naveen0301/iStock via Getty Images

Investment Thesis

Ovintiv (NYSE:OVV) is an oil and natural gas company, with a remarkably unmemorable name. This is the type of company that Peter Lynch recommends, one that isn’t highly followed, because few people can even pronounce it.

The reason why I’m bullish on this name is that in the coming twelve months, I believe Ovintiv will return +12% of its market cap to investors.

Put simply, Ovintiv is committed to returning 50% of its free cash flow to shareholders and with a much better-hedged book, there’s ample upside in this cheap stock.

Energy Markets in 2023

There are a lot of misconceptions when it comes to energy. In the first case, there’s the erroneous fallacy facing natural gas. Many have been led to believe that our energy security issues have been solved by a few weeks of above-average warm weather.

I’m biased in my stance. However, objectively, we must keep in mind that natural gas is used not only for heating our homes but to provide year-round electricity.

For example, when there’s a heat wave in the summer, this will lead households to turn on their air conditioning. Hence, this will see a large surge in electricity. Particularly if heat waves become pronounced.

In fact, the same as the cold causes people discomfort, the heat can bring about serious complications. Other examples could be households increasingly seeking electricity to charge their EVs.

My point here is that just because at this moment in time natural gas prices are low, this does not mean that they’ll remain low for the coming months of 2023.

Next, oil demand isn’t going to go away. For example, in the past several days we’ve heard United Airlines (UAL) talk about the high demand for flights.

I highlight this example to demonstrate that even now, months after the ‘great reopening’, households are eager to get out and about. But my crucial point here is not only the high demand for flights in the US. But if we keep in mind the ‘great opening’ that we saw in the US after the lockdowns, but now extrapolate this to China.

In China, they’ve had nearly three years of lockdowns. Think about not seeing family members for three years. That’s going to create a massive increase in flights.

Put another way, the oil market may appear to be oscillating at a 6-month low, but this period had to embrace the SPR release as well as China’s lockdowns.

With both of these headwinds removed, we are going to see a dramatic shift in this supply-demand balance.

Ovintiv’s 60% Exposure to Oil

Part of the reason why OVV hasn’t gone anywhere in the past several months is that not many big funds can even pronounce this company’s name.

And beyond this, the fact that in 2022 this company was heavily hedged at horrible price points, would have removed this company from investors’ radars.

However, in 2023, its oil hedges don’t come into effect until $120 WTI (that’s a very high WTI price). And between the present $80 WTI price and $90 WTI, a lot of good things can happen to Ovintiv.

Capital Allocation Strategy, 50% Return to Shareholders

Consider what Ovintiv’s CFO Corey Code said on their earnings call,

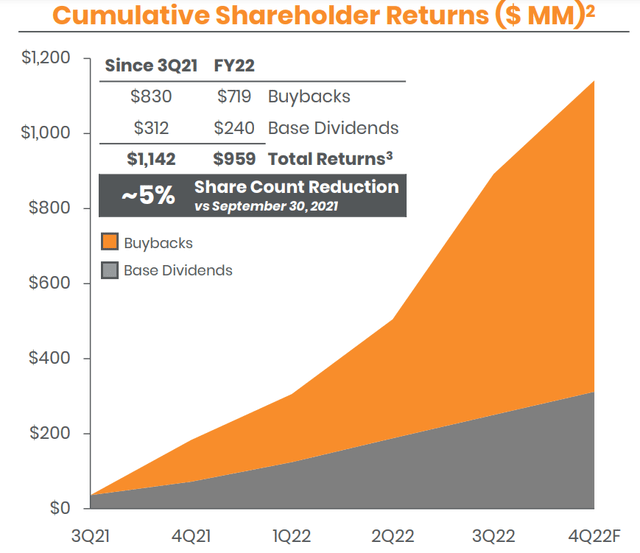

We announced in early July that our return of free cash flow to shareholders would increase from 25% to 50%.

[…] if the macro stays where it’s been recently, we’ll see significant cash returns and debt reductions next year, which could be a point at which we contemplate going above the 50%.

OVV’s management team is committed to returning 50% of its free cash flow to shareholders. And as I’ve already alluded to above, in 2022 its free cash flow was significantly reduced due to poorly priced hedges.

OVV presentation

I believe that in 2023, OVV could see around CAD$4 to CAD$5 billion in free cash flow. To put this figure into perspective, I believe that if OVV returns 50% of its free cash flow to investors in 2023, this could see investors receiving around 12% yield via buybacks and dividends.

The Bottom Line

No investment is without risks and OVV is no different. Even though I’m very bullish on energy, I was just as bullish in early 2022, and that didn’t translate into much, particularly after the summer.

That being said, when I compare the performance in energy with other areas of the market, I feel vindicated.

Put another way, I believe that paying a low multiple to free cash flow for energy stocks, such as OVV, provides investors with a large margin of safety.