kontrast-fotodesign

After writing about Clean Energy Fuels (NASDAQ:CLNE) and Montauk Renewables (NASDAQ:MNTK), today’s article focuses on OPAL Fuels (NASDAQ:OPAL), a U.S. company that operates vertically in the RNG market having both of the above companies as its main competitors. In recent years OPAL has made an intensive investment campaign to increase its RNG production, including by converting renewable power plants into RNG production facilities, as well as upgrading its network to 298 fuel stations in the U.S. as of December 2023. The RNG market is characterized by increasing competition, but I believe OPAL could establish itself as one of the leaders thanks to its extremely verticalized business. Despite this, OPAL is still characterized by low operating cash flow generation compared to competitors as well as higher debt and high risk of capital dilution. Considering these and other risks analyzed in more detail in the article, as well as the outcome of my Discounted Cash Flow model, I currently assign to OPAL a Hold rating. If interested in the world of renewable energy, on EuroEquity Research you’ll find several analyses of companies operating in it.

Business Overview

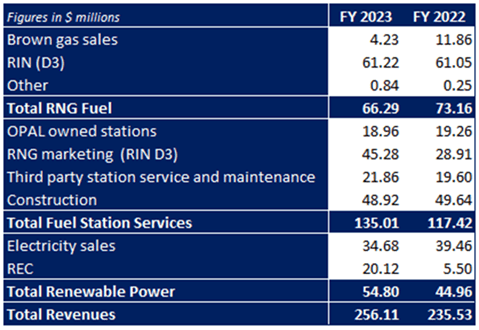

Demand for RNG is expected to increase in the coming years both globally and in the US. IEA data highlight potential growth of 20% between FY23 and FY28. In addition, new technological developments such as Cummins’ 15l engine could represent a significant increase in RNG use with positive effects on overall biofuel demand. Within this highly dynamic ecosystem, OPAL Fuels operates within three specific business areas: RNG Fuels, Fuel Station Services and Renewable Power.

OPAL SEC Filings and Author’s Analysis

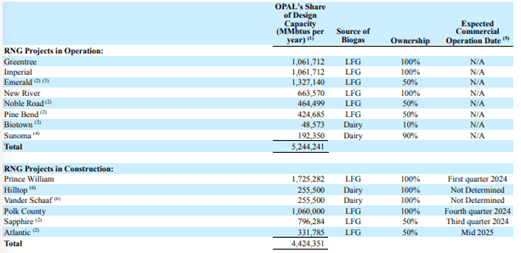

RNG Fuels deals with the production of RNG obtained from landfill, livestock waste and organic waste. As of December 2023, it has production of 2.7 MMBtus obtained through 8 plants in operations, up from 2.2 MMBtus in FY22. In FY24, management expects production of 4.4-4.8MMBtus. OPAL has reached 5.2 MMBtus in terms of production capacity, to which 4.4 MMBtus should be added by the second half of 2025, including 1.7 MMBtus from the conversion of the Prince William renewable power production plants. In FY23 the segment produced 25.9% of total revenues, down from 31% recorded in FY22 due to decrease in volumes related to brown gas sales. 92.5% of RNG fuels revenues are derived from the cellulosic biofuel

RIN (D3).

OPAL Annual Report FY23

Fuel Station Services is engaged in the construction and O&M of fuel stations for third parties, as well as its own. In carrying out its activities, OPAL is also involved in the management and monetization of environmental credits. In FY23 it operates through 298 stations, up from 137 in FY22 and 68 in FY21, highlighting the company’s focus on this market segment, which in fact is worth 52% of total revenues in FY23. Digging even deeper, 14% of the segment’s revenue came from owned stations, 16% from third -party station O&M, 36% from EPC activity, and 33% from environmental credits. In FY23 the segment experienced a 15% YoY growth, almost entirely attributable to growth in environmental credits revenues from $28.9m in FY22 to $45.3m in FY23.

Renewable power engages in electricity generation from biomethane for a nameplate capacity of 112MW, expected to decrease as early as FY24 due to the conversion of Prince William I and II plants to RNG facilities. In FY23 it is worth 21.4% of total revenues, up 21.9% YoY, attributable to increased revenues from RECs (Renewable Energy Certificates). Although it still constitutes a sizable chunk of revenues, it is no longer the focus of the company’s projects, as can be seen by the near absence of investments in the segment compared to those made in fuel stations and RNG facilities.

OPAL Annual Report FY23

A Comparison with MNTK and CLNE

As evident in the business overview, OPAL stands out as one of Montauk’s main competitors in RNG production and one of Clean Energy Fuels’ main competitors in fuel station construction and O&M. In particular:

MNTK produced 5.5 MMBtus of RNG in FY23, flat YoY, compared to 2.7 MMBtus produced by OPAL. In terms of renewable power, OPAL’s installed capacity is significantly higher than Montauk’s, with 112MW versus Montauk’s 30MW. Moreover, OPAL outperforms its competitor both in terms of growth perspective and Capex investments, although the difference appears to be decreasing based on FY24 estimates. Finally, the most important difference concerns the total concentration of MNTK’s business in RNG and renewable power production, compared to OPAL also active in EPC and O&M of fuel stations.

