ayo888

The Brazilian oil kingpin – Petrobras has had the spread between its common (NYSE:PBR) and preferred (NYSE:PBR.A) shares widen lately with the premium of the former on the latter surpassing one standard deviation above the 5-year average. Now that the company was pulled from the privatization list, I see no justification of significant premium of the common over the preferred shares, so some mean reversion should follow, opening up a potential arbitrage opportunity. The idea could be played out by going long the preferred shares and selling the common stock. Last I covered Petrobras in November.

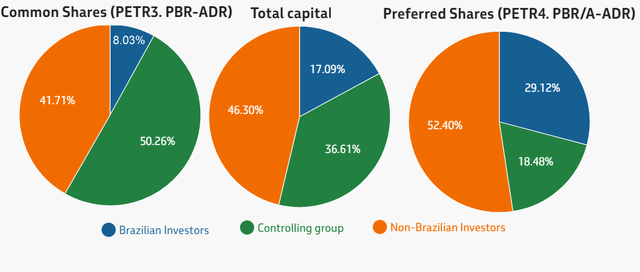

Ownership structure

Petrobras has a dual class ownership structure with 7.4M common shares and 5.6M preferred shares. While the majority of the PBR.A shares are owned by private investors (retail and institutional), the Brazilian government holds 50.3% of the common shares, which ensures that it has control over the entity as the preferred stock has no voting rights.

Petrobras’ ownership structure (Petrobras)

PBR Vs. PBR.A

The main difference by the two classes are the voting rights, which belong only to the common shares. On the other hand, according to Petrobras’ Bylaws, preferred shares have advantage when it comes to dividends:

Preferred shares shall have priority in the event of repayment of capital and the receipt of dividends, of at least 5% (five per cent) as calculated on the part of the capital represented by this kind of shares, or 3% (three percent) of the net equity value of the share, whichever the greater, participating on equal terms with common shares in capital increases arising from the capitalization of reserves and profits.

In reality, the company has been distributing equal amounts of dividend to both classes, so naturally the one with the lower price offers higher yield. The Bylaws also states that there could not be any conversion of one class into the other and vice versa. While PBR.A has no voting rights in general, there is an exception in the election of BoD members:

At the General Shareholders Meeting which decides on the election of Board of Directors members, the right to vote of preferred shareholders is subject to the satisfaction of the condition defined in § 6 of the art. 141 of the Corporate Law, of proven uninterrupted ownership of equity during the period of 3 (three) months, at least, immediately prior to the staging of the Meeting.

The arbitrage opportunity

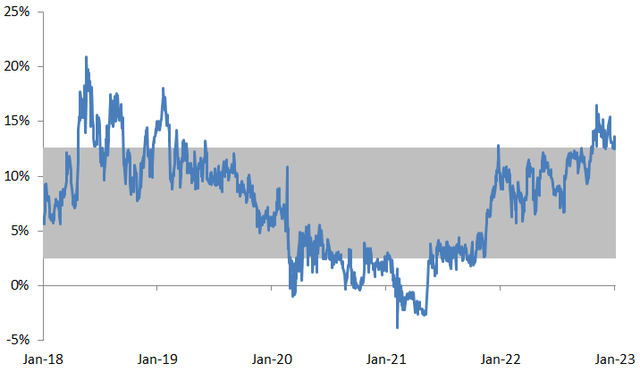

I looked at the 5-year historical premium of common over the preferred shares in order to get a sense of the dynamic, establishing a one standard deviation band over the average value. The premium is calculated as (PBR/PBR.A-1) and presented in a percentage form. It turns out that the current premium is significantly above the 5-year average right at the upper 1 standard deviation band.

Premium of PBR over PBR.A (Calculated by the author using data from Investing.com)

* the grey zone is one standard deviation range around the average value

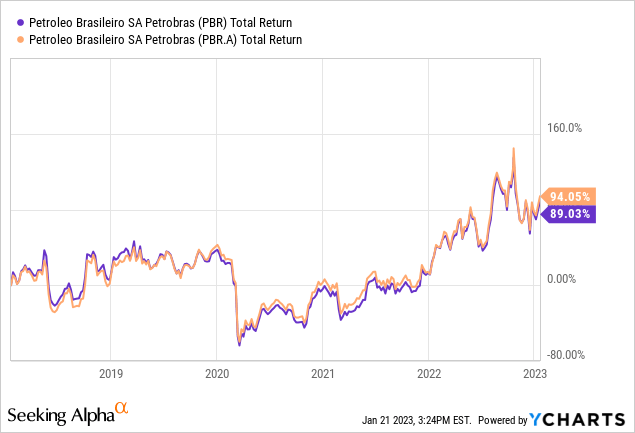

Since both classes are being paid equal dividends, on that regard there is no reason for a significant difference of their price. When it comes to voting rights, the Brazilian government has a controlling majority, so based on that a premium on the common stock doesn’t seem logical. If the company is to be privatized the case for a premium could be made, but with the election of Lula as president, the company has been removed from the privatization list. In addition, looking at the total return level, the PBR.A has achieved higher return, due to its lower base while the dividend amount is equal to both classes. Based on these, I expect that some mean reversion should follow and the premium should shrink.

Those who want to take a shot on the shrinking premium thesis should sell PBR and buy PBR.A. Note, that both positions should be equal in dollar value terms, not in number of shares terms, since the latter would give exposure to the nominal value of the spread not the premium in percentage terms. Such positioning won’t require tying a lot of capital, since the proceeds from the short position could be used to finance the long position. As far as the potential reward, if the premium shrinks to its 5-year average of 7.6%, this would imply potential return of 5.3%, without taking borrowing costs into account.

Risks and considerations

The good thing about playing the premium is that the exposure to macroeconomic as well as the majority of company specific risks is eliminated – after all, the direction of the share price doesn’t matter, the only thing of interest is the premium. The only situation, where the spread dynamics may break in a major way would be a change in the Brazilian law putting one class at a serious advantage/disadvantage to the other. However, this doesn’t seem likely at the moment or the near future.

Another important consideration are borrowing costs – shorting the common stock will come at an expense so it’s a matter of calculations weather that expense won’t melt a considerable part of the theoretical profit from a potential mean reversion.

Lastly, as markets are not always rational, the premium may stay elevated or even expand for some time, despite the lack of market logic. In this case the arbitrage play may not yield positive returns.