tarasov_vl/iStock via Getty Images

Introduction and thesis

Old Dominion Freight Line (NASDAQ:ODFL) is a prominent transportation company specializing in less-than-truckload (LTL) shipping. The company has emerged as a key player in the logistics and freight industry.

ODFL is a classic example of a long-term compounder. Its competitive position is based on a superior offering, allowing for market share growth and an impressive ability to incrementally capture industry growth. Management’s razor-focus on long-term development has yielded these returns, positioning the company for continued success.

We are not convinced by ODFL’s current valuation, although likely will not have been for most of the last decade. At an FCF yield of 2% and a growth rate of 8-10%, we just do not see sufficient returns without a noticeable decline in capex spending, the timing of which is not certain. For this reason, we rate the stock a hold.

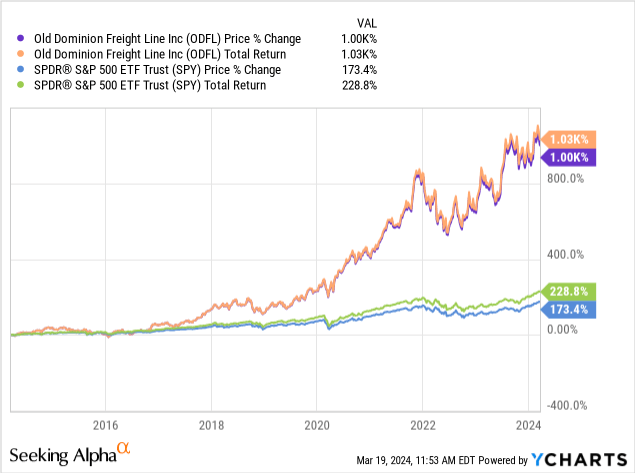

Share price

ODFL’s share price performance has been fantastic, generating over 1,000% returns in an almost unabating upward trajectory. This is a reflection of the company’s impressive ability to execute financial development, allowing for compounding returns.

Financial analysis

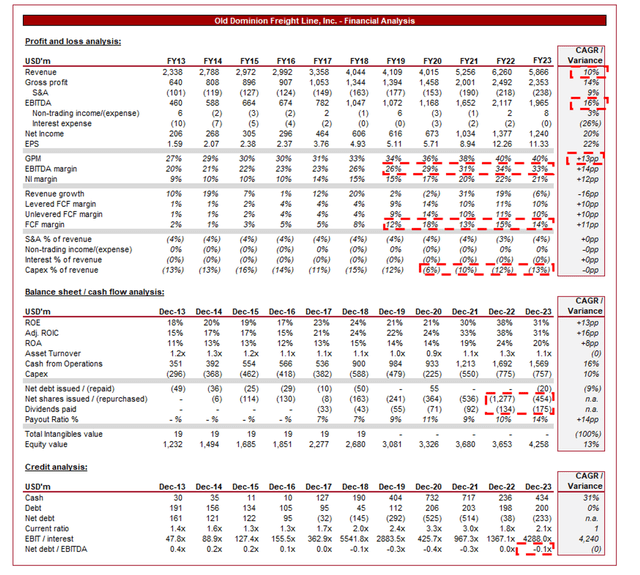

Capital IQ

Presented above are ODFL’s financial results.

Revenue & Commercial Factors

ODFL’s revenue growth has been impressive given the maturity of its industry and its weighting toward organic generation, with a CAGR of +10% into FY23. Even better than this is its EBITDA trajectory, which has grown at a CAGR of +16% (+14ppts of margin).

Business Model

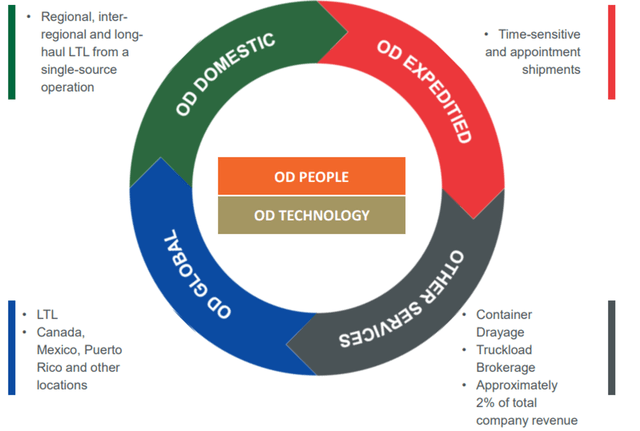

ODFL

ODFL primarily operates in the LTL freight industry. This means that it consolidates smaller freight shipments from multiple customers into a single trailer or truck, optimizing efficiency and reducing costs. The company utilizes a hub-and-spoke distribution system. It has strategically located service centers (hubs) that act as central points for freight consolidation and distribution. ODFL is the second largest player in this industry with ~10,800 tractors and ~46,500 trailers, estimating its market share at ~12-13%.

