xavierarnau/E+ via Getty Images

In my view, Perdoceo Education Corporation (NASDAQ:PRDO) offers a reasonable upside from current levels. The stock price has room to improve as the company undergoes a significant business model transformation. In addition, the valuation appears to back up my thesis. Let me walk you through this potential opportunity.

Company Overview

Perdoceo Education Corporation offers educational services through for-profit online teaching. Perdoceo provides degrees from Associate to Doctorate level as well as professional courses. Through its two accredited institutions, Colorado Technical University (CTU) and The American InterContinental University System (AIUS), the company offers a range of degrees, mainly focusing on Business Studies, IT, and Health Education.

Industry and Business Analysis

First, I will depict some basic numbers about the company’s students and industry, before diving into the fundamentals. Importantly, based on its enrollments, we know that 68% of students are over 30, while 76% are in Business Studies and around 68% did so at the Bachelor level. All the above data depicts what kind of consumer the company is servicing, and how it can affect its market presence expansion.

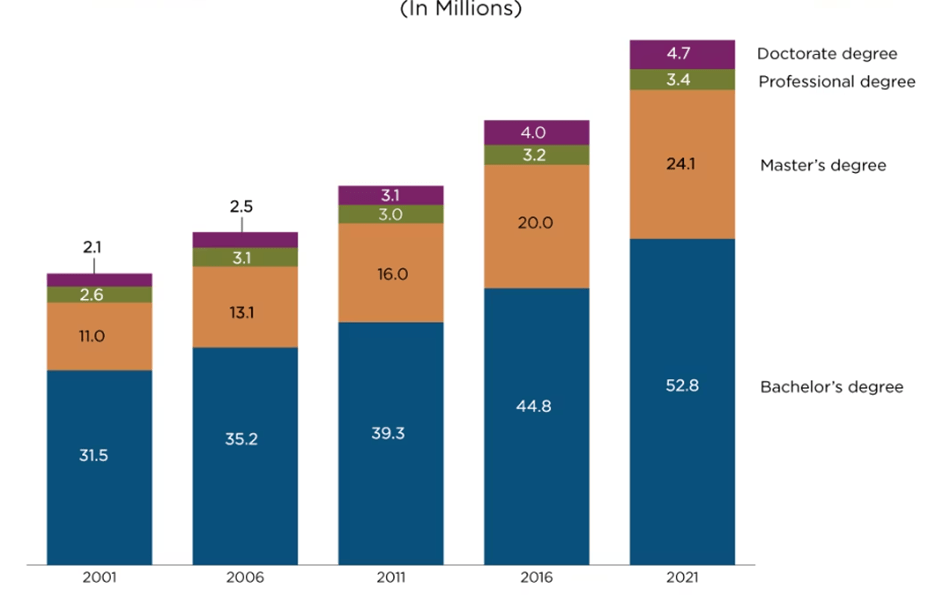

When diving into the education-student data in the US, I found some encouraging trends. According to census.gov, at the end of 2021, around 62.2% of the population 25 and older had an Associate’s degree as its highest level of school completed – in other words, only 38% got a bachelor’s or higher. Fortunately, that is changing, as depicted in the figure below, and that trend will continue to rise, as many states have pledged to attain 60% of working adults with a college degree. Importantly, according to the latest 10-K, in the US there were 25.3 million students enrolled in a university degree by the end of 2021.

Degree statistics ( https://www.census.gov/library/visualizations/2022/comm/a-higher-degree.html)

While the online trend has helped accessibility in education, a trend that PRDO has taken advantage of, the costs remain there. Since Bachelor’s degrees are the most popular among Perdoceo’s students and Business Studies remain the top category, I will take a BSBA as the base case. This will help us comprehend the following breakdown and comparison vs other institutions. At CTU and AIUS, the overall cost of the online program costs around $62,100 or $340 per credit hour charged every quarter. While according to US News, the average online credit hour price rounds $333, this also accounts for public schools, and these schools while historically cheaper charge out-of-state fees. PRDO’s rates also come up cheaper than other for-profit education organizations as shown later.

