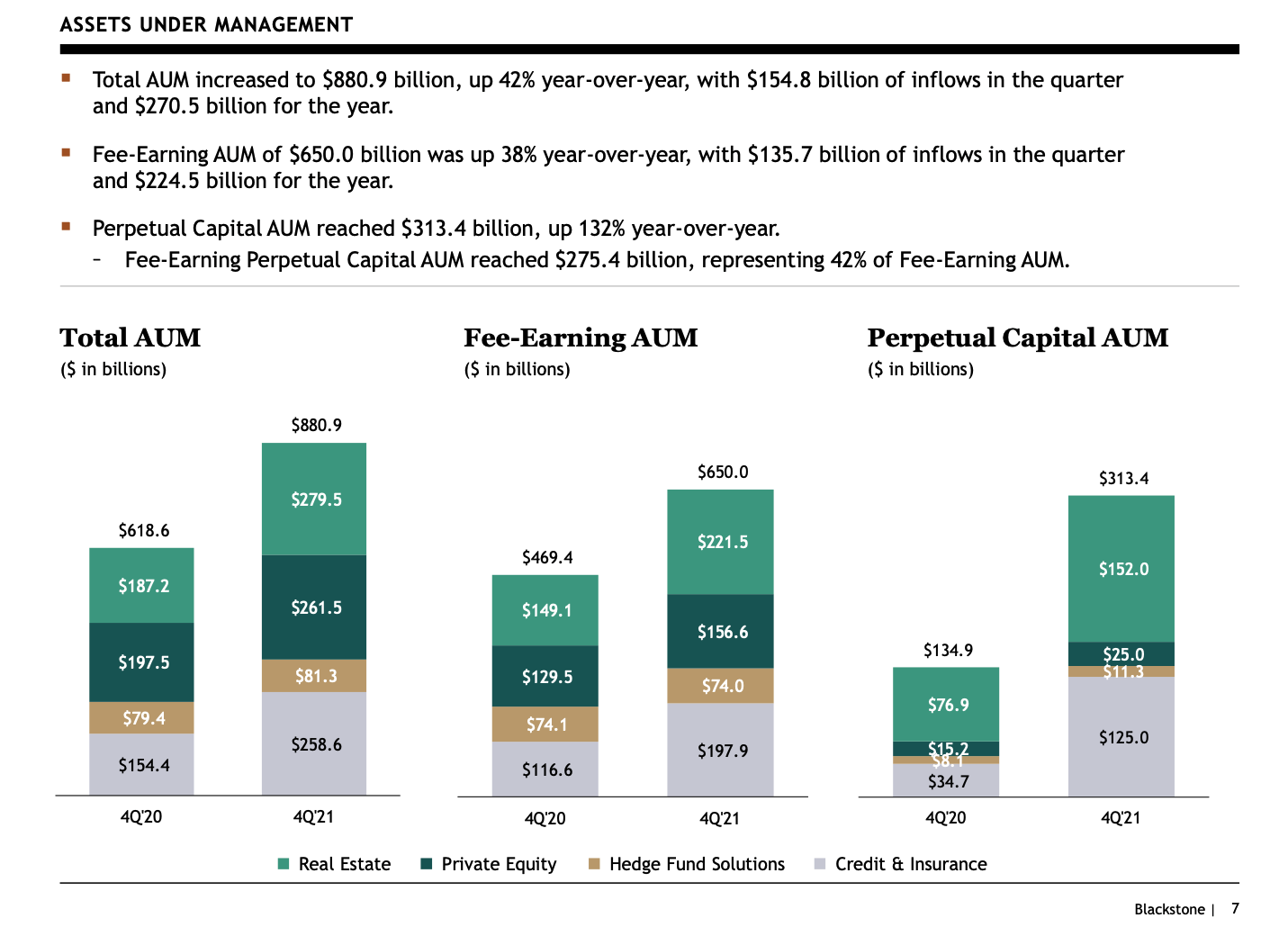

OneSpan (NASDAQ:), a world chief in digital safety and e-signature options, held its Q2 2024 earnings name, revealing sturdy monetary efficiency and organizational updates. Victor Limongelli, who has served as interim CEO since January, was confirmed as President and CEO. The corporate reported a 9% improve in income and a 15% rise in Annual Recurring Income (ARR), alongside a major increase in adjusted EBITDA to $16 million. With a strategic shift in direction of software program, which now contains 75% of whole income, OneSpan expects double-digit subscription income progress for the complete yr. Regardless of the anticipation of declining {hardware} income, the corporate stays on monitor with its steerage for the yr, projecting revenues between $238 million and $246 million and ARR between $166 million and $170 million.

Key Takeaways

- Victor Limongelli is confirmed as President and CEO of OneSpan.

- Q2 income grew by 9%, with ARR growing by 15%.

- Adjusted EBITDA reached $16 million, and money from operations was $2 million.

- Software program and providers now signify 75% of whole income.

- Full-year subscription income is predicted to develop in double-digits, whereas {hardware} income could decline.

- OneSpan plans to overview capital allocation by year-end, specializing in shareholder returns.

- Full-year income steerage is reaffirmed, with elevated ARR and adjusted EBITDA projections.

Firm Outlook

- OneSpan anticipates continued progress in software program income, with a full-year double-digit improve in subscription income.

- The corporate expects to fulfill its full-year income steerage of $238 million to $246 million.

- ARR is projected to finish the yr between $166 million and $170 million.

- Adjusted EBITDA is forecasted to be within the vary of $55 million to $59 million.

- The corporate will assess its money era and capital necessities, aiming to return capital to shareholders.

Bearish Highlights

- Upkeep and help income noticed a slight decline attributable to decreases in legacy perpetual contracts.

- The gross revenue margin for the digital agreements enterprise dropped to 63% from 72% attributable to discontinued R&D investments.

Bullish Highlights

- Q2 income for authentication options rose by 19% to $14.9 million.

- Digipass {hardware} token income remained steady at $19.7 million.

- The gross revenue margin elevated to 67%, up from 59% within the earlier yr.

