Funtay

Permian Resources (NYSE:PR) doesn’t expect to make any more very large deals around the scale of its Earthstone acquisition for a while, but it has continued to be active doing smaller transactions. Permian recently announced that it made a couple acquisitions at a combined price of $175 million, while also engaging in acreage trades and making grassroots transactions to add 20 or 30 net acres at a time.

Weaker commodity prices have reduced my estimate of Permian’s 2024 free cash flow to under $1.3 billion now, nearly $400 million less than when I looked at it in October. This trims my estimate of Permian’s value to $15.50 per share at long-term $75 WTI oil and $3.75 Henry Hub gas. As Permian’s share price has gone down over 12% since I looked at it in October, I now consider Permian to be a decent value at its current share price.

Notes On Acquisitions

Permian mentioned that it may take a pause from large-scale private deals for now. It mentioned during its Q3 2023 earnings call that it had looked at a lot of large-scale deals in 2023, but didn’t find anything other than the Earthstone acquisition that met its criteria.

However, Permian is focusing more on smaller acquisitions that it believes provide a high rate of return. In Q3 2023, Permian completed 20 of these small grassroots working interest and leasing transactions, adding approximately 740 net Delaware Basin acres. In Q4 2023, Permian said that it made over 35 more grassroots working interest and leasing acquisitions, adding approximately 500 net acres.

Permian has also continued to be active with transactions that are more sizable than the grassroots acquisitions, but are still relatively minor for a $10+ billion company. It announced two transactions that added a combined 11,500 net leasehold acres and 4,000 net royalty acres for $175 million. Permian also noted that the price per net leasehold acre was approximately $10,000 after adjusting for production value. This suggests that current production from the acquired assets is around 1,250 to 1,500 BOEPD. The acquired assets also added over 100 gross operated locations in Eddy County.

Permian also disclosed that Earthstone’s $67 million divestiture of its Eagle Ford assets was completed in Q4 2023, after Permian’s acquisition of Earthstone was completed. These assets include approximately 1,000 BOEPD in current production. Earthstone had previously disclosed that Q3 2023 production from these assets was around 1,160 BOEPD (83% oil).

Finally, Permian announced that it executed an acreage trade in Q1 2024 that gave it 2,000 net acres in Lea County, adding to its operated inventory. It traded 2,000 net acres that involved lower working interest operated acreage or non-operated acreage. This gives it more inventory that it intends to develop in 2024 in exchange for inventory that it wasn’t expecting to develop in the near-term.

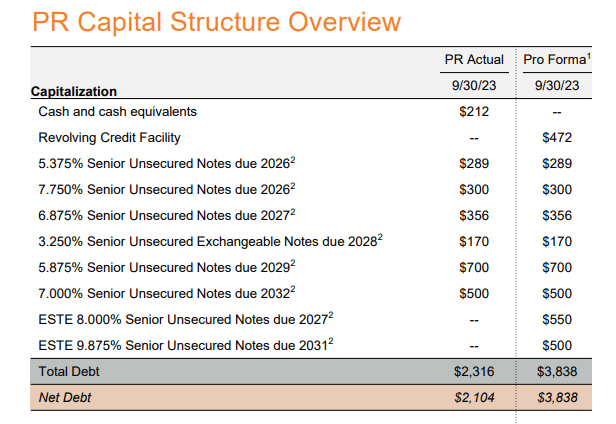

Permian’s Debt Structure

Here’s a look at Permian’s debt at the end of Q3 2023, proforma for the closing of its Earthstone acquisition. Subsequently (in December 2023), Permian issued another $500 million in 7.0% unsecured notes due 2032 at 99.5% of par.

Permian’s Capital Structure (permianres.com (Q3 2023 Earnings Presentation))

Proforma for this note offering, Permian would have zero credit facility debt (net of cash on hand) and $3.865 billion in outstanding notes. The next note maturity is in 2026 and Permian indicated that approximately $2.2 billion of its outstanding notes are callable during 2024.

All of Permian’s notes except its 2028, 2031 and 2032 notes are callable during 2024. The 2031 notes (Earthstone) are callable starting in 2026, while the 2032 notes are callable starting in 2027. The 2028 exchangeable notes have an exchange price that is around half of Permian’s current share price, so those notes are likely to be converted into shares rather than redeemed for cash.

