New markets require new approaches and tactics. More than 250 experts and industry leaders will take the stage at Inman Connect New York in January to help you navigate the market shift — and prepare for success in 2023. Register today and get a special offer $1099 ticket price.

Even at the tail end of a year filled with big iBuying shakeups, this week’s news was a shocker: Eric Wu — cofounder and CEO of Opendoor and in many ways the public face of the entire sector — was stepping down.

The announcement also revealed that Opendoor President Andrew Low Ah Kee was resigning, that Chief Financial Officer Carrie Wheeler would now take the helm at the company as the new chief executive, and that the company was pulling off a few other leadership shuffles too boot.

Executive turnover is common among big companies, including and especially in real estate. But Opendoor’s announcement is a big deal because right now all eyes are on the iBuyers. After both Zillow and Redfin exited the sector, and after the remaining players posted huge losses last quarter, there’s an active debate in real estate about what the future of tech-enabled cash buying looks like — and if it has a future at all.

Inman reached out to industry experts Friday to figure out what all this means. The takeaway from these conversations is that Opendoor is not on the verge of collapse. But at the same time, the company is navigating a challenging market with a challenging business model. It is in other words, an existential moment for Opendoor, and by extension, for the concept of iBuying in general.

An existential moment

Though Wu’s stepping down as CEO has been the headline-dominating news, Opendoor’s actual announcement is a bit more complex: Wu isn’t leaving the company, but rather stepping into the role of president of Marketplace. The move will consequently see him helm Opendoor’s new Exclusives product, which is designed to directly connect homebuyers and sellers.

Exclusives represents a pivot for Opendoor toward a leaner product that at least theoretically doesn’t require vast amounts of cash.

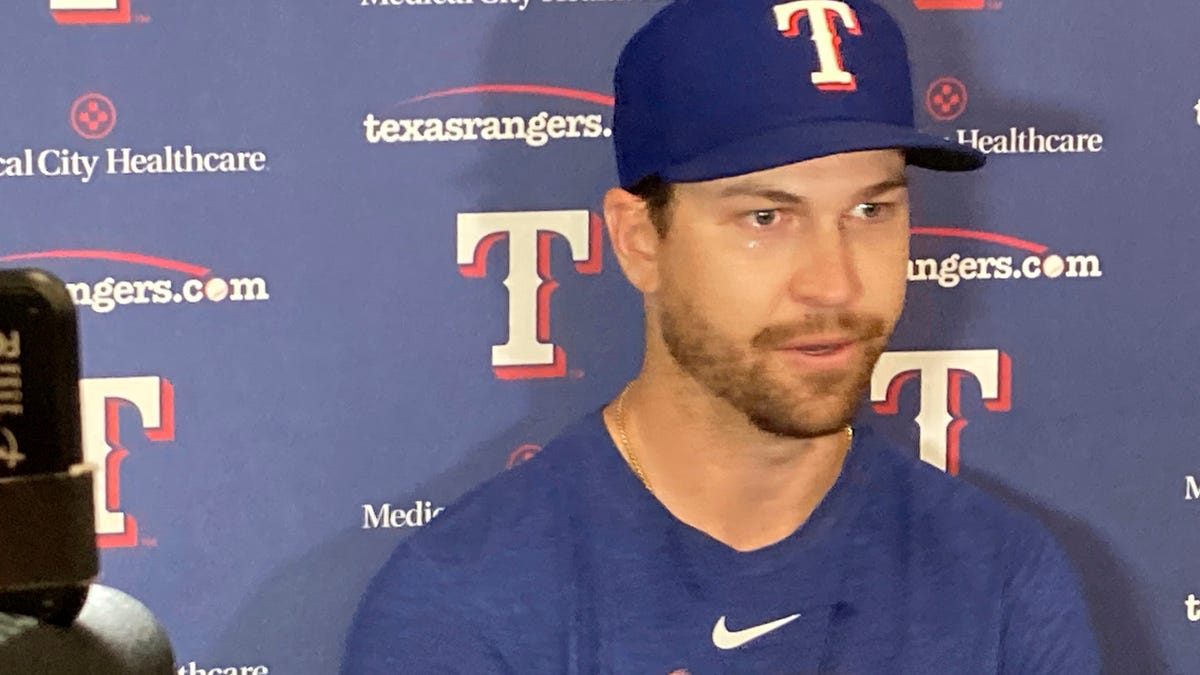

Russ Cofano

On Friday, Inman asked Russ Cofano — a long-time real estate veteran today serving as CEO of Collabra Technology — if he saw Wu’s stepping down as part of that pivot, or as a component in a more existential moment for Opendoor.

“Pivots many times are existential moments,” Cofano replied. “I think it’s both. I think they’re finding that the iBuying model is not going to sustain them, especially in the market we have and will have for the foreseeable future. And they’ve got to build a platform while they have the economic resources and cash in the bank to do that.”

When Inman reached out to real estate analyst Mike DelPrete, he said the executive shakeup was “super significant” and compared it to “the president and the vice president both resigning at the same time.”

