Ake Ngiamsanguan/iStock through Getty Pictures

Revisiting Palantir Applied sciences After Q2 Outcomes And S&P 500 Inclusion

Palantir Applied sciences (NYSE:PLTR) has been one in every of my worst funding calls on Searching for Alpha to date. On February 16, 2023, or a couple of 12 months and a half in the past, I downgraded my very profitable sturdy purchase name, which had generated a 42% whole return, considerably outperforming the S&P 500 (SPY), to a promote ranking attributable to overvaluation considerations. In hindsight, my promote name was untimely as I had a good worth estimate of simply $8 for the inventory, based mostly on very gradual development expectations for the corporate. Nevertheless, since then, administration has efficiently accelerated its development in a significant method, and the inventory has soared over 250% since that promote name, making it one of many worst funding rankings of my investing profession.

Fortunately, I’ve nonetheless profited considerably from my publicity to Palantir shares as a result of I used to be lengthy the inventory once I rated it a powerful purchase, after which – as soon as I modified to a Promote ranking – I bought the inventory after which bought places in opposition to it in case it dipped once more, however I didn’t brief it. In consequence, I made sturdy fast positive factors on the inventory’s run up in worth in addition to off of expired put premiums. Nevertheless, the reality is that I nonetheless clearly misinterpret this inventory and have been made to appear like a idiot on it in consequence.

With that stated, I’ll revisit the inventory in mild of Q2 outcomes and the latest S&P 500 (SP500) inclusion in thoughts and share my up to date evaluation of the thesis.

Palantir Q2 Earnings

Palantir posted very spectacular Q2 outcomes, with business income in the US hovering by 55% 12 months over 12 months. US authorities income delivered a powerful 24% year-over-year development fee. The worldwide enterprise generated first rate efficiency general, however considerably lagged behind the US enterprise, with 15% year-over-year worldwide business development and 21% year-over-year worldwide authorities income development. Nevertheless, on a sequential foundation, worldwide business income truly declined by 1% attributable to continued headwinds in Europe, and there was an 18% sequential development within the worldwide authorities enterprise. It is very important remember that the expansion within the worldwide authorities enterprise was largely fueled by the warfare in Ukraine in order that development quantity just isn’t essentially indicative of the long-term development potential of the enterprise.

Nonetheless, their general headline income development was sturdy at 27% 12 months over 12 months and equally sturdy at 7% sequentially. Palantir was additionally fairly worthwhile, with a GAAP web revenue of $134 million, leading to a strong 20% revenue margin. GAAP earnings per share got here in at six cents, and adjusted earnings per share had been $0.09.

The worth proposition of Palantir’s merchandise was additionally verified by the truth that they proceed to draw enterprise from a number of the prime firms on the planet, together with latest offers with BP (BP) during which Palantir signed a five-year deal to collaborate strategically on introducing new synthetic intelligence capabilities by Palantir’s AIP platform and supporting BP’s oil and gasoline manufacturing operations. Furthermore, Microsoft (MSFT) and Palantir have additionally partnered to serve US protection intelligence businesses with AI companies. Maybe the strongest validation of the thesis is that Palantir lately joined the S&P 500, which provides a considerable amount of extra demand from passive traders and establishes Palantir as one of many main AI firms with a confirmed, worthwhile, and sturdy enterprise mannequin. Given these latest headlines alongside Palantir’s sturdy steadiness sheet and cash-generative enterprise mannequin, it seems that Palantir’s threat when it comes to its sustainability is kind of low.

PLTR Inventory Valuation Mannequin

That stated, Palantir continues to be struggling to generate sturdy and spectacular development exterior of the US. Although the top-line income development of 27% 12 months over 12 months and seven% quarter over quarter is spectacular, it pales compared to the valuation that the market is assigning to the inventory. Presently, it trades at 59.3 occasions EV/EBITDA and has an 87.42 occasions price-to-earnings ratio.

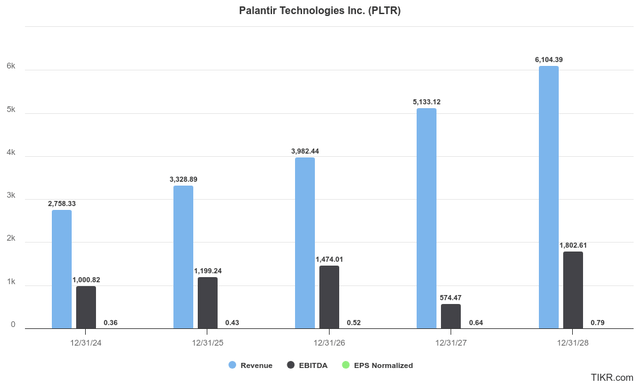

Furthermore, analysts are usually not anticipating the corporate’s income to speed up a lot past what was generated this previous quarter. The corporate is forecast to ship a 22% income CAGR and a 15.8% EBITDA CAGR by 2028, whereas normalized earnings per share are anticipated to develop at a 22.1% CAGR over that span, placing 2028 earnings per share at $0.79.

Analyst Consensus PLTR Progress Projections (TIKR)

Even when the market had been to assign it a really beneficiant 40 occasions earnings a number of, assuming rates of interest fall meaningfully over that interval attributable to Federal Reserve fee cuts and continued sustained sturdy development outlook for the corporate, the inventory worth can be simply $31.60, which is down about 10% from right now’s $34.60 inventory worth. That is no less than three years and 1 / 4 into the longer term. This implies it is rather tough to discover a valuation that is smart proper now or a situation during which the present inventory worth is smart except the corporate can massively speed up its earnings per share development. Provided that the corporate has struggled to broaden its margins materially over time, it’s exhausting to see how this occurs except the corporate can also massively speed up income development. To try this, it must put up worldwide income development charges akin to what it’s attaining within the US business house. Once more, it’s exhausting to see that occuring, particularly on condition that Europe truly shrank sequentially this previous quarter.

Investor Takeaway

Whereas Palantir is proving to be a a lot stronger firm with typically higher development than I feared a 12 months and a half in the past, and due to this fact deserves a a lot larger inventory worth than my authentic truthful worth estimate, the market is way too smitten by its prospects proper now. I imagine PLTR inventory deserves a pointy pullback, and I believe $20.00 at most is a good worth within the present setting given the consensus analyst forecasts for development. In consequence, I’m giving the inventory a powerful promote ranking.

Nevertheless, since it might require a big shift for the inventory to achieve these ranges, I’ve no plans to brief the inventory, as Palantir is a living proof of why I by no means brief shares as a result of the market can keep irrational far longer than I can keep solvent, and I desire to allocate my hard-earned capital to constructive development tales fairly than making an attempt to foretell swings in market sentiment.