ssucsy/iStock Unreleased through Getty Photos

Introduction

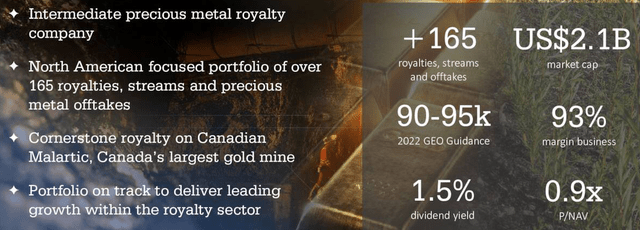

Montreal-based Osisko Gold Royalties (NYSE:OR) launched the primary quarter of 2022 outcomes on Could 12, 2022.

Essential Observe: I’ve adopted OR quarterly since 2018 with 16 articles and counting. This new article is a quarterly replace of my article revealed on January 26, 2022. All numbers indicated on this article are transformed into US$

Osisko Gold Royalties owns 70% of Osisko Improvement Corp. Because of this, the belongings, liabilities, outcomes of operations, and money flows of the Firm consolidate the actions of Osisko Improvement and its subsidiaries.

Additionally, After Bermuda growth acquired 100% of Tintic Consolidated Metals LLC, Osisko Bermuda Ltd. entered a non-binding metals stream time period sheet with a wholly-owned subsidiary of Osisko Improvement.

1 – 1Q22 Outcomes snapshot

Internet earnings attributable to Osisko’s shareholders had been US$1.42 million or US$0.01 per share; adjusted earnings had been US$18.22 million or $0.11 per primary share.

One unfavourable ingredient for shareholders is that the corporate initiated a purchased deal of 18.6 million shares at $13.45 for $250.2 million.