This considerable infrastructure scale has allowed ODFL to have a comprehensive and extensive network that covers the entire United States. This broad coverage allows the company to serve a wide range of customers with shipping needs across different regions. The scale is fundamentally critical to reducing its marginal cost to service customers given it needs to maximize its existing capacity, which not only translates to superior margins but also influences its flexibility on pricing.

Strategy

Management’s approach is to generally seek incremental improvements in all aspects of the company’s operations, while clearly taking a long-term view on its development and remaining disciplined with specific criteria.

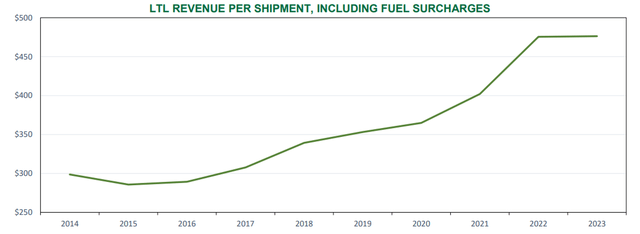

ODFL employs a strategic pricing model that considers various factors such as distance, freight class, and volume. This model, alongside its ability to minimize costs, has allowed the company to offer competitive pricing while maintaining profitability. ODFL is conscious of its relationships with clients, targeting revenue per shipment in excess of costs each year to allow for margin improvement and reinvestment, albeit will take a long-term view with relationships in mind, As the following illustrates, the trajectory of this has been impressively consistent, driving revenue in conjunction with volume.

ODFL

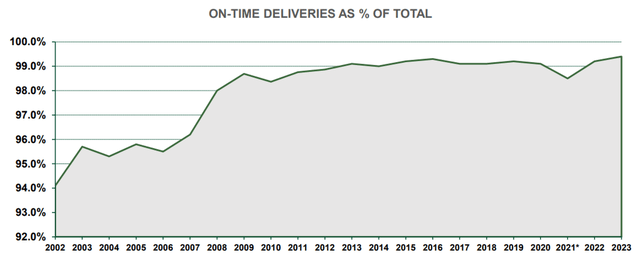

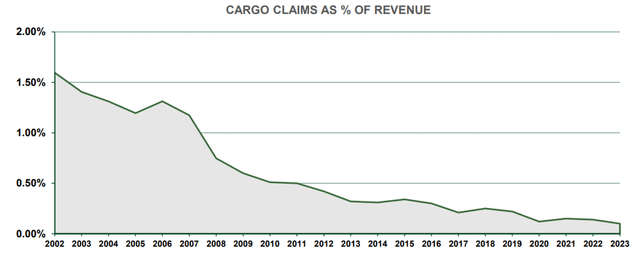

Underpinning scale and pricing has been a clear desire to improve the quality of its offering. Management has invested significantly in technology to enhance its operations. This includes advanced tracking systems, real-time data analytics, and integrated communication tools. Further, ODFL has developed a commitment to providing high-quality service and reliability. The company emphasizes on-time delivery and the safe handling of freight. As the following illustrates, the proportion of on-time deliveries is almost perfect, while the number of cargo claims is sub-0.5%. Even with already impressive levels, Management has delivered incremental improvements that will directly translate to client satisfaction and the acceptance of price increases.

ODFL ODFL

Finally, the company is constantly investing in a modern fleet of trucks, technologically advanced equipment, and service center networks (and infrastructure within). This not only ensures the reliability and quality of its services but also contributes to operational efficiency and compliance with developing standards. This does come at a cost to shareholders, with capex comprising an eyewatering 13% of revenue. This said, we consider this a cost of gaining market share, with optimization possibly allowing for FCF growth but likely at the cost of its long-term trajectory.

