asbe

Introduction

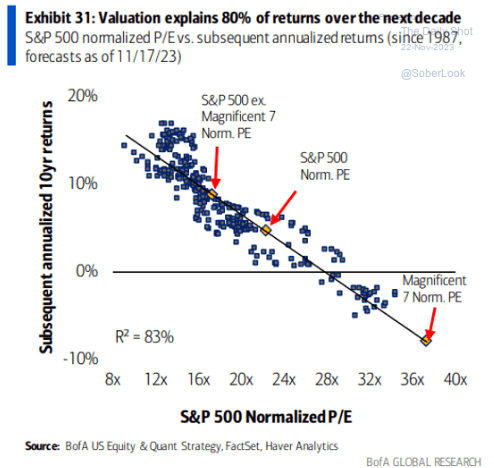

If there’s one thing I have highlighted in recent articles, it’s my increased focus on value stocks, given that the stock market valuation hints at subdued long-term total returns.

Generally speaking, this favors stocks with low valuations and/or decent yields, as we can expect a bigger part of future total returns to come from dividends.

Bank of America

I discussed all of this in my 2024 Outlook article, which was published on December 5.

So, why is this article about Palo Alto Networks (NASDAQ:PANW), a high-flying tech stock that has risen 111% in 2023?

Well, as I’m not a typical value investor (I look for the sweet spot between growth and value), I always have growth stocks on my watchlist to buy once opportunities appear.

This is what I wrote in my 2024 Outlook article (emphasis added):

I’m also buying growth stocks, albeit very carefully. I mainly do this to hedge myself against being wrong (I don’t want to be entirely overweight in higher-yielding stocks and value plays). In this case, I’m buying proven stocks with good balance sheets and anti-cyclical demand. I’m not buying companies with lofty valuations, operations in highly competitive industries, and a high dependence on speculative stock market sentiment.

Hence, in this article, I will explain why I put the PANW ticker on my watchlist. Despite its recent performance, I believe it offers value on stock price corrections.

So, let’s take a closer look!

Cyber Security Is Where It’s At

Palo Alto Networks may not be cheap, which is why I am waiting for a potential correction of this red-hot stock market. However, it offers anti-cyclical demand growth in one of the most important industries in the world.

The company is a global cybersecurity provider established in 2005 and headquartered in Santa Clara, California. It currently has a $93 billion market cap.

According to the company, it aims to create a safer world by empowering enterprises, organizations, service providers, and government entities to defend against sophisticated cyber threats.

As most of us may be aware, the massive rise in global connectivity comes with incredible risks.

