Pgiam/iStock via Getty Images

Partners Group (OTCPK:PGPHF) is probably a little expensive. There is a high probability of AUM growth, which we are comfortable assuming given AM dynamics. PEs are not too bad, with the fixed fees being pretty reliable given the state of the asset class. We have concerns around how recent 2021 investment cohorts and those from a couple of years before will become realised in the future and the rate of performance fees in revenues. In summary, we think past performance will not be repeated, and that PE investors will have to be satisfied with much lower rates of return.

Evolutions

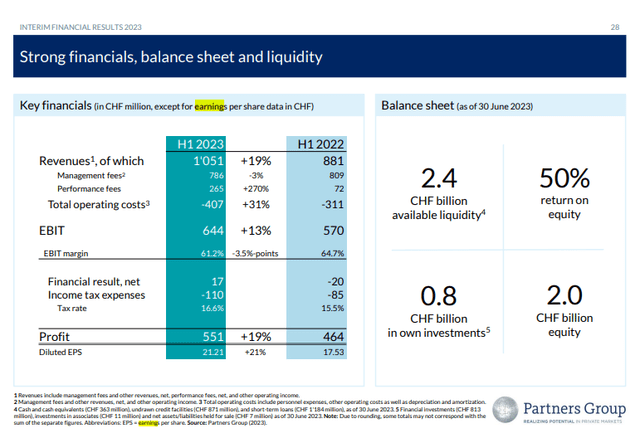

On the basis of management fees only, the PE of Partners Group is around 30x. Performance fees transmit quite dramatically into the bottom line as an addition, and currently there has been a jump in performance fees thanks to exits in particular from infrastructure which had no contribution to performance fees last year as initially invested funds had only just been returned. Management fees will grow consistently, we estimate at around 5% based on historical averages, as money continues to flow into the private asset classes.

There are a couple of considerations. The 2021 vintage was disproportionately large, double the normal allocations were made in 2021. Allocations thereafter are being made in a tougher environment with worse capital cost conditions and fewer return levers. Where a portfolio could turnover in a matter of a few years, below a typical 5-7 year longer-term average, we believe to achieve the same multiples on money, more time will now be needed compared to before. Anyone who thinks that PE will proceed as before may be in for a rude awakening, and there is plenty of journalism that corroborates a towering backlog of investments that need to be exited after a slow 2023 and 2022. There is both the problem of allocating and exiting at sufficiently good MoMs, where we think the average turnover of a PE portfolio could increase dramatically on average as capital costs likely remain elevated compared to the zero-interest environment of before.

Conclusions

Fixed and Performance Fees (H1 Pres)

There is around 1.6 billion CHF in management fees annually, with performance coming in as extra. Underlying growth in management fees at 5% is not unreasonable. The AUM is around 120 billion CHF. To illustrate the normalised economics, it is not entirely uncommon for performance fees to exceed management fees, especially in specific sectors for Partners Group. If 10% of the AUM is redeemed annually at a 2x MoM, then around 2% of the AUM could come in as performance fees, which is in excess of 2 billion CHF ahead of the fixed management fees. This magnitude of performance fee was achieved in the infra segment as of the H1. The issue is how quickly can a fund product complete its function, and also how profitably. Leverage effects are going to be troublesome, and multiple expansion unlikely. While a 2x MoM or more was possible up till 2022 from 2017, a 20% reduction in multiples even with successful intervention in portfolio companies is going to reduce returns or lengthen how quickly previously achieved returns can be achieved. We think around a 1:2 ratio is possible on a normalised basis in the current environment between performance and fixed fees based on a 1.3x MoM estimate in a five-year period, or a 1.6x MoM over a 10-year period, consistent with our assumption of around a 20% multiple reduction consistent with what we believe may be an enduring high cost of capital environment. That means current earnings are close to a good run-rate estimate. Crudely, that puts Partners Group at around a 22x, or less between a 4-5% earnings yield which is not insufficient considering the continued ability to raise funds. However, it isn’t compelling either.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.