PENN BOUGHT ARRACTIVE DEMOS TWICE. NIETHER BARSTOOL FOR ESPN TO DATE HAVEN’T PROVEN THAT ASSUMPTION.

Hirurg

- Penn Leisure (NASDAQ:PENN): Two key strikes wanted to show Mr. Market optimistic on the inventory once more

- Little query {that a} succession of questionable strikes has sunk the as soon as glowing prospects for Penn shares to a promote name by a number of analysts—together with me.

- My core bull place on the shares turned bearish on my appraisal of the brick and mortar administration savvy, having failed in two digital efforts—to this point.

- Penn’s energy has all the time been its smarts that drove its regional on line casino enterprise to management quantity and earnings.

Premise: My optimistic place on the inventory going again three years was constructed off execution of a wise, floor rooting blue-collar administration tradition. However Penn fell in love with digital when its technique from day one was to purchase, not develop, from scratch, a sports activities betting database. We noticed this from the Barstool purchase in 2020, ultimately costing the corporate $850m. The outcome was marginal. Barstool sports activities ebook generated a lower than 5% market share. Even a dream present demo (55m stoolies) encountered huge aggressive headwinds from, the 2 sector leaders, Flutter Leisure (FLUT) and DraftKings (DKNG).

Nicely behind the leaders, there have been one other 10 marginal platforms within the sector. On line casino operators MGM and Caesars had the assets to construct share by throwing cash on the enterprise. However neither has to this point come near a market share anyplace close to the highest two.

MGM partnered with UK big Entain and CZR purchased legacy platform each in brick and mortar sportsbooks and their very own 65m buyer database. But, every has but to penetrate the mixed 70% share of Flutter and Draft Kings. Each are nonetheless lingering in single determine/ low double determine shares regardless of aggressive advertising spend over 5 years.

Above: Commerce continues to fall under $20. A falling knife?

Stipulation: On June 27, I revealed an SA article based mostly on information from the Hollywood gossip web site, The Ankler. The piece handled the continuing controversy between Wall Road analysts. Many Hollywood executives resent the typically intrusive judgments of analysts on streaming administration.

The instance cited was the horrific name by 30-year veteran celebrity BofA’s Jessica Reif Ehrlich: Simply earlier than the ATT spinoff, she mentioned the deal had an 82% upside forward. It now trades at $19.26. She branded it the “worst name I’d ever made” and confessed to being “mortified” that so many individuals misplaced cash on her name.

I included myself among the many intrusive analysts. However I do declare a little bit of immunity from the critiques. In all of the items I write with recommendation to the streamers, an excessive amount of its POV springs from my 30 years as a senior government in lots of multi-billion greenback gaming and leisure corporations. My objective is all the time to spherical out traders’ information base in a inventory that makes an attempt to clarify how and why sure choices are made. The concept is to infuse a information monitor that will assist traders perceive the within of determination processes properly past what any customary metric will do.

The digital failure to this point

After a continuing tussle with Barstool’s Dave Portnoy over the annoying, if not painful intrusions of licensing officers, Snowden needed him gone. So Penn emptied the digital treasury of $500m, paying the maverick media mogul to only go away. The general digital invoice for Penn then grew to $850m.

With no lesson realized by the primary incorrect flip, Penn then moved to Disney’s ESPN, basically shopping for a advertising partnership for an additional $1.5b over ten years as a rebranded cloak for Penn’s sports activities betting platform. The model: ESPN Guess. It is early, however to this point, the brand new subscriber base is larger than the Barstool Sportsbook was (ESPN estimated 71m, down 20% during the last 5 years).

Dave Portnoy actually wasn’t the issue. Irritating sure. However the core drawback was extra optimism over the Barstool 55m database.

However outcomes to this point have but to maneuver Wall Road. When the Barstool deal was introduced in 2020, Penn traded at ~ $33. Information of the Penn purchase out final March noticed the inventory dip to $22.20. However since encouraging first week sign-ups, there was nothing within the ESPN Guess efficiency thrilling Mr. Market. Whereas the sector continues to develop at a CAGR 10.3% fee, the brand new model stays within the basement of sports activities betting platforms—that’s to this point.

There’s a lot time forward for the ESPN Guess to maneuver up in a sector with ebullient development, it’s true. However at this level, the 2 sports activities betting strikes by Penn have racked up a sunk funding now reaching towards $2 billion.

Primarily, flat Penn YoY income and earnings for its casinos recommend that the corporate could properly have misplaced its means within the eyes of traders. The dynamic of property acquisitions and enhancing earnings from its present casinos, which was a part of the rationale for sturdy optimistic sentiment on the inventory, seems gone.

Including to the digital uncertainties was a quantum leap within the Penn customer support requirements by instituting an ongoing check of a “contactless” course of for purchasers from examine in to take a look at. In different phrases, within the check properties now, a buyer arrives, is greeted by a welcoming video, checked in by screens, requested if assist with baggage is required, strikes to a room and utilizing the good cellphone can:

1. Set up a buyer rewards ID in order that play incomes factors could be calculated towards comps, scan or make all reservations for in property facilities, eating, spa, reveals and so on.

2. This digital service clearly eliminates tons of payroll in the long term—an early response to the specter of AI, in addition to price of labor.

However in my 35 years of expertise working on line casino advertising and associated operations, our precedence was based mostly on our assumption that everybody has a slot machine and a buffet. The important thing approach to differentiate one property from one other was to ship visibly higher private customer support. Survey after survey of shoppers proved this fact.

