We Are

PDD Holdings (NASDAQ:PDD), also called Pinduoduo, is a number one e-Commerce platform in China and one of many high three Chinese language e-Commerce firms, subsequent to Alibaba (BABA) and JD.com (JD), that dominate the market. PDD Holdings affords a wide range of e-Commerce and associated companies reminiscent of success and logistics and Pinduoduo owns the massively fashionable, deal-focused e-Commerce platform Temu. PDD Holdings is seeing robust tailwinds for its gross income and web revenue and producing a ton of free money circulate. Whereas not as low cost as both Alibaba or JD.com, PDD Holdings is well-positioned to ship sustainable progress for shareholders and improve its inventory buybacks sooner or later, making it a possible capital return play for buyers!

PDD Holdings is a China-based e-Commerce progress play

China has a inhabitants of 1.4B and the quantity of shoppers shopping for services and products on-line is rising quickly. PDD Holdings is well-positioned to profit from this progress as the corporate is closely centered on the Chinese language e-Commerce market. PDD Holdings owns Temu.com, a discount- and discovery-focused purchasing web site that caters primarily to retail patrons, however not solely in China. Temu caters to the purchasing wants of a global viewers and permits Chinese language producers to straight promote to their prospects. Temu was based in 2022 and competes straight with Alibaba’s Aliexpress. Temu affords {discount} offers for kitchen home equipment, garments, sneakers, jewellery and wonder merchandise in addition to each different class that involves thoughts. With its give attention to {discount} offers, PDD has gained a loyal following and is among the fastest-growing e-Commerce firms in China.

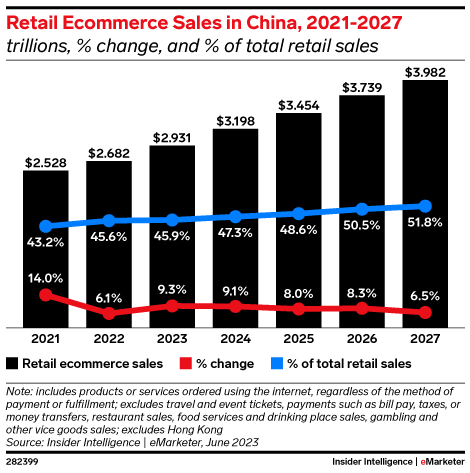

Clearly, with such a giant inhabitants, China is a strong play for e-Commerce progress buyers. In China, in keeping with eMarketer, the marketplace for retail e-Commerce gross sales is ready to develop 8% yearly over the subsequent 4 years which ought to present sustained tailwinds for gross revenue and EPS progress for PDD Holdings.

eMarketer

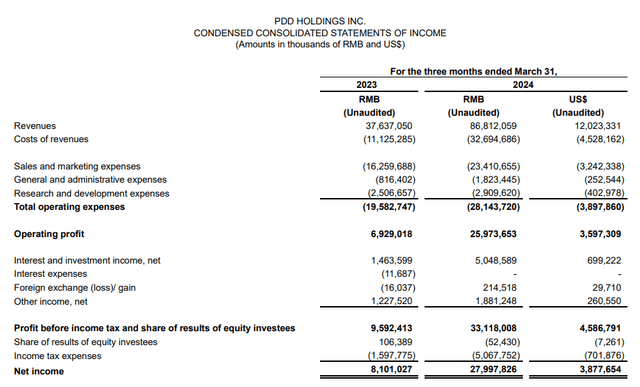

PDD Holdings generated 86.8B Chinese language Yuan ($12.0B) in revenues within the first fiscal quarter, exhibiting a 12 months over 12 months improve of 131%. Income from on-line advertising and marketing companies surged 56% 12 months over 12 months to 42.5B Chinese language Yuan ($5.9B) whereas transaction-related income reached 44.4B Chinese language Yuan ($6.1B), exhibiting a rise of 327% 12 months over 12 months.