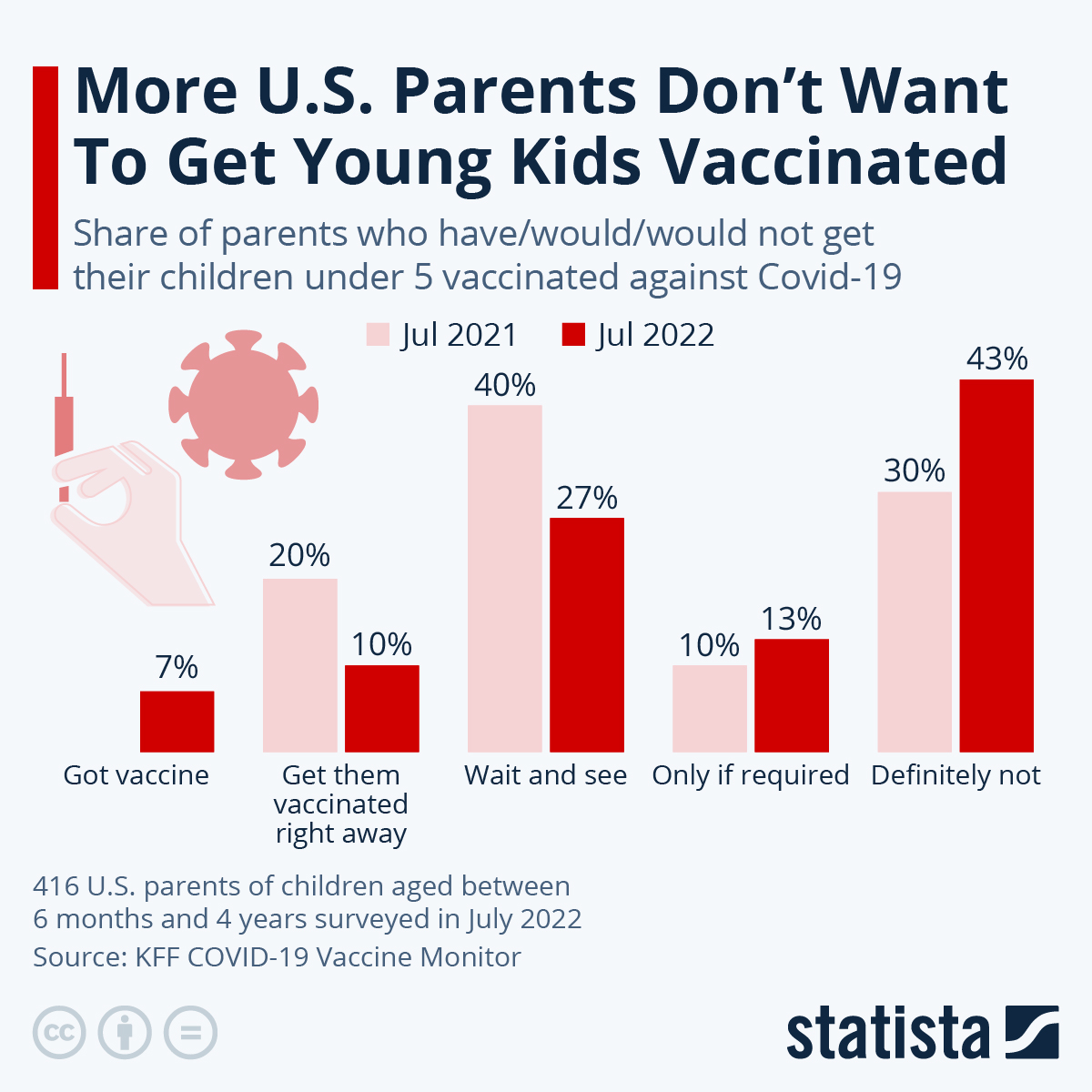

OR 1Q22 Highlights (Osisko Gold Royalties)

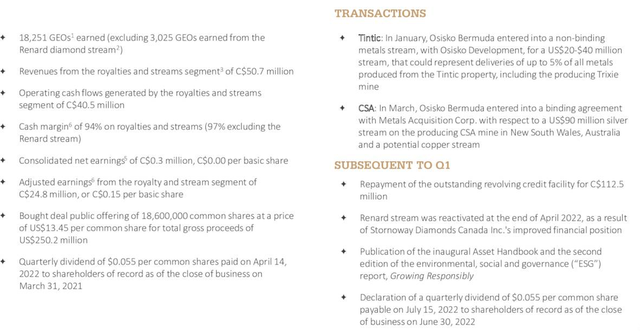

2 – Inventory efficiency

Osisko Gold Royalties belongs to the 5 streamers I usually cowl on Looking for Alpha.

My long-term streamers are Wheaton Valuable Metals (WPM) and Franco-Nevada (FNV). I contemplate the corporate a great various within the streamer phase, particularly for many who need to commerce the sector brief time period. We are able to evaluate OR positively with Sandstorm Gold (SAND).

OR is underperforming the group and is now down 25% yearly, beating solely SAND.

Osisko Gold Royalties – Financials And Manufacturing In 1Q22 (in US$)

Observe: Values can differ barely as a result of conversion from CAD to USD. Osisko Gold Royalties signifies CAD$ outcomes with an trade fee (CAD vs. USD) of 0.79 in 1Q22. It’s what I utilized to the desk beneath.

| Osisko Gold Royalties | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Whole Revenues (included off-take curiosity) in US$ Million | 53.24 | 46.85 | 39.49 | 39.59 | 46.92 |

| Internet Earnings in US$ Million | 8.4 | -12.1 | 1.4 | -16.55 | 0.26 |

| EBITDA US$ Million | 25.1 | -2.8 | 13.7 | -9.95 | 16.76 |

| EPS diluted in US$/share | 0.05 | -0.07 | 0.01 | -0.10 | 0.00 |

| Working money move in US$ Million | 17.0 | 25.3 | 32.4 | 9.98 | 18.65 |

| Capital Expenditure in US$ Million | 31.5 | 76.0 | 63.7 | 49.22 | 17.63 |

| Free Money Move in US$ Million | -14.5 | -50.7 | -31.3 | -39.24 | 1.02 |

| Whole Money US$ Million | 257.85 | 211.43 | 119.92 | 90.39 | 357.35 |

| Lengthy-term Debt in US$ Million | 319.25 | 328.93 | 319.87 | 320.65 | 327.30 |

| Dividends per share are US$ | 0.038 | 0.038 | 0.038 | 0.044 | 0.044 |

| Shares excellent (diluted) in Million | 167.17 | 167.90 | 168.22 | 167.15 | 185.9* |

| GEOs | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Estimated Manufacturing gold equal Oz Eq. | 19,960 | 20,178 | 20,032 | 19,830 | 18,251 |

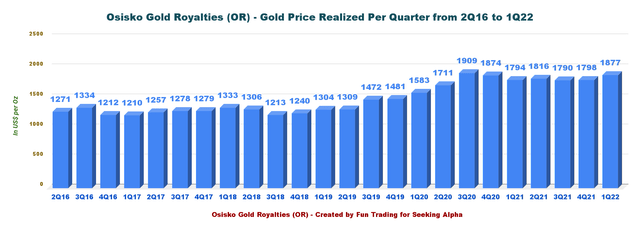

| Gold value realized in US$ per ounce | 1,794 | 1,816 | 1,790 | 1,798 | 1,877 |

| Silver value realized in $US per ounce | 26.26 | 27.00 | 24.00 | 23.51 | 24.01 |

Supply: Firm launch. Extra information can be found to subscribers solely.

