miljko/E+ via Getty Images

Investment thesis

Olaplex (NASDAQ:OLPX) is undervalued. OLPX is a company that specializes in haircare products that have been proven effective through scientific research. The company has a strong omni-channel strategy, with a presence in both specialty retail and direct-to-consumer channels, which allows them to reach customers across various channels. They also have a strong branding strategy, which has helped to establish their reputation as a credible source of product recommendations in the hair care industry. Overall, OLPX has a strong position in the haircare market and is well-positioned for growth.

Business overview

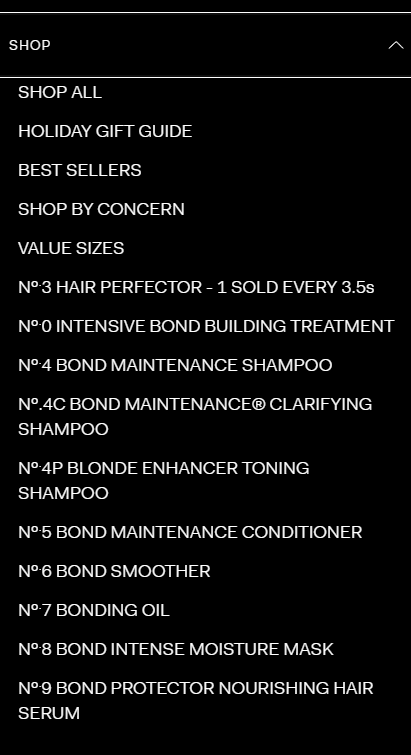

OLPX is a company dedicated to advancing the field of cosmetic technology. Experts in the field of hair care, they offer products that have been proven effective through scientific research. Here is a non-exhaustive list of what they offer:

Olaplex homepage

Haircare, like beauty, is a large market

When it comes to size and potential expansion, I see the haircare industry as a sizable opportunity. Consumers today care more about health and wellbeing than in the past. To be more specific, OLPX customers buy the product because it improves their hair health. OLPX seems to have zeroed in on a crucial subsector of the hair care market: the treatment of damaged hair, which is a major contributor to overall hair health. This is a good place to begin, as 91 percent of American women regularly subject their hair to damaging practices like dyeing and heat styling, which has resulted in a high demand for OLPX’s products.

Other than that, the long-term growth prospects of the haircare market are supported by a number of significant tailwinds. Customers’ opinions of their hair have a significant impact on how they feel about themselves, so I have no doubt that the continued focus on personal appearance and wellness will lead to higher sales in the category. The old adage goes something like this: if you can make someone feel good about themselves, you can get them to part with their money, even if it’s for something as frivolous as a luxury good.

As I mentioned before, I think consumers are becoming more health-conscious, and this has led to a surge in interest in and demand for high-quality, all-natural beauty products that are supported by cutting-edge science. Here is where OLPX stands out from the competition: their products and services are already in a good position to meet the growing demand from customers. In addition, a growing body of research shows that omni-channel retailing is preferred by customers over online-only options. I think OLPX’s omni-channel strategy puts them in a good position to reach out to global consumers across all channels of purchase and expand market share.

Omni-channel strategy works like magic

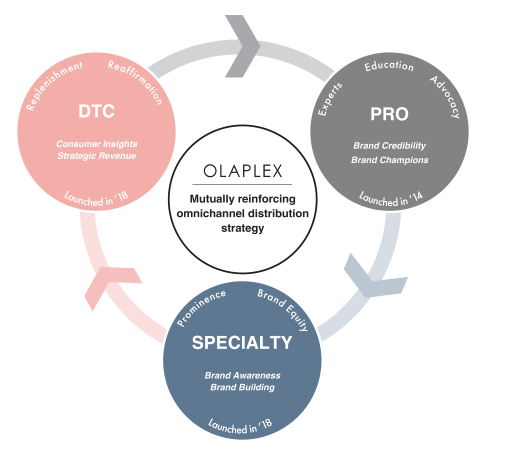

A powerful feedback loop that reinforces consumer spending across channels is created by OLPX’s integrated channel strategy across all its channels.

To begin, they have digital capabilities that serve as a backbone for all of their channels and give them access to consumers directly. In addition, OLPX’s professional channel helps establish the company as a credible source of product recommendations to consumers, which benefits the company’s specialty retail and direct-to-consumer channels. About 35% of OLAPLEX customers, according to the prospectus, have been introduced to the product by their hairstylist. After being exposed to OLPX products in this way, many customers go on to buy them through OLPX’s specialty retail and direct-to-consumer channels.

When compared to the vast selections offered by many brands, OLPX’s retail partners receive a carefully selected portfolio of highly productive products with incremental benefits. OLPX, in my opinion, is able to reach consumers more effectively thanks to its presence in both specialty retail and direct-to-consumer channels, while also benefiting the salon industry as a whole when customers seek out salon-strength OLAPLEX treatments to complement their at-home regimens.