PDD

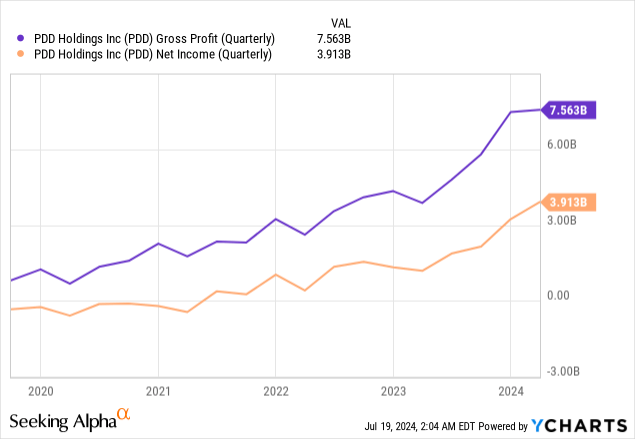

Pinduoduo’s give attention to {discount} offers has allowed the corporate to construct a loyal buyer base and the e-Commerce platform has achieved spectacular progress within the final a number of years. PDD Holdings’ gross and web income are each in a long run uptrend given the corporate’s continuous growth within the e-Commerce market, innovation and use of synthetic intelligence so as to optimize its discovery-based purchasing recommendations. The efficient use of synthetic intelligence, for instance within the context of buy suggestions and tailor-made purchasing feeds, might be conversions drivers for e-Commerce platforms going ahead.

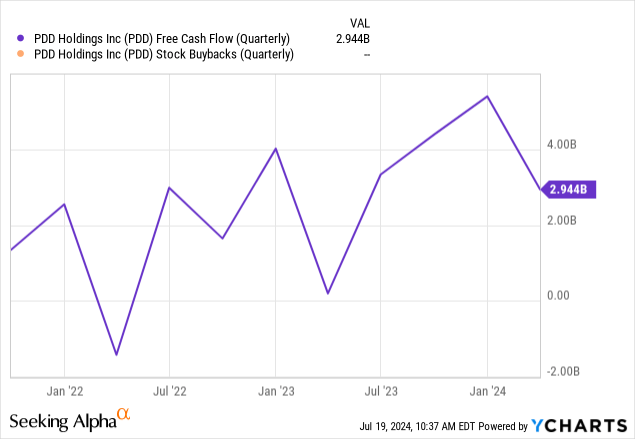

Free money circulate and capital return potential

Pinduoduo generates a number of extra money from its e-Commerce operations. A few of this money is invested in constructing giant language fashions which can help conversion initiatives on the corporate’s e-Commerce platforms. Nevertheless, Pinduoduo is just not actually shopping for again any shares which stands in distinction to Alibaba, for instance, which approved a $25B inventory buyback earlier this 12 months. Since Pinduoduo is already worthwhile when it comes to free money circulate, I can positively see the e-Commerce firm comply with into the footsteps of Alibaba and provoke inventory buybacks sooner or later, which, given the low P/E shares commerce at, can be an excellent use of money circulate.

