peshkov

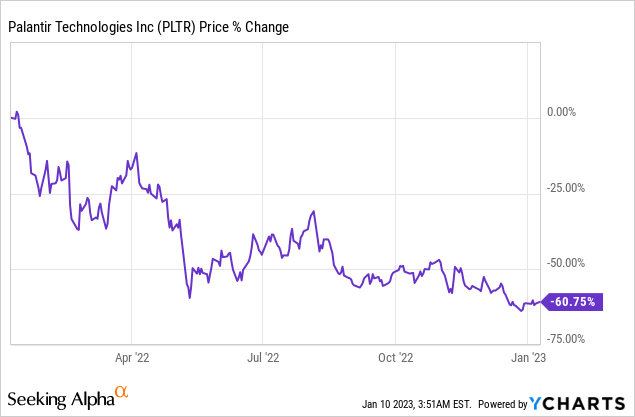

Palantir (NYSE:PLTR) has been brutalized in the last twelve months with shares losing 61% of their value due to souring investor sentiment and a slowdown in the firm’s top line growth. Although Palantir secured some big contracts with various government agencies last year, including from the US Army and the US Space Systems Command, investors appeared to lose interest in the company’s growth potential last year. With earnings coming up next month, I am discussing my expectations for Palantir’s Q4’22 and lay out what must happen for shares to revalue higher!

Strong customer acquisition could drive commercial and financial results in FY 2023

Palantir operates two distinct business segments. The first is the government business which solicits multi-year service contracts from various branches, including law enforcement and the military. Just at the end of December, Palantir announced a £75M contract with the British Ministry of Defence.

Government revenues accounted for 56% of Palantir’s revenues in the first nine months of FY 2022, showing a decrease of 3 PP compared to the year-earlier period. The reason for the decline in the share of government revenues has been Palantir’s success in rolling out its Foundry software platform to more customers in the commercial segment, which is the company’s second revenue stream.

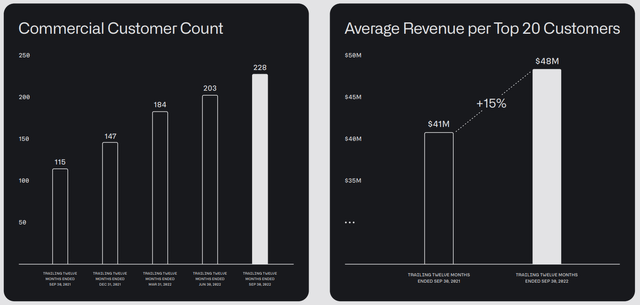

In the commercial segment, customer acquisition has been especially strong in FY 2022, in part because Palantir heavily invested in its sales team and made it a priority to sign on new commercial clients. At the end of the September-quarter, Palantir had 228 commercial customers in its portfolio, showing a year over increase of 98% year over year.

Source: Palantir

Despite a number of disappointments in FY 2022 (most notably the down-grade of its full-year revenue guidance), I believe Palantir overall still had a pretty decent year. One area in which Palantir was really successful was customer acquisition: as of the end of the September-quarter, Palantir had 337 customers using its various Foundry and software products on its books, showing a year over year increase of 66%.

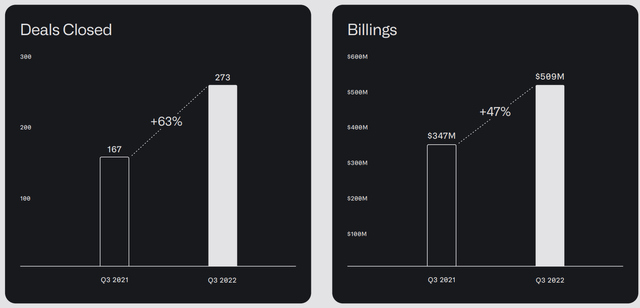

Palantir’s core business has momentum

Palantir grew its consolidated revenues 22% year over year to $477.9B in Q3’22 and the software analytics company guided for more than half a billion in Q4’22 revenues for the first time ever. Palantir also closed 106 new deals in the last twelve months (mostly with new customers), 78 of which were closed just in the third-quarter and nineteen of those had a deal value in excess of $10M. The firm’s total deal volume (as of September 30, 2022) was $4.1B, showing 14% year over growth. Customers continue to flock to Palantir’s Foundry solutions which help company’s centralize, streamline and analyze their large data sets and as long as Palantir continues to grow its customer base and deal value, I believe the software firm is on a good path towards profitability.