Mike DelPrete

“The situation hasn’t changed,” DelPrete said, alluding to his most recent dive into Opendoor, “but the situation is pretty dire to the point where you need a significant change.”

DelPrete also pointed to Opendoor’s struggles in the stock market.

Opendoor went public in December 2020, and in less than two months saw shares triple in value to nearly $35. Since a high point in February 2021, however, shares have been on an overall downward trajectory and on Friday they closed at just $1.71 — only slightly above an all-time low of $1.46.

Credit: Google

DelPrete pointed out that numerous publicly traded real estate companies are way down from their all-time high share prices, but Opendoor is “leading the pack” and “definitely down more than the mean.”

“At a certain point, investors and creditors and stakeholders loose confidence and demand change,” DelPrete continued. “I can imagine a situation in which Opendoor’s investors and creditors lost confidence and something needed to happen.”

It’s hard to know how the executive shakeup will impact investors’ appetite for Opendoor stock over time. Friday’s closing share price represented an 8 percent drop compared to Thursday — not great but also not cataclysmically bad.

Ryan Tomasello

Ryan Tomasello — managing director at financial services and analytics firm Keefe, Bruyette & Woods — told Inman Friday that some investors may look at the latest moves Opendoor has made and ultimately ask “why now?”

“This change obviously is coming at a very turbulent time for the company — navigating this housing slowdown,” Tomasello said. “This shakeup, I think investors will think of as adding to the list of risks that the company is currently facing in terms of execution.”

Questions about iBuying abound

As the largest iBuyer by far, anything that is “super significant” at Opendoor is also super significant for the broader sector — which at the moment is essentially limited to rival Offerpad and a number of smaller offerings such as Keller Williams’ Keller Offers and Anywhere’s Realsure. But either way, DelPrete framed the current moment as an existential moment for the cash buying concept itself.

“Both iBuyers are struggling,” he said. “Offerpad got their delisting notification and Opendoor lost nearly a billion dollars. These are pretty big hits.”

DelPrete was referring to a recent threat from the New York Stock Exchange to delist Offerpad if it can’t get its shares trading above $1. Opendoor doesn’t currently face the same issue, though if it can’t change the trajectory of its share price it may eventually find itself in the same boat. And the problem seems to simply be that buying, renovating and selling homes for a profit is really hard to do if prices are stagnant or declining.

Stefan Peterson

“From our point of view, iBuying is a challenging business, especially in these market conditions,” Stefan Peterson, cofounder and chief data officer of real estate marketplace startup Zavvie told Inman in an email Friday.

Cofano made a similar point, adding that Opendoor’s situation may color the public view of the iBuying business model in general.

“Opendoor is the default leader,” he said, “and for it to happen to them, it’s certainly an implication of the sustainability of this approach to iBuying overall.”

Tomasello identified the “problem at hand” for Opendoor as “the glut of stale inventory” that they’re still holding. Which is to say, the iBuyers bought a lot of homes when times weren’t quite as bad, and now have to offload those homes as the market worsens. Tomasello also wondered about the wisdom of dramatically changing things up at such a moment.

“The question is why not wait several quarters to get that behind you, or however long, before optically making all these changes at the top of the company?” Tomasello asked.

To be clear, no one was writing an obituary of Opendoor or iBuying. But it was apparent that many questions remain about how the concept can succeed going forward.

In Opendoor’s specific case, the answer appears to be newer concepts, such as Exclusives — Wu’s new focus — though DelPrete pointed out that at this stage that’s just a “teeny tiny baby of an initiative.”

A new chapter, not a final chapter

Cofano acknowledged that many observers will see Wu’s move as a demotion, and in a technical sense it was. But he also wasn’t willing to dismiss the idea that Wu is in fact “a founder guy” who is more comfortable building products than leading a publicly traded company.

“I think Opendoor has two issues,” Cofano said. “One is pivoting and another is recreating a business model that’s sustainable, because the one they have now doesn’t appear to be. And [Wu] is probably the best person in their organization to lead that charge.”

Cofano added that appointing Wheeler — whose background is in finance — as CEO also acts as a signal that the company is serious about making money.

Whatever happens, Wu has had a long and colorful journey to get this far. He began his career by building a real estate-related tech company that he later sold to Trulia, where he worked until 2013.

Eventually at Opendoor — founded in 2014 — Wu and his team decided to focus on making selling easier, and as a result invested heavily in an algorithm that could price homes quickly and accurately. They raised capital to scale the business, and, despite stiff competition from Zillow and Redfin, they became the leader of a new business model.

It’s unclear now what lies ahead for Wu and Opendoor’s next chapter. But whatever happens, there’s no question that Opendoor has already left a tremendous mark on the real estate industry.

“This is an example of entrepreneurial activity, and sometimes it works and sometimes it doesn’t,” Cofano concluded. “But our industry needs more entrepreneurial activities. We need people like Eric Wu who are willing to take risks and push change. From a philosophical standpoint, that pushes the entire industry to be better.”

Email Jim Dalrymple II