- Working revenue greater than doubled to $20.7 million from $8.5 million in Q2 2023.

- Digital agreements ARR grew by 25% to $61 million, with Q2 income up by 30%.

Misses

- There have been no vital misses reported within the earnings name.

Q&A Highlights

- The corporate mentioned the “lumpy” nature of its enterprise, with income recognition impacted by lead instances and supply schedules.

- There’s warning relating to income uncertainty within the {hardware} sector, however optimism to be on the upper finish of forecasts.

- Adjustments within the gross sales group have been met with satisfaction, as efficiency in safety and digital settlement companies stays sturdy.

- The European market, whereas not thriving, will not be in a extreme recession, and the macro setting is described as “okay.”

- Value financial savings are nearing the goal, with future changes more likely to be minor somewhat than substantial.

- Small incremental investments could also be made in product areas that provide buyer advantages.

OneSpan closed the quarter with $64.3 million in money and money equivalents and no long-term debt. Geographically, income was distributed with 41% from EMEA, 35% from the Americas, and 24% from Asia-Pacific. The corporate’s concentrate on price financial savings and focused investments displays a strategic strategy to navigating the present financial panorama whereas prioritizing buyer worth. The administration staff expressed gratitude for the individuals’ engagement and anticipates sharing additional progress within the subsequent quarter.

InvestingPro Insights

OneSpan’s (OSPN) latest Q2 2024 earnings name showcased an organization in a robust monetary place, with a transparent strategic concentrate on software program and providers. To additional perceive OneSpan’s market standing and future potential, we flip to InvestingPro insights for extra context.

InvestingPro Information reveals that OneSpan holds a market capitalization of $549.89 million, which displays the market’s valuation of the corporate. With a P/E ratio of 34.76 and an adjusted P/E ratio for the final twelve months as of Q2 2024 at 20.46, the corporate trades at a a number of that signifies traders predict earnings progress. Furthermore, the PEG ratio, which stands at 0.23, means that OneSpan’s share value is undervalued relative to its anticipated earnings progress, making it probably enticing to worth traders.