The interest rates on most of Permian’s notes (other than the 2031 notes) are relatively reasonable though, so there’s no hurry to redeem them.

Permian’s Potential 2024 Outlook

I have updated my model for Permian’s 2024 results to reflect the current strip of approximately $73 to $74 WTI oil and $2.50 Henry Hub gas.

I am modeling Permian’s 2024 production at 315,000 BOEPD (47% oil) currently, although Permian will provide its actual 2024 guidance in late February.

At 2024 strip prices, Permian is projected to generate $4.959 billion in revenues inclusive of hedges.

| Type | Units | $/Unit | $ Million |

| Oil (Barrels) | 54,038,250 | $72.00 | $3,891 |

| NGLs (Barrels) | 27,594,000 | $24.00 | $662 |

| Natural Gas [MCF] | 200,056,500 | $1.85 | $370 |

| Hedge Value | $36 | ||

| Total Revenue | $4,959 |

This leads to a projection that Permian can generate $1.292 billion in free cash flow (before cash income taxes) in 2024 at current strip prices while increasing production by low-single digits from its proforma Q3 2023 production, including a full quarter’s worth of contributions from the Novo assets.

| Expenses | $ Million |

| Lease Operating, Cash G&A and GP&T | $943 |

| Production Taxes | $394 |

| Cash Interest | $280 |

| Capital Expenditures | $2,050 |

| Total Expenses | $3,667 |

Permian’s official 2024 plans may differ from my model, but I believe this to be a reasonable estimate of what Permian will do in 2024.

Notes On Valuation

At long-term (after 2024) $75 WTI oil and $3.75 Henry Hub gas, I now value Permian at approximately $15.50 per share. This is a slight decrease from my previous $16 per share estimate of Permian’s value. This reflects the lower 2024 free cash flow estimates for Permian, as both oil and gas prices have trended downwards since October.

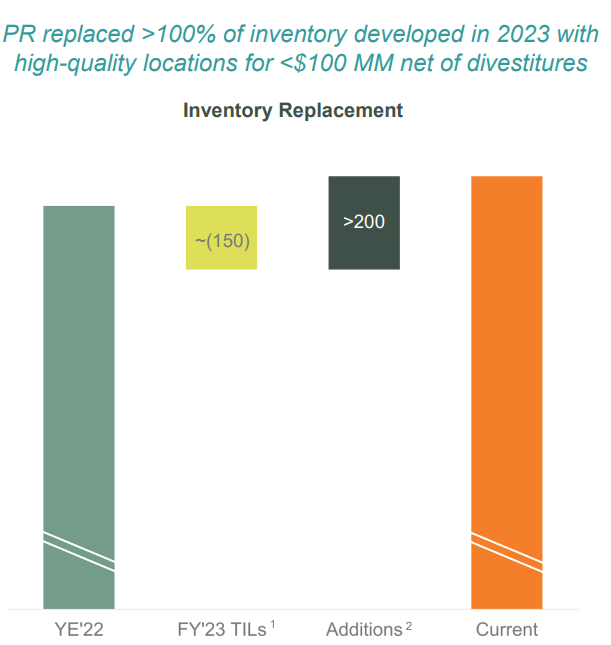

Permian’s Inventory Replacement (permianres.com (Portfolio Optimization Update))

Permian has also been successful in replenishing its inventory at reasonable costs. Permian notes that its grassroots acquisitions and recent $175 million in larger acquisitions have more than replaced the inventory it developed in 2023. Continued efforts in this area may help improve Permian’s value a bit.

Conclusion

Permian Resources is now projected to generate a bit under $1.3 billion in free cash flow in 2024 at current strip prices. This is close to $400 million less than what I had projected for it in October, reflecting weakening strip prices for 2024. As a result, I have trimmed Permian’s estimated value to $15.50 per share. This is still close to 20% more than Permian’s current share price though.

Permian has continued to be active with smaller acquisitions, allowing it to more than replace the inventory that it developed in 2023. This is helpful in maintaining Permian’s longer-term value and capital efficiency.