Alex Domash, Lawrence H. Summers 13 April 2022

With US inflation reaching 7.9% in February 2022, the Federal Reserve moved to extend the federal funds charge by 0.25 share factors at its March assembly. The Federal Open Market Committee’s (FOMC) newest Abstract of Financial Projections (2022), launched on the identical assembly, tasks rates of interest to achieve 1.9% by the top of 2022. In response, there was a lot dialogue over the plausibility that the central financial institution can obtain a comfortable touchdown with out pushing the US financial system right into a recession.

Whereas engineering a comfortable touchdown is traditionally very uncommon, Fed Chair Jerome Powell informed lawmakers in early March that he believes attaining a comfortable touchdown is “extra probably than not” (Powell 2022). The FOMC’s March forecast (FOMC 2022), in addition to the consensus forecast from the Federal Reserve Financial institution of Philadelphia’s Survey of Skilled Forecasters (FRBP 2022), helps this declare: in each forecasts, inflation recedes to beneath 3% by 2023 and unemployment stays beneath 4%.

To look at the plausibility of the Fed’s forecasts, we have a look at quarterly knowledge going again to the Nineteen Fifties and calculate the chance that the financial system goes right into a recession throughout the subsequent 12 and 24 months, conditioning on various measures of inflation and unemployment. Our evaluation is motivated by the truth that overheating circumstances like low unemployment and excessive inflation are often adopted by recessions within the near-term. For instance, Fatas (2021) exhibits how the US financial system has by no means displayed vital durations of low and secure unemployment, reminiscent of these predicted by the FOMC.

Our central discovering is that given the present inflation of almost 8% and unemployment beneath 4%, historic proof suggests a really substantial probability of recession over the subsequent 12 to 24 months.

Historic proof suggests excessive chance of recession

Desk 1 exhibits the historic chance of a recession occurring throughout the subsequent one and two years, conditional on contemporaneous measures of CPI inflation and the unemployment charge. The outcomes point out that decrease unemployment and better inflation considerably enhance the chance of a subsequent recession. Traditionally, when common quarterly inflation rises above 5%, the chance of a recession over the subsequent two years is above 60%, and when the unemployment charge drops beneath 4%, the chance of a recession over the subsequent two years approaches 70%.

Since 1955, there has by no means been 1 / 4 with common inflation above 4% and unemployment beneath 5% that was not adopted by a recession throughout the subsequent two years.

Desk 1 Historic chance of a recession conditional on completely different ranges of CPI inflation and unemployment, utilizing knowledge from 1955-2019

The above outcomes don’t mirror our use of the CPI slightly than various inflation measures, or the usage of the unemployment charge slightly than various labour market tightness measures. Measuring labour market tightness with the job emptiness charge, which we have now advocated for in our prior work (Domash and Summers 2022), suggests a fair greater chance of recession over the subsequent 12 and 24 months. Equally, utilizing Core PCE inflation or wage inflation slightly than the CPI additionally yields the identical conclusions.

Some might argue that the historic knowledge introduced in these tables overstate the chance of recession, since there was a pattern in the direction of better enterprise cycle stability in latest many years. Motivated by this concern, and to make most use of accessible data, we use a probit mannequin to foretell the chance of a future recession based mostly on present financial circumstances and controlling for a time pattern.