Source: Palantir

These are my expectations for Palantir’s Q4’22

Palantir has overall executed its business strategy well in the first nine months of FY 2022 and the company is likely to report continued strong customer acquisition, especially in the commercial segment, in Q4’22. My expectations for Palantir’s Q4’22 earnings — which are set to be reported next month — are as follows:

1. Palantir will likely end the year with more than 350 total customers that are using Foundry platforms and other services. The company added an average of more than 30 new customers per quarter in the last year, so my estimate may be on the conservative end.

2. Although there is a slowdown in the commercial business, I believe commercial customers will continue to adopt Foundry products due to the obvious value they offer them in driving efficiency gains. I expect between 15-20% year over year commercial revenue growth in the fourth-quarter with a similar annualized rate of growth in FY 2023. Palantir’s commercial revenues grew 17% in Q3’22, so the company should be able to meet the projection range for the fourth-quarter easily.

3. Palantir’s commercial customer base likely grew at rates similar to those in the last couple of quarters and the company could end the year with 245-255 paying commercial customers in its portfolio. In the commercial segment, Palantir added an average of 28 customers each quarter in the last year, but growth has been slowing down in Q3’22, so I am a bit more careful with my projection here. If Palantir acquired 28 commercial customers in Q4’22, the company would report a customer count at the top-end of my guidance.

4. Palantir guided for $1.9B to $1.902B in revenues in FY 2022, implying a revenue growth rate of 23% year over year. I expect Palantir to meet (or slightly exceed) this guidance on a full-year basis due to strong execution in the commercial business.

5. Considering recent contract wins (as indicated above), I believe Palantir’s deal value could see growth in the low-teens on a full-year basis.

6. I expect Palantir to report $40-50M in free cash flow for Q4’22 which would result in full-year free cash flow somewhere between $172M and 177M. This means Palantir could be looking at a free cash flow margin of 9-10%. Anything above this margin level could be a strong catalyst for Palantir’s shares.

7. Palantir may or may not confirm its longer term annual revenue growth target of 30%. If it does, shares may also revalue higher.

Palantir’s valuation

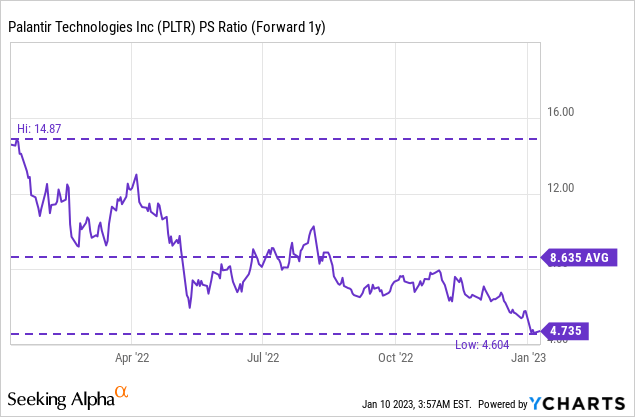

Palantir’s commercial revenue growth is decelerating which contributed to growing valuation pressure in 2022. Based off of sales, Palantir is valued at a P/S ratio of 4.7 X which is 46% below the average firm’s P/S ratio in the last year.

Risks with Palantir

The big risk for Palantir, as I see it, is that adoption of Foundry products could weaken in a recession environment which could put Palantir’s longer term annual revenue growth target of 30% at risk. Palantir has lowered its revenue target from 30% to 23% in FY 2022 and slowing top line growth in FY 2023 would likely be a strong reason for investors to sell their shares. Another risk factor relates to the company’s high SBC expenses which are preventing the software analytics company from reporting positive net income.

Final thoughts

As long as customer acquisition and deal value growth remained strong in Q4’22, I believe the software analytics firm has a good chance of seeing a valuation rebound in FY 2023. The commercial businesses is still growing rapidly and the software company is not that far away from achieving a 50% revenue share from the commercial segment.

If Palantir executed well in Q4’22, which I expect, than investors would have a strong justification to reconsider Palantir’s shares in FY 2023. If Palantir fails to meet expectations, then the stock could sharply revalue lower after earnings. Better than expected free cash flow, robust deal value growth and strong commercial customer acquisition in Q4’22 could be catalysts for Palantir’s shares next month. For those reasons, I believe Palantir remains a hold for now!