OPIXTECH OVERVIEW

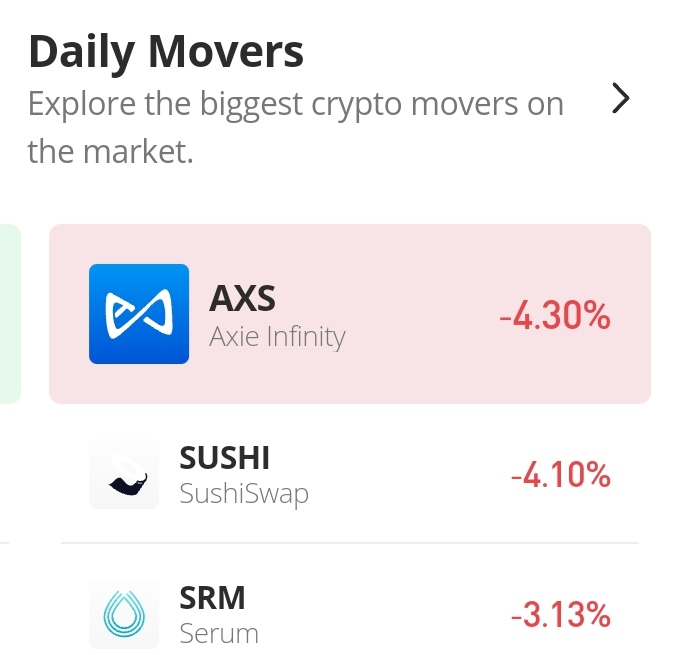

(1) Forex rebate strategic trading | Transparency | High lot rebates

The company use 3 Accounts mechanism with Transparent and Standardized subscription model.

(a) Capital Account – Investor deposit account

(b) Rebate Account – Rebates profit account

(c) PAMM Account – Trades monitoring account

Subscribe to Opix Algo, you will be given three accounts, one fund account, to make money in the foreign exchange market through Raynar Prime; one rebate account, as the designated account for receiving rebate profits; one PAMM account, completely transparent to observe transaction records and real-time transactions .

(2) In-Depth Trading Strategy, No Directional Risk, Automatic Position Opening and Closing

The company looks for the demand for the order book through the data of liquidity providers to complete low-cost (low spread) two-way transactions. Long EUR/USD 50 lots, short EUR/USD 50 lots. At this time, the company’s management account, both orders are in a floating loss situation. Yet there is no market risk of skyrocketing or bottoming out. The company’s entry conditions are already set by mathematical models, and the worst result is a loss of 10 spreads. The best entry result is a flat spread +-0 pips. It is not excluded that the optimal result is that the profit has been made by >1 pips when entering the market.

(3) Flat exit, earn rebate profits, and stimulate the efficient market

In the next step, the company’s algorithm will continue to observe and calculate the demand for the order book, and close the two orders on hand separately at the time of the volume shock, with the goal of closing the floating loss in the PAMM account. The results are as follows.

A: long and short EUR / USD, total loss of 10 pips, total rebate of 8 pips (algorithm did not work, both orders are entered with the default spread, minus the rebate, equivalent to a loss of 2 pips)

B: long and short EUR / USD, total profit and loss of 0 pips, total rebate of 8 pips (algorithm works normally, the profit and loss of the two orders are even, which is equivalent to the earnings of 8 points of rebate without loss)

C: long and short EUR/USD, total profit of 10 pips, total rebate of 8 pips (market conditions are excellent, two orders are profitable, equivalent to the principal protection, improve the amount of capital of the algorithm operating account, the investor resolutely earned 8 pips of rebate.)

(4) Intraday trading, no overnight rates, +-20 trade orders completed daily

By trading intraday, the rebate strategy’s orders will not have to pay overnight rates on Forex. Daily +-20 orders are equivalent to +-20 times of rebate profit.

If $1000 is assigned to a trading order of 0.014 lots, and 20 orders a day is equivalent to 0.28 lots, then calculate the rebate bonus for investors, which is multiplied by $18 lots of rebates, which is equivalent to $5 per day, 0.5%; $100 per month, 10.00%

Different investment amounts will be allocated to different strategies

If $5,000 is allocated to a trading order of 0.086 lots, and 20 orders a day equals 1.72 lots, then calculate the rebate bonus for investors, which is multiplied by $18 lot rebate, equals $30.96 per day, 0.62%; $619.20 per month, 12.38%

If $30,000 is assigned to a trading order of 0.64 lots, and 20 lots a day equals 12.8 lots, then calculate the rebate bonus for investors, which is multiplied by $18 lots rebate, equals $230.40 per day, 0.77%; $4,608 a month, 15.36%

*All calculations are done by reverse calculation and are not meant to be accurate.