So whereas I preferred the daring, revolutionary check by Penn beating the inevitable to the punch, I feel the ultimate judgment of the check should still uncover a major buyer phase that prefers excessive contact private service. Total, Penn’s transfer to digitize the enterprise could also be untimely. To date, its ESPN Guess deal has misplaced practically $200m in 4 months. Add that to the prior failed Barstool deal and you’ve got $1b within the tank. Add that the ESPN deal has greater than 9 years to run with Disney at $150m per. When and if the rebranding advertising effort will flip worthwhile stays to be seen.

The Penn buying and selling historical past YTD remains to be not fairly

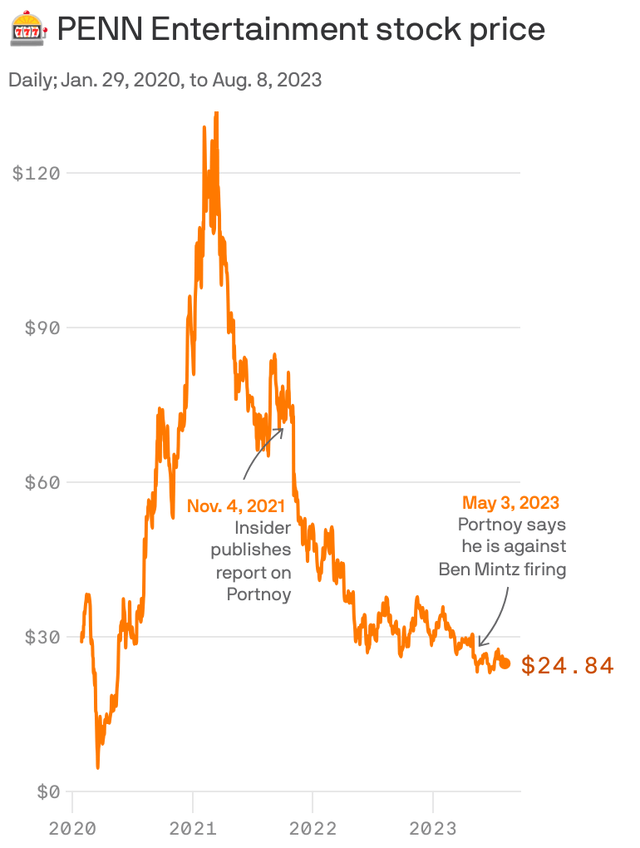

Think about the underperformance of its on line casino enterprise over a number of quarters, its fumbles on digital, the worth historical past shouldn’t stun traders. Only a few highlights and low lights.

Worth at writing: $19.28

June 2018: $33.59. (This can be a month after the SCOTUS determination).

All-time excessive: February 2021 (a submit covid restoration 12 months): $128

Inventory at Jan 2024:

Quick curiosity: 14+%, nearly two p.c above float, on the cusp of concern.

Worth at Jan 2024: $25.95

Ahead prospects

A on line casino inventory with 42 properties and a buyer rewards base within the space of 20m experiencing a plummeting of its share worth anyplace close to its March 2021 excessive ~$142% instructions our consideration. It’s price a glance to see if there’s any catalyst within the close to or intermediate time period that would begin the inventory climbing again at a tempo making it a BUY.

We see little to this point.

Financials intruding: Final February, S&P International downgraded Penn scores—B+.

Present ratio: 1.04

Leverage: 6.5X

Lengthy-term debt to 2/24: $7.1b

Downgrade solely attributable to anticipated losses in digital they imagine can run $$350m to $420m this 12 months in promotion of ESPN Guess.

So Penn inventory’s destiny in the intervening time is completely within the palms of its digital efficiency, not any exponential development in its casinos. Including the anticipated losses to this point to what SP International thinks it can lose in digital this 12 months, brings the grand sunk complete to over $2b.

The digital playing sector will present a wholesome development to 2023, however the basic enterprise mannequin remains to be flawed. That received’t change for ESPN Guess. It’s a low margin enterprise, requiring platforms to maintain development regardless of a necessity to scale back promotional spend. Additionally it is a low barrier to entry sector, already crowded with practically 15 platforms. And ESPN Guess is among the many late comers.

Our view now: For those who maintain at present costs bearing even a small revenue, promote to keep away from a falling knife situation, as continued losses in Penn digital will spell rising brief rates of interest. For those who see a attainable discount, take a cross for now. The inventory is nowhere close to the place some fundamentals recommend it’s price a purchase sign.

For those who maintain a small place, you may need to roll the cube for the following quarter to mirror a sector large spike in sports activities betting springing for the beginning of the NFL season.

A powerful surge of ESPN Guess past its weak begin may be a short-term maintain. A market share acquire to a excessive single digit quantity face to face with MGM or CZR might flip some sentiment optimistic. The Penn geography is deep into states with highly effective soccer fandom.

Penn was a inventory we have been strongly bullish on when it was turning out earnings and powerful income features from properties lengthy owned and not too long ago acquired. We noticed digital as a small, however future contributor to the group. We preferred administration’s ability units. However in time, we didn’t like its give up of treasury and administration focus to digital lengthy after it had confirmed a useless loser—not less than brief time period.

At this level, at finest, Penn is a watch record inventory.

On the on line casino aspect, Penn has fundamental energy in its geographic range, and properly run properties in extremely aggressive markets. However we don’t see extra properties being added this 12 months.