The corporate’s income progress can be sturdy, with an 8.99% improve during the last twelve months as of Q2 2024, aligning with the reported 9% improve in Q2 income. This progress is supported by a robust gross revenue margin of 69.43%, indicating environment friendly price administration and a stable enterprise mannequin.

InvestingPro Suggestions spotlight a number of key factors that traders could discover encouraging. Administration’s aggressive share buyback initiative alerts confidence within the firm’s worth and future prospects. Moreover, OneSpan’s steadiness sheet is wholesome, holding more money than debt, offering monetary flexibility and stability. Lastly, the corporate has skilled a robust return during the last month and three months, with value returns of 14.96% and 17.19%, respectively, suggesting constructive market sentiment.

For readers thinking about a deeper dive into OneSpan’s monetary well being and market potential, there are further InvestingPro Suggestions accessible, providing extra nuanced evaluation and funding issues.

Full transcript – VASCO Information Securi (OSPN) Q2 2024:

Operator: Good day and thanks for standing by. Welcome to the Q2 2024 OneSpan Earnings Convention Name. Right now, all individuals are in a listen-only mode. After the audio system’ presentation, there will likely be a question-and-answer session. [Operator Instructions] Please be suggested that right this moment’s convention is being recorded. I might now like at hand the convention over to your first speaker right this moment, Joe Maxa, Vice President of Investor Relations.

Joe Maxa: Thanks, operator. Good afternoon, everybody and welcome to the OneSpan second quarter 2024 earnings convention name. This name is being webcast and could be accessed on the Investor Relations part of OneSpan’s web site at traders.onespan.com. This afternoon, after market shut, OneSpan issued a press launch and filed a Type 8-Okay with the SEC asserting outcomes for our second quarter 2024. As well as, the corporate plans to file a separate Type 8-Okay this afternoon asserting the appointment of Victor Limongelli as President and CEO. Victor has been the corporate’s interim CEO since January 4, 2024. To entry a duplicate of the press launch, Type 8-Ks and different investor data, please go to our web site. Victor Limongelli and our CFO, Jorge Martell, will be part of me on right this moment’s name. Following the ready feedback, we are going to open the decision for questions. Please observe that statements made throughout this convention name that relate to future plans, occasions, or efficiency, together with the outlook for full yr 2024 and different long-term monetary targets, are forward-looking statements. These statements contain dangers and uncertainties and are primarily based on present assumptions. Consequently, precise outcomes may differ materially from the expectations expressed in these forward-looking statements. I direct your consideration to right this moment’s press launch and the corporate’s filings with the U.S. Securities and Trade Fee for a dialogue of such dangers and uncertainties. Additionally observe that sure monetary measures that could be mentioned on this name are expressed on a non-GAAP foundation and have been adjusted from a associated GAAP monetary measure. We’ve got offered an evidence for and reconciliations of those non-GAAP monetary measures to essentially the most immediately comparable GAAP monetary measures within the earnings press launch and within the investor presentation accessible on our web site. As well as, please observe that each one progress charges mentioned on this name seek advice from a year-over-year foundation until in any other case indicated. The date of this convention name is August 1, 2024. Any forward-looking statements and associated assumptions are made as of this date. Besides as required by regulation, we undertake no obligation to replace these statements because of new data or future occasions or for every other purpose. I’ll now flip the decision over to Victor.