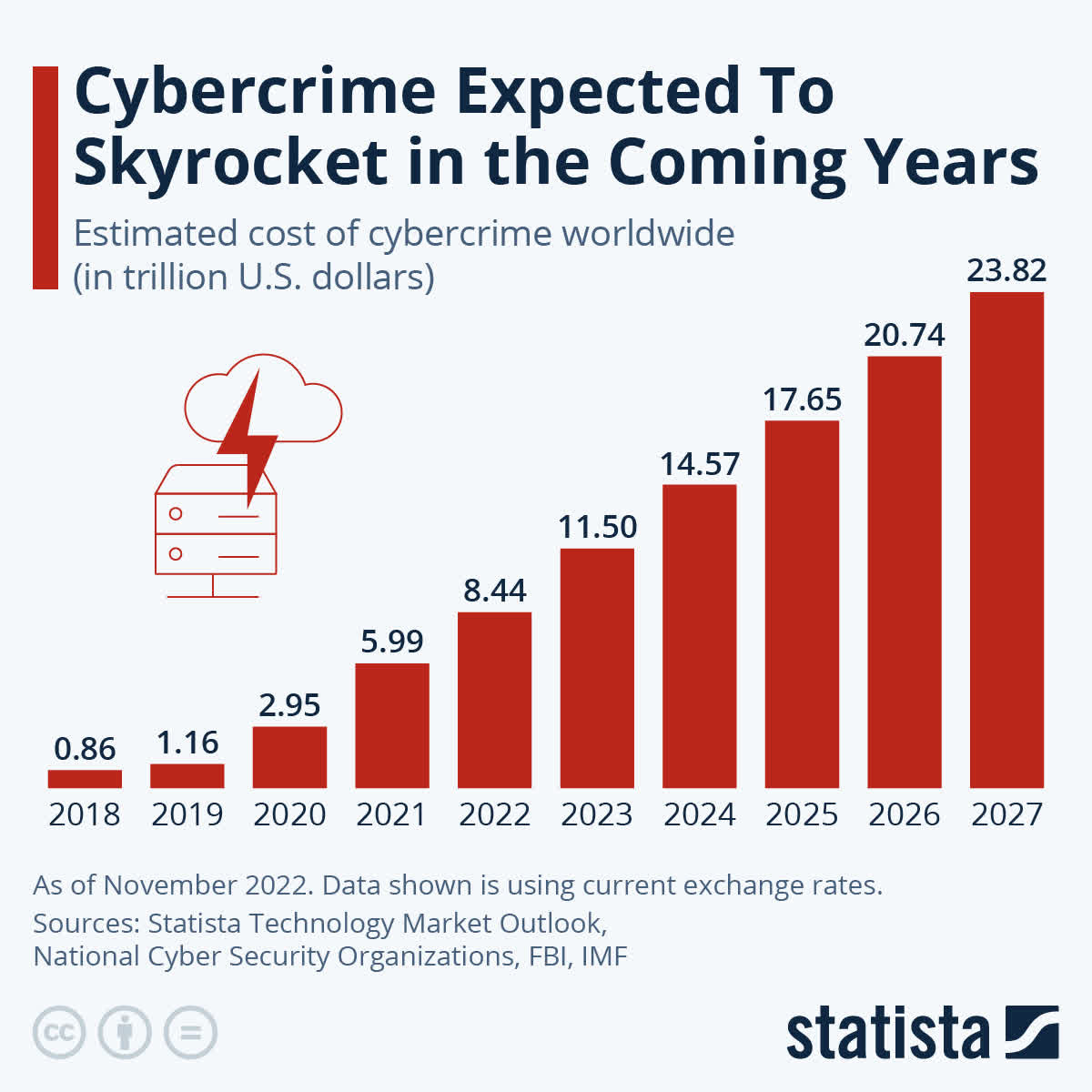

Using Statista data (as of November 2022), we see that we are in a massive uptrend when it comes to cybercrime. The cybercrime the world witnessed before the pandemic is a walk in the park compared to what we should expect in the next few years.

Statista

With that in mind, Palo Alto Networks offers a range of products, subscriptions, and support services.

Hardware and software firewalls, SD-WAN, Panorama, and subscriptions like Advanced Threat Prevention, GlobalProtect, and Enterprise DLP are key components.

Cloud-delivered security services cover Advanced URL Filtering, DNS Security, IoT/OT Security, and more.

Prisma Access and Prisma SD-WAN enhance cloud security, while Prisma Cloud secures cloud-native applications.

It has a well-balanced revenue breakdown between subscriptions and support services.

| USD in Million | 2022 | Weight | 2023 | Weight |

|---|---|---|---|---|

Subscription | 2,539 | 46.2 % | 3,335 | 48.4 % |

Support | 1,599 | 29.1 % | 1,979 | 28.7 % |

Global Cybersecurity Provider | 1,363 | 24.8 % | 1,578 | 22.9 % |

Essentially, PANW adopts a holistic approach to cybersecurity, offering a suite of solutions that span across network security, cloud security, security operations, and threat intelligence.

This all-encompassing strategy makes sure that organizations can fortify their “digital perimeters” based on a “zero-trust” model.

What’s interesting are the ML-Powered Next-Generation Firewalls.

These firewalls embed machine learning in the core, enabling real-time detection and prevention of zero-day threats.

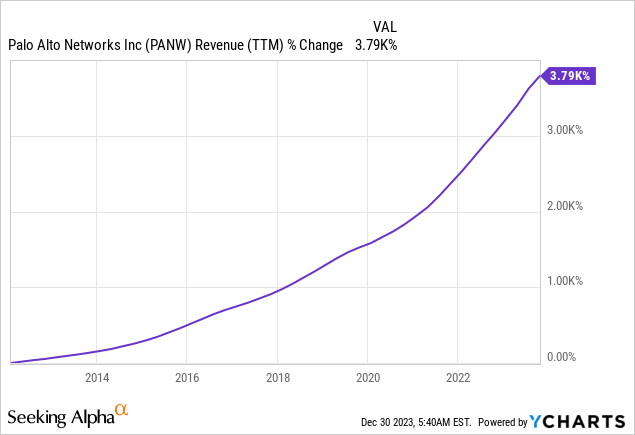

Based on this context, PANW is at the right place at the right time, as evident by its historical sales growth.