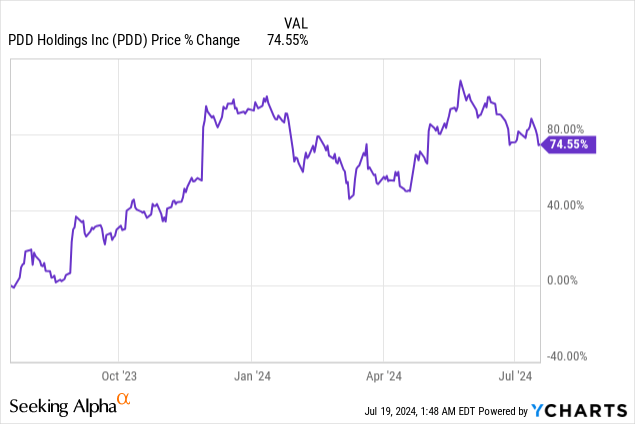

Valuation of PDD Holdings

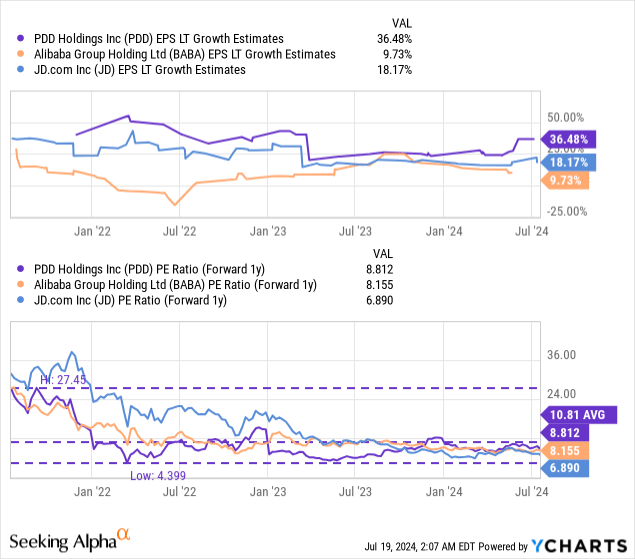

PDD and different Chinese language large-cap e-Commerce platform are low cost resulting from numerous elements together with structural points in China’s economic system and growing competitors within the e-Commerce market. China’s GDP solely grew 4.7% within the second-quarter, under expectations of 5.1%, resulting from slowing shopper spending and a troubled property sector that has suffered resulting from extreme hypothesis lately.

Moreover, U.S. buyers are scared to the touch Chinese language large-cap firms, largely as a result of Beijing has a historical past of involving itself in company affairs. Questions concerning the rule of legislation and company governance have overly negatively affected investor attitudes in direction of Chinese language firms.

Whereas these dangers usually are not completely unjustified, e-Commerce progress in China may be very low cost. China has the second-largest market by inhabitants dimension (after India) which clearly makes it a lovely long run e-Commerce progress play.

PDD Holdings is at the moment valued, regardless of a projected long run EPS progress price of 36%, at a P/E ratio of solely 8.8X… which is about 19% under the corporate’s long term valuation common. I imagine that Chinese language e-Commerce platforms may a minimum of commerce at 10X FY 2025 earnings given their progress potential and usually constructive gross revenue momentum.

A 10X P/E ratio is probably going a low estimate for PDD, given its stronger than common EPS progress. A 10X earnings multiplier additionally implies solely 14% upside revaluation potential and a good worth of $150. In the long run, I can see Pinduoduo revalue to a 12-13X P/E ratio — akin to what I imagine is affordable for Alibaba, additionally due to its robust free money circulate — which means a a lot greater honest worth of $180-195.

Dangers with PDD Holdings

The most important threat for PDD Holdings is a sluggish restoration in China’s economic system which can weigh on shopper spending and due to this fact on e-Commerce gross sales. This threat is partially offset by what I count on to be an aggressive roll-out of AI merchandise that might assist drive conversions and common order values. What would change my thoughts about Pinduoduo is that if the e-Commerce firm had been to see detrimental gross revenue momentum or declining free money circulate.

Remaining ideas

There are many issues to love about Pinduoduo, the proprietor of the extensively fashionable Temu e-Commerce web site. The corporate is producing very robust high line progress as its give attention to {discount} and discovery-based purchasing offers is paying off. Pinduoduo can be seeing constructive gross revenue momentum and will comply with into the footsteps of Alibaba which is extra closely centered now on returning free money circulate to shareholders, primarily by way of its inventory buyback plan. What I like most about Pinduoduo is that the e-Commerce firm’s shares commerce at an enormous {discount} to honest worth whereas PDD is anticipated to take care of appreciable EPS progress momentum going ahead. With a P/E ratio of 8.8X, inventory buybacks would additionally make a ton of sense!