Pgiam/iStock via Getty Images

Perella Weinberg (NASDAQ:PWP) is one of many of the public advisors that we follow. We note this quarter that compensation expense ratios, comp ratios for short, have gone steadily up. Also, contrary to the assumptions we made in our last Q2 article where we got the headcount figures wrong based on assumptions from statements made on the call, the overall senior headcount wasn’t actually rising, which means contrary to our previous thinking underlying comp expense may come down unless the coming year ends up being great and bonuses are paid. In addition to decent quarterly performance with greenshoots in M&A sprouting, we think that turnover has elevated comp ratios temporarily, and that they are not settled at these higher levels. Run-rates should be in line with last year, and senior banker productivity should start to meaningfully rise soon. PWP is still earlier on in its journey, and we think that the valuation differential that results from that is an opportunity. On the other hand from a trading perspective, we also feel that pricing in line with 2021 levels is premature.

Earnings

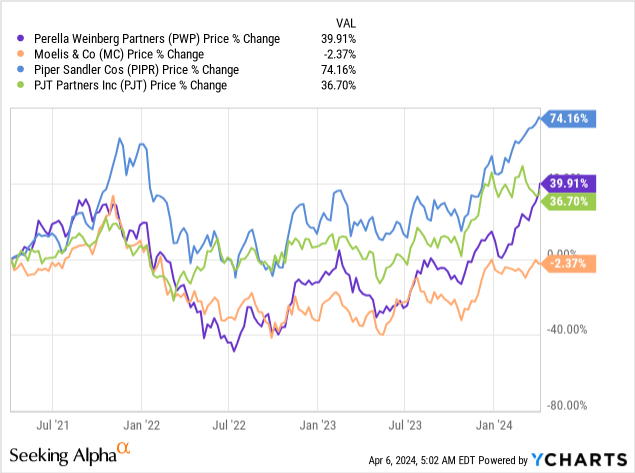

The company saw strong growth in the Q4 at 16% YoY, with overall FY revenues up 3%. That’s quite good, and in line with some of the other companies in our coverage in advisory. Both Moelis (MC) and Piper Sandler’s (PIPR) advisory business had these sorts of numbers in Q4. They demonstrated that some greenshoots are sprouting, even though deal timelines are permanently longer, and some of the performance now might just be a maturing backlog in this quarter after markets digested the slowdown in M&A activity.

In general, PWP has been bucking trends, particularly last year, on account primarily of its European franchise and its strong restructuring platform. However, the company is explicit that the pickup in activity is being driven by M&A, and while there have been some important restructuring mandates including in crypto, regular advisory is still the main driver with no huge restructuring boom yet. Private credit does seem to be a secular growth area on account of drypowder and also the tougher financing conditions.

We have some comments though on the cost side.

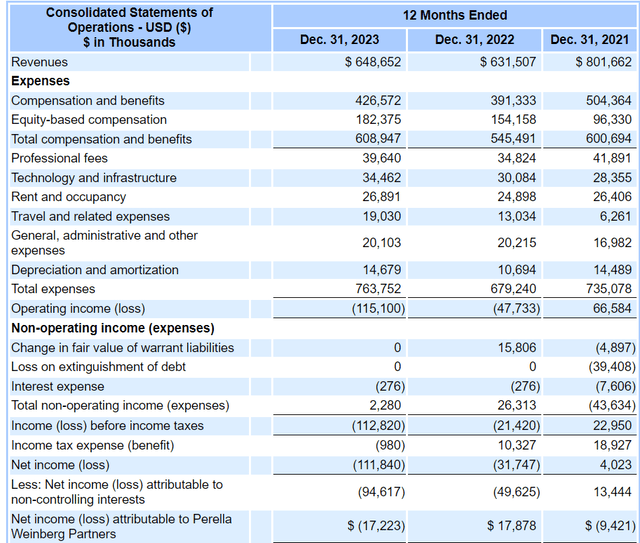

IS (10-K)

Revenues are up even for the FY despite the decline in general dealmaking activity of around 30%. Yet compensation ratios have come up quite a bit from last year despite limited sequential revenue growth.

