The American Academy of Actuaries — a gaggle of often sober and smart folks — just lately issued a quick making the case for “Elevating the Social Safety Retirement Age.”

Their argument is simple. Social Safety is operating a 75-year deficit equal to three.5% of taxable payrolls. The one strategy to repair the issue is to lift revenues or minimize advantages. Life expectancy at 65 has elevated, and is projected to proceed to extend, which pushes up program prices. Subsequently, Congress ought to make folks work longer and postpone claiming their advantages. Elevating the total age to 70 may minimize the long-run deficit by a couple of third.

Simply to be completely clear, rising Social Safety’s Full Retirement Age is not only a query of “suspending” claiming; it’s a profit minimize. Those that are capable of delay retirement obtain one much less 12 months of advantages. Those that can’t modify their retirement habits get decrease advantages because of the elevated actuarial adjustment — an adjustment made to maintain lifetime advantages fixed no matter claiming age. Presently, these claiming at age 62 obtain solely 70% of the profit accessible at 67. If the Full Retirement Age have been elevated to 70, that quantity falls to 55%.

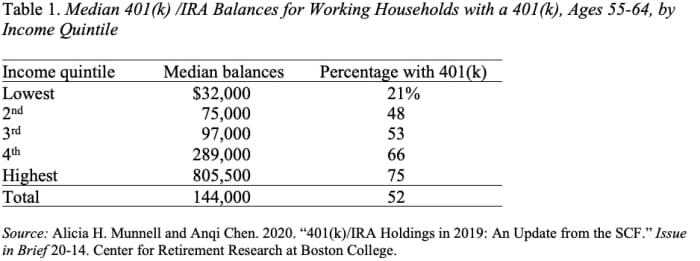

I’m towards any type of profit minimize, as a result of the remainder of the U.S. retirement system appears fairly wobbly to me. At any second, solely about half of personal sector staff are coated by any kind of office retirement plan. Meaning some folks by no means are coated and are completely reliant on Social Safety, whereas others transfer out and in of protection and find yourself with modest balances.

Learn: Do I have to file a tax return if most of my earnings is from Social Safety?

We truly understand how a lot folks have of their retirement accounts from the detailed monetary knowledge within the Federal Reserve’s Survey of Shopper Funds. As of 2019 — the date of the most recent survey — households (with a 401(ok)) approaching retirement (ages 55-64) had $144,000 in 401(ok)/IRA balances (see Desk 1). Which will sound like quite a bit but when they purchase a joint-and-survivor annuity, they may obtain solely about $600 per thirty days. And this quantity is prone to be their solely supply of retirement earnings past Social Safety as a result of the standard family holds no different monetary property. Reducing Social Safety advantages can be a catastrophe for many Individuals.

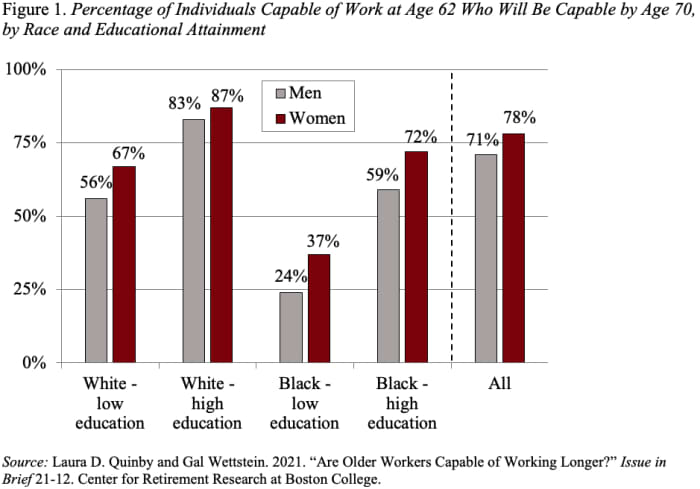

Furthermore, rising the Full Retirement Age is probably the most pernicious type of profit minimize, as a result of it hurts probably the most weak who’re compelled to say early. And it’s clear who these individuals are.

Learn: You might be getting the fallacious Social Safety profit verify — right here’s repair it

In a current research, my colleagues examined “working life expectancy” for all people and by race and schooling. They checked out people who’re anticipated to be working at 62 and calculated the chance that they may nonetheless be able to work if Social Safety’s Full Retirement Age have been elevated to 70 (see Determine 1). The train confirmed that whereas age 70 may be potential for a big majority of high-education whites, it’s out of the query for a lot of women and men with low schooling — notably Blacks — and even for a lot of high-education Black staff. These people would find yourself with grossly insufficient advantages.

Sure, it’s potential, because the actuaries counsel, that among the ache created by rising the Full Retirement Age may very well be offset by increasing Incapacity Insurance coverage. However I’ve no confidence this is able to occur. So, don’t minimize Social Safety advantages. And, if for some motive we resolve to take action, don’t do it by elevating the Full Retirement Age.