franckreporter

This year’s most significant market trend is likely the collapse of many office REITs. Top office REIT indices remain around the same levels they crashed to during the 2008 recession. Vornado (VNO), a prominent New York office REIT, is racing to sell numerous properties in an effort to improve waning liquidity levels. Currently, all US commercial properties have lost around 16% of their peak values from early 2022. Office property values are now down around 27%, with many analysts believing a total 40% decline is likely due to rising vacancies and higher capitalization rates. Problematically, large office buildings in central urban areas face the most significant total risk due to the urban decay “doom loop,” where lower human traffic leads to higher crime, causing more employers to adopt work-from-home or exit urban areas.

Across US metros, the most up-to-date office occupancy rates are just around 31% to 56% throughout the week and slightly lower in New York at a 22% to 56% range. That data is much better than the 10% to 30% range seen in 2021. The rate of improvement in occupancy has also slowed dramatically, with total occupancy levels stagnating far below pre-COVID levels of roughly 80%. Most companies continue to pay for this unused space, so Manhattan’s current ~23% vacancy rate should continue to climb over the coming two years. City leaders remain hopeful that occupancy levels will naturally return to pre-pandemic levels. Still, I believe that is much less likely, considering the data shows an apparent stagnation in that trend. Further, many companies may lower occupancy levels once their leases expire to generate savings. Lastly, I expect rising urban crime rates to slowly promote the “urban doom loop” issue, depending on cities’ willingness to tackle that issue.

At any rate, substantial stock price declines have led to many office REITs trading far below their book values. The REIT with the lowest price-to-book ratio with a market capitalization over $1B is Paramount Group (NYSE:PGRE). PGRE trades at an extremely low “P/B” of just 0.29X, indicating potential for significant undervaluation. Of course, the REIT primarily focuses on large urban New York City office properties, likely worth much less than they were two years ago. That said, PGRE’s short interest is currently 6.4%, which though not exceptionally high, indicates speculators are betting against it. Given the situation’s complexity, I believe PGRE deserves closer inspection to determine its fair value.

Assessing Paramount Group’s Risk Exposure

I believe Paramount Group is currently valued as if insolvency is particularly likely. One major issue with assessing the stability of office REITs is that the market is considerably illiquid and lags fundamental trends significantly. Total commercial office property transaction volumes are down some 70% year-over-year and a staggering 79% for office properties. Banks have nearly completely halted commercial property lending. Overall, the CRE market, particularly for urban offices, looks very different from the residential market in 2006-2009, with virtually no market liquidity making it challenging to know where valuations genuinely are.

Around 71% of Paramount Group’s income usually comes from Manhattan offices, with the remaining 29% from San Francisco offices. Based on its average rent per square foot of $87, we can surmise that its buildings are of higher quality in each market. However, that is not necessarily a positive factor because Paramount is exposed explicitly to those properties with the most significant total potential valuation decline. For example, a low-quality office with vacancy issues before COVID would typically have a capitalization rate of 7-9% or more, so an interest-rate-driven cap rate increase, combined with new vacancy issues, would not necessarily dramatically lower its valuation.

At the early 2022 cap rate trough, Paramount’s offices likely were valued at 4.5% to 5% capitalization rates, giving them far more price change risk should capitalization rates increase. Based on real interest rates alone, I expect capitalization rates to rise by ~3% for properties that should grow NOI at the same pace as inflation. The total change for urban Manhattan and San Francisco offices is likely to be higher due to the possibility of an extended NOI decline.

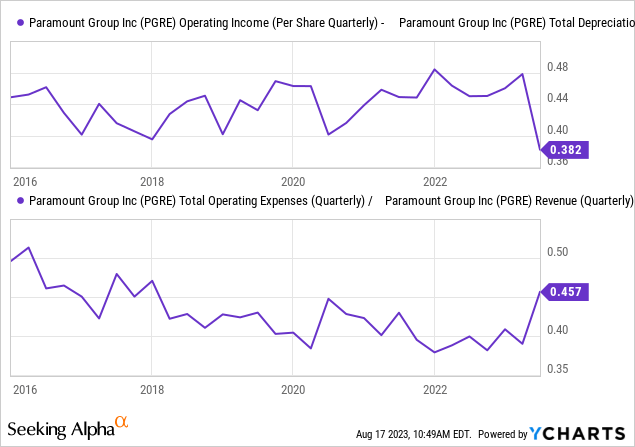

Thus far, Paramount has suffered a notable decline in its net operating income and an increase in its operating cost overhead. See below:

Note, NOI per share is estimated using OI plus D&A, though measured as OI – (D&A * -1) due to the charting system.

Paramount NOI has been relatively stable in recent years until the significant decline last quarter. That represented a ~21% YoY decline; however, the year-over-year decline using the company’s more in-depth calculation is closer to 17% due to impacts from other operating income. The company estimated its Q2 NOI at $84.7M, or $339M annually. The sharper decline was triggered by a lease termination from SVB due to its failure and a partial lease surrender from JP Morgan (JPM) following its First Republic (OTCPK:FRCB) acquisition.

