Cristi Croitoru

Funding Thesis

Oracle (NYSE:ORCL) is again on the entrance foot, with fiscal Q1 2025 delivering eye-popping steering. Arguably, its RPO determine being up 53% y/y stole the limelight for this quarterly report.

However past that, there was a ”well-argued” narrative that Oracle’s cloud providing is now the most important a part of its total enterprise and rising quickly.

All in all, this makes paying 22x subsequent 12 months’s non-GAAP EPS a beautiful valuation and worthwhile contemplating. Let’s soar to it.

Oracle’s Close to-Time period Prospects

Oracle is a world expertise firm that gives a variety of services and products to assist companies enhance their operations. Its key choices embrace cloud infrastructure (”OCI”) and databases which cater to varied industries.

Oracle’s improvements purpose to boost enterprise productiveness and effectivity, incorporating superior options reminiscent of embedded AI. The corporate’s partnerships with main cloud suppliers like AWS, Google Cloud, and Microsoft Azure additional develop the attain of its cloud providers, significantly its famend Oracle Database.

Oracle’s fiscal Q1 2025 cloud enterprise has proven robust progress, with its complete cloud income up by 22% within the quarter, pushed by each its SaaS and IaaS segments.

Cloud database providers grew 23%, whereas OCI consumption income surged by 56%. The corporate’s cloud remaining efficiency obligation (”RPO”), a number one measure of future income, grew greater than 80%, reflecting sturdy demand for longer-term cloud contracts, whereas its complete RPO was up 53% y/y.

What’s extra, Oracle famous within the earnings name its formidable plans to double its capital expenditure to satisfy growing demand and develop its cloud areas globally, pointing to sustained near-term cloud progress and powerful prospects.

Nonetheless, Oracle faces vital competitors within the cloud area from giants like AWS, Google, and Microsoft, particularly as these corporations additionally improve their cloud choices.

The decrease margins related to its OCI enterprise, though bettering with time is anticipated to dampen Oracle’s near-term profitability margins versus its conventional legacy choices.

Moreover, Oracle’s speedy progress in demand has led to provide constraints, which the corporate is addressing by way of elevated automation and bigger knowledge middle buildouts, however these logistical points nonetheless characterize a key headwind and are costly to roll out.

Given this balanced background, let’s now focus on its fundamentals.

Oracle Guides for At Least Double-Digits

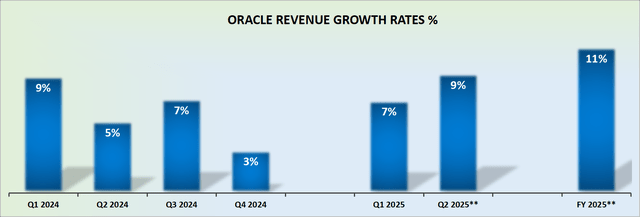

ORCL income progress charges — writer’s graphic

Oracle is now not a fast-growing firm. And that is the attraction of this setup. It is a firm that was perceived by buyers to easily be ticking alongside.

What buyers did not count on to see is that Oracle’s RPO elevated by 53% y/y, with 38% of its RPO being acknowledged within the subsequent twelve months.

This allowed Oracle to confidently information that it will develop by a minimum of double digits within the subsequent twelve months.

Individually, I’ve implied this to imply round 11% topline progress, however I would not be stunned to see that the determine that finally will get reported is increased than this.

Given this renewed progress price, let’s now take into consideration its valuation.

ORCL Inventory Valuation — 22x Subsequent Yr’s Non-GAAP EPS

As an inflection investor, you could at all times have a agency grasp of an organization’s steadiness sheet. Oracle holds about $75 billion of web debt. For me, this consideration retains me out of this identify. Even when I am bullish on an organization, what stops me most often is the form of its steadiness sheet. I prefer to spend money on corporations the place their steadiness sheet is an asset and never a legal responsibility to the funding thesis.

That being stated, there’s nonetheless loads to love about Oracle. Working example, the high-end of fiscal Q2 2025 EPS steering (as reported), is anticipated to be up 12% y/y to almost $1.50.

Given Oracle’s momentum, along with the $1.39 of non-GAAP EPS simply reported, this provides the sense that Oracle’s non-GAAP EPS this 12 months may attain near $6.35 per share, which is increased than analysts’ present estimate of $6.27 non-GAAP EPS per share.

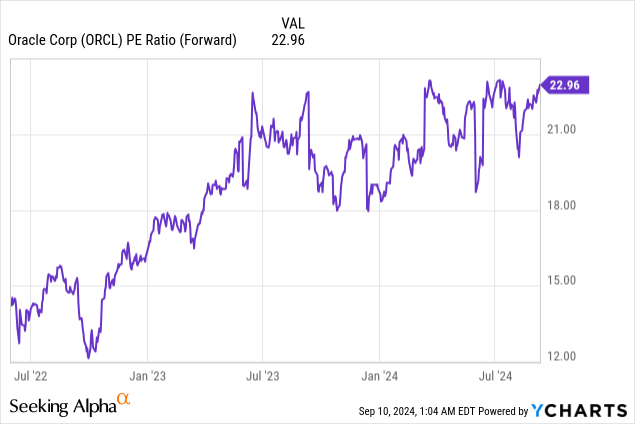

Consequently, which means that buyers are being requested to pay round 24x this 12 months’s non-GAAP EPS.

Now, if we presume that as Oracle’s non-GAAP EPS continues to develop at 11% y/y into subsequent 12 months, this might put Oracle on a path in the direction of $7.05 of non-GAAP EPS. In sum, this leaves Oracle priced at 22x subsequent 12 months’s non-GAAP EPS.

Now, astute readers could be fast to opine, that is largely the identical a number of that Oracle has been buying and selling at for a while, see beneath. What is the upside then?

This is the factor, Oracle is now rising its topline at a faster tempo than buyers beforehand anticipated. So, you get a extremely worthwhile enterprise, that’s well-positioned within the rising cloud sector, and with extra progress than anticipated. That is usually a really enticing setup that’s value pondering contemplating.

The Backside Line

Paying 22x subsequent 12 months’s non-GAAP EPS for Oracle is a compelling funding as a result of the corporate has firmly positioned itself as a significant participant within the quickly increasing cloud sector.

With double-digit progress, a surge in its cloud enterprise, and strategic partnerships with business giants like AWS, Google, and Microsoft, Oracle is on a transparent path to sustained income and earnings enlargement. Whereas Oracle’s steadiness sheet does carry round $75 billion in web debt, the corporate’s operational momentum and improved cloud margins make this valuation affordable, significantly as demand continues to outstrip provide.