Continuing with the business education assumption, the rankings provided by Niche.com give 117 for CTU and 380 for AIUS out of 1243 for the best colleges for business in America. Knowing these two colleges have recently entered the online scope is not bad for the price. As for individual survey reviews, while mixed, I found that both colleges get a 3.3-3.8 out of 5 stars score for the most part. I believe the company is doing a fair job at the educational level, while the industry trends seem favorable.

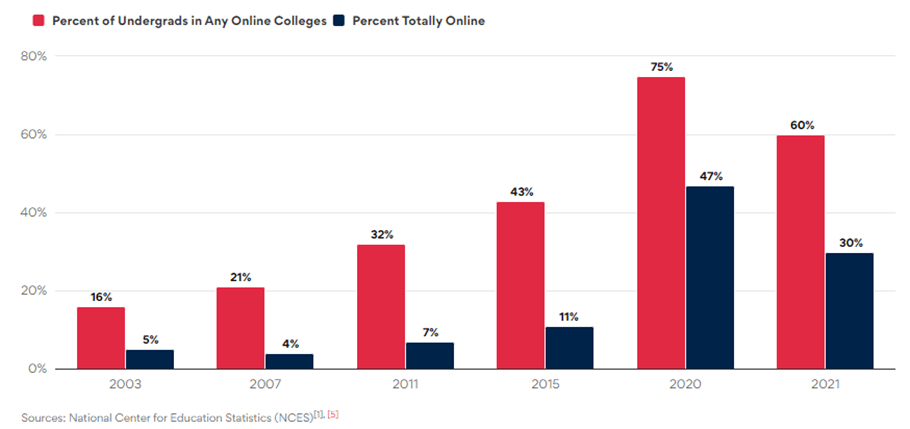

The education business has been turning its focus to online education. I will be leaving the massive open online courses (MOOC) industry aside, namely Coursera, Udemy, and the sort, as these companies do not focus on accredited degree programs. Online education courses have taken a step forward, and for-profit organizations seem to be leading the race. According to the latest data from National Center for Education Statistics (NCES), in 2021 colleges enrolled about 5.6 million fully online students – 450,000, roughly 8% of total online students, entered the for-profit college category. Looking back in time, I find the trend posted by NCES to be positive, fueled by the % spike during the pandemic year.

Online education progress (NCES)

Adding some color to the sub-industry, for-profit institutions had 649,000 fully online students enrolled at the end of 2021. During that year, CTU and AIUS enrolled 40,400 students, which results in approximately a 6% market share by that standard. Importantly, US News reported that CTU and AIUS are the 3rd and 4th largest online institutions by student count – only behind Liberty University (LU) (115,000) and Arizona State (ASU) (62,551).

Financial Analysis

Diving into some financial figures, the financial analysis will turn out positive. I will use the latest 5-6 year period for the main part of the financial analysis. This is due to the change of strategy implemented by the company to switch towards an online model for its education services. Before that, the company run various portfolios of in-person campuses and had less presence in the online education industry.

As a result, it is helpful to note that the new approach is to run an asset-lite business model with low Capex. The latest Capex figure has not surpassed the $13M threshold over the last five fiscal years, and management expects that number to be roughly 1-2% of revenues in the future. All of it while PPE remains a small portion of its balance sheet, currently at $50 million, and has never been over $76 million during the same period.

Over the last five years, its Cash and ST Investments position has increased from $228M to $510M, primarily due to internal cash generation from operations. Notably, cash flow from operations (CFO) during the last three fiscal years (2020-22) was $179 million, $191 million, and $148 million respectively, thanks to a healthy net income origination. As of 1Q23, current assets amount to $585 million, for a current ratio of 4.3x and comparably almost ⅔ of its market cap. Besides a change from cash to ST investments in the last year of $229 million, the management team has started a conservative roll-up strategy.

