WASHINGTON DC, Jan 31 (IPS) – Meeting our climate change goals will require massive investments in clean energy projects, in both advanced economies and across the Global South. But financing projects in the latter group of countries requires an increase in foreign capital inflows that will be constrained by currency exchange rate risk. Creating an innovative Exchange Rate Coverage Facility can help to overcome this constraint.

Over the coming two decades, annual energy emissions across the Global South (not counting China) are currently projected to grow by 5 Gt. Analysis by the International Energy Agency, the World Economic Forum and the World Bank shows that reversing this dynamic so as to meet the climate goals of the Paris Agreement, while also supporting the development needs of these countries, will require a four- to seven-fold increase in clean energy investments by 2030 from the current level of $150 billion.

Significantly, most of the needed clean energy projects provide domestic-oriented services (such as power from solar or wind power plants, public transit systems, building efficiency retrofit campaigns, electric vehicle charging stations). These generate local currency revenues.

Although much of the funding for these projects will come from domestic resources, the sheer magnitude of the required investment will necessitate significant amounts of foreign capital, potentially $180 billion or more per year by 2030.

Exchange rate risk (i.e., the potential that the local currency devalues relative to the foreign currency loan or other investment) is a major impediment to mobilizing large foreign capital flows for these projects (albeit, not the only one).

This risk translates into many problematic impacts. Notably, it increases the cost of capital, raises the financial liabilities of domestic stakeholders as their local currency depreciates, and, perhaps most significantly, constrains the level of foreign investment.

While currency hedging and other options exist (including specialized programs for developing countries), they can be expensive and are lacking for many Global South currencies, particularly at the long tenors, low cost and large scale required to support many clean energy investments.

If this currency risk cannot be overcome, it will be impossible to mobilize the level of foreign capital inflows that developing countries require to grow their energy systems with a low-emissions trajectory. This poses risks for both rich and poorer countries in the global effort to lower greenhouse gas emissions.

What to do to address this impediment? We propose an Exchange Rate Coverage Facility (ERCF), a blended-finance vehicle that would be funded by a combination of host country stakeholders, multilateral/bilateral development and climate agencies, and climate-engaged international capital.

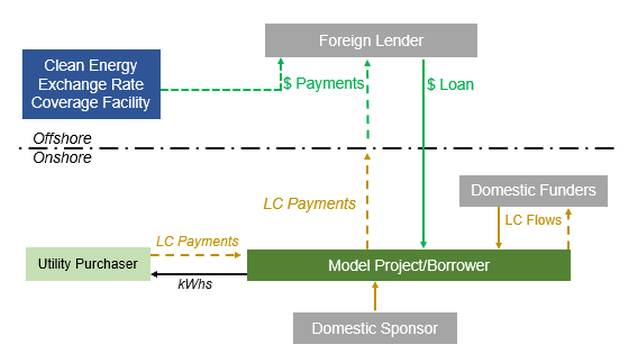

The ERCF would be established as an offshore facility to absorb currency exchange risk on its balance sheet. It would issue guarantees protecting international lenders against this risk (see figure 1), while in parallel helping to insulate domestic sponsors from it. The Facility would pay any and all shortfalls between the value of contracted local currency (LC) payments and foreign currency (FC) debt repayments if the local currency (LC)depreciates relative to pre-defined exchange rate .

Under our proposed financing structure, the Facility would be a “blended finance” vehicle funded by the following :

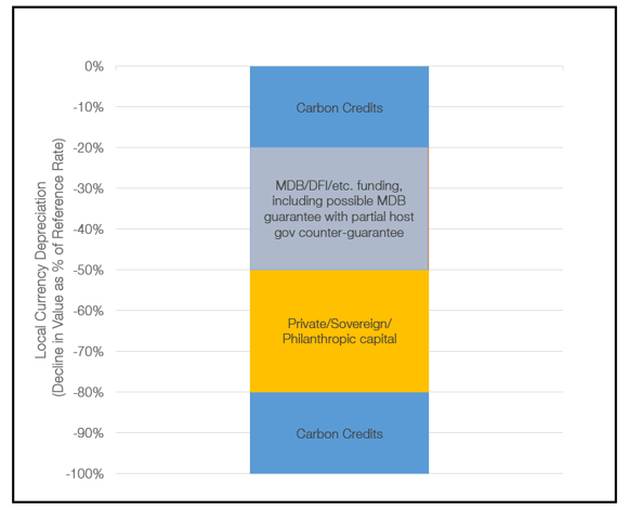

(i) carbon credits generated by the clean energy project that are assigned to the Facility, which would cover “first loss”;

(ii) multilateral development banks (including guarantees counter-guaranteed by host countries), development finance institutions and other development/climate agencies, providing funding for defined subsequent losses; and

(iii) international capital, including philanthropies, sovereign wealth funds, and interested private institutions, covering “third loss”.

A fuller description of this facility is set out in the report: “Scaling Clean Energy Through Climate Finance Innovation: Structure of an Exchange Rate Coverage Facility for Developing Countries.”

The Facility could generate multiple benefits:

(i) catalyzing additional foreign financing for clean energy projects in developing countries;

(ii) lowering exposure of local project stakeholders to currency exchange rate shifts, thereby reducing prospect of tariff increases if the LC depreciates;

(iii) reducing the cost of foreign financing to clean energy projects;

(iv) facilitating scalability of coverage;

(v) supporting the growth of carbon credits projects and markets;

(vi) enabling funders to leverage financial impact through blended-finance structure; and

(vii) flexibility to include specialized windows (e.g., country-specific programs, including under the Just Energy Transition Partnerships being discussed with South Africa, Indonesia, Vietnam and others).

To mobilize international capital flows in the magnitude required to achieve the dual objectives of sustained development and low emissions, there is a need for new financial tools.

The proposed blended-finance ERCF is being incubated as a solution to address currency exchange risk as part of the initiative on Mobilizing Investments for Clean Energy in Emerging Economies. Its proponents welcome interested organizations and individual experts to join forces on the implementation of a pilot Facility to facilitate increased funding for the global clean energy transition.

Authors: Philippe Benoit, Adjunct Senior Research Scholar, Center on Global Energy Policy, Columbia University; Jonathan Elkind, Senior Research Scholar, Center on Global Energy Policy, Columbia University; Justine Roche, Energy Initiative Lead, World Economic Forum

This piece was first published by the World Economic Forum

© Inter Press Service (2023) — All Rights ReservedOriginal source: Inter Press Service