Victor Limongelli: Thanks, Joe and thanks, everybody, for becoming a member of the decision right this moment. Over the past 7 months, I’ve obtained to know the OneSpan staff and it has been an actual pleasure to work facet by facet with them as we have improved OneSpan’s operational efficiency. I am wanting ahead to additional enhancements. I am excited to maintain the momentum going and I am honored that the Board felt the identical means in making my function everlasting. As , we have made vital progress this yr, underscored by a robust second quarter which included 9% income progress, 15% ARR progress and adjusted EBITDA of $16 million, or 27% of income. We additionally generated $2 million in money from operations within the second quarter, an incredible enchancment as in comparison with the prior yr interval once we used $20 million in money. And we ended the quarter with $64 million in money available. Our concentrate on operational excellence and accountability all through the corporate is driving worthwhile progress. Over the previous few years, we have continued to develop our software program enterprise. And within the first half of 2024, we have reached the purpose the place software program and providers is roughly 3/4 of whole income and {hardware} is about 1/4 of income. As compared, when you take a look at our enterprise 3 years in the past, the break up was roughly 64% software program, 36% {hardware}. Our gross sales staff has carried out a fantastic job in transitioning the corporate to extra higher-margin software program income. Specifically, our gross sales staff executed very nicely throughout the second quarter with bookings coming in forward of our inner plan. The gross sales staff has been working onerous to remain near prospects in order that we are able to proceed to enhance our efficiency in response to buyer suggestions. As you may think, I am very happy with the staff’s efficiency. Along with the sturdy efficiency by the gross sales staff, our renewals staff has made strides in closing upkeep renewals in a well timed trend. 12 months-to-date, our on-time renewal price has improved in comparison with 2023 and the speed of renewals closed inside 30 days of the due date additionally improved year-over-year. That’s good progress and a testomony to the nice work of our renewals staff. Our R&D staff has continued to make enhancements to our SaaS choices and we count on to see improved operational effectivity mirrored in elevated gross margins as we transfer by the rest of the yr. Trying forward, our R&D staff in safety is, I believe it is honest to say, reenergized and is engaged on enhancements and new merchandise reminiscent of FIDO {hardware} tokens. Turning to our two enterprise items. I am thrilled with the second quarter delivered by our staff within the digital agreements enterprise. Digital agreements grew strongly and have become worthwhile, excluding onetime prices which Jorge will talk about in additional element. In Digital Agreements, now we have considerably accomplished our transition to a SaaS mannequin. Our sturdy second quarter income and ARR progress charges had been pushed primarily by growth contracts and, to a lesser extent, new logos. In our Safety enterprise unit, we noticed sturdy subscription income progress and general income progress was on par with our low- to mid-single-digit progress price expectation for 2024. It additionally continued to be a strongly worthwhile enterprise. Our purpose is to have each enterprise items ship progress and profitability and we’re nicely on our approach to attaining that purpose. I’m, after all, thrilled with the sturdy ARR progress and our improved profitability and money circulate, in addition to the sturdy gross sales quarter the staff delivered. It will be an excessive amount of to say the staff closed each alternative however there have been actually offers that closed in Q2 which may have been anticipated to happen in Q3. That’s nice, after all and that we might somewhat have the offers closed earlier however it does make Q3 more difficult. As well as, the third quarter, when it comes to seasonality, is usually not a very sturdy bookings quarter for us. Provided that context, coupled with the sturdy first half efficiency, for the steadiness of the yr, we count on our subscription income to be up double-digits over the prior yr, whereas we count on upkeep income to say no considerably, largely because of the finish of lifetime of the Dealflo product in addition to perpetual to time period conversions. As well as, given our present visibility into our {hardware} pipeline and anticipated buyer {hardware} supply schedules, we anticipate a decline in {hardware} revenues within the second half as in comparison with the prior yr. That stated, we count on each enterprise items to be worthwhile in each the third and fourth quarters. So we now count on our full-year adjusted EBITDA to be greater than beforehand forecast. Lastly, I would like to notice that the Board plans to undertake by year-end a overview of our money era and capital wants, balancing these components with a want to return capital to shareholders. General, we stay dedicated to operational excellence and to driving environment friendly income progress to assist guarantee we obtain our annual profitability and money circulate commitments. With that, I’ll flip the decision over to Jorge. Jorge?