Since 2012, PANW has grown its revenue by roughly 3,800%, with a notable acceleration after 2020, when the world witnessed the start of more rapid cybercrime growth (we also see this in the Statista chart above).

With that in mind, let’s dig a bit deeper to find out how PANW is evolving and growing shareholder value.

PANW Remains In A Great Spot For Growth

During the November 29 UBS Technology Conference, the company elaborated on its operating environment and capabilities.

One of the most important things the company mentioned was that the financial impact of cyber attacks, with hackers demanding substantial ransom payments, has created a lucrative market for cybersecurity services.

Due to the minimal legal consequences faced by attackers, businesses are compelled to invest in robust cybersecurity measures to protect their assets and reputations.

There is growing recognition at the corporate level, including the C-suite and board of directors, regarding the critical importance of cybersecurity.

This heightened awareness translates into sustained cybersecurity budgets, indicating a consistent and robust demand for cybersecurity solutions.

Even more important, the adoption of artificial intelligence (“AI”), particularly precision AI in the cybersecurity domain, represents a significant business opportunity.

Companies like Palo Alto Networks are leveraging massive datasets, ingesting petabytes of data daily, to enhance their AI-driven cybersecurity capabilities.

Copilots, driven by generative AI, are expected to become table stakes in the industry within the next 12 to 18 months.

In an in-depth paper, Palo Alto notes that AI is also a great driver of efficiency to get more safety with fewer people.

Palo Alto Networks

Looking forward, the industry is poised for consolidation and “platformization.”

As copilots become commonplace, managing multiple solutions from different vendors may pose a challenge for businesses.

This trend opens up opportunities for companies that can offer integrated solutions, potentially leading to market consolidation and the emergence of dominant platforms in the cybersecurity space.

In light of these developments, the company’s venture into XSIAM addresses critical pain points in the cybersecurity industry, particularly in SOC (Security Operations Center) management.

The identified inflection point emphasizes the need for real-time security solutions, creating a market demand for innovative offerings like XSIAM.

Its success in reducing the meantime to remediate security incidents significantly positions XSIAM as a compelling solution for businesses seeking to enhance their cybersecurity capabilities.

Financially, Palo Alto Networks has generated an impressive $1 billion pipeline within a year of XSIAM’s launch, reflecting robust market interest and potential revenue growth.

Meanwhile, the diverse customer base, including 5,300 Cortex customers, offers a solid foundation for tapping into existing relationships and expanding the market reach for XSIAM.

Recent Numbers Confirm A Strong Trend

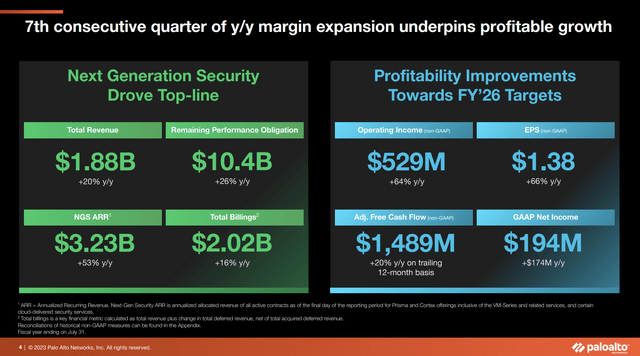

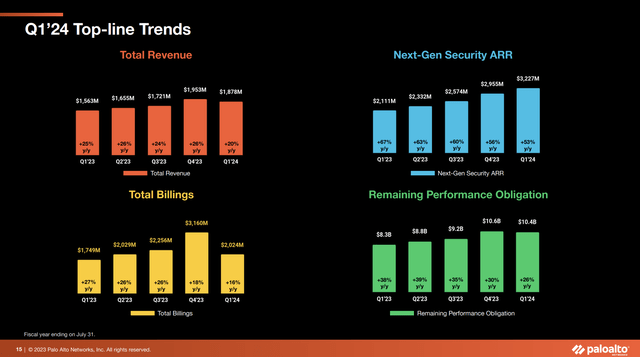

In the first quarter of its 2024 fiscal year, Palo Alto reported impressive financial results.