Nearly half of Paramount Group’s rent comes from financial companies, including insurance and banking. No tenant accounts for over 5% of PGRE’s revenue; however, the REIT has higher exposure to potentially struggling banks and financial services companies. Furthermore, the financial sector is likely one of the most work-from-home friendly. While there have been some efforts to increase office activity at large banks, many financial executives say they will quit or retire before being forced to return to their office five days a week.

In my view, many companies today are likely testing to see whether or not they’ll need to renew their leases. Since most are stuck in leases regardless of occupancy, they may discourage WFH until given the choice to renew their leases, after which they’d likely save money by reducing excess office space. Although PGRE had a lease rate of 89.6% last quarter, that figure may decline by 10-20% over the coming year or two, pushing NOIs down by potentially around 25-35% since overhead costs will not necessarily fall with lower lease rates. Additionally, even if vacancy levels are maintained, they will almost certainly be at lower costs, as rising vacancies already promote significant rent declines in urban areas. Sublease discounts on urban offices are currently around 20% to 40%, with Manhattan’s highest available sublease space.

What is PGRE Worth Today?

Based on the above data, I believe PGRE’s annual NOI will decline to around $270M based on some combination of lower rents and higher vacancy rates, or 20% below its current annual NOI level. The company has a balloon of leases expiring from 2024 to 2026, which I expect to have the most significant negative impact on its NOI. Thus, its 2023 NOI will likely remain near Q2 levels and may not fall to the $270M level until at least 2026.

That assumes that office occupancy levels rise slightly above current levels but remain around 20% below pre-COVID levels (meaning ~60%). Some companies wish to improve occupancy more, while others are switching closer toward a WFH or hybrid model. As more companies can save by making that switch, occupancy levels may fall even lower. Urban decay issues in NYC and San Francisco, or a potential recession that causes more lease terminations, would undoubtedly accelerate PGRE’s NOI declines. I would not be surprised if PGRE’s NOI falls below my estimate; however, that could be too far into the future.

Based on the change in real interest rates and that figure’s strong correlation to cap rates, I expect PGRE’s properties to eventually be worth a capitalization rate of around 7.5% to 8%. Such a significant capitalization rate increase requires longer-term real Treasury rates to remain flat. Real interest rates may continue to rise due to the yield curve steepening, with the 10-year real rate rising by around +50 bps this year, with considerable growth in recent weeks. Although a recession could cause real rates to decline again, that would not necessarily aid commercial properties because cap rates are also correlated to corporate risk premiums.

Accounting for these factors, I expect Paramount’s property portfolio will be worth roughly ~$3.48B by ~2025, or $270M divided by 7.75%. The company also owns around $1.47B in other tangible assets, bringing its estimated asset value to ~$4.95B. Against $4.02B in total liabilities, its estimated net equity value is $930M. In this case, its $840M minority interest need not be accounted for because I am using NOI estimates which remove NOI attributable to non-controlling interests. Thus, my NAV estimate for PGRE is $930M, or $4.28 per share of common stock, 7.5% below its current valuation.

The Bottom Line

Overall, I believe PGRE is roughly fairly valued today. Although it trades at a considerable discount to its book value, most of its properties are likely worth much less than it paid for them due to the unfortunate combination of lower future NOIs and interest rate-driven cap rate growth. My valuation assumes cap rates only rise in line with real interest rates and what I believe to be a fair but relatively conservative NOI decline. In reality, PGRE’s NOI could decline by more than 20%; however, I doubt that would occur before 2026 since around 45% of its leases expire in 2030 and beyond. It could lose NOI on those long-term leases due to corporate financial issues, which are not necessarily off the table, as seen in First Republic and SVB.

Notably, most of Paramount’s debt is fixed with interest rates around 3% to 4.5%, created before 2022. In 2024, the company faces a ~$555M debt maturity and a considerable maturity of ~$1.44B in 2026. Total maturities through 2026 are around $2.38B (~$1.91B fixed). Based on that, I estimate that its interest costs on that fixed-rate debt will rise to around $143M (assuming CMBS remains about 7.5%) from an estimated $70M today, creating a roughly $73M interest expense increase. The company’s TTM funds from operations are ~$130M, so its FFO will likely decline by ~55% based on increased interest costs alone in my view.

After expected income declines due to vacancy issues, I believe PGRE may be insolvent by 2026. However, the company does have ~$430M in cash today, so it may manage to pay off some of its debt to avoid such a significant increase in interest costs. Still, given banks are dramatically lowering CRE lending and Paramount’s credit risk profile is high, I generally expect it to face significant refinancing issues over the coming years.

Considering that, I am slightly bearish on PGRE and do not believe it is a good recovery opportunity, despite its substantial decline in valuation. That said, PGRE is not an excellent short opportunity because it is not trading at a hefty valuation premium. Further, it is possible that black-swan events could save the company, the best of which would be a successful “back to the office” shift or a return to QE that lowers mortgage rates. However, those who read my articles likely know I firmly believe each scenario is unlikely, with negative black swan events (see 2020) seemingly more likely. That said, an analyst with a more positive office occupancy outlook could justify a higher NAV estimate for PGRE.