Jorge Martell: Thanks, Victor and good afternoon, everybody. I will begin by offering a short replace on our price discount actions. We realized $8.5 million in annualized price financial savings from our restructuring efforts within the second quarter of 2024. Cumulative annualized financial savings totaled $73.5 million. We imagine we’re on monitor to realize our purpose of $75 million in cumulative annualized price financial savings by the top of this yr. Now turning to our second quarter outcomes. ARR grew 15% to $165 million and our web retention price was 112%, up from 107% final quarter. Through the quarter, we noticed a robust improve in digital agreements in new ACV and robust will increase in contract expansions from present prospects in each enterprise items. Second quarter 2024 income grew 9% to $60.9 million as in comparison with the identical interval final yr, pushed by 4% progress in Safety Options and 30% progress in Digital Agreements. Subscription income grew 29% to $29.6 million, together with 19% progress from Safety Options and 41% progress from Digital Settlement. The sturdy progress in subscription income was partially offset by a modest decline in upkeep income which is by design as we transition to a SaaS and subscription license mannequin. {Hardware} income was flat year-over-year. Second quarter gross margin was 66.2% in comparison with 61.5% within the prior yr quarter. Gross margins had been impacted by 2.4 share factors in Q2 2024 and by 2.8 share factors in Q2 2023 attributable to onetime prices. Excluding these onetime prices, the rise in gross margin was primarily pushed by favorable product combine attributable to progress in subscription income, partially offset by a rise primarily based on depreciation of capitalized software program prices. Second quarter GAAP working revenue was $7.6 million in comparison with an working lack of $17.8 million within the second quarter of final yr. Will increase in income and gross revenue margin, mixed with a lower in working bills, primarily from decrease head count-related prices and decrease restructuring prices, led to the improved efficiency. GAAP web revenue per share was $0.17 within the second quarter of 2024 in comparison with a GAAP web loss per share of $0.44 in the identical interval final yr. Non-GAAP earnings per share was $0.31 within the second quarter of 2024. This compares to a non-GAAP loss per share of $0.18 within the second quarter of 2023. Second quarter adjusted EBITDA and adjusted EBITDA margin was $16.1 million and 26.5% in comparison with unfavorable $3.8 million and unfavorable 7% in the identical interval of final yr, respectively. Turning to our Safety Options enterprise unit. ARR grew 9% within the second quarter to $105 million. ARR progress was negatively impacted by roughly 1.5 share factors because of the relocation of identification verification merchandise to our digital agreements enterprise unit in the beginning of this yr. Second quarter income elevated 4% to $45.5 million. Subscription income elevated 19% to $14.9 million, pushed primarily by growth of licenses from present prospects for authentication options. Upkeep and help income declined by lower than $1 million year-over-year to $9.7 million with progress from on-premise subscriptions, offset by the anticipated declines from legacy perpetual contracts. Digipass {hardware} token income was mainly flat with the prior yr at $19.7 million. Q2 2024 gross revenue margin was 67% as in comparison with 59% within the second quarter of 2023. The rise in margin is primarily attributable to favorable product and buyer combine. As well as, Q2 2023 gross margin was impacted by roughly 3.5 share factors associated to a listing write-off cost. Working revenue was $20.7 million and working margin was 46% in comparison with $8.5 million and 19% in final yr’s second quarter. The will increase in income and gross revenue margin, mixed with lowered working bills, primarily attributed to restructuring and different price discount actions all through nearly all of the improved efficiency. Turning to our monetary outcomes for our digital agreements enterprise. ARR grew 25% to $61 million. ARR progress benefited by roughly 3 share factors because of the relocation of identification verification merchandise to digital agreements in the beginning of this yr. Second quarter income grew 30% to $15.5 million, pushed primarily by each new contracts and growth of renewal contracts and to a a lot lesser extent, the relocation of identification verification merchandise. Subscription income, consisting of 100% cloud-based options in each Q2 2024 and within the prior yr quarter, grew 41% to $14.8 million. Second quarter gross revenue margin was 63% as in comparison with 72% within the prior yr quarter. Through the quarter, we decided to discontinue R&D investments in our Belief Vault blockchain product. Excluding onetime prices associated to this determination, Digital Agreements’ Q2 2024 gross margin would have been 10 share factors greater. Working loss was $0.2 million as in comparison with an working lack of $7.1 million in Q2 final yr. The improved efficiency was pushed by a rise in income and a lower in working bills, primarily attributed to restructuring and different price discount actions and was partially offset by a rise in price of revenues. Excluding onetime prices of roughly $1.8 million, Digital Agreements’ second quarter 2024 working revenue would have been constructive. Now turning to our steadiness sheet. We ended the second quarter of 2024 with $64.3 million in money and money equivalents in comparison with $42.5 million on the finish of 2023. We generated $2 million in money from operations throughout the quarter and used $2 million in capital expenditures, primarily capitalized software program prices. We’ve got no long-term debt. Geographically, our income combine by area within the second quarter of 2024 was 41% from EMEA, 35% from the Americas and 24% from Asia-Pacific. This compares to 48%, 33% and 19% from the identical areas within the second quarter of final yr, respectively. I’ll now present our monetary outlook. For the complete yr 2024, we’re reaffirming our beforehand issued income steerage. We’re growing our ARR steerage to mirror its year-to-date power, partially offset by some second half contraction associated to beforehand sundown merchandise and we’re growing our adjusted EBITDA steerage to mirror a rise in working leverage. Extra particularly, we count on income to be within the vary of $238 million to $246 million; ARR to finish the yr within the vary of $166 million to $170 million, as in comparison with our earlier steerage vary of $160 million to $168 million; and adjusted EBITDA to be within the vary of $55 million to $59 million, as in comparison with our earlier steerage vary of $51 million to $55 million. Absent share repurchases, we proceed to count on to finish the yr with greater than $70 million of money. That concludes my remarks. Victor?

