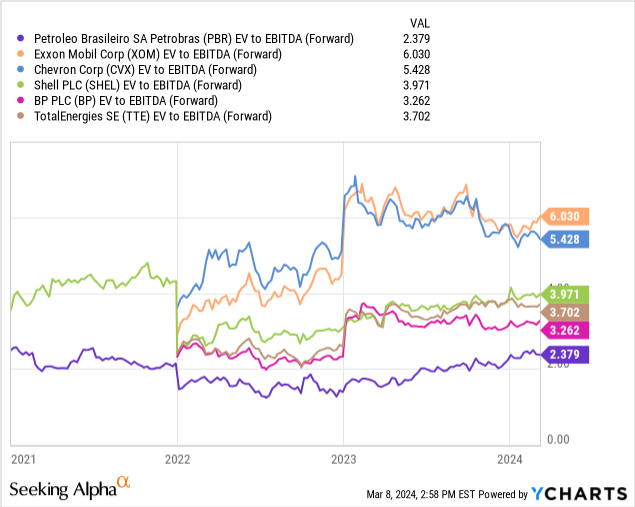

Petrobras has political risks due to its dependency on its Brazilian assets and since Brazil is a shareholder in the company. That being said, one can argue that these risks are more than accounted for, considering the undemanding valuation Petrobras trades at:

Based on EBITDA estimates for the current year, and relative to the enterprise value of each company (which accounts for debt and cash on the balance sheet), Petrobras is pretty cheap compared to both US-based and European supermajors. At just 2.4x EBITDA, Petrobras offers an EBITDA yield of 42%, while Exxon Mobil, Chevron, BP p.l.c. (BP), TotalEnergies SE (TTE), and Shell plc (SHEL) trade at EBITDA yields of 17% to 30% right now. With the highest EV/EBITDA ratio being just 6 among the companies in this group, none of them look expensive in absolute terms — but Petrobras is the cheapest by far. While I do not believe that it would make sense for Petrobras to trade at an XOM-like valuation, at way less than half of XOM’s valuation, Petrobras is pricing in considerable risks. For someone who isn’t afraid of these risks, Petrobras could be quite an attractive investment.

The combination of a still pretty high dividend yield, strong assets such as Brazil’s pre-salt layer, and a very undemanding valuation has merit. On the other hand, risk-averse investors may favor buying the more expensive and lower-yielding competitors where assets are more diversified and where political risks are lower, so I wouldn’t call Petrobras a must-own stock for everyone.