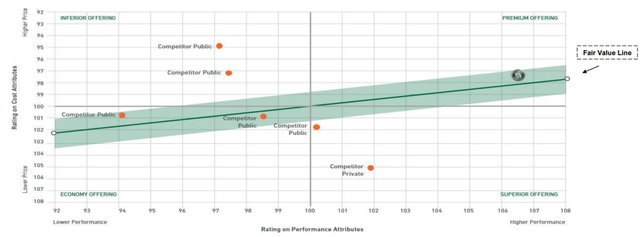

The success of ODFL’s approach is best illustrated by the change in shipments over the last decade. Whilst Public Carriers, which have an estimated market share of 65%, have experienced a -8% decline in service centers and a -6% decline in shipments per day since 2012, ODFL has experienced an increase of +17% and +75%, respectively. This is a direct transfer of market share from its peers to ODFL, reflecting both a dissatisfaction with the existing carriers and also the quality of ODFL’s offering. ODFL’s competitive positioning in the market is fantastic, with growth likely to come primarily from its peers.

ODFL

Financials

ODFL’s recent performance has been poor, with top-line growth of -3.7%, -15.2%, -5.5%, and +0.3% in its last four quarters. In conjunction with this, its margins have declined relative to FY22.

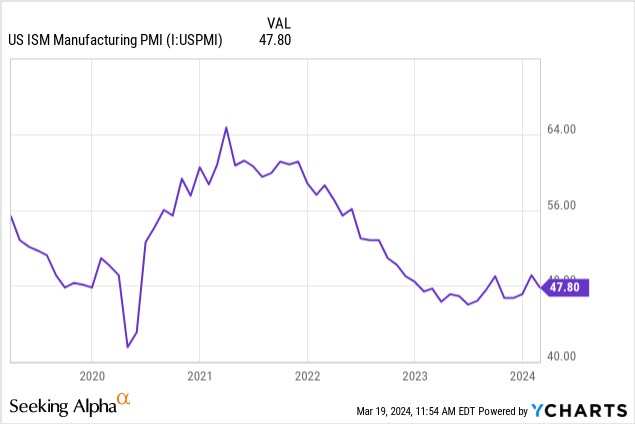

The company’s decline during FY23 is a reflection of the wider macroeconomic environment. With softening demand and capital investment across the US, negatively impacted by elevated rates and inflation, the need for shipments has softened, additionally impacting prices.

The company is exposed to the manufacturing and industrials industries, driving a large portion of the consistent volume of shipments. These industries have particularly struggled with the cost of capital, contributing to delays and cancellations of projects, albeit appear positioned well for long-term investment due to infrastructure trends. As the following illustrates, the ISM manufacturing PMI, a reliable indicator of activity within the economy, has steadily declined since 2022 and has yet to show clear evidence of an upward trajectory. This appears to be leading in nature, with ODFL feeling the impact in early 2023. It is worth highlighting that its performance appears to have improved moderately in Jan-Feb24, suggesting the bottom may have been reached, with slightly better results ahead until rates begin declining.

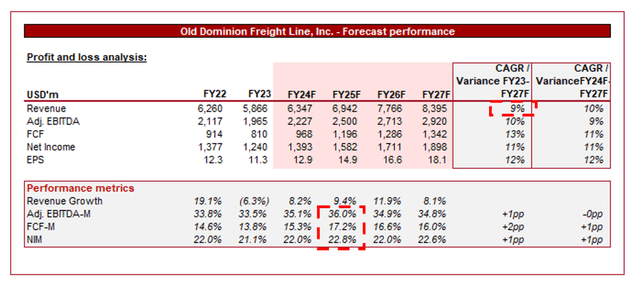

Looking ahead, analysts are forecasting a continuation of ODFL’s current growth trajectory, with a CAGR of +9% into FY27F. Alongside this, margins are expected to incrementally improve.

We are in broadly supportive of these forecasts. Whilst the company has clearly gained considerable market share, we see scope for further gains. The level captured since 2012 can only be attributable to a considerably superior offering. On an absolute basis, ODFL still has massive room to grow at only ~12% market share. This is before we consider the underlying growth in the industry and the potential for sequential price uplifts.

Capital IQ

Balance sheet & Cash Flows

Management has taken a conservative approach to debt, with ODFL in a net cash position. Should rates sufficiently decline, the company could ladder up its debt with growth to fund distributions.

