Can Nonpartisanship Quell Horsetrading?

The relevant difference between markets and politics does not lie in the kinds of values/interests that persons pursue, but in the conditions under which they pursue their values/interests.

James M. Buchanan Jr., 1986 Nobel Prize Lecture

Many pundits of Indian politics recently expressed their anxieties about ‘horse-trading,’ the phenomenon of sitting legislators switching their political affiliations. They decried the politicians’ craft as a form of apathy towards the values of democracy. The overarching fear expressed, however, was that the political process was becoming like a marketplace characterized by moral ambiguity and money-grubbing.

Such analyses have become platitudes, though they raise valid concerns about political funding and its limits. In fact, commentaries on the ethics of undeclared political transactions always traverse murky waters. This is because representatives are but people like us, and no more altruistically driven than those who elect them. If we, as voters, do not display transparent, disciplined motivations in the first place, there is little to be said about the ‘moral’ relapse of the system downstream. Nor is this to label ethics itself as irrelevant, but to give a finer resolution to our view.

Ironically, we can paint a fuller picture of ‘horse-trading’ by probing the etymology of the phrase. The term came to be used in the United States sometime between 1870-1900 to describe the market for horses, which was rife with information asymmetry. In other words, because a horse’s condition was difficult to assess at the time of the transaction, there was great scope for sellers to be dishonest about the merits of their goods. This idea supposedly entered the mainstream through a bestselling novel of the time, the theme of which was that business thrives on such practices. That business thrives in these conditions is true, but not in the way this view suggests. It is the general asymmetry of information amongst participants in the market that encourages entrepreneurs to compete to fill these gaps to reap profits. Deceitful practices are simply violations of the contracts that govern trade and are more likely when competition is restricted. Thus, the market is a process that helps us interact reliably despite imperfect knowledge and uncertainty. It does not at all thrive on cheating.

In the market, through the exchange of different kinds of goods and services over time, we learn to pick up the signals communicated to us by prices. An adjustment process is constantly in motion throughout the system so that this communication is constantly in sync with reality. So when we apply the metaphor of ‘trading under information asymmetry’ to opportunistic political exchanges, we are effectively making an economic argument about the incentives of that institution.

In other words, in wondering why already elected representatives need to re-enter a transaction to meet their aims, we are pushed to think in terms of institutional reasons. These are primarily two-fold: the quasi-federalism of the Indian polity and the country’s partisan political system. The electoral system in India embeds candidates in two distinct political contests, each with its own incentives: one where they compete for votes and another where they compete for stability and strong backing. Conventionally, we assume that the latter will neatly supervene upon the former. But this is hardly the case.

Shruti Rajagopalan lays out the question of fiscal federalism in her assessment of the state of Indian cities. At a more basic level, however, the false federalism of India is set up to maintain the country’s multi-party system. Historically, citizens’ negotiations with the Indian state have been carried out through several (even if evolving) identity groups. The problem with this kind of politics is that it hides from view the individual, and its corresponding economic policy resembles an ideological contest for resource allocation among two or more central planning boards.

Since the party system is tied to voting and legislation, it also shapes both into collectivist processes. Whenever a political party gains a majority hold over the center, the concentration of financial power with it threatens to supersede any diversity in voters’ choices. Furthermore, the centralized party high-command is overpowered and constantly geared towards elections at various levels. Thus, the switching of allegiances post-elections can be seen as a relatively inexpensive way for politicians to signal their strength and demand greater control.

On the other hand, if we did away with the system of political parties, a substantial number of contradictions like horse-trading would cease to exist. In fact, nonpartisan democracy would approximate a competitive market for governance to the greatest extent possible, and as a byproduct, free the economy of state control. It is precisely for this reason that the moral view on the problems of governance, from selection to implementation, is limiting.