- The company achieved a revenue of $1.88 billion, marking a 20% growth.

- Product revenue increased by 3%, while total service revenue experienced a robust 25% growth.

- Notably, subscription revenue reached $988 million, growing by 29%, and support revenue stood at $549 million, reflecting a 17% increase.

Palo Alto Networks

Unsurprisingly, PANW witnessed consistent revenue contributions across all geographic areas.

The Americas grew by 20%, EMEA by 19%, and JAPAC by 23%.

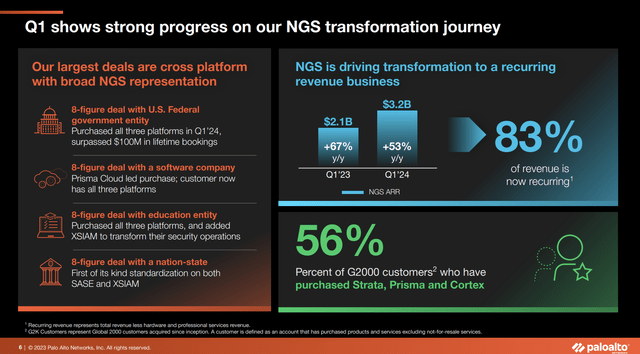

Especially the strength of PANW’s next-generation capabilities was a key driver, with NGS Annual Recurring Revenue (“ARR”) surpassing $3 billion for the first time, which translates to a remarkable 53% growth rate.

Palo Alto Networks

Strong contributions were observed across the entire NGS portfolio during the first quarter.

Total billings reached $2.02 billion, marking a 16% increase. Some analysts thought that this number was too low. This caused some post-earnings volatility.

However, the company attributed volatility in billings to ongoing payment conversations with customers. The company noted that discussions about payment terms and duration in final renegotiations had an impact on the total billings.

Palo Alto Networks

Palo Alto Networks employed various financial strategies. These included offering annual billing plans, financing through PANFS, and partner financing.

While these strategies did not impact demand or annual revenue, they introduced variability in total billings.

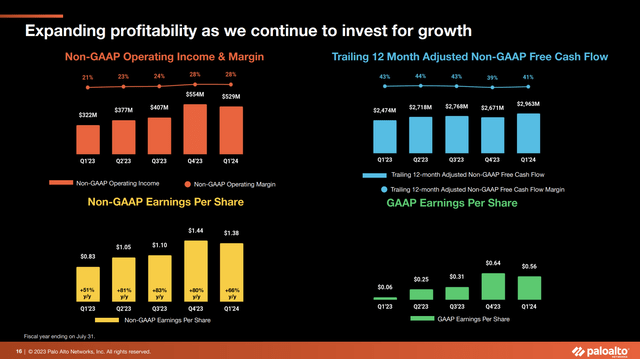

Furthermore, the company showed significant improvement in operating margins, expanding by 760 basis points year-over-year.

The gross margin for Q1 stood at 78%, increasing by 370 basis points. This improvement was attributed to higher gross margins and efficiencies across operating expense lines.

Palo Alto Networks

Adding to that, the company maintained a strong cash position, ending Q1 with cash equivalents and investments of $6.9 billion.

Cash flow from operations was $1.526 billion, and adjusted free cash flow for the quarter was $1.489 billion.

The company is expected to end this year with $3.8 billion in net cash, which means it has more cash than gross debt.

Thanks to this balance sheet, the company is protected against an environment of elevated rates and is in a good spot to acquire companies.

In its 1Q24 earning call, it discussed the definitive agreements to acquire two companies, Dig Security Solutions, and Talon Cyber Security, for approximately $232 million and $435 million, respectively.

These acquisitions are expected to close in the second quarter of the 2024 fiscal year.