Talking about long-term debt, the company has a long history of low leverage. During the last 15 fiscal years, the company has not relied upon leverage to fund operations. Additionally, current assets have historically been at least 1.0x times over total liabilities – and the current ratio has never been lower than 1.5x times. Consequently, the management team has built the flexibility to support organic growth initiatives, such as technology upgrades while looking for M&A opportunities in the market.

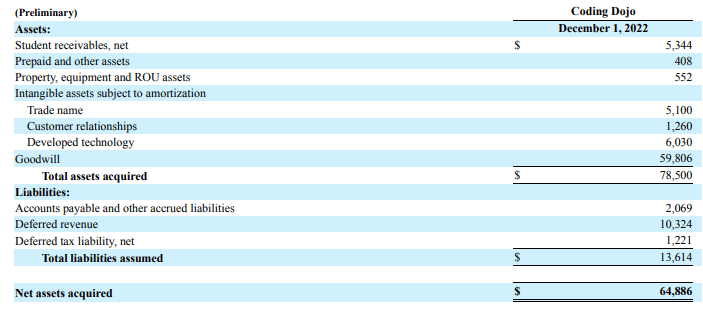

The company completed two acquisitions in 2022, namely CalSouthern and Coding Dojo. These two acquisitions are to be paid in cash for $84 million. As a result, Goodwill has increased to $243 million, up from $162 million on a YoY basis. Coding Dojo was purchased for almost $65 million, and it is now reported under the CTU segment of the company. Coding Dojo reportedly had $35 million in revenues for 2022 – which implies a purchase price of less than 2x EV/Rev. Following the breakdown of the acquisition given by the company, note that goodwill is a reflection of the revenue growth opportunities as outlined in the latest 10-Q.

Coding Dojo acquisition breakdown (PRDO’s 10-Q)

The Coding Dojo acquisition was a strategic move looking to expand its educational offerings in the computer science and technology areas. Coding Dojo also offers a technology platform that enables online learning, a move towards a more diverse content offering by PRDO. Importantly, the platform has an average rating of 4.4 stars – according to coursereport.com, adding some quality content to the course offerings. On the other hand, the CalSouthern acquisition will report earnings under the AIUS segment, while the institution mainly offers educational courses in behavioral sciences and business management.

Now let’s turn the page to the profitability side of the business. The management team, while being conservative in its funding and operations, is also really focused on achieving healthy bottom-line margins. Again, this comes as a result of strong student retention, and innovative marketing strategies, such as de corporate partnership program.

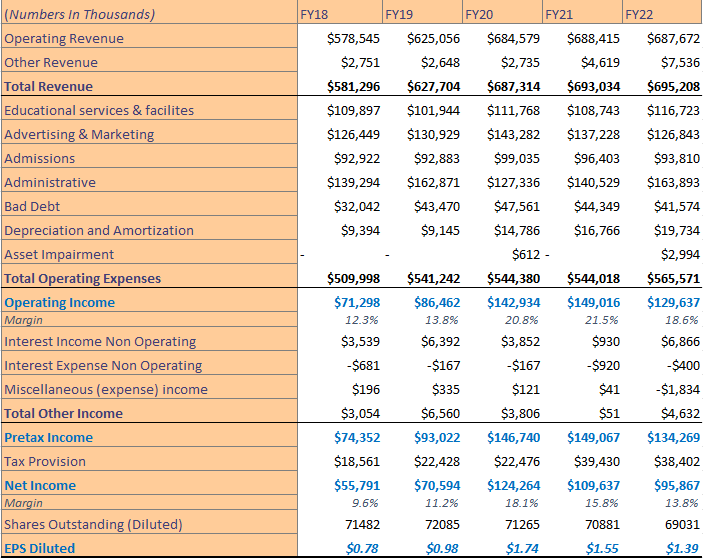

Starting from the top line, the overall improving trends in the for-profit online education industry paired with the individual strategy of the company, has resulted in revenue growth. As of FY18 total revenues reached $581 million, while the latest fiscal year number came at $695 million. Showcasing how the remote system and its advantages are here to stay. Moving forward, know that in nearly 1 of every 2 educational institutions, there will be budget increases for Online program development. Revenue in the Online Education market is expected to experience a 9.5% CAGR through 2027, Statista says. That accounts for MOOC learning and other more rapid segments in the industry, but it will be illustrative in our forecasts by the time I value the stock.