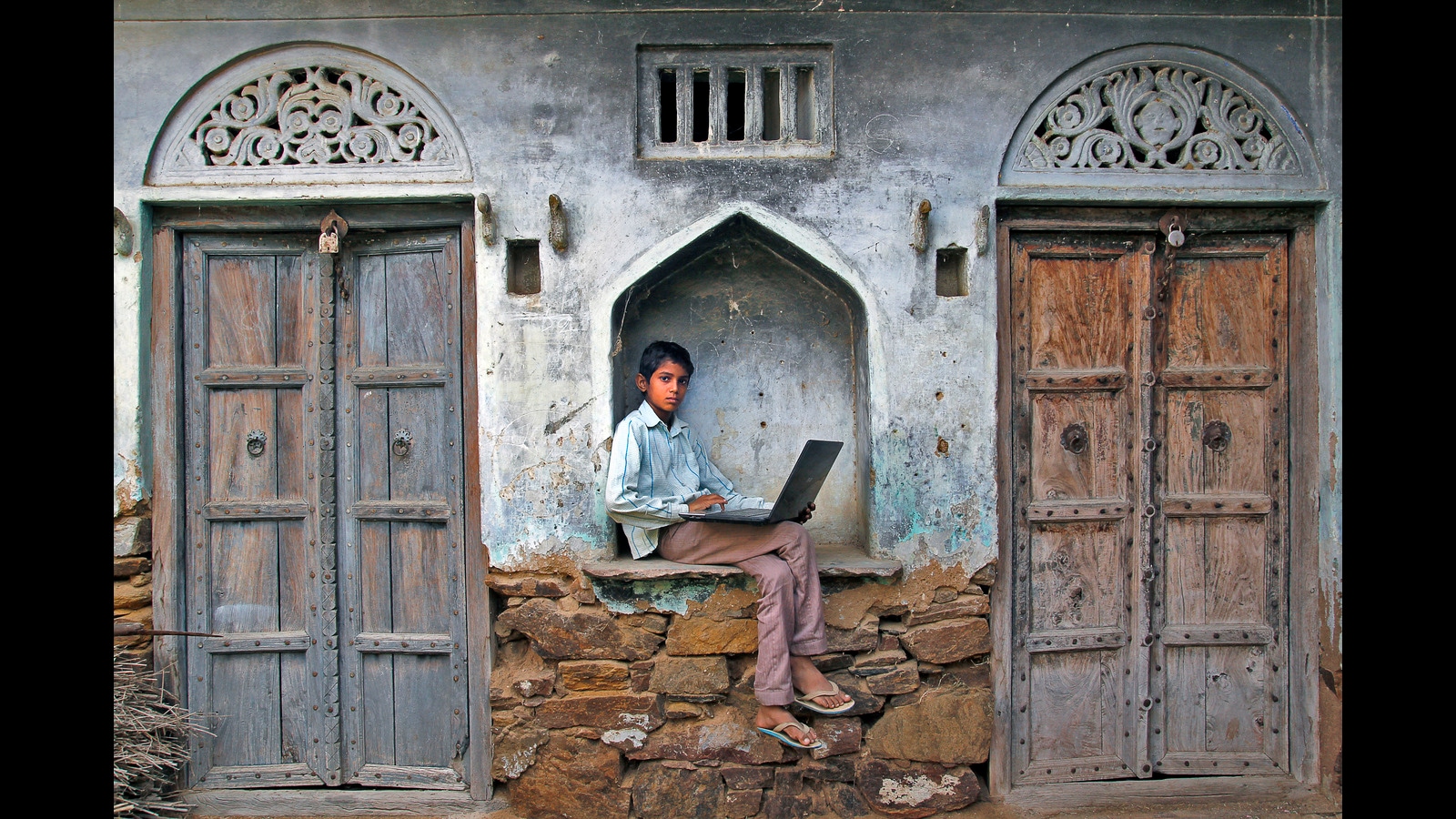

The institutional view offers a better analysis of how context shapes behavior. Hence, nonpartisanship can be viewed as the right institutional context for decentralized experimentation in governance. It distributes the party-based top-down incentives (abetted by the lack of federalism) into the bottom-up incentives of the population of an economic locale (a city/town/village). Furthermore, as a general practice, this form of representative governance does have roots in the socio-historical experience of the Indian subcontinent.

Parth Shah, for instance, has written about M K Gandhi’s vision of the self-governing Indian village and how the idea could serve as a template for ‘politics without political parties’. He also cites historical records of the kudovolai system of the Chola period in India, in which anyone could contest for governance, the result being decided randomly through a ritualistic lucky draw. The selected individual would then serve for a year, was subject to certain criteria for disqualification, and was barred from being a candidate for the next three years. What this shows us is that alongside the specific incentives directly tied to administrative performance, the broader environment in which they play out deeply shapes the process of representation. It might not be enough to call for greater autonomy at smaller levels as long as ideological factionalism bears upon it. Even James Madison grappled with this tension in Federalist No. 10. He was against direct democracy (among a relatively small, territorial populace) because the ease of political communication within such systems created the risk of majoritarianism.

Madison’s idea of extending the sphere of the political process sounds similar in principle to Adam Smith’s notion of the extent of the market. If the extent of the market spurred greater specialization, absorbing the polity within the market such that the true prices of all its transactions are reflected might hold the same potential. This would enable the specialization of not just several government services but of institutional decision-making itself. Political costs would not be decoupled from economic costs, thereby diluting the ‘difference in conditions’ pointed out by James Buchanan. Moreover, Virgil Storr has shown that the understanding of the market “as a social space” includes forms of extra-economic social activity. Clearly, this is an underexplored frontier. Lastly, it would be useful to go back to F. A. Hayek’s “nomos” approach to rule-making. The idea of a nonpartisan, market polity is not to return to historically given institutions or abandon intervention in all realms of social life, but to develop a system that best facilitates the competitive process. The nomos approach seeks to find an institutional framework that can strengthen the adaptive capacity of private initiative under conditions of asymmetric information. The services of representation and governance ought to be thought of in these terms.

Jayat Joshi is a Writing Fellow and a Prometheus Fellow at Students For Liberty.