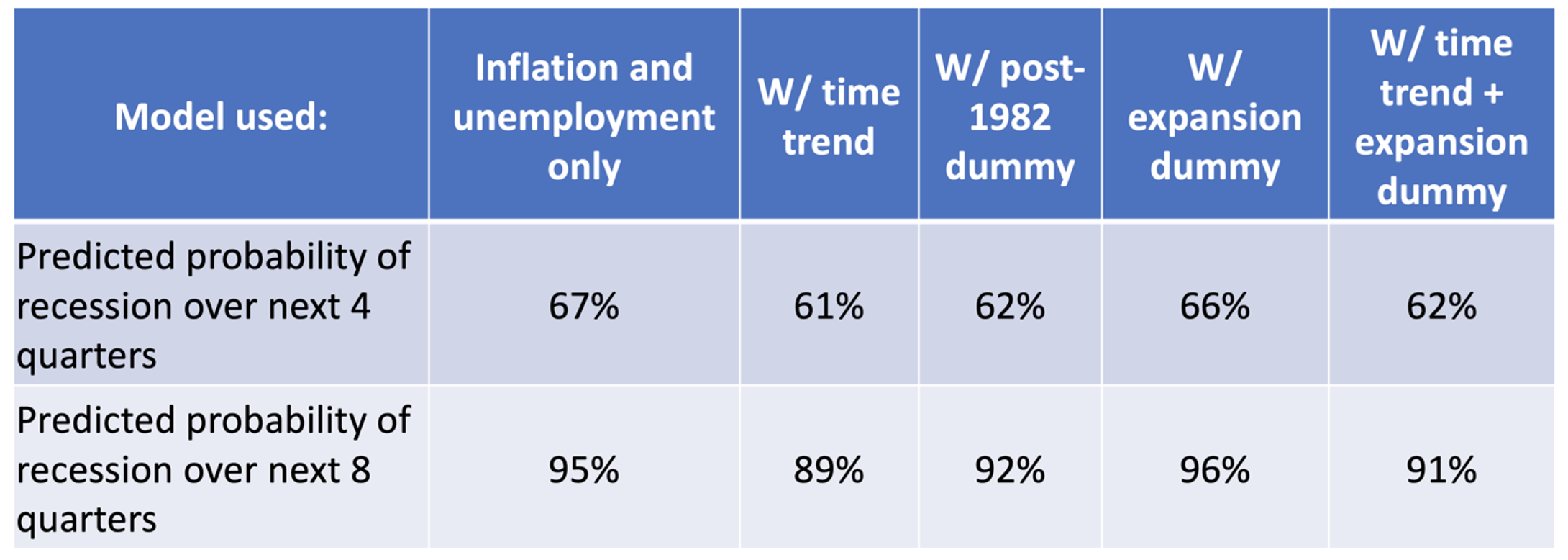

Desk 2 presents the outcomes from our probit fashions, exhibiting the expected chances of a recession occurring over the subsequent 12 and 24 months for 5 completely different mannequin specs. In our baseline mannequin, we use a four-quarter trailing common of inflation and a one-quarter lag of unemployment as our essential explanatory variables. To permit for the likelihood that recession chances have declined over time, we even have specs that embrace a time pattern (column 2) and a dummy for years after 1982 (column 3). We discover in our regressions {that a} pattern in the direction of better enterprise cycle stability doesn’t seem in any vital means as soon as one controls for financial circumstances. Lastly, we embrace a specification with a dummy for whether or not the financial system is greater than six-quarters into an financial enlargement (column 4), and with the time pattern and enlargement dummy (column 5).

Desk 2 Predicted chances of a recession occurring over the subsequent 12 and 24 months

These outcomes counsel a really excessive probability of recession within the coming years and are strong throughout many mannequin specs. Furthermore, the findings don’t mirror our selection to make use of the CPI because the inflation measure or the unemployment charge because the slack measure. Utilizing wage inflation, slightly than the CPI, ends in greater predictions of the chance of recession, and utilizing Core PCE inflation ends in related predictions. Changing the unemployment charge with the emptiness charge (which we consider to be a greater tightness indicator) additionally yields greater predicted chances of a recession over the subsequent years.

Total, the proof we current means that engineering a comfortable touchdown is a really tough factor to do in a quickly rising, inflation financial system.