In my opinion, OLPX digital initiatives have helped to foster this positive cycle, which has opened up numerous opportunities for cross-channel shopping. This unified strategy should propel OLPX’s rapid expansion across all sales channels and geographies. Finally, OLPX is able to leverage this integrated channel strategy internationally thanks to the popularity of their brand and the extensive network of stylists around the world. I believe the company is well established in the professional community and has recently expanded into direct-to-consumer sales.

Prospectus

OLPX branding has set them apart from the pack

The founders of OLAPLEX set out to create a product line that would meet the needs of both stylists and their clients in terms of scientifically-based hair health solutions. OLAPLEX, in my opinion, is successful in building brand loyalty because of the trust and confidence it inspires among its customers thanks to its ability to deliver on its promise of providing scientifically supported solutions for hair health. Particularly impressive is the fact that OLPX will have over 150,000 repeat customers at BSG, a network of stores and direct sales consultants that sell professional salon brands to professional hairstylists, between 2020 and 2021. (as reported by S-1) If OLPX keeps up the same level of innovation and quality of results that it currently provides, I have no doubt that it will remain a popular choice among consumers.

Opportunities to expand into other verticals

Consumers would be interested in OLAPLEX product offerings across a variety of beauty categories, especially given OLPX’s reputation for delivering rapid results, and I think OLPX is well positioned to expand into the large, multibillion-dollar beauty and personal care category by leveraging their differentiated technology platform. According to the S-1, management has also indicated that they plan to apply their knowledge of innovation to new markets, with the goal of providing consumers with healthy alternatives to their existing personal care routines. I have faith that they can pull this off because they employ a stringent product development process that integrates scientific knowledge with feedback from various channels, and they work closely with professional hairstylists to develop and test new products before they hit the market.

I have no doubt that their already substantial consumer base-which has led to massive interest in their new haircare offerings-will help them branch out into the beauty and wellness industries in the not-too-distant future.

Strong management team

There is a strong management team at OLPX, as there is at every successful business. The executive team at OLPX has worked in the cosmetics and high fashion industries for many years, gaining invaluable strategic and operational experience. Their leadership is backed by a board of directors comprised of industry professionals with backgrounds in cosmetics, technology, digital media, and business operations. Members of the board have, for instance, extensive experience at illustrious corporations like Chanel, Conde Nast, Stitch Fix, Instagram, Facebook, Lululemon, and Sonos (as per S-1).

Valuation

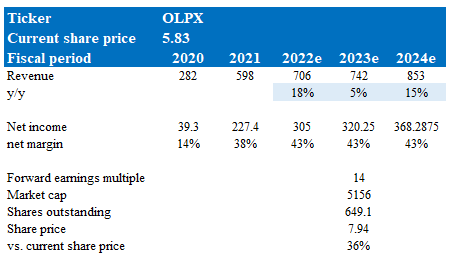

My model suggests that OLPX is undervalued today. My model values OLPX on a forward earnings basis, as the business is generating earnings that can be used to approximate future cash flow today. The model follows management’s FY22 guidance (both revenue and earnings).

Overall, I expect OLPX growth to continuing as they gained share, but growth should decelerate in FY23 given the recession outlook (high interest rates and inflation). Thus far, the business has been executing well, and as such, I believe they should be able to recover post this weak macro period.

OLPX is trading at 14x forward earnings today, and I assumed it would trade at a similar range 1 year from now as I do not expect any major events that would change this. That said, OLPX used to trade at a much higher multiple, so that leaves room for a potential re-rating upward.

Based on these assumptions, I believe OLPX’s stock is worth $7.94 in FY23.

Own estimates

Risks

High revenue concentration among a few customers

While there are benefits, such as easier client management, there is also a risk. These customers may be able to negotiate better terms during contract negotiations, and it is difficult for OLPX to reject such terms because they risk losing a large client, which would hurt OLPX’s financials.

Brand reputation is important

OLPX’s strong brand equity among consumers is a central tenet of the bull thesis; however, if the company’s product quality were to decline, it could have a negative impact on the company’s image. OLPX is not the first well-known brand to take a long time to bounce back from a scandal.

Conclusion

In conclusion, I think the current price of OLPX is undervalued. OLPX is a company that focuses on advancing cosmetic technology and offers hair care products that have been proven effective through scientific research. They have a strong presence in the treatment of damaged hair, which is a major contributor to overall hair health. Their omni-channel strategy has helped to create a feedback loop that reinforces consumer spending across channels, and their branding has set them apart from competitors. Overall, the long-term growth prospects of the haircare market, along with OLPX’s focus on hair health and effective products, make it a good opportunity for expansion.