12MN/iStock by way of Getty Photographs

Peabody Vitality (NYSE:BTU) reported Q2 preliminary revenues of $1.31B-$1.34B. This was truly beneath the $1.41B analyst consensus estimate. Internet earnings amounted to $400M-$420M and adjusted EBITDA to $570M-$590M. That is lots of internet earnings and EBITDA on a $3 billion market cap in only one quarter.

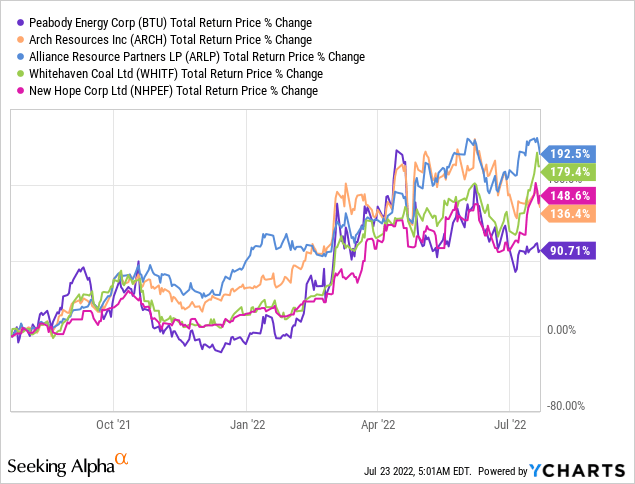

Peabody has lagged coal friends a bit over the previous 12 months. Traders appear apprehensive in regards to the money margin quantities the corporate must put up to cowl its hedges. As time goes on, the danger of margin calls on the hedging e book are reducing as Peabody has been in a position to deleverage and adapt to this new actuality of violently swinging margin necessities. Peabody ended Q2 with $544M of money margin posted whereas holding $1.12B in money and money equivalents. Lengthy-term debt is available in barely beneath $1.1 billion.

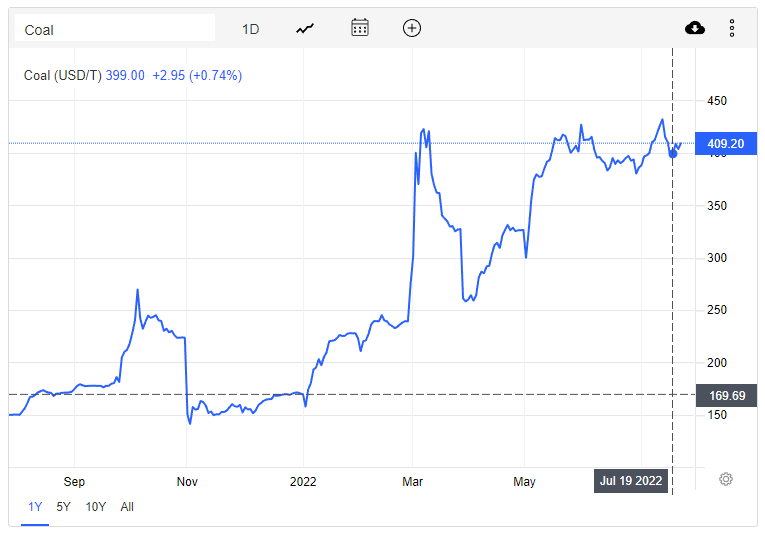

Earnings are very excessive as a result of coal costs are very excessive this 12 months:

coal value 2022 (Tradingeconomics.com)

In keeping with the IEA’s newest Electrical energy Market Report electrical energy demand progress is slowing in 2022. It’s slowing down from a robust post-Covid restoration in 2021. As a result of financial progress is weakening and power costs have been hovering after Russia’s invasion of Ukraine. The IEA expects 2.4% demand progress for 2022, roughly according to years earlier than Covid shocked the world.

Robust renewable progress is displacing some fossil gas capability. CO2 emissions by way of electrical energy era are more likely to fall from a 2021 excessive on a world degree in 2022.

Due to excessive gasoline costs (most notable in Europe, which is being tactically pressured on this entrance by Russia) coal spare capability has been introduced on-line. A number of European international locations delayed phase-outs of coal vegetation and/or have lifted coal import restrictions.

Chinese language demand has been considerably muted due to its rolling Covid lockdowns. This has resulted in a robust 2.6% contraction of Chinese language GDP in Q2. This coverage is unlikely to be continued eternally. Or, because the FT put it in a current editorial:

All of those facets of China’s malaise have been exacerbated by Beijing’s “dynamic zero-Covid” insurance policies, which have subjected cities to rolling lockdowns to attempt to include the virus. Nevertheless, the financial frailties that now characterise the Chinese language economic system are taking up a distinctly structural hue.

Covid ought to nonetheless be taken critically. However not by way of ultra-strict lockdowns. Beijing ought to speed up its vaccine programme, enable international mRNA vaccines to be administered on a nationwide scale and coax the various unvaccinated folks over 60 to get a jab. The time has come for Xi and his authorities to jettison its vaccine nationalism and acknowledge the efficacy of international merchandise.