* Osisko Improvement closed personal placements for mixture gross proceeds of roughly $251 million throughout the quarter. So far, the corporate has acquired gross proceeds of $42.4 million. The rest of the funds are held in escrow and will probably be launched upon sure situations, together with completion of the itemizing of the frequent shares on the New York Inventory Trade and shutting of the Tintic acquisition

Evaluation: Revenues, Earnings Particulars, Free Money Move, Debt, And Manufacturing Particulars (in US$)

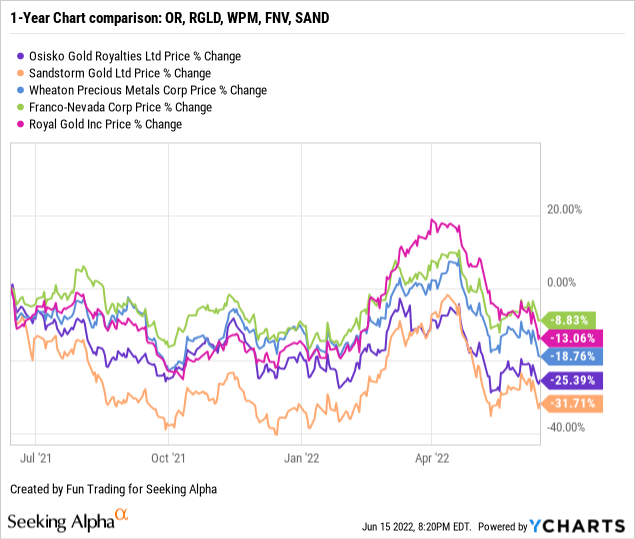

1 – Revenues had been US$46.92 million in 1Q22 (together with revenues from offtake pursuits).

OR Quarterly Revenues historical past (Enjoyable Buying and selling)

Osisko Gold Royalties posted revenues of US$46.92 million within the first quarter of 2022, down from US$53.24 million in the identical quarter a yr in the past.

On a consolidated foundation, web revenue for the primary quarter was US$0.26 million, in comparison with US$8.40 million within the 1Q21. The adjusted earnings had been US$17.2 million or US$0.12 per share.

Money working margin was 94% from royalty and stream pursuits. The corporate owns over 165 royalties, streams, and offtakes.

OR 1Q22 necessary information Presentation (Enjoyable Buying and selling)

CEO Sandeep Singh mentioned within the convention name:

So we proceed to profit from our enterprise mannequin with the best money margins in our historical past final quarter, clearly primarily based on the gold value having been fairly sturdy. The margin at 94%, once more, continues to trace precisely in direction of our steering.

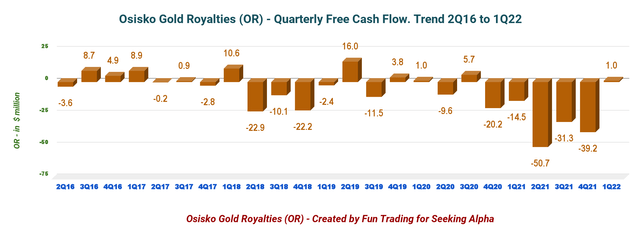

2 – Free money move was a lack of US$1.02 million in 1Q22

OR Quarterly Free money move historical past (Enjoyable Buying and selling)

Observe: The generic free money move is the money from working exercise minus Capex.

Free money move for the primary quarter of 2022 was $1.02 million, with a trailing 12-month free money move lack of $120.23 million.

Osisko additionally introduced a first-quarter 2022 dividend of C$0.05 or US$0.044 per frequent share. OR acquired in 1Q22 250K shares below the corporate’s NCIB program for C$ 4.9 million.

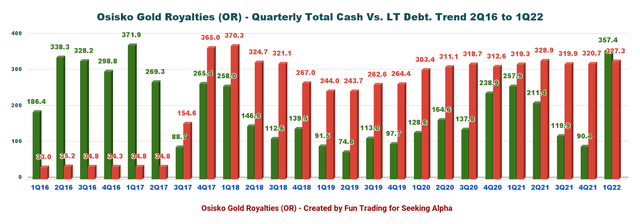

3 – No Internet debt in 1Q22

OR Quarterly money versus Debt historical past (Enjoyable Buying and selling)

No extra Internet debt this quarter, with a complete money place of $357.35 million and complete debt of $327.30 million in 1Q22.

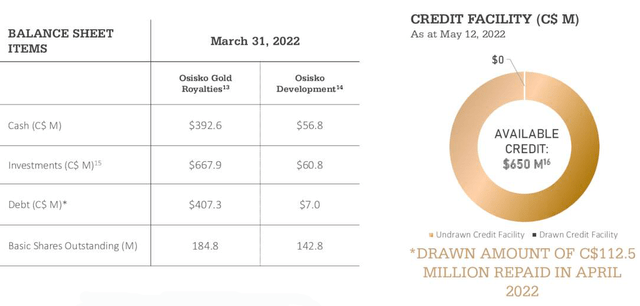

Under are the small print (in CAN$):

OR Liquidity (Osisko Gold Royalty)

The huge enhance in money was as a result of purchased deal of 18.6 million shares offered at $13.45 for complete proceeds of $250.2 million. The shares excellent diluted are estimated at 185.9 million.