Victor Limongelli: Thanks, Jorge. We had a wonderful second quarter and first half of 2024. Trying on the second half of the yr, we all know that now we have extra work to do with a purpose to ship a wonderful yr. I am excited and proud to be main the OneSpan staff and we’ll proceed to focus our efforts on delivering worth to our prospects and thereby creating worth for our shareholders. Jorge and I’ll now be glad to take your questions.

Operator: [Operator Instructions] Our first query comes from the road of Grey Powell with BTIG.

Grey Powell: Okay. Congratulations on the nice set of outcomes.

Victor Limongelli: Thanks.

Grey Powell: Sure, completely. So perhaps Victor, to begin off. I imply you have been at OneSpan as CEO for 7 months now. You posted 2 good studies. Do you see something main that must be modified, or are there any areas the place you wish to perhaps improve your focus and degree of investments?

Victor Limongelli: Sure. Let me discuss these outcomes. We’re actually proud of our ARR progress and the general power in our software program enterprise. My background, my historical past, 20-plus years, has been on the software program facet. So I did not know {hardware} and that is a more recent enterprise for me. However I’ve to say, I am liking that enterprise as nicely. It is an excellent margin enterprise and now we have these lengthy relationships with prospects over a few years. And we’re — it is not a easy ratable enterprise like SaaS is however general, it is a good enterprise. And we’re doing a little funding there. I’ve stated earlier than that the purpose is to have each enterprise items rising and worthwhile. We have made large strides on that. The Safety enterprise, I do suppose wants — may gain advantage from some further funding on product refreshes. And we’re beginning to try this and we’ll proceed to try this as we arrange our 2025 plan.

Grey Powell: Understood. Okay. That is useful. After which simply typically, throughout software program, it has been a reasonably tough Q2 thus far. And also you sort of alluded to this on the decision, or the ready remarks however I imply you simply added extra web new ARR this quarter than the prior 3 quarters mixed. So I imply, like, what shocked you essentially the most? What drove the upside? And has something modified throughout the enterprise?

