This text is an on-site model of our Unhedged e-newsletter. Join right here to get the e-newsletter despatched straight to your inbox each weekday

Good morning. Ethan right here; Rob’s off reeling in a giant catch, hopefully.

Monday was a brutal day in Ukraine. The newest experiences are that Russia is shelling cities as civilians evacuate. The demise toll, already grim, is climbing. Western nations are discussing a Russian oil import ban, so shares fell and oil soared.

At present, I take a look at two financial questions this conflict has posed. Disagree with me? Agree profusely? E-mail me: [email protected].

Are oil shocks inflationary?

Shock and awe won’t describe Russia’s invasion of Ukraine, however it actually suits the response in commodities markets. Wheat costs are at all-time highs. Nickel is spiking. Oil brushed $139 per barrel yesterday, with some speak that it might but attain $200.

Excessive inflation, uncontrolled vitality costs, geopolitical turmoil — it’s a wide-open door for Seventies US stagflation comparisons. And former Treasury secretary Larry Summers walked proper by way of it on Friday, telling Bloomberg TV that America faces “actual dangers of a Seventies-type situation” stemming from an oil shock and extreme, inflationary stimulus.

Federal Reserve chair Jay Powell’s congressional testimony final week was principally boring. However in it, he too hinted at a stagflationary view of oil shocks. From Howard Schneider of Reuters:

Beneath tough guidelines of thumb that Powell supplied, the bounce in oil from round $75 a barrel in late December to round $110 on Thursday, if it lasts, might add practically 0.9 share level to headline inflation and reduce practically half a share level from financial development

The thought is that pricier vitality (and, to a lesser extent, different commodities) feeds into different costs and eats away at shopper spending, all whereas disrupting inflation expectations. Why would costly vitality unanchor expectations when little else has? Partly as a result of everybody buys it, and partly as a result of customers are extremely conscious of vitality prices. You most likely know roughly what a tank of fuel prices with out checking.

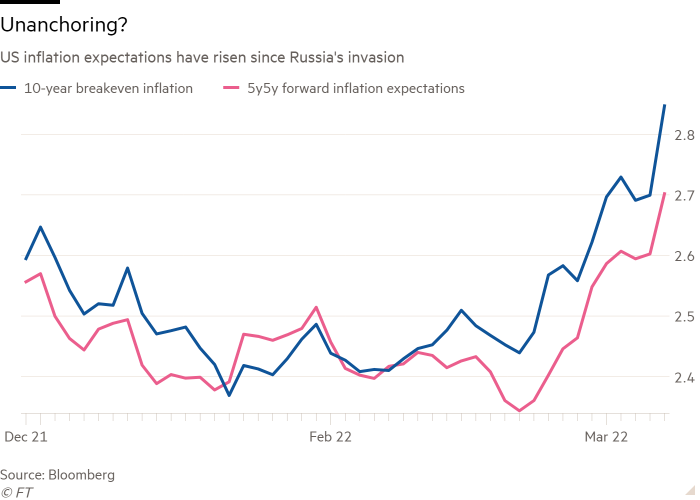

Certainly, US inflation expectations have moved uncomfortably excessive because the invasion:

As we’ve heard advert nauseam these days, unmoored expectations danger an inflationary spiral the place a cornered Powell has little alternative however to choke the financial system to sleep. However not everyone seems to be so apprehensive. Among the many dissenters is George Goncalves, US macro head at MUFG, who informed me it’s a bit overblown:

I imagine oil-induced inflation, if it persists, will possible be briefly inflationary, however long-term it normally results in a development shock.

Quick-term inflation expectations are already reacting and it’s potential that shopper survey measures from the NY Fed will react too. Nevertheless, issues like 5y5y inflation measures received’t go unhinged. They didn’t through the Covid stimulus rounds of trillions of {dollars} of easing, so this oil transfer received’t have that huge an affect on long-term views.

The expansion shock Goncalves mentions might be disinflationary, as Evan Brown and Luke Kawa of UBS argued lately:

In our view, an excellent bigger spike in oil and/or pure fuel costs wouldn’t kick off a sustained inflationary spiral. It’s extra possible that this is able to lead to decrease development, and in flip decrease inflation, earlier than too lengthy. Both spending extra on vitality would trigger customers to chop again in different areas, or central banks would aggressively tighten coverage and crush the growth — and by extension, inflation.

If vitality costs get excessive sufficient, demand will dry up as more cash goes towards shopping for the identical, or a smaller, quantity of vitality. That leaves much less buying energy for every thing else. Or else central banks will get queasy on the short-term value shock. Both method, no spiral.

Whether or not this disinflationary argument is correct, the Seventies comparisons are actually imprecise. On the time, inflation expectations had been already elevated — about 4 per cent by one estimate — within the months earlier than the 1973 vitality shock. That’s a lot much less true now, which might clarify the unfavourable correlation between vitality costs and core inflation (ie, excluding vitality and meals) over the previous twenty years.

The tight labour market is the place I’m least sure about what an oil shock will do. A vital part of the Seventies inflationary spiral was labour’s potential to safe wage will increase on the tempo of inflation. Publish-lockdown market situations have lent staff newfound bargaining energy (although from a low base). There may be some similarity right here. You may think staff, sick of shelling out for costly fuel, demanding wage will increase. I simply don’t know if the impact is large enough to spark a wage-price spiral.

Powell says he’s watching the oil-inflation dynamic “very fastidiously”. As Covid-specific inflation fades, this might quick develop into an important query in markets.

How doomed is the greenback?

Western sanctions towards Russia have made cash look political. Is the long-anticipated decline of the US greenback nigh? Jon Sindreu thinks its standing will not less than take a physique blow. Right here’s Sindreu within the Wall Avenue Journal:

But your complete artifice of “cash” as a common retailer of worth dangers being eroded by the banning of key exports to Russia and boycotts of the type firms like Apple and Nike introduced . ..

Certainly, the case levied towards China’s makes an attempt to internationalise the renminbi has been that, in contrast to the greenback, entry to it’s at all times vulnerable to being revoked by political concerns. It’s now obvious that, to a degree, that is true of all currencies.

The chance to King Greenback’s standing continues to be restricted because of most nations’ alignment with the West and Beijing’s capital controls. However monetary and financial linkages between China and sanctioned nations will essentially strengthen if these nations can solely accumulate reserves in China and solely spend them there. Even nations that aren’t sanctioned could need to diversify their geopolitical danger.

His prediction that sanctioned nations will flip to China seems believable. Proper after Mastercard and Visa fled Russia, 4 Russian banks introduced plans over the weekend to forge relationships with UnionPay, China’s greatest card community. However as this argument grows fashionable, I’m wondering if it undersells the US benefit.

Because the worldwide finance economist (and pal of Unhedged) Eswar Prasad wrote in Barron’s on Friday, China’s greatest drawback is its lack of unbiased courts or an autonomous central financial institution. These, alongside Beijing’s capital controls and the greenback’s usefulness as a funding forex, create a sturdy benefit for the greenback. For many world traders, the alternate options are worse. Sanctions don’t a lot change that.

I wouldn’t be shocked if, as Sindreu suggests, the greenback’s place is barely dented as some traders hedge geopolitical danger. Maybe over time the greenback will undergo demise by a thousand cuts. However for now its place stays about as safe because it was a month in the past.

One good learn

For extra dollar-themed studying, Adam Tooze in his wonderful Chartbook writes that we’re seeing polarities, not blocs, forming within the world financial system.

Beneficial newsletters for you

Due Diligence — Prime tales from the world of company finance. Join right here

Swamp Notes — Skilled perception on the intersection of cash and energy in US politics. Join right here