After 1Q22, OR repaid in filled with the excellent revolving credit score facility in April 2022 for $112.5 million and has now a C$650 million in liquidity.

4 – Manufacturing in gold equal ounce and particulars

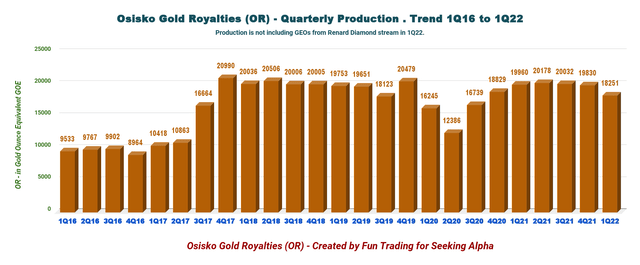

OR Quarterly Gold Equal Historical past (Enjoyable Buying and selling)

Osisko Gold Royalties produced 18,251 GEOs (excluding 3,025 GEOs from Renard) within the first quarter of 2022, down 8.6% from 1Q21 and eight% sequentially.

Gold value elevated this quarter to $1,877 per oz, and silver was $24.01 per ounce.

OR Quarterly gold value per GEO historical past (Enjoyable Buying and selling)

5 – Steerage 2022 and Odyssey mission.

The corporate expects between 90K and 95K GEOs in 2022.

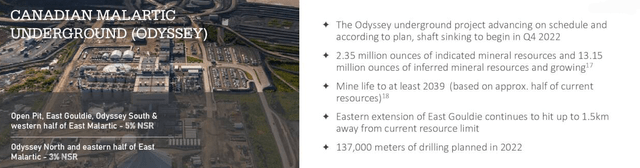

Additionally, on the Canadian Malartic underground, additionally referred to as Odyssey, the shaft sinking is scheduled to start in 4Q22.

OR: Odyssey mission at Canadian Malartic 3% NRI (Osisko Gold Royalties)

Technical Evaluation and Commentary

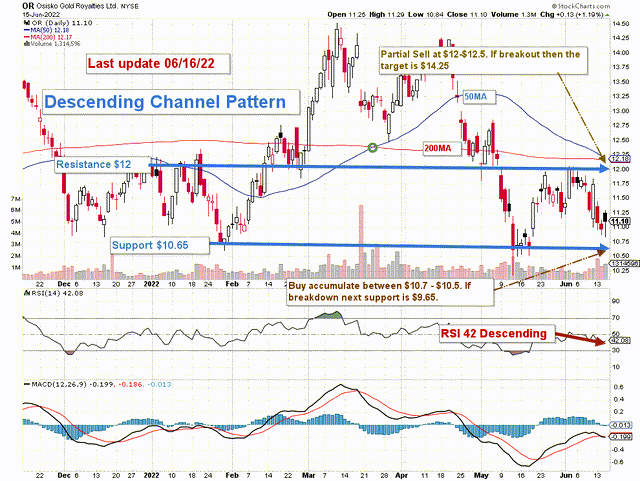

OR: TA Chart short-term (Enjoyable Buying and selling)

The inventory OR types a descending channel sample with resistance at $12 and help at $10.65.

The short-term buying and selling technique is to commerce LIFO about 60%-65% of your place. I recommend promoting between $12 and $12.5 and ready for a retracement beneath $10.65 to build up once more with potential decrease help at $9.50.

If the gold value loses momentum and crosses $1,800 per ounce, relying on the inflation risk, and after the FED hiked by 75-point this month, OR could break down and retest $9.50.

Conversely, if inflation will get stronger and the FED’s motion is just not producing the specified impact, the gold value might ultimately strengthen and attain $1,900 per ounce. On this unlikely case, OR might attain $14.25.

Watch gold like a hawk.

Observe: The LIFO methodology is prohibited below Worldwide Monetary Reporting Requirements (IFRS), although it’s permitted in america by Usually Accepted Accounting Rules (GAAP). Due to this fact, solely US merchants can apply this methodology. Those that can’t commerce LIFO can use another by setting two completely different accounts for a similar inventory, one for the long-term and one for short-term buying and selling.

Warning: The TA chart should be up to date ceaselessly to be related. It’s what I’m doing in my inventory tracker. The chart above has a doable validity of a couple of week. Bear in mind, the TA chart is a device solely that will help you undertake the proper technique. It’s not a approach to foresee the long run. Nobody and nothing can.

Writer’s observe: In the event you discover worth on this article and wish to encourage such continued efforts, please click on the “Like” button beneath to vote for help. Thanks.