Victor Limongelli: Effectively, I believe when you take a look at the outcomes and we talked about it however we had loads of good outcomes, as you commented. However one factor that basically stands out to me is the NRR, proper? It is — when you’re at 1.12, 1.10, 1.12, these forms of ranges, it is actually useful for the enterprise. And naturally, a lot, a lot simpler to develop ARR. And the power there was on either side of the enterprise. We had sturdy NRR outcomes on Safety as nicely. In order that was nice. It was a very large job by the staff.

Operator: Our subsequent query comes from the road of Rudy Kessinger with D.A. Davidson.

Rudy Kessinger: And Victor, congrats on the everlasting title.

Victor Limongelli: Thanks. Thanks, Rudy.

Rudy Kessinger: Sure. I wish to simply sort of dig in additional on sort of Grey’s query. $10.3 million of web new ARR, that is extra new ARR than you — nicely, about equal to this ARR that you just added during the last 3 quarters mixed. And your NRR, it is a TTM determine. For TTM NRR to leap 5 share factors in 1 quarter suggests you in all probability had both a value improve or some fairly large buyer growth. So may you simply unpack the $10 million of web new ARR and the soar in ARR and simply speak to any perhaps focus you had and perhaps some massive expansions or pull-forwards or what? As a result of the numbers are fairly vital relative to the previous a number of quarters and relative to sort of what’s implied within the second half information.

Victor Limongelli: Sure. Thanks, Rudy. I alluded to this within the ready remarks slightly bit. We closed a ton of enterprise, together with some massive offers and it was actually a fantastic efficiency by the gross sales staff. I will let Jorge dive into any numbers that he needs to deal with however the bookings efficiency was actually sturdy by the staff within the second quarter.

Jorge Martell: Sure. Simply so as to add to that, Vic and actually, so we did see nice growth. Specifically, we noticed one deal that is a low-7-figure deal that was extra cross-sell. And in order that’s a part of the NRR on the — we noticed them on the DA facet of the home. We additionally noticed nice growth in authentication merchandise or again in software program this quarter. We noticed comparable traction final quarter. This quarter was stronger. However the different factor to think about additionally, Rudy, is that we did see decrease churn and contraction this quarter that now we have seen previously. Partly finish of life was not likely a cloth quantity. It was about $0.5 million this quarter. Final quarter was slightly extra significant. And so I believe we benefited on either side. We had actually nice growth. That cross-sell that I alluded to within the DA facet of the home but additionally we noticed decrease churn and contraction. So we benefited throughout.

Rudy Kessinger: Okay. And only a fast follow-up on that after which I’ve obtained one other query. A low-7-figure cross-sell, that was low-7 figures of web new ARR from a single cross-sell on the DA proper?

Jorge Martell: Right.

Victor Limongelli: Sure.

Rudy Kessinger: Okay, that is useful. After which I suppose the information — the EBITDA information, I perceive like in Q1, you had some large multi-year time period licenses. Second half, it appears like your {hardware} goes to be a bit decrease than as it might sometimes be seasonality-wise. However nonetheless, the EBITDA information within the second half, I believe it implies roughly $20 million in second half versus $36 million within the first half, you are saying gross margins are going to be stronger. Clearly, you have obtained the price cuts coming in. It appears to OpEx really steps up within the second half. So may you simply unpack {that a} bit as nicely?

Jorge Martell: Sure, I can chime in right here. So I believe it will be slightly greater than the quantity you stated to have adjusted EBITDA however now we have, Rudy. However clearly, EBITDA is closely relying on income. As Victor stated, we count on year-over-year declines within the {hardware} enterprise primarily based on the soundness now we have right this moment. And that is primarily associated to the scheduled buyer deliveries, proper? So we clearly acknowledge income once we do the deliveries. In order we talked about, Rudy, it is a lumpy enterprise due to that. You have got lead switch manufacturing after which lead instances for deliveries after which correlating these with our buyer base, proper? So it is an entire — it takes loads of effort to try this on a constant foundation. So due to the income type of like slightly uncertainty on the {hardware} facet is what now we have been cautious about information. Clearly, we raised that based on our numbers and our forecast. We hope to be extra on the excessive finish of that vary and we’ll proceed to replace you guys as we proceed to make progress.