To follow, I will explore a little further in detail the company’s margins. Historically, the management team has used operating income as a proxy for profitability. Keep in mind the progress made between EBIT and Profit margins. Coming back to the latest 5-year period sample – see how the operating margin has improved from 12.3% in FY18 to 18.6% in the latest fiscal year. Similarly, the profit margin has climbed from 9.6% to 13.8% in the same period.

In the snapshot below, observe how the overall figures play over the sample period. After navigating through the ups and downs, the company has reached an improved level of profitability, managing even better operating efficiencies. The question remains whether these margins continue to expand supported by modest revenue growth.

5-year income statement results (PRDO’s 10-Ks)

Intuitively the company’s revenues come from direct student payments. Yet, education costs have increasingly become more unaffordable and adults are taking on debt to pay for it. While tuition and fees are the top sources of revenue, there should be an asterisk on those sources of cash. For instance, Corporate partnerships have worked well, at CTU and AIUS, 23.9% and 5.2% of total student enrollments come from such. Other funding sources come from Title IV Program funding, which by year-end 2022, it represented about 79% of all tuition cash receipts. However, the vital question is to know what percentage of that money is never collected due to bad debt.

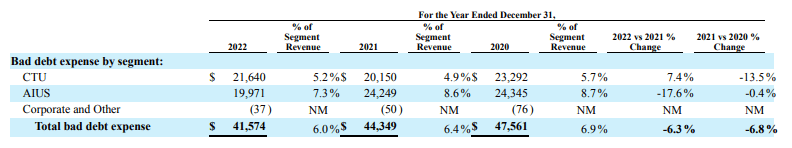

Below, there is a clear improvement in bad debt expense as % of revenues – primarily due to an improvement within the AIUS financial aid program. As of 1Q23, bad debt expense improved to 5.5% of revenues, helping to lower overall operating expenses.

Bad debt expense as % of revenue 3-year period (PRDO’s 10-K)

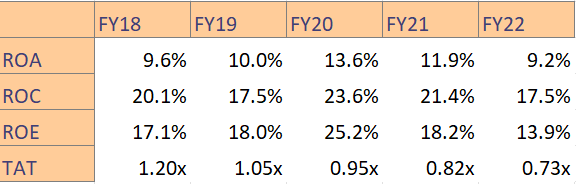

Conversely, these improvements have not translated into better ratios. In the table below, observe a glimpse of the mentioned ratios. For instance, ROC has not improved at the pace of the operating margin, partly due to the balance sheet expansion (assets have climbed from $482 million to $963 million in the 5 years). The roll-up strategy will need to support higher profitability to boost these ratios.

Profitability metrics (10-K and TIKR)

Peer Comps

The next question I will talk about is valuation and peer comparison. In short, how expensive is the stock compared to others? Well, here is the icing on the cake. Currently, the company trades at 2.70x times NTM EV/EBITDA – while the range over the last five years has been a high of 10.87x and a low of 1.46x and at 4.58x mean. By the forward P/E ratio, PRDO also looks like a bargain, currently trading at 7.41x times compared to a sector median of 15.74, per Seeking Alpha.

