izusek

We previously covered PayPal Holdings (NASDAQ:PYPL) in November 2023, discussing the pessimistic sentiments surrounding the declining Active Accounts and the impacted transaction margins from the dilutive Braintree segment.

However, we maintained our bullish stance surrounding PYPL’s prospects, with the bottom likely near, thanks to the refreshed management team and the stock’s moderating exponential curve.

In this article, we shall discuss how the PYPL stock’s pre-earning performance has exceeded expectations, with the management’s weak FY2024 guidance unfortunately reversing its upward momentum.

Despite so, we maintain our optimism surrounding its eventual turnabout, with the new management already introducing highly promising growth initiatives while laying off additional headcounts, with 2024 likely to bring forth top/ bottom line beats despite the prudent guidance.

The PYPL Investment Thesis Remains Robust, Thanks To The Management’s Growth Initiatives & Prudent Guidance

For now, PYPL continued to report a double beat FQ4’23 earnings call, with revenues of $8.03B (+8.2% QoQ/ +8.8% YoY) and adj EPS of $1.48 (+13.8% QoQ/ +19.3% YoY), building upon multiple beats over the past few years.

Most importantly, despite the market concerns for its declining total active accounts to 426M (-2M QoQ/ -9M YoY), the fintech’s total payment volume continues to grow to $409.83B (+5.7% QoQ/ +14.7% YoY).

These numbers indicate a sustained YoY acceleration observed since FQ2’23 and the growing stickiness of its platform amongst loyal users.

With PYPL’s FQ4’23 total active accounts and total payment volume already growing tremendously from FQ4’19 levels of 305M and $199B, respectively, we are not overly concerned about its temporarily impacted transaction margin of 45.8% (+0.4 points QoQ/ -3.9 YoY) compared to FQ4’19 levels of 53.8% (+0.4 points QoQ/ -0.9 YoY).

Most importantly, the new management already guided flat transaction margin dollars in FY2024, implying that their efforts to drive cost efficiencies and accelerate growth may bear fruit over the next few quarters, putting a stop in the decline of its profit margins.

As a result, PYPL investors only need to patiently wait out the transitionary period, with multiple layoffs already announced. In addition, the management introduced multiple new growth initiatives in the First Look Call on January 25, 2024:

- Fastlane by PayPal – Accelerated checkout process, projected to reduce completion time by as much as 50%. Early implementation by BigCommerce is already yielding increased conversion by +70%, with the global rollout likely to bring forth higher payment volumes.

- Smart Receipts – With 45% in open rate for PYPL’s e-mail receipts, merchants may entice customers to be repeat purchasers through AI-generated personalized recommendations and loyalty rewards on receipts.

- PayPal’s new Advanced Offers Platform on a new consumer app – offering shopping offers and rewards through personalized advertisements, thanks to the AI-generated recommendations.

- PayPal CashPass – PYPL’s new cashback offers from multiple top brands in the US, including: Uber (UBER), Walmart (WMT), Best Buy (BBY), McDonald’s (MCD), Ticketmaster, and eBay (EBAY), with no limit in cashbacks. Customers are also allowed to stack multiple cashback offers from merchants, PYPL, and payment partners, such as PayPal Cashback Mastercard (MA).

- Venmo Business Profiles – The integration of social media/ marketing outreach/ cashback offers on the digital wallet platform, with cashback directly stored in customer’s Venmo balance.

Therefore, anyone concerned about the supposedly weak FY2024 guidance may want to understand that it is more prudent for PYPL to set a lower bar and then beat those estimates over the next four quarters, especially since these growth initiatives are expected to be launched from Q1’24 onwards.

For now, the same competence has already been observed in its improving balance sheet, with growing net cash of $4.38B (+386.6% QoQ/ +873.3% YoY/ -24% from FY2019 levels of $5.8B).

This is on top of the excellent shareholder returns thus far, with 60M shares or the equivalent 5.5% of its float already retired over the last twelve months, and 90M / 8.3% since FY2019, respectively.

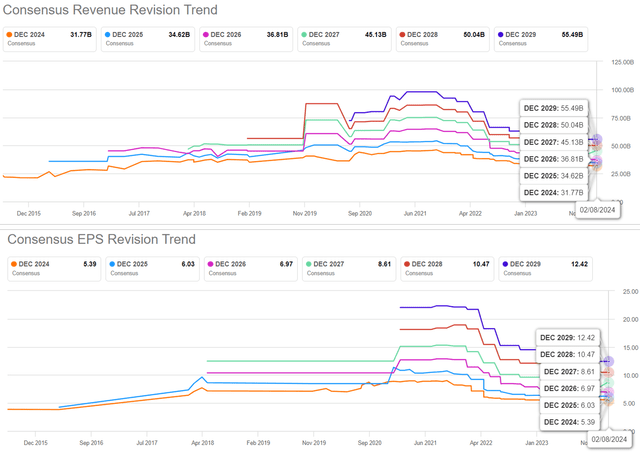

The Consensus Forward Estimates

Seeking Alpha

For now, the consensus remains bearish on PYPL’s prospects, with it expected to record a decelerating top/ bottom line growth at a CAGR of +7.4%/ +7.1% through FY2026, worsened by the management’s weak FY2024 guidance.

This is compared to the previous estimates of +13.4%/ +15.6% and the historical growth at a CAGR of +15.5%/ +19.1% between FY2016 and FY2023, respectively.

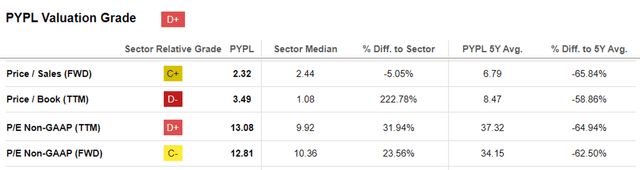

PYPL Valuations

Seeking Alpha

As a result of the consistent downgrades, we can understand why the market continues to discount PYPL’s FWD P/E valuations at 12.81x. This is compared to its direct peers, such as Block (SQ) at 35.38x, MA at 32.07x, Visa (V) at 28.18x, and SoFi (SOFI) at 57.13x.

However, readers must also note that the market has moderately upgraded PYPL’s FWD P/E valuations from the 9.42x recorded in the October 2023 bottom.

These numbers imply that the PYPL stock remains extremely undervalued especially when compared to its 3Y pre-pandemic mean of 32.28x, with it being an excellent value play candidate.

So, Is PYPL Stock A Buy, Sell, or Hold?

PYPL 1Y Stock Price

Trading View

Prior to the earnings call, PYPL has rapidly bounced from the October 2023 bottom, broke out of the 50/ 100/ 200 day moving averages, while appearing to retest the previous resistance levels of $60s. The +11.6% recovery has exceeded expectations indeed, despite it underperforming the SPY by +14.4% over the same time period.

Unfortunately, the weak guidance has also reversed its recent gains, with the stock’s upward momentum effectively halted and the previous support levels of $60s breached.

However, here is where we maintain our bullishness, with the new PYPL management determined to turn the ship around through drastic efforts and prudent guidance, as outlined above.

Combined with the consistent profitability and healthy balance sheet, we believe that the stock’s October 2023 bottom of $50 may hold, offering interested investors with the opportunity to add depending on their dollar cost averages.

With the selloff being overly done, we continue to rate PYPL as a Buy for patient investors, with the stock’s upward rerating a likely occurrence over the next few years.