In general, we are quite puzzled by the headcount dynamics. Comparing the 10-Ks and senior banker headcounts we see that the MD + Partner headcounts haven’t actually changed much between this year and last. Headcounts actually fell by 2 on the MD side. We were surprised by this since in the last coverage we did the company was highlighting that it made major waves of internal promotions to MD and partner. But the overall headcounts hadn’t changed which means there was a lot of turnover, probably of around 10-14% of the senior banker rank, based on around 14 new additions that were highlighted in the Q2 call. This also means that the average productivity of the MDs at PWP is higher than we thought, higher than averages one might expect from the industry even in a difficult market.

This has implications for the earnings. Growth in comp expenses were not commensurate with revenue growth, but that might be because of all sorts of signing on pay and severance pay associated with meaningful senior turnover. Some of this growth is not a permanent settling of comp expenses at higher levels, but will be somewhat transitory as the company repositions its talent. We think given similar sales to last year, similar profits to last year is entirely feasible as well, since all the inflation was in the comp line.

Bottom Line

That net earnings should be at higher baseline margins absent turnover frictions is a good start for the company which runs unprofitably as of now. If you also annualise the growth we’ve seen this Q4 for the next twelve months, we end up with a pretty solid EBIT line of around $100 million for 2024. No comp expense growth was assumed in line with 16% annualised growth, which is optimistic. PEs aren’t crazy on that crude estimate at around 18x, but it is above the 14.5x PE median on forward figures from Seeking Alpha. Considering two assumptions needed to be made to get there it’s not a superb figure.

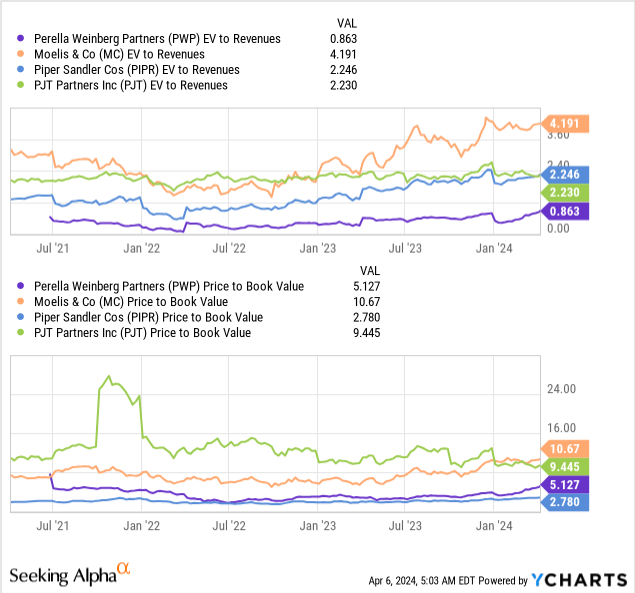

On the other hand on a P/B and EV/Revenue basis PWP looks much more attractive. It has also bought back significant number of shares at lows, which leverages it to a recovery a little bit.

But it trades at above 2021 levels despite clearly slower deal turnover times and also a market that at best has recovered to 2021 levels if you annualise current growth for the whole of 2024.

PWP is a more recently listed company. They are a very productive boutique and they have a stellar reputation. Their franchises are strong across Europe and the US, and they’ve been able to demonstrate idiosyncratic growth even in tough times, with a relatively resilient performance between 2021 and 2022 compared to some other players. In addition to general rebound in the M&A markets, even if it doesn’t quite come back to 2021 levels, new MDs and partners are likely not to be fully ramped yet in terms of learning economies either. On a valuation basis, being a little younger to the markets means that they likely have more of a ways to grow, and can probably pull off comparable margins to peers. Therefore, on a P/B and EV/Revenue basis the company looks alright in terms of value. Although we aren’t sure about the pricing at 2021 levels already. Things still would need to improve to approach that sort of environment again, and there are still outstanding questions about the economy. We wouldn’t want to give chase here.