Comfortable landings are traditionally unprecedented within the US

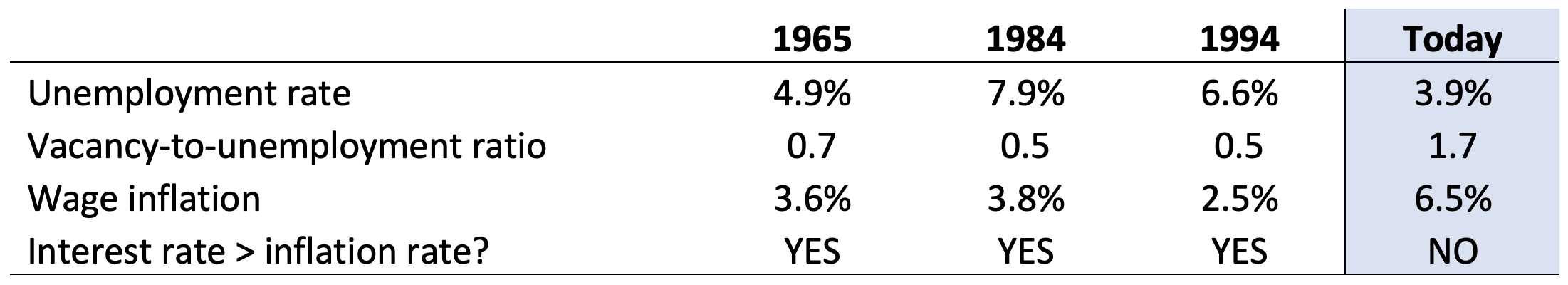

Some have argued that there are grounds for optimism on the idea that soft-ish landings have occurred a number of occasions within the post-war interval – together with in 1965, 1984, and 1994. We present, nevertheless, that inflation and labour market tightness in every of those durations had little resemblance to the present second. Desk 3 summarises the labour market circumstances throughout these alleged comfortable landings.

Desk 3 Labour market circumstances at the moment in comparison with previous durations

Observe: This desk makes use of quarterly averages from the primary quarter of the tightening cycle

In all three episodes, the Federal Reserve was working in an financial system with an unemployment charge considerably greater than at the moment, a vacancy-to-unemployment ratio considerably decrease than at the moment, and wage inflation nonetheless beneath 4%. In these historic examples, the Federal Reserve additionally raised rates of interest effectively above the inflation charge – in contrast to at the moment – and explicitly acted early to pre-empt inflation from spiralling, slightly than ready for inflation to already be extreme. These durations additionally didn’t contain main provide shocks reminiscent of these presently skilled within the US.

With inflation nearing 8% and unemployment beneath 4%, the Fed at the moment is means behind the curve, and now has to play catch-up to attempt to tame value will increase. Moderately than grounds for optimism, the historic expertise within the US is that slowing quickly accelerating inflation at all times results in substantial will increase in financial slack. Our conclusion echoes Ha et al. (2022), who argue that bringing inflation again to focus on probably requires a way more forceful coverage response than presently anticipated. Furthermore, not one of the calculations on this column accounts for the latest provide shocks related to the conflict in Ukraine, which is able to solely enhance the chance of recession even additional. We subsequently consider that the probability that the Fed achieves a comfortable touchdown within the financial system is low.

References

Domash, A and L Summers (2022), “How tight are US Labour Markets?”, VoxEU.org, 17 March.

Fatas, A (2021), “The short-lived high-pressure financial system”, VoxEU.org, 27 Oct.

Federal Open Market Committee (2022), “FOMC abstract of financial projections”, 16 March.

Federal Reserve Financial institution of Philadelphia (2022), “First quarter 2022 survey {of professional} forecasters”, Analysis Division, Federal Reserve Financial institution of Philadelphia. 11 February.

Ha, J, M A Kose, and F Ohnsorge (2022), “Right now’s inflation and the Nice Inflation of the Seventies: Similarities and variations”, VoxEU.org, 30 March.

Powell, J H (2022), “Home listening to on financial coverage and the state of the financial system”, Nationwide Cable Satellite tv for pc Company, 2 March.