Therese Fitzgerald

Stepping into the elevator in my office building, I was surprised to see an ad for Silicon Valley Bank. Then I remembered that, shortly after the San Jose-based bank was shuttered in March by the Federal Deposit Insurance Corp., most of its assets were purchased at a steep discount by First Citizens Bank. Today, it operates as a division of First Citizens.

But despite the bank’s swift reincarnation, its collapse—along with the demises of Signature Bank in March and First Republic in May—continues to reverberate throughout the real estate capital markets, particularly for local and regional banks.

Originations by “small banks” fell 53 percent year-over-year in the second quarter of 2023, according to MSCI Mortgage Debt Intelligence, which still groups local and regional banks into one category, even though the Federal Reserve today differentiates between “community” and regional banks.

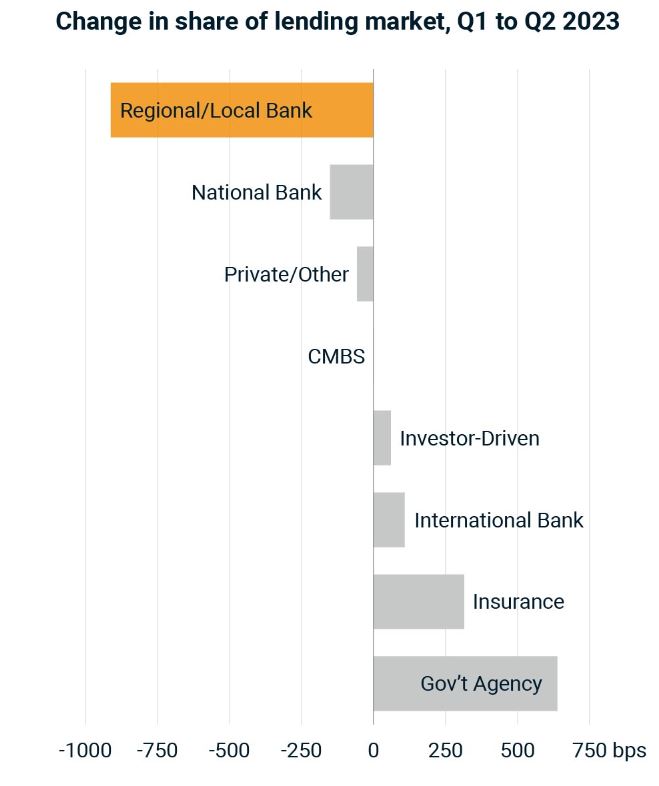

Meanwhile, smaller banks’ share of commercial real estate loans decreased from 34.2 percent in the first quarter to just 25.1 percent in the second quarter. That’s the most rapid decline in a single quarter ever, and one that is particularly “troubling” for MSCI Chief Economist Jim Costello.

“The actual level of their originations cooled between the first quarter and the second quarter,” Costello remarked. “And that’s not something we would have expected to see in any normal period. In any normal period, there is more deal activity in the second quarter than in the first quarter.”

READ ALSO: How Are You Adjusting to the Re-Adjustment?

Between 2012 and 2022, MSCI finds, originations increased 14 percent on average during the second quarter due to seasonal patterns in deal making. This year, second-quarter originations were down 4 percent. “It’s not like somebody else is just pulling ahead faster than them,” said Costello. “They’re actually putting on the brakes.”

The reason for the pullback, of course, is multi-layered, according to Costello. The bank failures, of course, had a chilling effect on similar institutions.

In 2009, amid the Great Financial Crisis, the Federal Reserve created a “national bank” category to single out larger institutions for Comprehensive Capital Analysis and Review and regulation, and to separate them from smaller institutions that presumably needed less review and fewer rules. When high interest rates and the post-pandemic slide exposed poor investment decisions by some non-national banks this spring, however, there were cries that the smaller institutions needed more scrutiny.

Bank failures aside, market conditions are also increasing banks’ cost of capital and forcing them to redefine risk. “It might be tied to all the underlying factors that led to troubles in those banks to begin with,” Costello observed.

And, don’t forget, second-quarter deal volume was down about 60 percent from last year when rates were still fairly low.

Where it hurts the most

The near-term impacts of small banks retreating are certainly being felt by many non-institutional investors in markets such as Toledo and Kansas City that depend on their relationships at smaller banks, Costello noted. There is still debt available for these borrowers, but it will be more expensive and more “problematic.”

Source: MSCI

“In the short term, it limits the availability of debt to the typical clients of those regional and local banks,” he said. “Folks who were normally coming to them for financing were smaller property owners and particularly in smaller markets.”

Though smaller banks are not just in small markets. Signature Bank had $33 billion of New York City-area commercial real estate loans on its books at the end of 2022—and $20 billion of that was multifamily.

Costello does not, however, foresee banks backing away from commercial real estate in any permanent way. For many, helping local communities grow is “explicitly” in their charters. But smaller banks are likely to proceed more conservatively while debt and equity markets reprice.

“If you look at the senior loan officer survey from the Fed, clearly, bank lenders are becoming a little bit more cautious and restrictive of what they’re willing to do,” Costello said.

And while smaller banks will likely be exempt from the new capital requirements for large lenders being debated by Congress, the tighter standards are expected to affect the behavior of all banks.

“They’re just pulling back because of changes in the financial markets, which is probably a temporary thing,” he said. “But long-term, they’re probably going to still want to be in the real estate world. That’s their bread and butter.”

So, while Silicon Valley Bank will probably always remind us of the worst-case scenario, its re-emergence may also be emblematic of the enduring demand for smaller lending institutions.