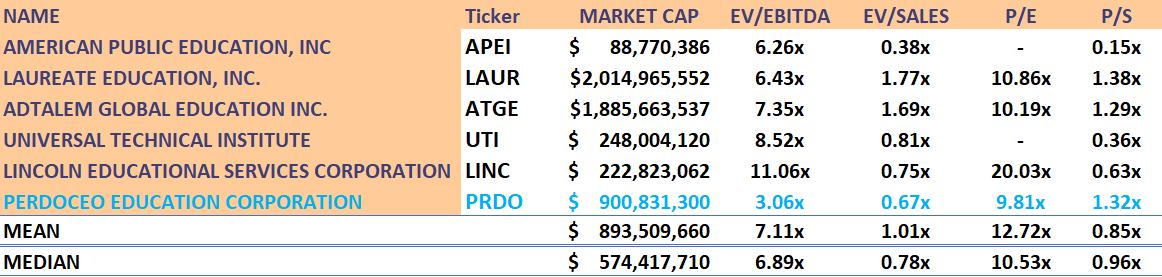

The peer group for the valuation segment has been selected to offer the closest business model comparison possible. Some online platforms such as Coursera or Udemy have been left out of the group as they mainly focus on MOOCs and are widely unprofitable. With that being said, the table below shows how Perdoceo’s valuation compares to peers. All the multiples are based on a NTM basis, for clarity. It does not take much time to realize that the shares seem inexpensive.

Peer group comparison (TIKR and Author’s Own Estimates)

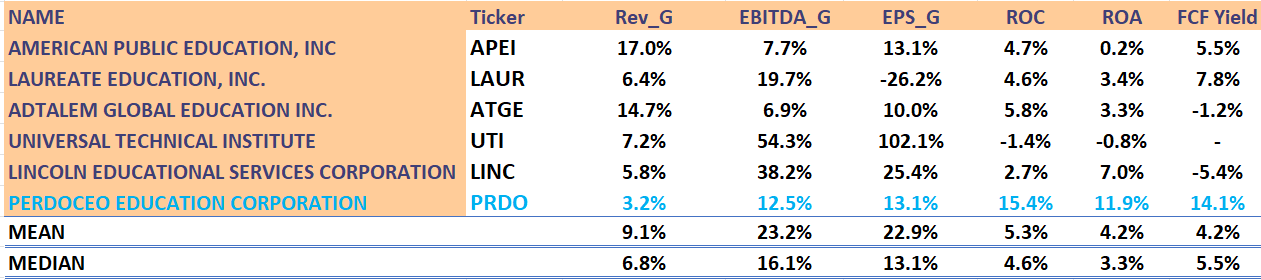

Some may intuitively attribute this cheap valuation to too low growth rates, however, I am not arguing about growth, rather I am making a value pitch. It is illustrative to see in the figure below how the company compares growth and profitability metrics, in particular FCF yield. Lower-than-median growth rates are in contrast with above-average profitability. So the question then becomes, is it profitable enough? Or is the growth not as robust as other companies to justify a multiple expansion? Well, to answer these questions I will walk you through a DCF model for more clarity.

Peer Group Comparison (Seeking Alpha and Author’s Own Estimates)

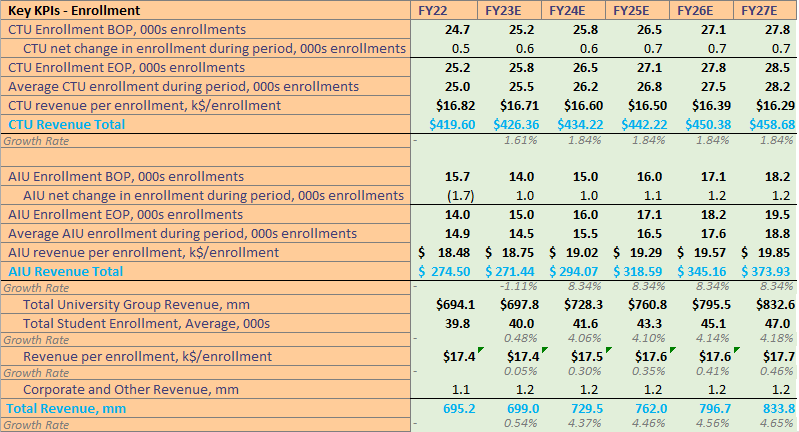

Dealing with a value story, I thought that coming up with a DCF model will be more explicative. The comps group, while illustrative, may not tell the whole story. As I have been arguing during the article, the company has been careful at taking care of operating costs, and over the last few years, the margin advancements have coupled well with the M&A. As part of our assumptions for the DCF model, I will take slightly improving margins – especially in the bad debt expense area and mild student enrollment growth due to new course offerings and acquisition tailwinds. In addition, some key KPIs, such as student enrollment and revenue per enrollment are depicted below for the next five-year period.

