Moment Makers Group

Shares of cancer resistance concern ORIC Pharmaceuticals, Inc. (NASDAQ:ORIC) have seen huge gains since late October 2023, after it released promising initial data from its ORIC-114 program. The brain-penetrant candidate induced multiple partial responses in NSCLC patients, including a complete response in one who had treatment-naïve brain metastases in a Phase 1b study. With a recent private placement providing funding into 2H26 and two other early-stage programs in the clinic, this clinical stage biotech firm merited a deeper dive. An analysis follows below.

Seeking Alpha

Company Overview:

ORIC Pharmaceuticals, Inc. is a South San Francisco based early clinical stage biopharmaceutical concern focused on the development of therapies that counter resistance mechanisms in cancer; hence, the acronym ORIC: Overcoming Resistance in Cancer. The company has three programs in the clinic that leverage its expertise in hormone-dependent cancers, precision oncology, and key tumor dependencies. ORIC was formed in 2014 and went public in 2020, raising net proceeds of $125.2 million at $16 per share. The stock trades just below $14.00 a share, translating to an approximate market cap of just over $900 million.

Cancer Resistance

Thanks, in large measure to small breakthroughs (seemingly on an annual basis), the U.S. death rate from cancer has fallen 33% from 216.0 deaths per 100,000 in 1990 to 143.8 deaths per 100,000 in 2020. That said, ~600,000 Americans still die from cancer every year. A negative factor in the ongoing struggle with the disease is its ability to resist. Like a healthy cell, the cancer cell is equipped with survival mechanisms designed to evade attempts to kill it. ORIC is focused on three of these processes: innate resistance, where the body’s immune response to tumor cells is inadequate; acquired resistance, where cancer cells respond to treatment by inducing or enriching an oncogenic driver that promotes tumorigenesis; and bypass resistance, where a whole new signaling pathway is activated in response to treatment.

Pipeline

Leaning into its expertise in the area of cancer resistance, the company is advancing three early-stage clinical candidates that have all recently produced data.

Company Website

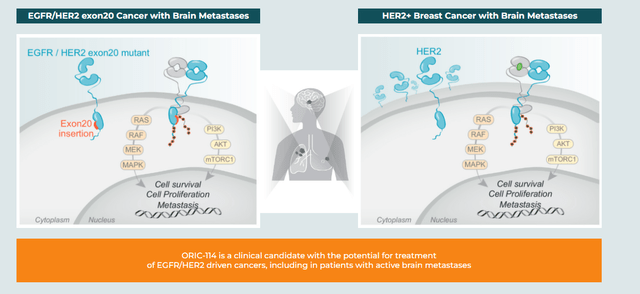

ORIC-114. The first was ORIC-114, an oral, brain-penetrant, irreversible inhibitor designed to target epidermal growth factor receptor (EGFR) and human epidermal growth factor receptor 2 (HER2) cancers with a high potency against exon 20 insertion mutations. To be sure, there were two approved EGFR exon 20 insertion mutation therapies until Takeda (TAK) was compelled to remove Exkivity (mobocertinib) from the U.S. market in October 2023 after its confirmatory trial (post-accelerated approval) failed to meet its primary endpoint. That development left Johnson & Johnson’s (JNJ) Rybrevant (amivantamab) as the only such remaining NSCLC therapy. However, it has shown poorly in the one-third of cases involving active brain metastases due to its inability to cross the blood-brain barrier.

Company Website

After demonstrating promise in the preclinic, ORIC-114 is undergoing evaluation in a Phase 1b study in heavily pre-treated patients with advanced solid tumors (predominantly non-small cell lung cancer (NSCLC)) with EGFR and HER2 exon 20 alterations or HER2 amplifications, including those with central nervous system (CNS) metastases.

Initial returns were encouraging with all three EGFR exon 20 patients dosed at 75mg demonstrating tumor shrinkage, including a complete response (CR) in a patient with untreated brain metastases at baseline. HER2 exon 20 patients experienced multiple partial responses including one that would have been a CR if not for persistence in non-targeted lesions. The safety profile was termed ‘favorable’ with a maximum tolerated dose not reached. Released on October 21, 2023, the market was slow to react to the news, with shares of ORIC actually trading 4% lower to $5.46 in the subsequent trading session.

Dose expansion will continue in multiple cohorts with a trial update anticipated in 1H25.

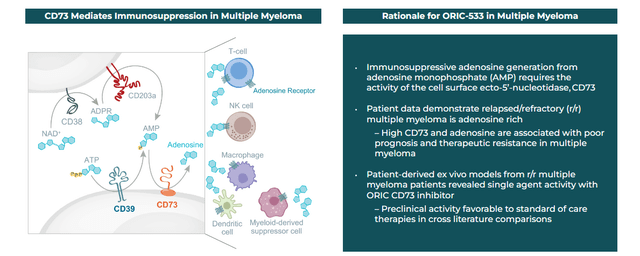

ORIC-533. The next compound to produce clinical results was ORIC-533, an oral inhibitor of CD73, which is crucial player in the adenosine pathway – believed to play a key role in chemotherapy and immunotherapy resistance. Initial returns from a dose escalation Phase 1b trial in multiple myeloma patients who were refractory to at least three lines of therapy were tepid, although no dose limiting toxicities or serious treatment-related adverse events were observed. Patients dosed at > 1200mg demonstrated increased CD8+ T cells and natural killer cells, while patients at 1600mg showed reductions in B-cell maturation antigen (BCMA) serum levels, a predictive marker of progression free survival.