OPAL has 298 fuel stations between owned and third-party facilities in FY23, selling 44m GGEs of RNG up from 29m sold in FY22. CLNE on the contrary, in addition to having more owned stations, operates over 600 service stations for a total of 225m GGEs sold in FY23, up from 198m in FY22. Despite lower sales volumes, OPAL has a much higher RNG output than CLNE, which began to invest in RNG production only since FY21, mainly through Joint Ventures, with very small volumes for the time being.

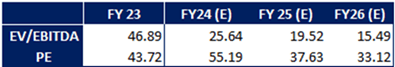

In consideration of the above, OPAL seems among the three companies to be the one best positioned to achieve complete market verticalization, with the possibility of creating synergies in terms of both revenues and costs. This dynamic also seems to be considered by the market, which assigns higher multiples for OPAL than for MNTK and CLNE. Nevertheless, OCF’s higher debt and lower output compared to them partly counterbalance the valuation.

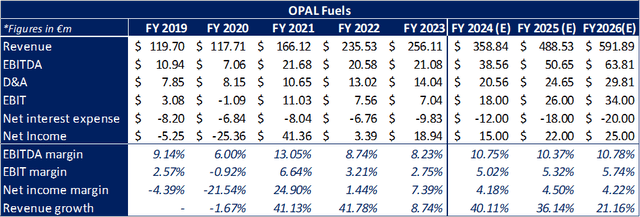

Commentary on financial and economic results

OPAL reported revenues up 8.74% in FY23, registering a decrease in the growth pace, partly due to the deconsolidation of VIEs, Emerald and Sapphire, which had a positive impact of $122m. This resulted in net income of $18.9m or $0.69 per share, a significant improvement from $0.12 per share in FY22. Excluding this accounting artifice, OPAL operating margins decreased, mainly due to an increase in some operating costs related to the Fuel Station Services segment. EBIT margin turns out to be 2.75% in FY23, down from 3.21% in FY22.

I expect a significant increase in revenues in FY24, especially if the ITC (Investment Tax Credit) from Emerald and the three landfill RNG projects coming online this year are confirmed, which should bring a positive impact of $40m. In addition, I expect growth in operating results with an EBIT margin at 5% in FY24, following the improved operating results of the fuel station services segment announced by management in Press Release. Notwithstanding, I believe a reduction in net income margin is plausible as FY23 results were significantly impacted positively by deconsolidation. Much will be contingent on the price of RIN, LCFS, and whether it is entitled to the abovementioned ITC.

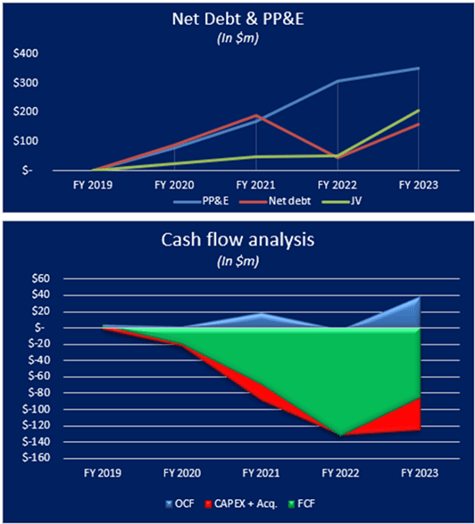

OPAL SEC Filings and Author’s Estimates

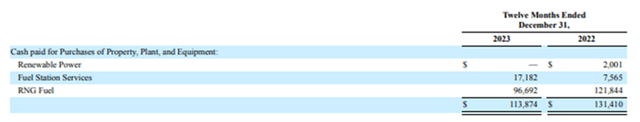

From a financial perspective, OPAL is undertaking a significant investment campaign, some of which I have discussed in previous sections. Capex and JV investments are estimated to be $230m in FY24, up from $126m in FY23. This will almost certainly cause a significant increase in debt, already at higher levels than its competitors, despite being well covered by PP&E and JV investments. For FY24, it has $263.4m available under the delayed draw term loan, and $36.2m under the revolver facility under the OPAL Term Loan. For these reasons, it should have enough liquidity to implement its investment plan, including taking advantage of the eventual collection of the ATM program announced in November 2023. OCF production still appears to be poor compared to the two competitors analyzed earlier, with heavily negative FCFs as an effect of the large volumes of investments made. This dynamic is expected to continue in FY24, despite an expected increase in OCF compared to $39m in FY23.