(5) Cutting-Edge Technology, In-Depth Execution, Reassuring Custody

The core technology of the company is the progress and innovation of algorithmic trading. Many traders use the technical analysis of the early 80’s, while the derivation of technological progress, the popularization of big data and the standardization of financial markets allow the company to use algorithms to analyze and identify patterns and changes in the order book to complete this trading strategy.

Data analysis: order flow analysis

Data analysis: Market maker warehouse volume and analysis data

Algorithm: Linear regression algorithm

Algorithm: Artificial Neural Network Algorithm (ANN)

Algorithm: Dynamic Time Warping Algorithm (DTW)

Indicator Model: Performance Metrics

(6) Algorithm led, highly expressive

Here the company also released their algorithm training phase and risk management for the algorithm. It is this perfect structure and the assessment and prevention of very small probability events that allows OpixTech to create sustainable wealth!

Opix Algo: Structure of Learning and Training Stage

Implement patterns of demand and supply

ANN to learn and test the group patterns

ANN to learn and test different types of patterns in each demand and supply groups

Evaluate the unknown patterns with our ANN model for classification

Implement DTW algorithm to predict the groups

ALGORITHM SAFETY

Pre-trade controls

check on market orders before they are sent to the markets. They allow for automatically blocking or cancelling orders as soon as trades occur outside defined price thresholds, surpass a maximum size, or post and excess number of orders automatically.

In-flight controls

allow users or providers to adjust execution parameters during an execution, often when market conditions change, or the algorithm behaves in an undesirable or unexpected way. This is important, for example, in instances of particularly low liquidity when market makers could dominate trading volume or stop trading altogether.

Post-trade controls

involve continued monitoring of intraday market and carrying trades with counterparties when limits are breached. Algorithms identify errors and potential issues, analysing the particular scenarios and improve execution strategies and risk controls.

(7) Opix Algo – ARCHITECTURE

(8) MetaTrader 4 The world’s most famous forex trading platform

(9) Company background

OpixTech was founded in 2017 and began providing market making services to institutional investors and family offices and they have not disappointed. In 2019, they expanded their services to selected stocks and proudly serve ECN and brokerage clients.

But they didn’t stop there, in 2020 they launched the Opix Algo in the FX CFD market to meet the needs of their focus group. As they continue to grow, they expand their client base to multiple countries and launch their services globally in 2022.

In 2023, OpixTech introduced cutting-edge algorithmic trading to retail users through a top-tier app, making it easier for everyone to use.

As they continue to innovate and expand, they plan to go public on a U.S. exchange in 2024 with the goal of becoming the world’s largest professional fintech community.

Their future plans include expansion into multiple financial infrastructures and strategic acquisitions to further expand their products and services, positioning them as a global leader in financial services.

It’s truly inspiring to see a company with such a clear vision and drive to succeed. I have no doubt that OpixTech will continue to make waves in the industry for years to come.

OpixTech is revolutionizing the way retail investors and the general public access the financial markets. With their sophisticated algorithmic trading technology, they offer accessibility and accuracy previously only available to institutional investors.

The benefits of this technology are numerous. By using algorithms to analyze large amounts of market data and execute trades, OpixTech is able to trade with lightning speed and accuracy. This level of efficiency means that retail investors can take advantage of market opportunities that may have been missed by traditional trading methods.

In fact, OpixTech’s algorithms are designed to minimize risk and maximize returns, resulting in better overall investment performance.

Most importantly, OpixTech is also committed to providing excellent customer service and support, so users can rest assured that they are in good hands.

In short, OpixTech provides a great solution for retail investors and the average person by leveling the playing field and making algorithmic trading available to everyone. It’s a game changer for the industry and perfect for anyone looking to take their investment strategy to the next level.

(10) Raynar Prime is an OpixTech Preferred Forex Broker.

(11) Trade Order Report

Having detailed trade order reports helps ensure transparency and accountability for all financial trades. These reports clearly document each trade, including the time and price of the trade. This is important because it helps prove that the trades being executed are legitimate financial dealings. This is especially important in today’s market, where investors are more concerned about the fairness and integrity of financial markets. It is a way to build trust and show that the company is operating in compliance.

Thank you for your support and interest in OpixTech. For more information about the latest news from OpixTech, please contact us via the following methods:

Personal Telegram: https://t.me/ethan33h

TMC Community Telegram: THE MONEY CLUB

Official Website: Opix Technology – OpixTech Accelerate Sustainable Wealth

Registration Link: Raynar Prime

Ping me, Join us