There is a warfare raging in Europe, winter is arising, and the villain controls Europe’s gasoline provide. China is imposing rolling Covid lockdowns, which is curbing its economic system and, consequently, demand for commodities (together with power). Quite a lot of cyclicals, notably coal producers, commerce at multiples, suggesting costs are about to fall off a cliff and/or demand will disappear eternally.

On the availability facet of issues, coal is not a progress market. Financing has been pulled from the coal sector on a world scale within the years previous to 2022. ESG tendencies have made it probably the most hated industries to bankroll. The IEA sees some U.S. manufacturing progress in 2022 however none in 2023:

In 2023, we anticipate coal manufacturing to whole 594 MMst, about the identical as 2022. A lot of the lower in coal mine capability that has occurred since 2020 seems to be everlasting. Coal producers have skilled labor and capital shortages, which we anticipate will proceed to restrict coal provide within the forecast.

It appears impossible that these excessive coal costs will revert again to long-term averages within the brief to medium time period.

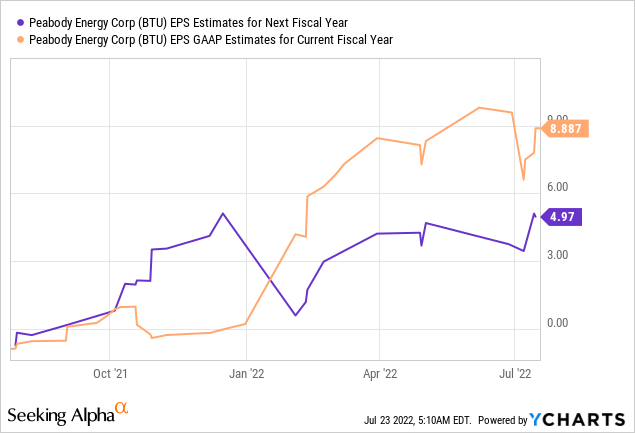

Analysts’ consensus is for $8.88 in EPS/share for this 12 months (which we’re midway by way of, and we all know coal costs are actually excessive). The consensus is for slightly below $5 in EPS/share for subsequent 12 months.

The $5 for subsequent 12 months is in fact fairly speculative. In apply, costs can fall in a short time if and once they do. For causes talked about earlier than, there ought to be one thing of a flooring underneath costs even when the extensively feared recession exhibits up in 2023. With a share value of $20 and practically $13 in anticipated earnings for this 12 months and subsequent, Peabody appears fairly purchase.

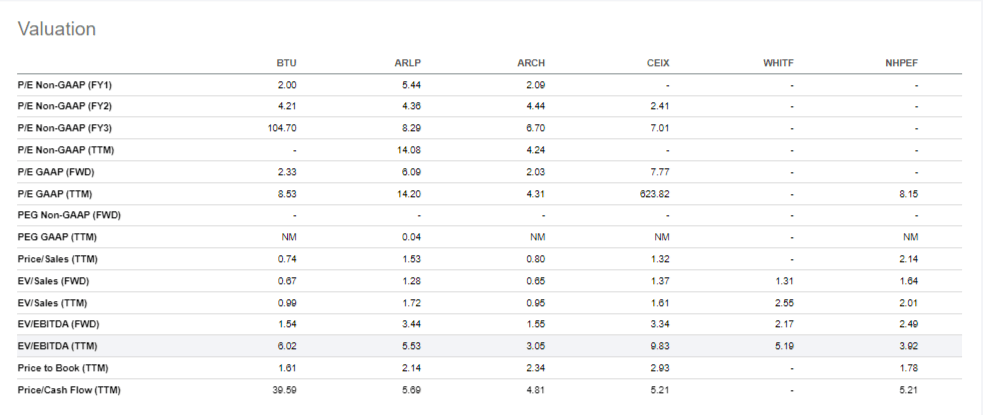

I pulled up valuations on Searching for Alpha for quite a lot of friends together with Alliance Useful resource Companions (ARLP), Arch Sources (ARCH) and Whitehaven Coal (OTCPK:WHITF) amongst others.

Coal business valuations (SeekingAlpha.com)

BTU trades on the decrease finish of the vary for this peer group. Specifically, it trades at 1.64x ahead EBITDA, 2.33x ahead P/E and 1.61x e book. These are useful metrics on this business, and BTU seems comparatively engaging. Typically talking, the valuations appear too low given the present profitability and outlook.

It’s useful to the profitability of the prevailing that there’s basically no long-term future for these firms. It’s a very speculative endeavor to make long-term investments on this business. Commodity industries are usually poor investments as a result of at any time when the going is nice, returns are pushed down by new investments in capability. The top of the coal business might lastly free it from that dynamic. Coal will seemingly disappear as a gas over the following decade(s), however these may probably be very worthwhile. In the meantime, the shares are priced as if it is sport over in ~2025.