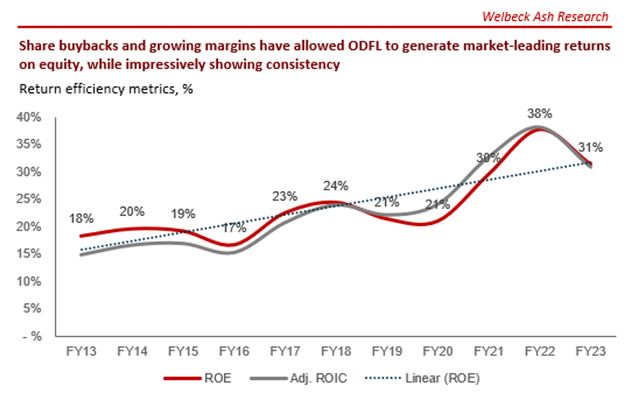

Speaking of distributions, Management has consistently paid dividends and repurchased shares, accelerating shareholders’ capital with excess returns. The long-term potential here is that as capex declines as ODFL matures, FCF should theoretically considerably increase, propelling returns forward.

Capital IQ

Industry analysis

Seeking Alpha

Presented above is a comparison of ODFL’s growth and profitability to the average of its industry, as defined by Seeking Alpha (20 companies).

ODFL performs exceptionally relative to its peers, outperforming on almost every metric. This is a reflection of its solid business model and customer-first approach. Its investment in quality and growth has yielded considerable benefits, differentiating the business and allowing for sustainable market share growth. Its peers would require significant investment to catch up to ODFL, while still lacking the pricing and scale advantage that comes with its LTL approach.

Valuation

Capital IQ

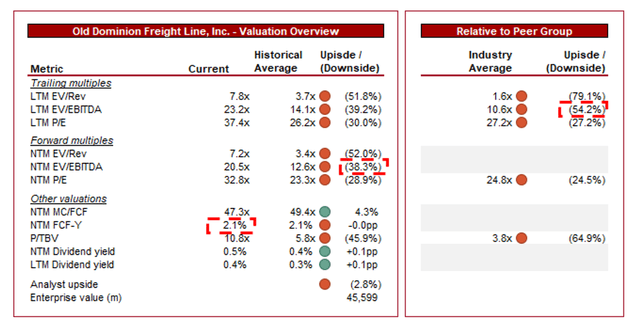

ODFL is currently trading at 23x LTM EBITDA and 21x NTM EBITDA. This is a premium to its historical average.

A premium to its historical average is warranted in our view, owing to its considerable margin improvement and continued market share growth. The company has been transformed during the decade and should be adequately reflected in its valuation. At a premium of ~40% on an EBITDA basis, we believe ODFL is likely at the top end of its fair value (35-45%).

Further, ODFL is trading at a considerable premium to its peers. Whilst a premium is justifiable due to its market share growth and superior offering for customers, we are not wholly convinced by the size. We believe investors are pricing in a medium/long-term reduction in capex spending, allowing FCF to expand considerably. This is the only reason a stock such as this, growing at sub-20%, can consistently trade at an FCF yield of 2.1%.

This is a stock that has likely never been “undervalued” during the last decade, yet has gained over 1,000%. With analysts forecasting a similar period of expansion in the coming 5 years, albeit with less margin improvement, ODFL should theoretically make market-leading gains. Yet, we cannot see justification for a buy rating.

Key risks with our thesis

The risks to our current thesis are:

- Technological advancements disrupting industry dynamics, such as self-driving vehicles.

- Economic uncertainties impacting shipping demand.

- Intense competition in response to economic conditions affecting pricing and profitability.

Final thoughts

ODFL is a fantastic business in our view, underpinned by a market-leading offering that has allowed it to consistently gain market share. The business has exploited inefficiencies and inadequacies in its industry to build a bulletproof brand and offering.

We see a continuation of its broader trajectory, particularly as the economic bottom has likely been reached. Despite the expansion financially and commercially, we still believe ODFL has a long runway to outperform.

ODFL’s valuation is difficult to reconcile in our view, likely pricing in long-term factors that are not necessarily reliably estimated. At an FCF yield of ~2% and considerable capex commitments in the medium-term, we suggest a hold rating.