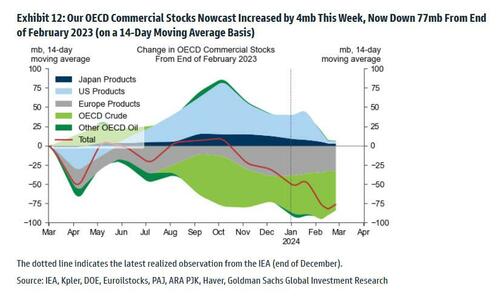

Oil prices may have risen to a 4 month high, but that is not nearly good enough for the oil exporting cartel – whose many members need the price to rise even more to fund their fiscal budgets – and this morning OPEC+ extended its oil supply cutbacks to the middle of the year in a bid to further short up prices and maintain the continued decline in global commercial inventories.

As Bloomberg reports, citing anonymous delegates, the curbs which total roughly 2 million barrels a day, will remain in place until the end of June. As has been the case, OPEC+ leader Saudi Arabia accounts for half of the pledged reduction.

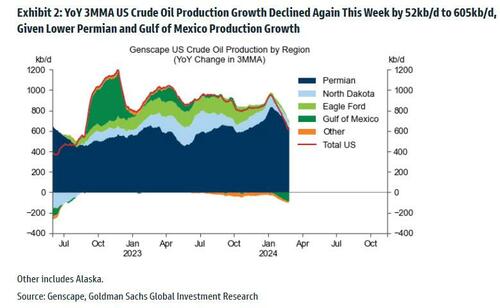

The move is hardly a surprise with traders and analysts widely expecting the extension, seeing it as necessary to offset a seasonal lull in world fuel consumption and soaring production from several of OPEC+’s rivals, most notably US shale drillers which are maximizing output to boost their prospects amid the unprecedented merger wave sweeping the US shale patch; however as shown in the chart below, the latest OPEC+ supply curbs come just as US shale output has peaked and growth is starting to shrink again, assuring that the next move in oil will be higher, perhaps violently so.

Some more details on the OPEC+ decision which are just an extension of already agreed upon production cuts:

- *SAUDI TO EXTEND VOLUNTARY CUT OF 1 MLN B/D UNTIL END OF 2Q

- *RUSSIA TO IMPLEMENT VOLUNTARY OIL CUT OF 471K B/D IN 2Q

- *UAE EXTENDS VOLUNTARY OIL CUT OF 163,000 B/D UNTIL END OF JUNE

- *IRAQ EXTENDS VOLUNTARY OIL CUT OF 220,000 B/D UNTIL END OF JUNE

A big reason for OPEC’s continue stinginess is that Riyadh needs a price above $90 a barrel as it spends billions on an economic transformation that spans futuristic cities and sports tournaments, according to Fitch Ratings. Its largest partner in the alliance, Russia, also seeks revenue to continue waging war on Ukraine.

That said, this being OPEC, there are also cheaters, and as Bloomberg notes, in the first month of this year, the group’s implementation of the cutbacks didn’t live up to the pledged 2 million barrels a day as both Iraq and Kazakhstan collectively pumped several hundred thousand barrels a day above their quotas, but promised to improve compliance and even compensate for any initial overproduction.

Russia meanwhile, has shown a very mixed performance. It only recently fully implemented the production cutbacks it promised to make almost a year ago. In January, the nation reduced its exports of crude oil as agreed by roughly 300,000 barrels a day, but promised curbs to shipments of refined fuels were less clear.

While the cartel’s decision to extend its curbs for the second quarter was widely expected, OPEC+ will likely face a tougher choice at its next scheduled meeting on June 1, when ministers will set policy for the second half of the year.

“You don’t want to bring barrels back in too early,” Saad Rahim, chief economist of commodity trading giant Trafigura Group, told Bloomberg television last week.

It’s unclear whether all members would be willing to subscribe to that policy. While Saudi Arabia has often urged the need for caution, its neighbor the United Arab Emirates has been keen to make use of recent investments in new production capacity.

Some forecasters believe that won’t be a problem, as a fledgling recovery in China and strengthening global demand will allow the group to relax its curbs and add more barrels later in the year. There has been “an improvement in overall market fundamentals,” said Paul Horsnell, head of commodities research at Standard Chartered Bank Plc. “OPEC could increase output” without flooding world inventories.