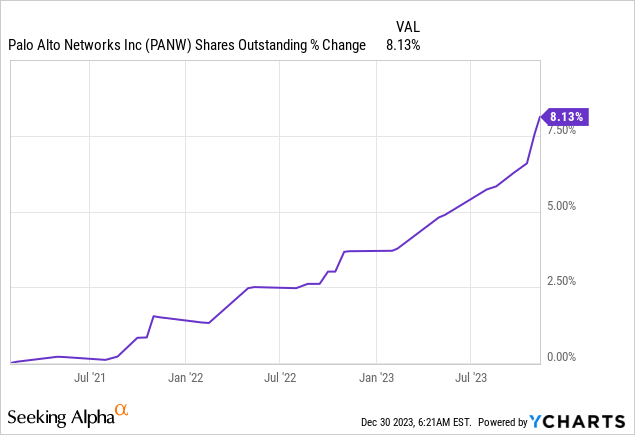

Moreover, the company repurchased approximately 300,000 shares in the first quarter.

Over the past three years, the share count has increased by 8%, which is decent, given that a lot of tech stocks are diluting shareholders much more aggressively.

I expect the growth rate in shares outstanding to slow further as PANW becomes more mature and capable of buying back stock.

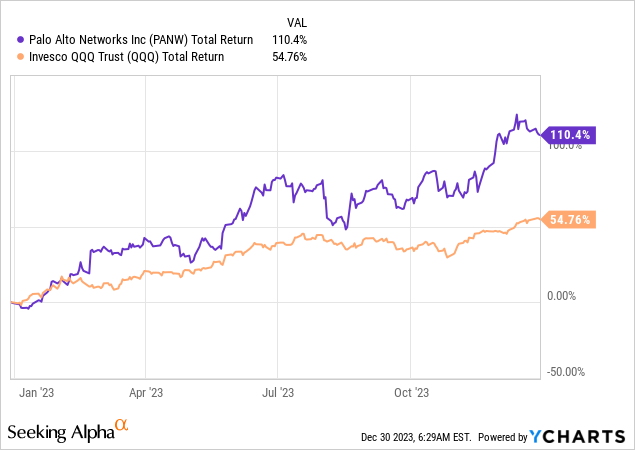

It also did not keep PANW from outperforming its tech peers.

Over the past twelve months, PANW has returned 110%, beating the impressive 55% performance of the tech-heavy QQQ ETF (QQQ).

This brings me to the valuation.

Valuation

Since its IPO, PANW shares have returned 26% per year.

Going forward, I expect the stock to outperform its peers, albeit with a potentially lower total return.

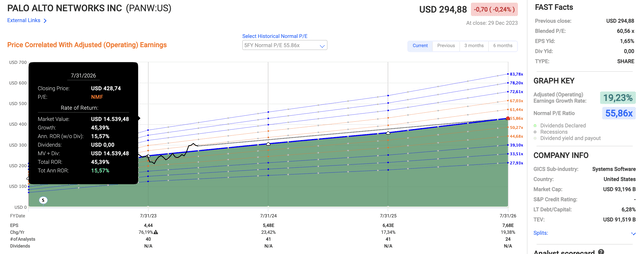

Using the data in the chart below:

- PANW is trading at a blended P/E ratio of 60.6x.

- This year (2024), EPS is expected to increase by 23%, followed by 17% expected growth in the 2025 fiscal year and 19% growth in the year after that.

- I believe that these growth rates warrant an EPS multiple between 50x and 55x, which would indicate an annual total return of 11% to 16%.

FAST Graphs

These numbers also imply a price target exceeding $400 (the current price is $295).

Nonetheless, I am not buying PANW at current prices.

The recent surge in the stock market and the fact that the market has now priced in six interest rate cuts in 2024 lets me believe that it’s important to be careful at current levels – especially when dealing with growth stocks.

While I am adding to certain value stocks, I prefer to buy PANW on 10% to 15% stock price weakness.

The key takeaway, however, is that I believe that PANW is one of the best tech stocks money can buy, benefiting from secular growth, great services and capabilities, and potential growth expectations that warrant a “lofty” valuation.

Takeaway

Despite my focus on value, Palo Alto stands out as a growth stock worth watching.

Despite its recent surge, PANW’s position in the cybersecurity industry, offering a comprehensive suite of solutions, positions it well amid the escalating threat of cybercrime.

The company’s focus on AI-driven cybersecurity and the success of XSIAM demonstrate a strategic approach to evolving industry needs.

Financially robust, PANW reported strong Q1 results, marked by significant revenue growth, improved margins, and strategic acquisitions.

If I get a buying opportunity in 2024, I will likely use it to somewhat expand my tech-focused exposure.