Model Forecasts (10-K and Author’s Own Estimates)

DCF Analysis

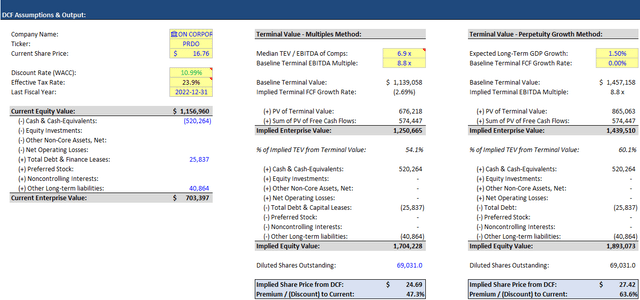

Finally, let me walk you through the DCF. In a conservative scenario, operating margins as defined by EBIT will be around 17% by 2027, down from 19% in 2023. Changes in NWC will be estimated to be the average of the past 15 years, or about -6% of the change in revenues on a YoY basis. Finally, Capex will be around 1.5% of revenues.

All in all, I believe that this is taking a conservative approach to our valuation. This can be seen in the WACC as I attributed a higher equity risk premium of 7% and a risk-free rate of 5.5% as the current yield curve is inverted. Finally, the median multiples are extracted from the peer group, and the shares are based on a diluted basis. Note I am not accounting for future share buybacks even though there is still $27 million available in the program.

Given the current cash and cash equivalents, long-term liabilities, and shares outstanding I arrive at two different prices by the multiples and the perpetuity method. The former arrives at $24.7 per share while the latter gives us a $27.4 target price. That is an average of $26 per share, or roughly 55% upside from current levels. Of course, a lot has to go well to reach those levels, and I am just providing the results of the DCF as explanatory – as I said the company’s value proposition may take time to materialize. However, I believe that directionally the stock has a lot of potential from current levels. For further color, see below the snapshot of the DCF model and key figures.

DCF Valuation (Author’s Own Estimates)

Risks

This all sounds good, however, the for-profit education industry has battled some ups and downs. Changes related to Title IV, the federal funds program, may adversely affect the company’s operations. As of last year’s end, about $511 million of the company’s revenue came from Title IV’s cash receipts. That could be serious if PRDO reaches the 90-10 (read more about the 90-10 rule) threshold level, which at the moment is far from reaching (currently around 73%). Further rulings regarding loan repayment and debt forgiveness have been also matters that the company is dealing with. In numbers, legal fees amounted to $14.5 million during the last fiscal year, fueled by responses to the DOE and acquisition efforts.

There could be more updates regarding the regulatory framework shortly. In any case, the company has proven to be on the right track when it comes to complying with these matters. Any subject changes could affect the company’s operations and student retention in particular.

Conclusion

In conclusion, there are a few key points to highlight for PRDO. First, the company has entered into a second phase of a business model transformation, that is, disposing of the in-person campuses to focus on online learning, while slowly addressing M&A opportunities. Notably, the margins are becoming better each quarter, due to better student funding management and cost efficiencies. The company’s profitability is best-in-class as compared to its peers, while the valuation remains cheap. Importantly, there is financial soundness to support organic and inorganic growth in the long term. The balance sheet is rock solid and the cash flow statements confirm a healthy business model. All of that results in a cheap stock, a sound business model, and industry tailwinds that position the company to do well if we have a long-term horizon. Overall, I like the value proposition and believe there is a reasonable upside from here.