Company Website

Concurrent to the data release in December 2023, management indicated ORIC-533 would make an “ideal” candidate in combination with other immune-based antimyeloma therapies and that it would pursue partnerships to that end after it completes the dose escalation portion of its current study, which should occur in 1H24. It supposedly has one with Pfizer (PFE) – more on that below. That said, there are 17 other clinical programs pursuing CD73 inhibition, although only one other that is orally administered.

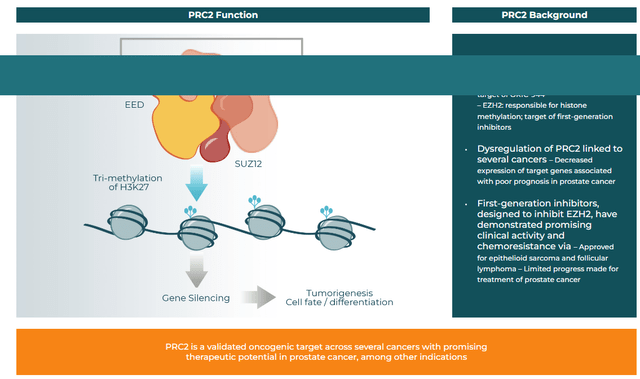

ORIC-944. Last to report was ORIC-944, an allosteric inhibitor of the polycomb repressive complex 2 (PRC2) via the embryonic ectoderm development (EED) subunit. It is designed to address innate resistance related to PRC2 dysregulation in a wide range of cancers, including prostate, breast, and hematological malignancies. Specifically, PRC2 decreases the expression of certain genes, making their targeting by therapies challenging. By attacking its EED subunit, ORIC endeavors to knock out many functions of PRC2, resulting in better targeted gene expression.

Company Website

Initial Phase 1b data from a metastatic prostate cancer study were released in early January 2024, with ORIC-944 demonstrating a half-life above ten hours, superior to other PRC2 inhibitors and supportive of once daily dosing. From an efficacy standpoint, it significantly lowered H3K27me3 levels – a marker downstream of PRC2 – at dosages as low as 200mg QD, suggesting clinical advancement in combination with androgen receptor inhibitors for prostate cancer. Such a trial is expected to commence in 1H24.

Collaborations

Both ORIC-114 and ORIC-944 came through in-licensing agreements.

The former came from Voronoi, who received $5 million cash and (at that time) $8 million of stock (283,259 shares @ $28.24 per) upfront. It is also eligible to collect up to $335 million of development, regulatory, and commercial milestones, as well as undisclosed royalties on ORIC-114. If ORIC pursues a second licensed product, the milestone payments on that one could reach $272 million.

ORIC-944 came courtesy of Mirati Therapeutics (MRTX) in 2020, after ORIC issued 588,235 shares of its stock at $34 a share, for a total consideration of $20 million. ORIC is not on the hook for milestone or royalty payments.

Additionally, Pfizer made a $25 million investment in ORIC in December 2022, purchasing 5.38 million shares at $4.65 per as part of a potential Phase 2 study encompassing ORIC-533 in combination with elranatamab, the investor’s investigational BCMA CD3-targeted bispecific antibody for the treatment of multiple myeloma. That trial may not come to pass as it was not specifically mentioned in the company’s upcoming milestones, which were part of its corporate update of January 8, 2024. Either way, Pfizer’s investment in the once fashionable name is looking very smart.

Share Price Performance

ORIC was a borderline blistering hot IPO in April 2020, priced at $16 with its opening trade at $26 during the uncertainty of the pandemic. Shares of ORIC peaked at $40.81 in December 2020 and cratered 94% to $2.36 by November 2022, when it was trading at an eye-opening 57% discount to balance sheet cash and investments. This gaping markdown was a function of the failure of its glucocorticoid receptor antagonist and then lead candidate ORIC-101 to demonstrate any meaningful efficacy against solid tumors in two Phase 1b studies, with the program shutting down in March 2022. Since the release of the ORIC-114 data in October 2023, its stock is up more than 100%.

Balance Sheet & Analyst Commentary:

The steady and substantial climb in share price permitted ORIC to conduct a less dilutive private placement on January 22, 2024, in which it raised gross proceeds of $125 million at $10 per share. When added to YE23 cash and investments of ~$235 million, the company has approximately $350 million in cash and marketable securities, which should provide the company an operating runway into 2H26.

Since the company posted its Q4 numbers on March 11th, five analyst firms including Oppenheimer, JP Morgan and Wedbush have reissued Buy ratings on the stock. Price targets proffered range from $17.00 to $25.00 a share.

Verdict:

ORIC appears to have something in ORIC-114. Assuming it does, HER2 exon 20 insertion mutations are observed in ~1.5% of all NSCLC patients; the number for EGFR exon 20 mutations is 2%. In 2023, 238,340 patients were diagnosed with lung cancer. NSCLC accounts for 81% of all lung cancers. That places the domestic opportunity at a fairly small ~6,800 annually. Obviously, it could have a much broader (and potentially global) application and yearly diagnoses don’t account for those who are currently living with the disease and were diagnosed more than 12 months prior. Still, it is a limiting factor of which to be mindful.

As for the other two clinical assets: Pfizer’s investment notwithstanding, ORIC-533 has not yet differentiated itself amongst the dozen and half CD73 inhibitors and data from ORIC-944 is too scant to make any informed decision.

As such, with no new data from ORIC-114 due until 1H25, ORIC appears more than fairly priced at a market cap of ~$560 million net of cash. Therefore, the recommendation is not to chase the rally that has seen the stock climb approximately 150% since its lows of late October.