Operator: Our final query comes from the road of Anja Soderstrom with Sidoti.

Anja Soderstrom: Congratulations on the nice quarter and the [indiscernible], Victor.

Victor Limongelli: Thanks. Thanks very a lot.

Anja Soderstrom: For this quarter, you are enterprise of adjustments throughout the gross sales group. So how a lot of this tailwind is pushed by demand versus your adjustments in execution do you suppose?

Victor Limongelli: Effectively, it is onerous to drag that aside. I believe the staff has executed higher. We did see good efficiency throughout the board. It was each in safety and within the DA enterprise. So it is onerous to say how a lot of that is because of underlying demand. I do not know if I may offer you a exact quantity on that. I am actually proud of how we’re participating with prospects and ensuring that we’re spending time assembly with them face-to-face and seeing what issues we are able to remedy for them. However I am unable to offer you a exact quantity on demand versus execution.

Anja Soderstrom: Okay. Understood. And let me ask you in a greater means perhaps. How is the macro setting for you? Like do you continue to see that as difficult? And when you’re getting the execution up and operating and the macro setting bettering, hopefully, finally, what engine of the purchasers and…

Victor Limongelli: That is a very good query. For us, Europe is a large market and the European economic system hasn’t been that nice however it’s not prefer it’s in a deep, deep recession both. So I do not like to speak about macro until it is on the extremes, proper? If the economies are booming, nice, which may present some elevate, or if there is a extreme recession, clearly, that hurts. I do not suppose the macro setting is improbable however it’s additionally — I imply, now we have to have the ability to execute by economies like this. This is not, I imply, removed from the worst economic system I’ve skilled with having run a public software program firm by the Nice Recession. So I view it as okay, I suppose. Does that make sense?

Anja Soderstrom: Sure. And when it comes to the price financial savings, it sounds such as you virtually reached your goal right here for the yr. Are you continue to searching for potential additional methods otherwise you’ve been sort of pushing it already?

Victor Limongelli: Jorge, do you wish to cowl that one?

Jorge Martell: Sure. So we’re virtually there, Anja, from a value financial savings perspective. A number of the — as we talked about earlier than, loads of these — the incremental 10 that we introduced final couple of earnings calls impacted DA and that was associated to, once more, the mandate that that they had which is having each enterprise be rising profitably. And so now we’re there. Now clearly, there will likely be incremental when it comes to fine-tuning, proper? It could possibly be 1 or 2 enterprise items, I believe, general company as nicely. So — however I do not suppose we are going to type of like put neon lights on it. It is simply a part of operating the enterprise, proper? We have simply obtained to be acutely aware about and making an attempt to enhance that and increase working margins. So I believe we’re — to your level, we’re virtually there, it should proceed to be however I count on extra fine-tuning somewhat than one other type of like enormous quantity popping out.

Anja Soderstrom: After which on the price facet, Victor, you talked about you’ll spend money on some merchandise and have them. Will there be any vital price will increase due to that?

Victor Limongelli: We are attempting — as Jorge alluded to in his feedback, we’re making an attempt to maintain a detailed eye on bills. We’ve not carried out our 2025 planning but. There could also be a small incremental funding in that space. However for essentially the most half, we’re making an attempt to direct our staff. We’ve got a robust staff. We’re making an attempt to direct them into areas that may have the most important profit for our prospects somewhat than simply throwing {dollars} at it. I do not suppose that is the precise strategy.

Operator: Thanks. I am exhibiting no additional questions at the moment. I might now like to show the decision again to Joe Maxa for closing remarks.

Joe Maxa: Thanks, everybody. We recognize your time and sit up for sharing our progress with you once more subsequent quarter. Thanks once more and have a pleasant day.

Operator: Thanks. This does conclude this system and chances are you’ll now disconnect.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.