Past performance is not a guarantee of future results.

Of course it isn’t. Things change. Especially if we’re referring to the past performance of a particular investment strategy, portfolio manager, mutual fund or individual stock.

But past performance of asset classes should be well understood. Especially the kind of past performance that’s taken place over longer stretches of time.

Stocks have been the best asset class in terms of outperforming inflation over the last century. We know this for certain. Over the last seventy years, stocks are undefeated versus inflation, but only over the longest time horizons. Stocks have outperformed inflation 100% of the time over all twenty year periods.

(follow me on Mastodon here, we’re building a new community free from the goblins and orcs who’ve polluted twitter to the point of dis-utility)

Can this past performance fail to show up in any future twenty year period? Of course it can. Never say never. Will stocks always be the best asset class versus inflation? Maybe not. Maybe bonds end up working better over the next two decades. Maybe cash. Maybe commodities or real estate or gold or CrackCoin or whatever else. We know anything is possible, which is why investing involves risk.

But when something has consistently worked over seven decades, without fail, regardless of all other conditions and variables, perhaps it’s best to take that risk rather than not. Even with the full acceptance of the Past Performance caveat. You can read more about inflation and find the chart above here at Goldman Sachs Asset Management with all related disclaimers.

How do stocks beat inflation? Allow me to oversimplify the story for the benefit of people who aren’t looking for a grad school-level dissertation the morning after Thanksgiving…

The stock market is valued on earnings (profits) and these earnings are reported in nominal terms. If Colgate sells you toothpaste for $2 in 2019 and then sells you that same tube of toothpaste three years later in 2022 for $4, the nominal revenue growth they are reporting to shareholders is 100%. Has Colgate’s cost to make, ship, market and sell that toothpaste gone higher? Yes. Is that cost higher by 100% thereby completely offsetting the revenue growth gain? Probably not. So revenue growth leads to earnings growth, even net of higher operating costs in an inflationary environment. This is how inflation actually helps companies grow their earnings up until a certain point where costs rise too much or demand destruction occurs.

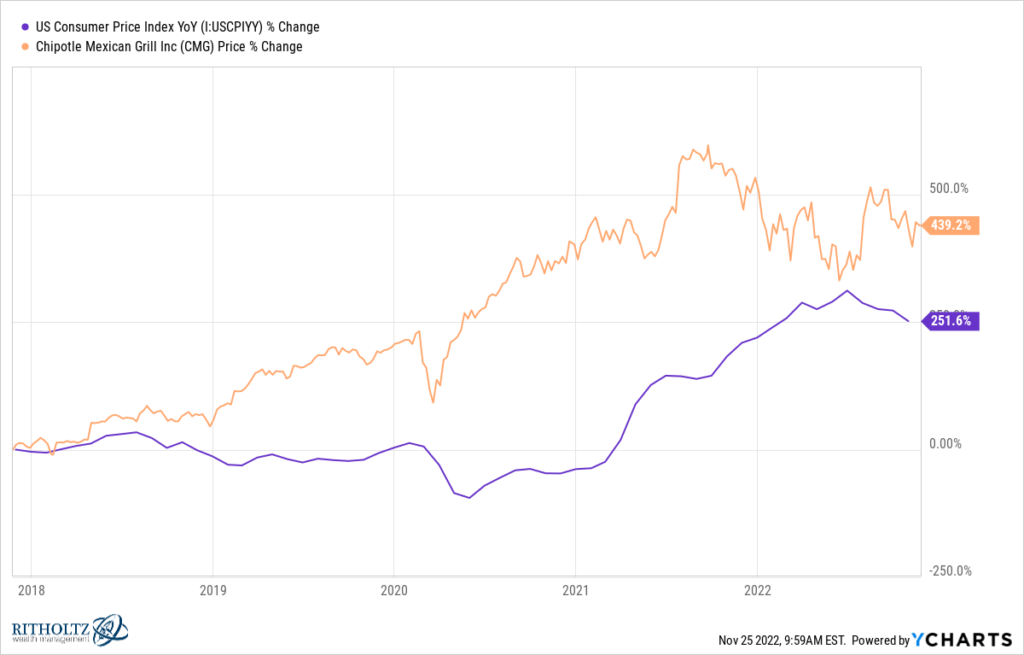

At Chipotle, the cost of a barbacoa burrito was $7.50 in 2017 and as of the end of 2021 it was $9.10. That’s a price increase of 21.33%. If Chipotle’s cost of making and selling that burrito only rose by 15% during that same period of time (I’m making this up, but bear with me), then Chipotle’s shareholders have benefited by increased earnings in both nominal and real terms. Chipotle’s net income was $176 million in 2017. It was $652 million last year. Inflation has risen but Chipotle’s ability to increase prices, open more stores, sell more burritos, etc has far outpaced it. A bar of gold could perhaps keep pace with inflation, but a burrito, properly prepared and marketed, can blow its doors off. Even if the burrito costs more to make each year.

I am conceding that the below may constitute one of history’s greatest chart crimes but I am posting it anyway – Chipotle’s stock price return versus year-over-year CPI inflation, over five years, blame YCharts for allowing me to create this atrocity:

In the current environment, companies are complaining about rising costs (especially labor) on every conference call, but they’re still getting by. Those costs are being passed along to consumers without much demand destruction (so far). This is why predictions of an earnings per share collapse for the S&P 500 have been wrong. S&P 500 companies are the most well-equipped companies in the world in terms of weathering higher costs. They eat higher costs for breakfast. Higher costs drive increases in innovation, which we are really f***ing good at in case you didn’t know.

At some point, persistently high inflation will hit demand harder than it already has. At some point, revenue growth and earnings growth will be much harder to come by as consumers push back or retrench. Tightening financial conditions will contribute to this pulling back. It’s a certainty – the only question is when and how high interest rates have to go for this to happen. The stock market knows this, hence the record volatility seen during the first nine months of this year.

But everybody knows this. The stock market has shed trillions in market capitalization already. It’s not news.

Meanwhile, there are stock charts pointing higher everywhere you look in today’s market. My friend JC at All Star Charts is saying “Fun Fact: The Dow Jones Industrial Average, after rallying over 5000 points since last month is already up 19.3% from its lows.”

Here’s his look at the S&P 500 and the percentage of S&P 500 stocks that are 20% up (or more) from this year’s lows.

The list is big and growing. If you can tear your eyes away from the profitless tech spectacle, you can see it everywhere. A hot CPI print in December could certainly negate this progress, but what if it doesn’t?

So yes, inflation is a reason to be wary of stock market volatility in the near term. But it is absolutely not a reason to not invest, so long as the road ahead is long and your time frame is measured in decades rather than weeks or months. In fact, inflation is all the more reason to continue to take the right risks, tuning out as much of the day to day bullsh*t as you possibly can.

Read also:

IS 3% THE NEW 2%? SIZING UP A SCENARIO OF HIGHER INFLATION TARGETS (GSAM)

Stocks in Bull Markets (All Star Charts)

Downtown Josh Brown (Mastodon)