Monarch co-founders (left to proper) Ozzie Osman, Jon Sutherland, Val Agostino.

Courtesy: Monarch

The non-public finance startup Monarch has raised $75 million to speed up subscriber development that took off final yr when budgeting software Mint was shut down, CNBC has realized.

The fundraising is among the many largest for an American shopper fintech startup this yr and values the San Francisco-based firm at $850 million, in response to co-founder Val Agostino. The Collection B spherical was led by Forerunner Ventures and FPV Ventures.

Monarch goals to supply an all-in-one cell app for monitoring spending, investments and cash objectives. The sphere was as soon as dominated by Mint, a pioneer in on-line private finance that Intuit acquired in 2009. After the service languished for years, Intuit closed it in early 2024.

“Managing your cash is likely one of the huge unsolved issues in shopper expertise,” Agostino mentioned in a latest Zoom interview. “How American households handle their cash continues to be mainly the identical because it was within the late 90s, besides in the present day we do it on our telephones as a substitute of strolling right into a financial institution.”

Monarch, based in 2018, noticed its subscriber base surge by 20 instances within the yr after Intuit introduced it was closing Mint as customers sought alternate options, in response to Agostino.

Not like Mint, which was free, Monarch depends on paying subscribers in order that the corporate does not must give attention to promoting from credit-card issuers or promote customers’ knowledge, mentioned Agostino, who was an early product supervisor at Mint.

Private finance app Monarch, which has raised a $75 million collection B funding.

Courtesy: Monarch

The startup aimed to make onboarding accounts and expense monitoring simpler than rival instruments, a few of that are free or embedded inside banking apps, in response to FPV co-founder Wesley Chan.

Chan mentioned that Monarch reminds him of earlier bets that he has made, together with his stake in graphic design platform Canva, in that Agostino is tackling a tough market with a recent strategy.

“What Val is doing, it is the successor to something that is been achieved in monetary planning,” Chan mentioned. “It is frictionless, it is easy to make use of and it is easy to share, which is one thing that by no means existed earlier than. That is why he is rising so shortly, and why the engagement numbers are so excessive.”

The corporate’s spherical comes amid a interval of muted curiosity for many U.S. fintechs that cater on to customers. Monarch is likely one of the few companies to lift a sizeable Collection B; different latest examples embrace Felix, a cash remittance service for Latino immigrants.

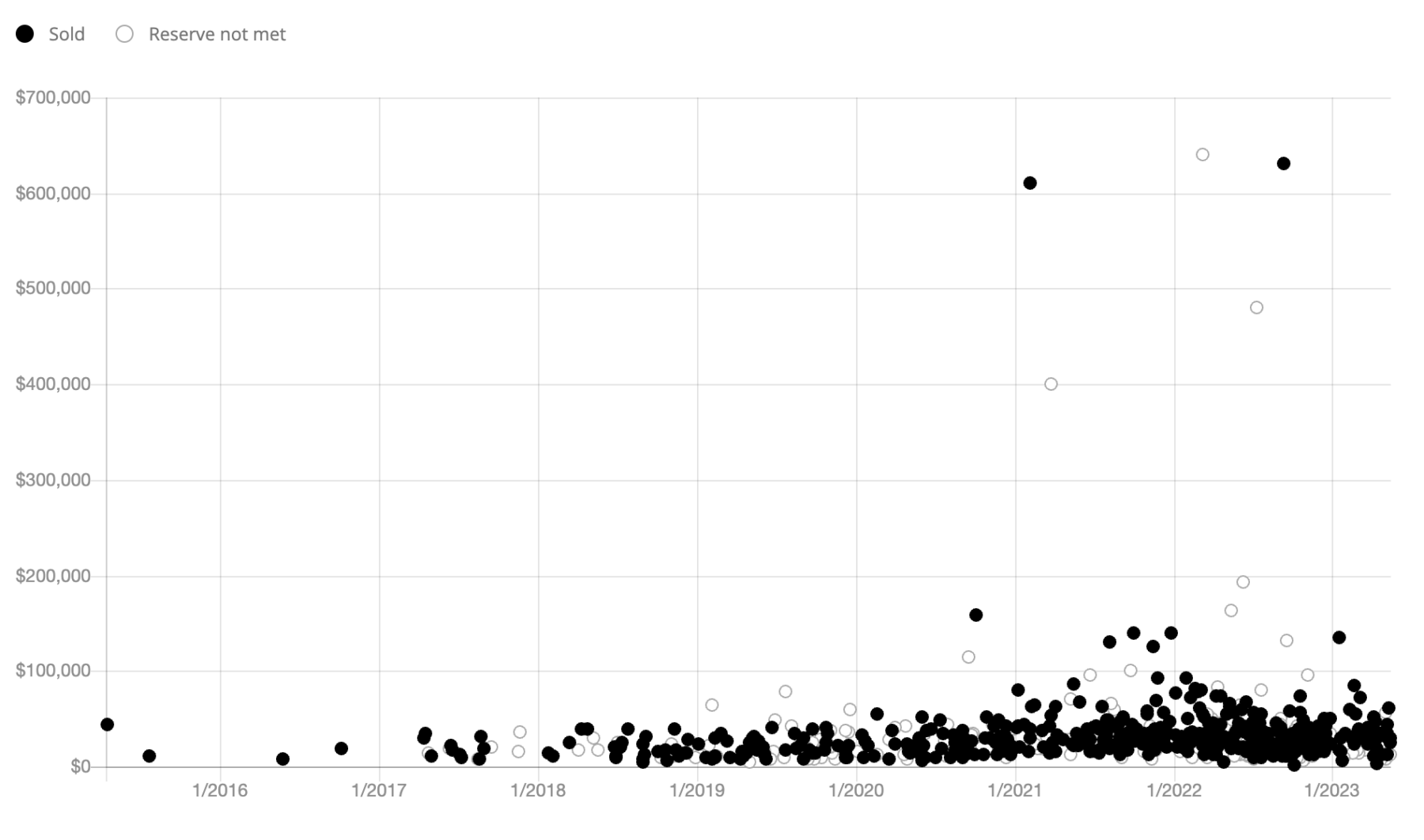

Fintech companies raised $1.9 billion in enterprise funding within the first quarter, a 38% decline from the fourth quarter that “indicators deepening investor warning towards B2C fashions,” in response to a latest PitchBook report. Roughly three-quarters of all of the enterprise capital raised within the quarter went to firms within the enterprise fintech area, PitchBook mentioned.

“The sector continues to be in nuclear winter” because it faces a hangover from 2021-era startups that “raised approach an excessive amount of cash and had zero progress and wrecked it for everyone else,” Chan mentioned. “That is nice with me, I like nuclear-winter sectors.”