OPAL SEC Filings and Author’s Analysis

Main Risks

The top two customers are worth 47% of OPAL’s total revenues, 36% and 11% customer A and customer B, respectively.

Company-owned facilities are often based on agreements like leases, usually 20 years in duration with renewal options. This factor makes the company’s assets extremely dependent on the decisions of third parties.

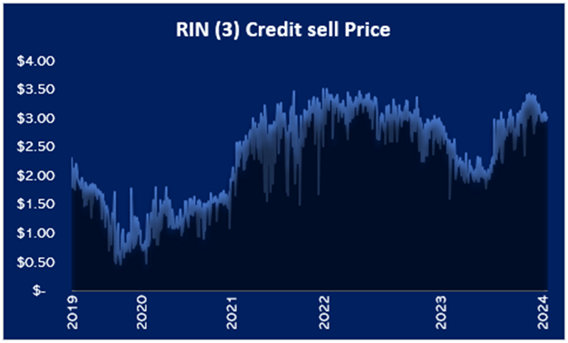

About 50% of revenues are derived from environmental attributes such as RECs, RIN(D3) and LCFS, a factor that makes revenues extremely volatile as can be seen in the graph below.

www.epa.org

Like all companies operating in this business, OPAL is extremely dependent on industry regulation in the United States. Changes to the regulations currently in place can therefore have significant impacts either positively or negatively. An example of this is the introduction of the Inflation Reduction Act in which the ITC, a tax credit that can result in a 30% lower cost in terms of the initial investment of a new project. At the moment, however, it is still unclear whether RNG production facilities fall under the regulations, creating confusion in the industry with the possibility of delaying or resulting in the elimination of already planned investments.

On Nov. 17, 2023, OPAL announced the launch of an ATM program for at least $75m in capital, leading to possible dilution of shareholder capital. Moreover, it has a significantly higher level of net debt than Montauk and Clean Energy, implying greater difficulty in taking on new debt and making future capital increases more likely.

As of December 2023, the Chairman of board of directors Mr. Mark Comora controls 94.1% of the voting rights. This concentration may in the long run lead to overshadowing the interests of minority shareholders.

Discounted Cash Flow

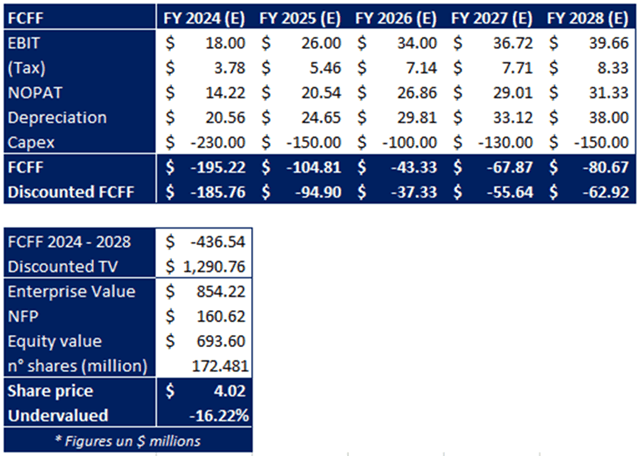

I conducted a DCF analysis to assess OPAL intrinsic value, returning a valuation of €4.02 per share, approximately 15% below the current market value. The following assumptions were used to determine the fair value:

Beta: 0.51 obtained from Investing.com.

MRP (5.7%) and Risk-Free rate (3.8%) were obtained by using 2023 Fernandez’s data, weighted by the geographic breakdown of the company’s revenues. A cost of equity of 4.77% was obtained.

Cost of debt (4.71%) was obtained from the ratio of interest expenses to total debt as of December 2023.

WACC = 5.09% increased by 0.5% to consider the risk associated with the limited market cap.

g = 2% in line with the inflation target in the US.

Author’s Analysis & Estimates

Conclusion

Author’s Analysis & Estimates

I believe that from a quality and organizational perspective, OPAL Fuels represents one of the best investment opportunities in the RNG sector. The operating model is highly specialized and verticalized, with one of the most extensive networks of RNG fuel stations in the United States and growing in-house RNG production that could soon exceed that of Montauk, as early as FY24 or FY25. This success has been achieved through a significant investment campaign, still ongoing, aimed at building a 10 MMBtus production chain by the end of 2025. However, I believe OPAL is slightly overvalued even considering expected future multiples. In addition, in my view there is a fair amount of capital dilution risk from higher debt than its competitors, which could limit its ability to take on additional debt in the medium term and force a capital increase. Increased cash flows and reduced dependence on external financing sources could act as catalysts to make the company an attractive opportunity. Overall, I assign a Hold rating to OPAL, pending a significant improvement in margins and, most importantly, an increase in operating cash flow generation, which is currently at too low a level.